The EUR/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.1630

- 폐장 전: 1.1666

- 전날 대비 # % 변동: +0.30%

The euro strengthened to $1.17, recovering from a drop to a monthly low amid a sell-off of the US currency. Pressure on the dollar intensified due to investor concerns regarding the Federal Reserve’s independence following statements by the Fed Chair about a US Department of Justice investigation, which the market perceived as an element of political pressure on the regulator. Upcoming macroeconomic releases remain the primary focus, including German GDP and US inflation data, which may set the tone for future monetary policy expectations. Meanwhile, weak Eurozone inflation statistics published last week continue to dampen expectations for ECB policy tightening this year.

거래 권고

- 지원 레벨: 1.1637, 1.1619, 1.1590, 1.1555, 1.1503

- 저항 레벨: 1.1697, 1.1718, 1.1753, 1.1765, 1.1786

The euro reached the 1.1697 resistance level, where sellers showed activity. The price is currently declining, but the market structure remains in favor of buyers. Intraday long positions (buys) can be considered from the 1.1637 support level, but only with confirmation. It is crucial for buyers to hold this level to maintain upward momentum. There are currently no optimal entry points for short positions (sales).

대체 시나리오:- Trend: Neutral

- Sup: 1.1637

- Res: 1.1697

- Note: Consider buys upon buyer activity at the 1.1637 support level. No optimal entry points for sales.

@ 뉴스피드: 2026.01.13

- US Consumer Price Index (m/m) at 15:30 (GMT+2); – USD, XAU (HIGH)

- US Home Sales (m/m) at 17:00 (GMT+2). – USD (MED)

The GBP/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.3396

- 폐장 전: 1.3463

- 전날 대비 # % 변동: +0.50 %

The British pound strengthened to $1.35, approaching a three-month high, as the US dollar weakened due to growing concerns over the Federal Reserve’s independence. Pressure on the dollar mounted after the Fed Chair’s comments regarding a DOJ investigation, which markets interpreted as another political move to force faster rate cuts. At the same time, investors remain cautious ahead of key UK macroeconomic data, including monthly GDP statistics. The domestic backdrop remains mixed: a business activity survey showed a contraction in hiring in December amid rising costs and deteriorating business sentiment following a tax-hiking budget, which limits the potential for further pound appreciation.

거래 권고

- 지원 레벨: 1.3451, 1.3393, 1.3347, 1.3354, 1.3292

- 저항 레벨: 1.3486, 1.3503, 1.3526, 1.3586

The British pound appears more confident than the euro. The price is trading above the EMA moving averages. The intraday bias remains with the buyers. Long positions (buys) can be considered from 1.3451, subject to confirmation. A breakout of the 1.3486 resistance level will open the path to 1.3516. No optimal entry points for sales.

대체 시나리오:- Trend: Neutral

- Sup: 1.3451

- Res: 1.3486

- Note: Consider long positions from 1.3451 with confirmation. A breakout of 1.3486 opens the path to 1.3516.

오늘은 뉴스가 없습니다

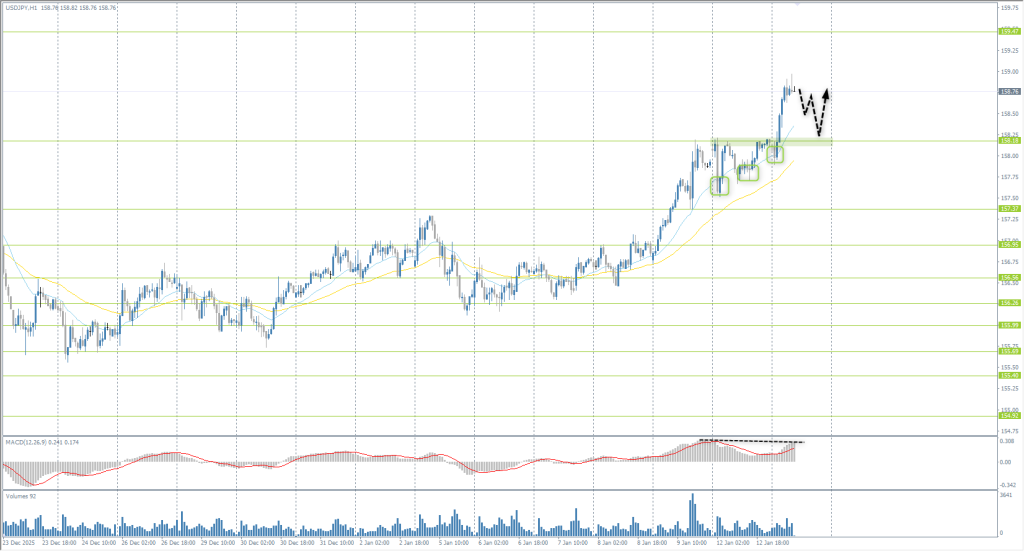

The USD/JPY currency pair

통화 쌍의 기술적 지표:

- 개장 전: 158.08

- 폐장 전: 158.16

- 전날 대비 # % 변동: +0.05 %

The Japanese yen weakened to the 159 level against the dollar on Tuesday, hitting its lowest point since mid-last year amid intensifying political uncertainty. Pressure on the currency was fueled by speculation regarding a potential dissolution of parliament by Prime Minister Sanae Takaichi in the coming months and expectations of a more active fiscal policy, raising concerns about increased government spending. Additionally, the Japanese Finance Minister expressed concern over the “one-sided weakening” of the yen during contacts with US counterparts, while risks related to Chinese export restrictions on strategic materials weighed on sentiment. Against this backdrop, the market remains divided on the timing of the Bank of Japan’s next rate hike, given conflicting macroeconomic signals.

거래 권고

- 지원 레벨: 157.37, 156.95, 156.56, 156.26

- 저항 레벨: 158.18, 159.47

The Japanese yen has depreciated sharply against the dollar. On higher time frames, the path to 160 is open, which potentially increases the likelihood of intervention by Japanese authorities. The price has currently deviated significantly from the average lines; therefore, considering the MACD divergence, it is better to wait for a corrective wave. For long positions (buys), the best levels to watch are the EMA lines or the 158.18 support level. No optimal entry points for sales.

대체 시나리오:- Trend: Up

- Sup: 158.18

- Res: 159.47

- Note: Focus on the EMA lines or 158.18 support for buy entries. No optimal entry points for sales at this time.

오늘은 뉴스가 없습니다

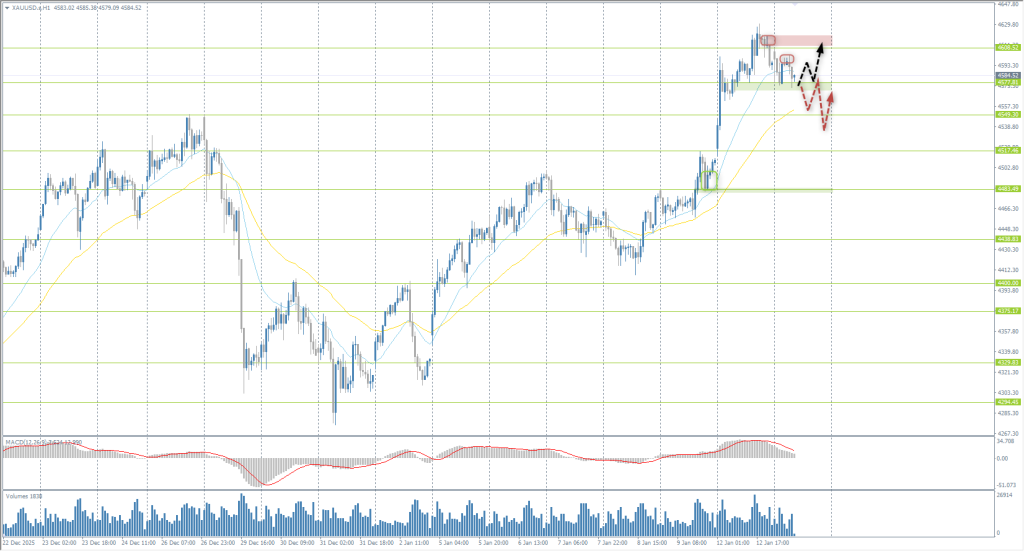

The XAU/USD currency pair (gold)

통화 쌍의 기술적 지표:

- 개장 전: 4520

- 폐장 전: 4593

- 전날 대비 # % 변동: +1.61 %

Gold prices stabilized around $4590 per ounce on Tuesday, close to the record high reached in the previous session, driven by safe-haven demand amid renewed fears over the US Federal Reserve’s independence and geopolitical tensions. US prosecutors have launched a criminal investigation into Fed Chair Powell regarding his testimony last June, which Powell labeled as part of President Trump’s efforts to pressure the Fed into lowering interest rates. Meanwhile, Trump announced 25% tariffs on countries trading with Iran on Monday, following repeated warnings of potential military action amid mass protests in the country.

거래 권고

- 지원 레벨: 4577, 4550, 4517, 4483, 4438, 4400

- 저항 레벨: 4608, 4650

Gold continues its upward rally. A limit seller has appeared above 4600, and the price is currently correcting. Buyers will likely attempt to hold the 4577 support level to continue the rally. However, if this level is broken, the price may correct toward 4550 or lower. Under these market conditions, consider buys from 4577 or 4550 with confirmation. Short positions (sales) are relevant intraday after a break of 4577, but with short-term targets, as they are counter-trend positions.

대체 시나리오:- Trend: Up

- Sup: 4577

- Res: 4608

- Note: Look for buys from 4577 or 4550 with confirmation. Intraday sales are only valid after a breakout of 4577 with tight targets.

@ 뉴스피드: 2026.01.13

- US Consumer Price Index (m/m) at 15:30 (GMT+2); – USD, XAU (HIGH)

- US Home Sales (m/m) at 17:00 (GMT+2). – USD (MED)

이 기사는 개인의 의견이므로 투자 조언 및/또는 제안, 금융 거래 수행에 대한 지속적 요청 및/또는 보증 및/또는 미래 예측으로 해석하시지 마시기 바랍니다.