The EUR/USD currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 1.0905

- Ditutup Sebelum: 1.0854

- % perubahan sepanjang hari terakhir: -0.47 %

The euro fell below $1.085 after ECB President Lagarde warned of weaker regional economic growth but downplayed inflation risks if the EU retaliates against US tariffs. Speaking to European lawmakers on Thursday, she warned that 25% US tariffs on European imports could cut Eurozone growth by negative 0.3% in the first year, while retaliatory tariffs would push growth to positive 0.5%. In addition, ECB spokesperson De Gallo emphasized that there is room for the ECB to further reduce borrowing costs as Eurozone inflation is less of a concern than in the US.

Cadangan perdagangan

- Tahap sokongan: 1.0830, 1.0677, 1.0602, 1.0561, 1.0466

- Tahap rintangan: 1.0864, 1.0918, 1.0947, 1.0979

The EUR/USD currency pair’s hourly trend is bullish, but close to change. The price has corrected to the level of priority change at 1.0832. Buyers are trying to protect positions here, but sellers have built a resistance level at 1.0864. Traders should return to buying only after the price fixes above this level. Selling can be considered from 1.0864, but also with confirmation. Most likely, amid the lack of economic events, the price will flatten between these levels until the end of the week.

Senario alternatif:if the price breaks through the support level of 1.0830 and consolidates below it, the downtrend will likely resume.

Tiada berita untuk hari ini

The GBP/USD currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 1.3002

- Ditutup Sebelum: 1.2968

- % perubahan sepanjang hari terakhir: -0.26 %

The Bank of England kept the benchmark interest rate unchanged at 4.5% and signaled a gradual and cautious approach to the further removal of monetary policy restraint. Despite notable progress on disinflation in recent months, international trade policy uncertainty intensified following the US announcement of tariffs, which triggered retaliatory measures from some governments and could lead to further price pressures. Meanwhile, investors processed fresh unemployment data with the jobless rate remaining unchanged at 4.4% and wage growth slowing slightly to 5.8%, in line with expectations.

Cadangan perdagangan

- Tahap sokongan: 1.2959, 1.2912, 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- Tahap rintangan: 1.3010

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish. After the decision of the Bank of England to keep the interest rate, sterling was under pressure. Currently, the price is seeking to test the level of 1.2912. For selling, you can use the EMA lines or the resistance level at 1.2959. There are no optimal entry points for buying right now.

Senario alternatif:if the price breaks the support level of 1.2912 and consolidates below it, the downtrend will likely resume.

Tiada berita untuk hari ini

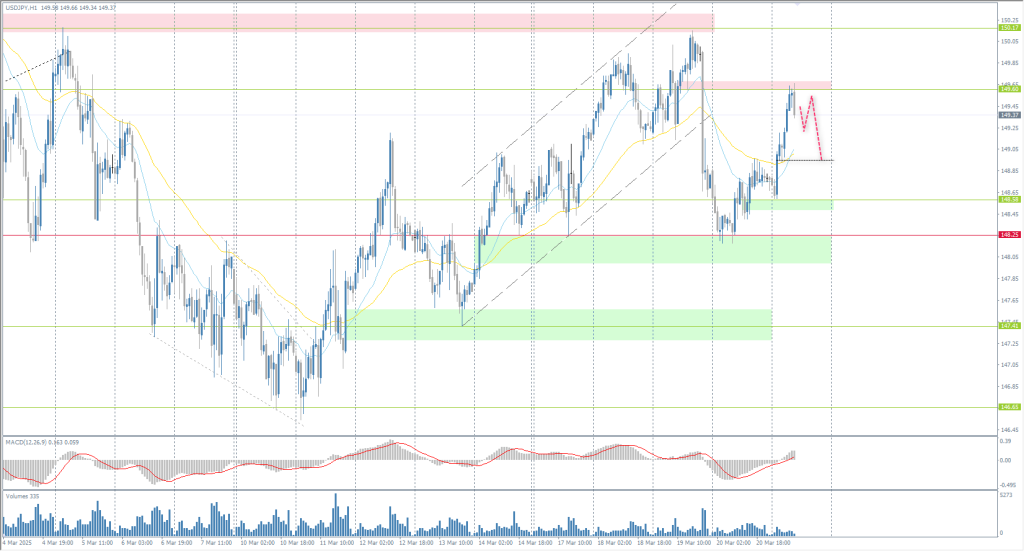

The USD/JPY currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 148.85

- Ditutup Sebelum: 148.77

- % perubahan sepanjang hari terakhir: +0.05 %

The Japanese yen fell to 149.5 per dollar on Friday, breaking a two-day rise as investors reacted to the latest inflation data. Japan’s core inflation rate slowed to 3% in February from 3.2% in January but still beat expectations of 2.9%. This is the second consecutive month that inflation has exceeded expectations, indicating continued price pressures and strengthening the case for further interest rate hikes. In the external market, the yen was pressured by a strengthening dollar as concerns over global growth and trade tensions pressured other major currencies, making investors cautious.

Cadangan perdagangan

- Tahap sokongan: 148.95, 148.58, 148.25

- Tahap rintangan: 149.60, 150.17, 151.29, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish. The Japanese yen rebounded sharply after testing the priority change level of 148.25. Now, the price has reached the resistance level of 149.60, where you can look for sell deals with the target of 148.95. There are no optimal entry points for buying now.

Senario alternatif:if the price breaks through the support level at 148.25 and consolidates below it, the downtrend will likely resume.

Suapan baharu untuk: 2025.03.21

- Japan National Core CPI (m/m) at 01:30 (GMT+2).

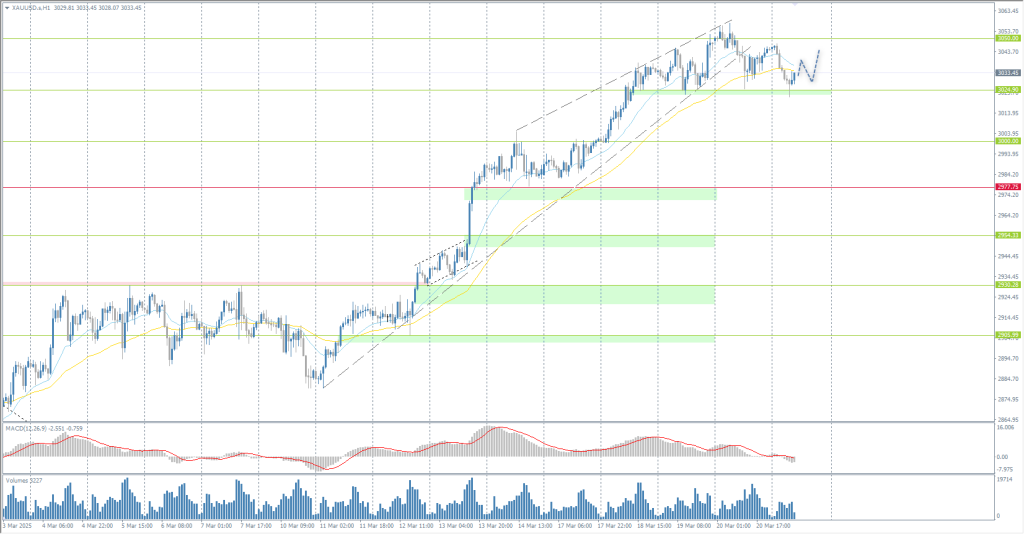

The XAU/USD currency pair (gold)

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 3049

- Ditutup Sebelum: 3045

- % perubahan sepanjang hari terakhir: -0.13 %

Gold traded around $3030 per ounce on Friday, staying near record highs and posting its third weekly gain, helped by dovish signals from the Federal Reserve and safe-haven demand. Meanwhile, tensions continued to escalate in the Middle East as Israel expanded its offensive on Gaza, Hamas struck Tel Aviv, and the US continues airstrikes on Houthi targets in Yemen. Markets also await the April 2 deadline for Trump to impose retaliatory tariffs on countries that have imposed duties on US goods, adding to global trade problems. Gold has risen more than 15% since the beginning of the year.

Cadangan perdagangan

- Tahap sokongan: 3024, 3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- Tahap rintangan: 3050, 3100

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold corrected to the support level of 2025. A false breakdown was formed, which opened the door for renewed buying. A move below 3025 is undesirable for buyers, as it will open the way for the price to 3000.

Senario alternatif:if the price breaks below the support level 2906, the downtrend will likely resume.

Tiada berita untuk hari ini

Artikel ini menyatakan pendapat peribadi dan tidak seharusnya ditafsirkan sebagai nasihat pelaburan, dan/atau tawaran, dan/atau permohonan berterusan untuk menjalankan transaksi kewangan, dan/atau jaminan, dan/atau ramalan peristiwa akan datang.