The EUR/USD currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 1.0818

- Ditutup Sebelum: 1.0791

- % perubahan sepanjang hari terakhir: -0.25 %

The euro fell below $1.08 after reports that White House aides are proposing to impose tariffs of around 20% on most US imports, although a final decision has not yet been made. Meanwhile, economic data showed Eurozone consumer price inflation fell to 2.2% in March, the lowest level since November 2024, mainly due to a slowdown in services prices. Core inflation fell more than expected to 2.4%, the lowest level since January 2022. With inflationary pressures easing and global trade tensions intensifying, expectations have increased that the ECB may cut interest rates by 65 bps this year.

Cadangan perdagangan

- Tahap sokongan: 1.0785, 1.0765, 1.0677, 1.0602, 1.0561, 1.0466

- Tahap rintangan: 1.0858, 1.0918, 1.0947, 1.0979

The EUR/USD currency pair’s hourly trend is bearish. The euro is flat at the EMA levels, approaching the 1.0785 support line. The price is squeezing in a triangle. This increases the probability of an impulsive breakdown. Selling should be considered if the price consolidates below the demand zone. Buying trades should be considered if the price consolidates above the trend line.

Senario alternatif:if the price breaks the resistance level of 1.0858 and consolidates above it, the uptrend will likely resume.

Suapan baharu untuk: 2025.04.02

- US ADP Nonfarm Employment Change (m/m) at 15:15 (GMT+3).

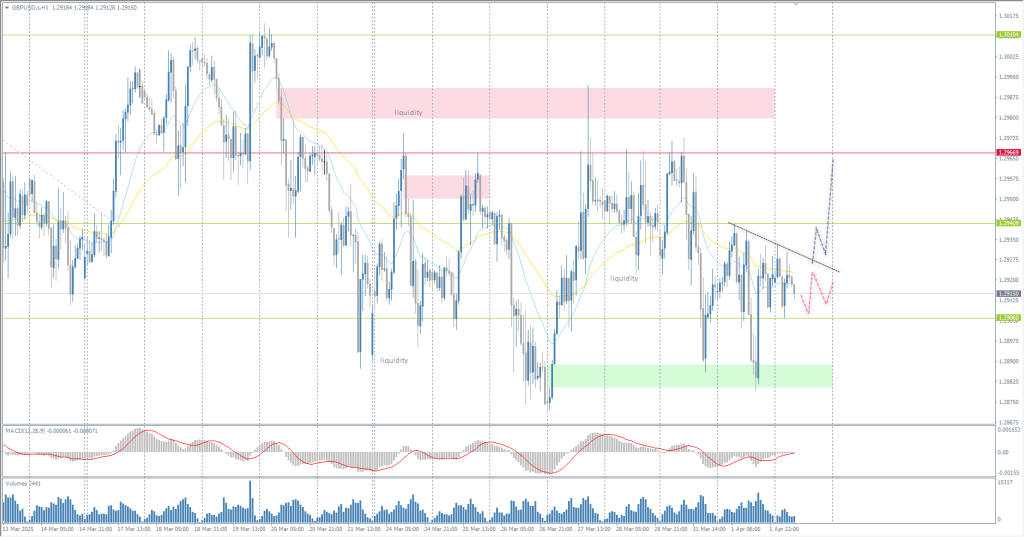

The GBP/USD currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 1.2916

- Ditutup Sebelum: 1.2922

- % perubahan sepanjang hari terakhir: +0.04 %

The UK Manufacturing PMI for March 2025 from S&P Global was revised upwards to 44.9 from the initial estimate of 44.6. Despite the upward revision, the index remained the lowest in the last 17 months. The downturn in the economy for UK manufacturers has deepened, with the pace of contraction in output and new orders accelerating amid the ongoing challenging environment. Business confidence fell to a near two-and-a-half-year low as concerns over government policy, rising costs, heightened geopolitical tensions, and potential uncertainty over tariffs affected both current and expected future conditions.

Cadangan perdagangan

- Tahap sokongan: 1.2906, 1.2873, 1.288, 1.2933, 1.2911, 1.2866, 1.2811

- Tahap rintangan: 1.2966, 1.3010

From the point of view of technical analysis, the trend on the GBP/USD currency is bearish. The price is forming a flat accumulation near the EMA lines. This indicates that investors are in no hurry to take positions due to trade tensions. Intraday, we can look for buying from the support level of 1.2906, but only with confirmation. A price fixing below 1.2906 may trigger a wave of sell-offs. At the same time, price consolidation above the downtrend line may open the way to 1.2941 and higher.

Senario alternatif:if the price breaks through the resistance level of 1.2966 and consolidates above it, the uptrend will likely resume.

Tiada berita untuk hari ini

The USD/JPY currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 149.92

- Ditutup Sebelum: 149.61

- % perubahan sepanjang hari terakhir: -0.20 %

Bank of Japan (BoJ) Governor Kazuo Ueda warned that new US tariffs could have a significant impact on global trade and economic growth. Speaking at Japan’s parliament, Ueda emphasized the uncertainty surrounding the potential impact of reciprocal tariffs on trade flows, business sentiment and inflation. The new duties, which take effect April 3, include a 25% duty on auto imports. These measures are in addition to existing US tariffs on aluminum and steel, as well as higher duties on all Chinese imports. Ueda plans to raise these issues at the upcoming G20 meeting, where US trade policy and its implications will be a major topic of discussion. Analysts believe the economic fallout could affect the Bank of Japan’s decision on interest rates, which are expected to rise in the third quarter of 2025, most likely in July.

Cadangan perdagangan

- Tahap sokongan: 148.98, 148.60, 148.25

- Tahap rintangan: 150.27, 151.02, 151.32, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish, but close to a shift. The yen is forming a flat accumulation with the boundaries of 148.98-150.27. Currently, the price seeks to test the liquidity above 150.26, where a sharp reaction of sellers is expected. At the same time, the price may bounce off the trend line, so it is important to assess the reaction. There are no optimal entry points for buying right now.

Senario alternatif:if the price breaks through the support level at 148.60 and consolidates below it, the downtrend will likely resume.

Tiada berita untuk hari ini

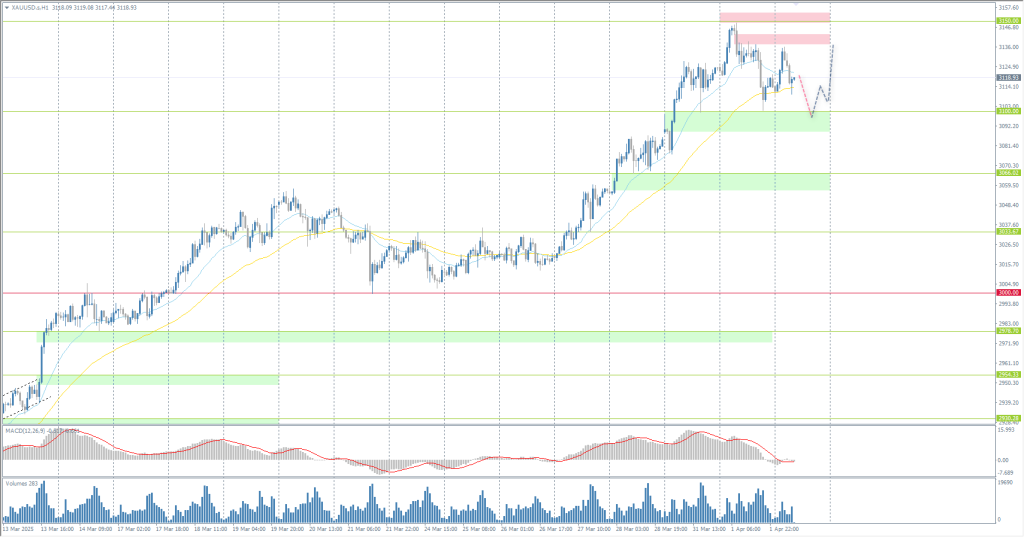

The XAU/USD currency pair (gold)

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 3124

- Ditutup Sebelum: 3113

- % perubahan sepanjang hari terakhir: -0.35 %

Gold jumped to a new record high of $3,140 an ounce, posting its best quarterly performance since September 1986, as investors seek safety ahead of President Donald Trump’s impending imposition of tariffs, which has heightened fears of a global trade war. Trump announced the retaliatory tariffs, which will take effect on Wednesday, will apply to all countries rather than a smaller group of 10 to 15 countries, with additional tariffs on automobiles to follow on Thursday. In addition to trade concerns, gold’s rally has been fueled by expectations of lower interest rates, continued central bank buying and strong demand for gold-backed ETFs.

Cadangan perdagangan

- Tahap sokongan: 3100, 3057, 3037,3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- Tahap rintangan: 3136, 3150, 3200

From the point of view of technical analysis, the trend on the XAU/USD is bullish. There are first signs of the profit fixation on gold. The price is correcting under the pressure of closing earlier open purchases. Currently, gold is likely to form a flat accumulation. For buying we can consider the demand zone below 3100. For selling we can consider the resistance level of 2136 and 3150, but with confirmation in the form of a bearish reaction.

Senario alternatif:if the price breaks below the support level of 3000, the downtrend will likely resume.

Suapan baharu untuk: 2025.04.02

- US ADP Nonfarm Employment Change (m/m) at 15:15 (GMT+3).

Artikel ini menyatakan pendapat peribadi dan tidak seharusnya ditafsirkan sebagai nasihat pelaburan, dan/atau tawaran, dan/atau permohonan berterusan untuk menjalankan transaksi kewangan, dan/atau jaminan, dan/atau ramalan peristiwa akan datang.