The EUR/USD currency pair

Indikator teknikal pasangan mata wang:

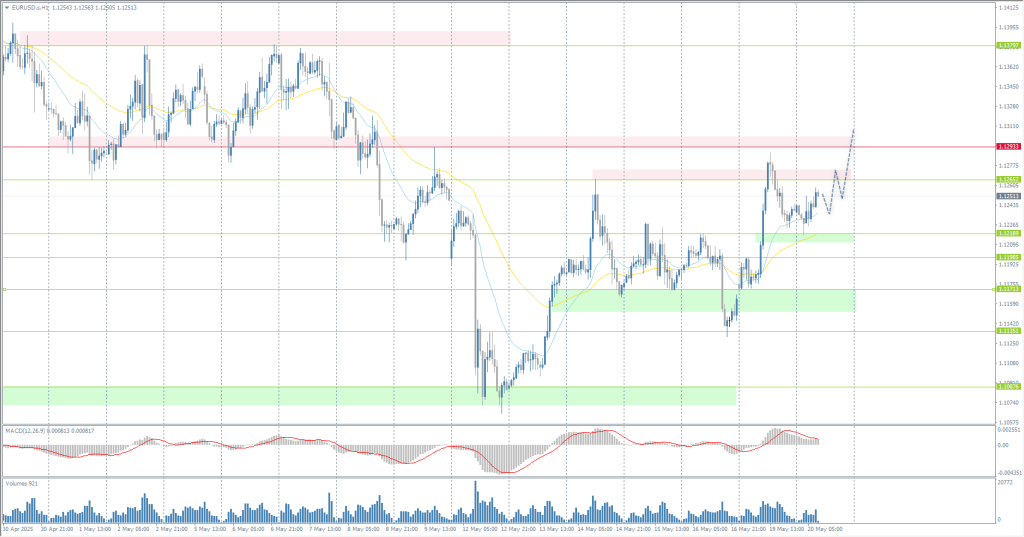

- Dibuka Sebelum: 1.1175

- Ditutup Sebelum: 1.1238

- % perubahan sepanjang hari terakhir: +0.56 %

According to the European Commission’s spring expectations, the Eurozone economy will grow by 0.9% in 2025 and 1.4% in 2026, down from 1.3% and 1.6%, expected since late autumn. The downgrade in the projection is primarily happening due to the impact of rising tariffs and increased uncertainty caused by recent abrupt changes in US trade policy. Eurozone inflation is projected to fall to 2.1% by mid-2025, reaching the ECB’s target earlier than previously expected, and to fall to 1.7% in 2026, down from the 1.9% expected in autumn. In Germany, the bloc’s largest economy, the Commission expects economic activity to stagnate overall in 2025.

Cadangan perdagangan

- Tahap sokongan: 1.1219, 1.1170, 1.1135, 1.1088, 1.1017, 1.0902

- Tahap rintangan: 1.1293, 1.1379

The EUR/USD currency pair’s hourly trend is bearish. However, the intraday bias is currently in favor of the buyers. Currently, the price is aiming at the level of priority change at 1.1293. For buy deals, we can consider the 1.1219 support level, but with confirmation in the form of initiative. You can also consider buying from the EMA lines. There are no optimal entry points for selling right now.

Senario alternatif:if the price breaks the resistance level of 1.1293 and consolidates above it, the uptrend will likely resume.

Tiada berita untuk hari ini

The GBP/USD currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 1.3267

- Ditutup Sebelum: 1.3361

- % perubahan sepanjang hari terakhir: +0.70 %

The British pound climbed above USD 1.336, nearing the seven-month peak of USD 1.34 reached in April, as investors are optimistic ahead of key UK economic data releases and an important political breakthrough with the EU. On Monday, the UK and the EU reached a landmark agreement to reset relations after Brexit. The deal includes cooperation on energy, defense, and reciprocal fishing rights until 2038.

Cadangan perdagangan

- Tahap sokongan: 1.3326, 1.3253, 1.3121

- Tahap rintangan: 1.3322, 1.3356, 1.3382

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly time frame has changed to an upward trend. The British pound has consolidated above the priority change level. At the moment, a divergence has formed on the MACD indicator, indicating a possible correction. For buying, it is best to consider the EMA lines, or the support level of 1.3326. There are no optimal entry points for selling right now.

Senario alternatif:if the price breaks the support level of 1.3215 and consolidates below it, the downtrend will likely resume.

Tiada berita untuk hari ini

The USD/JPY currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 145.26

- Ditutup Sebelum: 144.85

- % perubahan sepanjang hari terakhir: -0.28 %

The Japanese yen held at 144 per dollar on Tuesday as the US dollar weakened after Moody’s downgraded its credit rating. Investors will be assessing Japan’s nationwide inflation data this week. Further upward price pressures are expected, potentially contributing to the yen’s strength. Investors are also paying attention to upcoming Japanese trade data amid the looming effects of upcoming US tariff measures. Recently, the third round of negotiations is expected to begin as early as Friday in Washington.

Cadangan perdagangan

- Tahap sokongan: 144.00, 143.01

- Tahap rintangan: 144.75, 145.46, 146.36, 148.28, 150.47

From a technical point of view, the medium-term trend of the USD/JPY has changed to a downtrend. Currently, the price is aiming at the demand zone below the support level of 144.00. For sell deals we can consider EMA lines or resistance level 144.75, but with confirmation. The MACD divergence indicates weakness, so we should not expect a strong price decline without a corrective pullback.

Senario alternatif:if the price breaks through the resistance level of 147.12 and consolidates above it, the uptrend will likely resume.

Tiada berita untuk hari ini

The XAU/USD currency pair (gold)

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 3211

- Ditutup Sebelum: 3230

- % perubahan sepanjang hari terakhir: +0.59 %

Gold rose by 0.6% on Monday after Moody’s downgraded the US to ‘Aa1’ from ‘Aaa’ on Friday, citing rising debt and interest rates “that are significantly higher than those of similarly rated sovereigns.” However, optimism over a possible ceasefire between Russia and Ukraine has somewhat reduced demand for safe-haven assets. The US President Donald Trump said Monday after a phone call with Russian President Vladimir Putin that Ukraine and Russia would “immediately” begin cease-fire talks, but possibly without US participation.

Cadangan perdagangan

- Tahap sokongan: 3201, 3151, 3103, 3049

- Tahap rintangan: 3266, 3347, 3370

From the point of view of technical analysis, the trend on the XAU/USD is bearish, but the conditions for reversal of the medium-term trend are being created. The price is starting to clamp into a triangle, which is often a harbinger of an impulsive movement. The support level of 3201 can be considered for buying, but with confirmation. The profit target is the resistance level 3226. If the price fixes impulsively below 3201, it will lead to a sharp sell-off to 3151.

Senario alternatif:if the price breaks and consolidates above the resistance level 3226, the uptrend will likely resume.

Tiada berita untuk hari ini

Artikel ini menyatakan pendapat peribadi dan tidak seharusnya ditafsirkan sebagai nasihat pelaburan, dan/atau tawaran, dan/atau permohonan berterusan untuk menjalankan transaksi kewangan, dan/atau jaminan, dan/atau ramalan peristiwa akan datang.