The EUR/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.1747

- 폐장 전: 1.1720

- 전날 대비 # % 변동: -0.23%

At the start of 2026, the euro weakened toward $1.17 following an impressive 13.5% surge in 2025 – its strongest annual gain since 2017. Investors remain focused on new catalysts, primarily monetary policy expectations in the Eurozone and the US. The ECB has signaled its intention to keep rates unchanged for now, citing steady economic growth and inflation near target levels, though Christine Lagarde highlighted high uncertainty complicating future projections.

거래 권고

- 지원 레벨: 1.1680, 1.1656, 1.1590, 1.1555, 1.1503

- 저항 레벨: 1.1706, 1.1723, 1.1765, 1.1786, 1.1802, 1.1833

The euro fell sharply as the dollar strengthened due to the situation in Venezuela. The price reached the 1.1680 support level. Despite a bounce, the intraday bias remains with the sellers. Sell trades can be considered from the 1.1706 resistance level, but with confirmation. There are currently no optimal entry points for buys.

대체 시나리오:- Trend: Down

- Sup: 1.1680

- Res: 1.1706

- Note: Consider intraday sales from 1.1706 with confirmation. No optimal entry points for buys at this time.

@ 뉴스피드: 2026.01.05

- US ISM Manufacturing PMI (m/m) at 17:00 (GMT+2). – USD (MED)

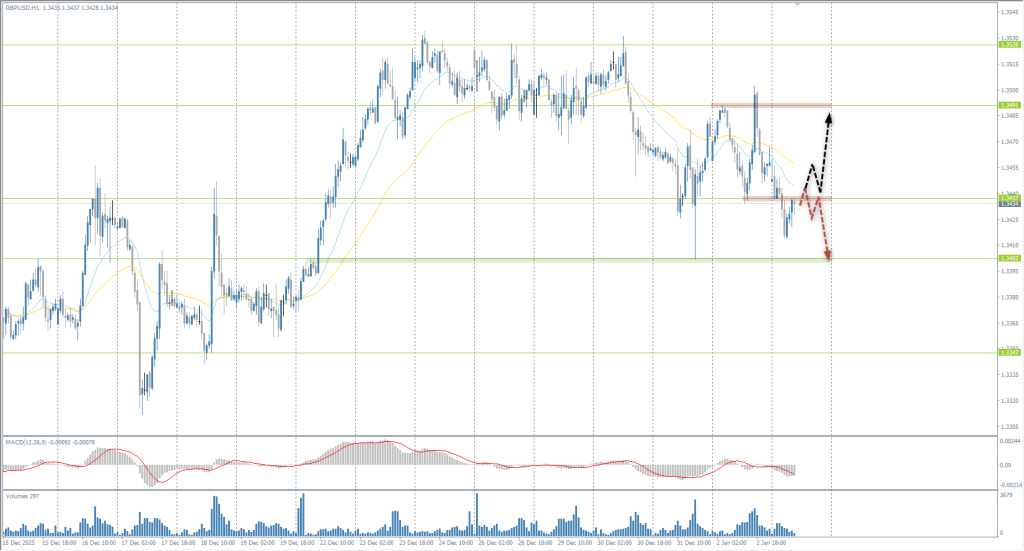

The GBP/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.3459

- 폐장 전: 1.3458

- 전날 대비 # % 변동: -0.01 %

In 2025, the Bank of England cut interest rates four times, bringing the base rate to 3.75%, with a total of six cuts since the easing cycle began last August. At the final meeting of the year, the central bank adopted a cautious stance: rates will likely fall gradually, but room for further maneuvering is limited as they approach neutral levels. Markets are currently pricing in one more 25-basis-point cut to 3.5%. If inflation falls faster than expected amid weak growth, rates could drop to 3% by the end of 2026, potentially pressuring the pound.

거래 권고

- 지원 레벨: 1.3402, 1.3347, 1.3354, 1.3292, 1.3268, 1.3156

- 저항 레벨: 1.3437, 1.3491, 1.3526, 1.3586

The British pound appears slightly more resilient than the euro. The price has consolidated below 1.3437, keeping the intraday bias with the sellers. There is a high probability of a decline and a retest of liquidity below 1.3402. However, if buyers manage to push the price back above 1.3437, it will form a locked balance, which could lead to a sharp price spike.

대체 시나리오:- Trend: Neutral

- Sup: 1.3402

- Res: 1.3437

- Note: Consider sell trades from the 1.3437 resistance. An impulsive breakout and consolidation above this level would open opportunities for buys.

오늘은 뉴스가 없습니다

The USD/JPY currency pair

통화 쌍의 기술적 지표:

- 개장 전: 156.64

- 폐장 전: 156.86

- 전날 대비 # % 변동: +0.14 %

On Monday, the Japanese yen weakened to 157 per dollar, hitting a two-week low despite BoJ Governor Kazuo Ueda’s statements regarding readiness to raise rates if economic and inflation projections are met. His comments reflect growing confidence in Japan’s exit from deflation, but this was insufficient to support the currency in the short term. Additional pressure came from fiscal policy concerns following PM Sanae Takaichi’s plans for large-scale stimulus. Investors are also monitoring intervention risks amid business community calls for action against yen weakness.

거래 권고

- 지원 레벨: 156.96, 156.56, 156.00, 155.69, 154.92, 154.41, 154.17

- 저항 레벨: 157.28, 157.78, 159.47

The yen continues to weaken against the dollar. Price reached the 157.28 resistance, where price action must be monitored. Consolidation above this level opens the way to 157.78. If sellers return the price below 156.96, intraday selling opportunities will open.

대체 시나리오:- Trend: Up

- Sup: 156.96

- Res: 157.28

- Note: Looking for buy deals from 156.96 with confirmation. Consolidation below 156.96 could trigger a decline to 156.56.

@ 뉴스피드: 2026.01.05

- Japan Manufacturing PMI (m/m) at 02:30 (GMT+2). – JPY (MED)

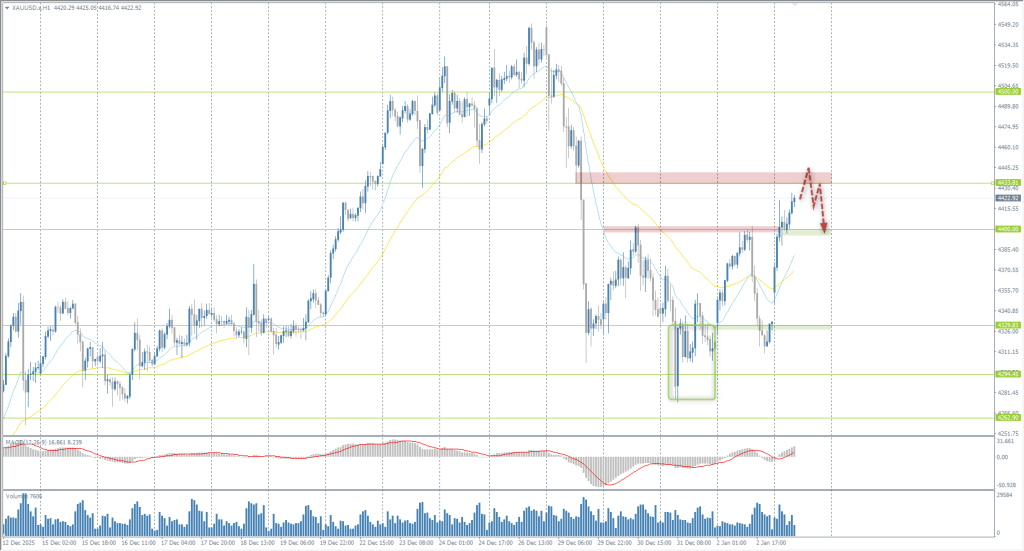

The XAU/USD currency pair (gold)

통화 쌍의 기술적 지표:

- 개장 전: 4332

- 폐장 전: 4332

- 전날 대비 # % 변동: 0.0 %

Gold prices rose by more than 1% on Monday, surpassing $4,400 per ounce. The market was buoyed by the sharp escalation in geopolitical tensions following the US capture of Venezuelan President Nicolás Maduro, which spiked safe-haven demand. Donald Trump’s statements about Washington “managing” Venezuela temporarily increased fears of instability. Markets are also focusing on Friday’s US Non-Farm Payrolls report for interest rate clues.

거래 권고

- 지원 레벨: 4400, 4329, 4294

- 저항 레벨: 4433, 4500, 4550

Gold has consolidated above 4400 and is now aiming for a test of the 4433 resistance. If sellers react there, the price will likely enter a range between 4400-4433. It is crucial for buyers to prevent the price from closing below 4400 again to avoid another sell-off.

대체 시나리오:- Trend: Neutral

- Sup: 4400

- Res: 4433

- Note: Consider intraday sell trades from the 4433 resistance. Buyers must hold the 4400 level.

@ 뉴스피드: 2026.01.05

- US ISM Manufacturing PMI (m/m) at 17:00 (GMT+2). – USD (MED)

이 기사는 개인의 의견이므로 투자 조언 및/또는 제안, 금융 거래 수행에 대한 지속적 요청 및/또는 보증 및/또는 미래 예측으로 해석하시지 마시기 바랍니다.