The EUR/USD currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 1.1710

- Ditutup Sebelum: 1.1763

- % perubahan sepanjang hari terakhir: +0.45 %

French Prime Minister François Bayrou will face a vote of confidence, which he is expected to lose, possibly forcing President Emmanuel Macron to appoint his fifth prime minister in less than two years. Later in the week, on Thursday, the European Central Bank will hold a meeting, at which policymakers are expected to leave rates unchanged for the second consecutive meeting. The ECB is assessing the impact of prolonged trade uncertainty and the potential consequences of proposed US tariffs, while inflation remains on target for the third month in a row.

Cadangan perdagangan

- Tahap sokongan: 1.1756, 1.1704, 1.1680, 1.1642, 1.1629, 1.1584, 1.1528

- Tahap rintangan: 1.1786

The EUR/USD currency pair’s hourly trend is bullish. Yesterday, the euro price updated its weekly high, failing to reach the support level of 1.1680. At the moment, the price is forming a flat accumulation above 1.1756. It is important for buyers to keep the price above this level to maintain the rally. A sharp drop in the price below 1.1756 could trigger a sell-off, which is also confirmed by the formation of a MACD divergence.

Senario alternatif:if the price breaks the support level of 1.1629 and consolidates below it, the downtrend will likely resume.

Tiada berita untuk hari ini

The GBP/USD currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 1.3495

- Ditutup Sebelum: 1.3544

- % perubahan sepanjang hari terakhir: +0.36 %

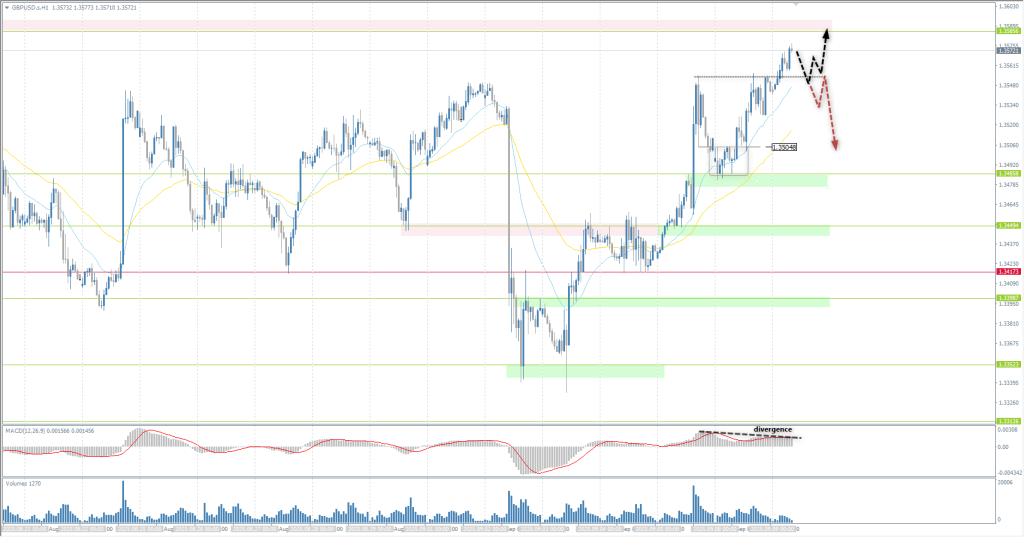

Sterling is currently being driven by the broad direction of the dollar and is being helped by the growing interest rate premium that the UK offers compared to the US (and Germany). Expectations regarding the Bank of England have also changed. The probability of a rate hike has fallen from 100% ahead of the BoE’s last meeting this year to 40%. Many, if not most, observers recognize the risk that the government will take new measures to increase revenue, and an additional tax on British banks has already been proposed as a possible option. The resignation of Deputy Prime Minister Reiner over a tax issue adds to Prime Minister Starmer’s problems, while news of seasonal adjustment problems at the ONS, which overstated retail sales by GBP2 billion, complicates the fiscal pressure on Chancellor Reeves. However, the weakness of the dollar was a more important factor, and this helped the pound to rise.

Cadangan perdagangan

- Tahap sokongan: 1.3549, 1.3449, 1.3398, 1.3312, 1.3281

- Tahap rintangan: 1.3585

In terms of technical analysis, the trend on the currency pair GBP/USD has changed to upward. The British currency is heading towards the resistance level of 1.3585, above which there is a large accumulation of liquidity. The MACD indicator signals a divergence, which increases the likelihood of a correction from 1.3585. A sharp drop in price below 1.3549 could trigger a sell-off.

Senario alternatif:if the price breaks through the support level of 1.3417 and settles below it, the downtrend will likely resume.

Tiada berita untuk hari ini

The USD/JPY currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 148.11

- Ditutup Sebelum: 147.49

- % perubahan sepanjang hari terakhir: -0.42 %

The Japanese yen strengthened to around 147.3 per dollar on Tuesday, continuing the previous session’s gains, as the dollar fell amid growing expectations of a more significant rate cut by the US Federal Reserve. In the domestic market, investors assessed the political implications of Prime Minister Shigeru Ishiba’s resignation, which came after a deepening rift in the ruling party and pressure following his defeat in national elections late last year. The event also coincided with Japan’s failure to reach a trade agreement with the US.

Cadangan perdagangan

- Tahap sokongan: 147.09, 146.74

- Tahap rintangan: 147.54, 147.87, 148.26

From a technical point of view, the medium-term trend of the USD/JPY is bullish, but close to a reversal. The price is testing the priority change level, and there is no reaction from buyers. Most likely, the decline will continue to 146.74 to test the liquidity pool. Intraday, sales to this level can be considered. There are no optimal entry points for buy deals at this time.

Senario alternatif:if the price breaks through the support level of 147.09 and consolidates below it, the downtrend will likely resume.

Tiada berita untuk hari ini

The XAU/USD currency pair (gold)

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 3594

- Ditutup Sebelum: 3636

- % perubahan sepanjang hari terakhir: +1.17 %

On Tuesday, gold reached a new all-time high of $3,650 per ounce, driven by growing expectations that the Federal Reserve will cut interest rates before the end of the year. Investors are now awaiting data on the US Producer Price Index and Consumer Price Index, which will be released later this week and may provide additional guidance on the Fed’s next steps. In addition to rate expectations, demand for the precious metal as a safe haven is also supported by uncertainty surrounding US tariffs and geopolitical risks. Since the beginning of the year, gold has risen 39% amid a weakening US dollar, active purchases by central banks, loose monetary policy, and heightened global uncertainty.

Cadangan perdagangan

- Tahap sokongan: 3575, 3560, 3500, 3469, 3438, 3402, 3383, 3374

- Tahap rintangan: 3600

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold continues to rally. However, the MACD indicator points to a cumulative divergence, which increases the likelihood of a corrective movement. For sell deals, it is necessary to wait for liquidity to be captured above resistance levels so that there is fuel for the price to correct. For buy deals, it is also worth looking for false breakouts below to support maintaining the rally.

Senario alternatif:if the price breaks the support level of 3511 and consolidates below it, the downtrend will likely resume.

Tiada berita untuk hari ini

Artikel ini menyatakan pendapat peribadi dan tidak seharusnya ditafsirkan sebagai nasihat pelaburan, dan/atau tawaran, dan/atau permohonan berterusan untuk menjalankan transaksi kewangan, dan/atau jaminan, dan/atau ramalan peristiwa akan datang.