The EUR/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.1673

- 폐장 전: 1.1659

- 전날 대비 # % 변동: -0.12%

On Thursday, the EUR/USD pair dropped to a four-week low. Pressure on the euro was exerted by the general strengthening of the US dollar, as well as data showing an unexpected deterioration in Eurozone economic sentiment in December. An additional “dovish” factor for ECB policy, and consequently negative for the euro, was the easing of price pressure from producers: the Eurozone Producer Price Index (PPI) in November showed its sharpest decline in the last 13 months. As a result, money markets are pricing in almost no policy tightening: swaps estimate the probability of a 25 bps ECB rate hike at the upcoming February 5 meeting at 0%.

거래 권고

- 지원 레벨: 1.1629, 1.1590, 1.1555, 1.1503

- 저항 레벨: 1.1659, 1.1675, 1.1718, 1.1753, 1.1765, 1.1786

The euro price has consolidated below 1.1659, opening the way to 1.1629 and below. The intraday bias favors sellers, but a divergence is forming on the MACD indicator. High volatility is expected today due to the NFP news. For sales, consider the 1.1659 and 1.1675 levels. Buys are possible only after the price consolidates above 1.1675.

대체 시나리오:- Trend: Down

- Sup: 1.1629

- Res: 1.1659

- Note: For sell deals, consider the 1.1659 and 1.1675 levels. Buys are possible only after the price consolidates above 1.1675.

@ 뉴스피드: 2026.01.09

- Eurozone Retail Sales (m/m) at 12:00 (GMT+2); – EUR (MED)

- US Non-Farm Payrolls (m/m) at 15:30 (GMT+2); – USD, XAU (HIGH)

- US Average Hourly Earnings (m/m) at 15:30 (GMT+2); – USD, XAU (HIGH)

- US Unemployment Rate (m/m) at 15:30 (GMT+2); – USD, XAU (HIGH)

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+2). – USD (MED)

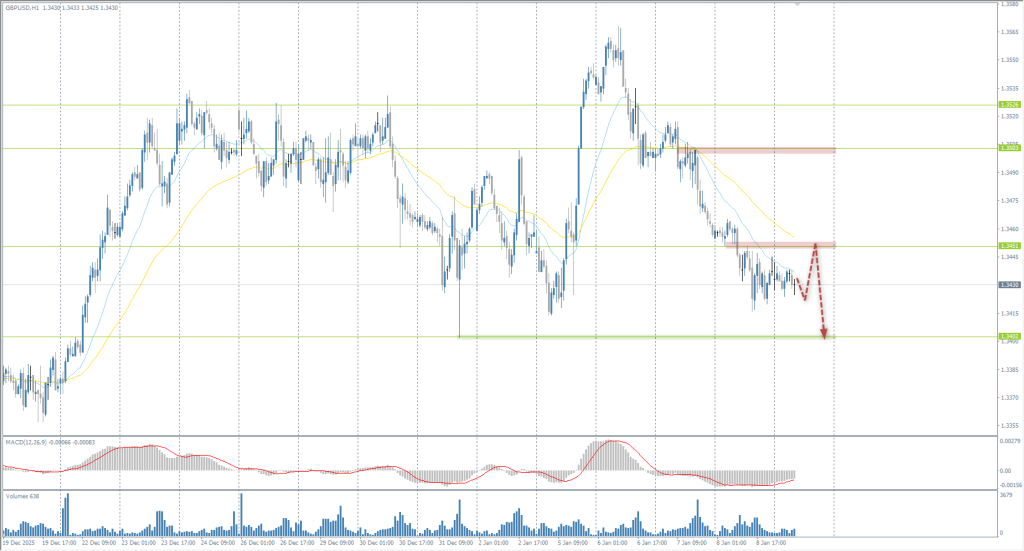

The GBP/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.3455

- 폐장 전: 1.3437

- 전날 대비 # % 변동: -0.13 %

The British pound continues to fall against the US dollar. On Thursday, the Dollar Index rose to 98.9, reaching its highest since December 9, as investors assessed mixed US macro signals and revised Fed policy expectations. US labor market data appeared resilient: initial jobless claims rose slightly to 208k, while job cut announcements in December fell to 35.553, the lowest level since July 2024, easing fears of a sharp economic slowdown. Meanwhile, market participants still expect the Fed to hold rates steady in the near term with high probability (around 90%), pricing in several cuts toward the end of the year.

거래 권고

- 지원 레벨: 1.3402, 1.3347, 1.3354, 1.3292

- 저항 레벨: 1.3451, 1.3503, 1.3526, 1.3586

The British pound consolidated below the 1.3451 level. The intraday bias remains with the sellers, and there is a high probability of a decline to 1.3402. Sell trades are best considered from the EMA lines or the 1.3451 resistance level, but with confirmation. For buys, evaluate the price reaction at 1.3402.

대체 시나리오:- Trend: Down

- Sup: 1.3402

- Res: 1.3451

- Note: Sell trades are best considered from the EMA lines or the 1.3451 resistance level, but with confirmation. For buys, evaluate the price reaction at 1.3402.

오늘은 뉴스가 없습니다

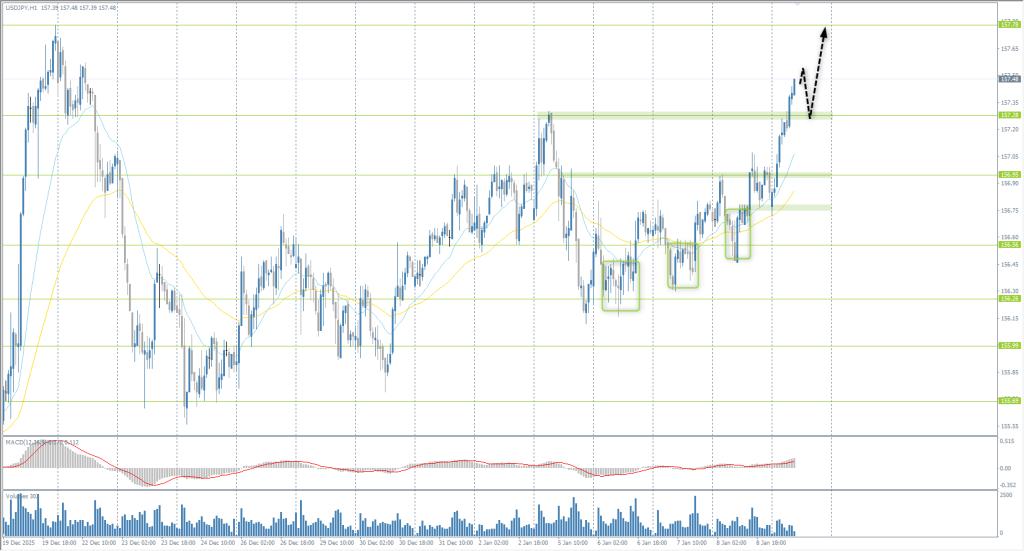

The USD/JPY currency pair

통화 쌍의 기술적 지표:

- 개장 전: 156.61

- 폐장 전: 156.76

- 전날 대비 # % 변동: +0.07 %

On Friday, the Japanese yen weakened above the 157 per dollar level, extending its decline for a fourth consecutive session. The primary pressure factor was the strengthening US dollar amid investor analysis of US macro data and a reassessment of Federal Reserve monetary policy prospects. The yen’s weakening occurred despite relatively positive domestic data: household spending in Japan rose 2.9% in November, aided by seasonal winter shopping. However, real wages contracted by 2.8% as price growth continued to outpace nominal income gains. This remains a key constraint for the Bank of Japan, which links further policy tightening to sustainable growth in real household incomes.

거래 권고

- 지원 레벨: 156.95, 157.28, 156.56, 156.26, 155.69, 154.92, 154.41, 154.17

- 저항 레벨: 157.78, 159.47

The Japanese yen consolidated above the 157.28 level, and the road is now open to 157.78. The intraday bias favors buyers. However, the price has deviated significantly from the EMA lines. For buys, it is best to wait for a pullback to 157.28 or the EMA lines. There are currently no optimal entry points for sales.

대체 시나리오:- Trend: Up

- Sup: 157.28

- Res: 157.78

- Note: For buys, it is best to wait for a pullback to 157.28 or the EMA lines. There are currently no optimal entry points for sales.

오늘은 뉴스가 없습니다

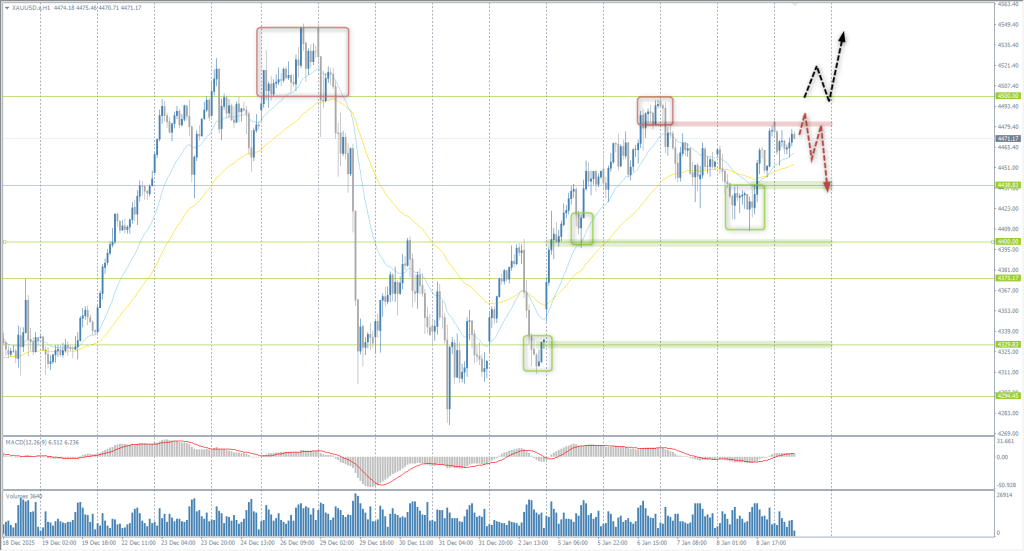

The XAU/USD currency pair (gold)

통화 쌍의 기술적 지표:

- 개장 전: 4460

- 폐장 전: 4476

- 전날 대비 # % 변동: +0.36 %

Gold has recovered and is trading above $4,470 per ounce amid a combination of renewed safe-haven demand, persistent rate-cut expectations, and steady official purchases. Rising geopolitical risks, primarily the escalation around Venezuela following US actions, and general global uncertainty have once again increased investor interest in gold as a risk-hedging tool. China extended its gold acquisition streak to 14 consecutive months, reducing available supply. Major investment banks, including HSBC and Morgan Stanley, maintain or raise their 2026 price expectations, citing these same fundamental factors.

거래 권고

- 지원 레벨: 4438, 4400, 4375, 4329, 4294

- 저항 레벨: 4500, 4550

A locked balance has formed on gold below 4438. The intraday bias favors buyers, but the price is currently facing a resistance level. For buys, consider the EMA lines or the 4438 level, but with confirmation. There are currently no optimal entry points for sales.

대체 시나리오:- Trend: Up

- Sup: 4438

- Res: 4500

- Note: For buys, consider the EMA lines or the 4438 support level, but with confirmation. There are currently no optimal entry points for sales.

@ 뉴스피드: 2026.01.09

- US Non-Farm Payrolls (m/m) at 15:30 (GMT+2); – USD, XAU (HIGH)

- US Average Hourly Earnings (m/m) at 15:30 (GMT+2); – USD, XAU (HIGH)

- US Unemployment Rate (m/m) at 15:30 (GMT+2); – USD, XAU (HIGH)

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+2). – USD (MED)

이 기사는 개인의 의견이므로 투자 조언 및/또는 제안, 금융 거래 수행에 대한 지속적 요청 및/또는 보증 및/또는 미래 예측으로 해석하시지 마시기 바랍니다.