The EUR/USD currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 1.1597

- Ditutup Sebelum: 1.1610

- % perubahan sepanjang hari terakhir: +0.11 %

The US dollar received moderate support thanks to improved market sentiment related to trade relations between the US and China. The strengthening of the US dollar put pressure on the euro. Investors are awaiting delayed US inflation data and preliminary PMI readings for key eurozone economies, which will be released on Friday and may provide new signals regarding the future trajectory of monetary policy.

Cadangan perdagangan

- Tahap sokongan: 1.1600, 1.1543

- Tahap rintangan: 1.1638, 1.1667, 1.1686, 1.1728

The hourly trend for EUR/USD is bullish. The situation has remained virtually unchanged since yesterday. The price reached the support level of 1.1600, and after testing liquidity below, buyers took the initiative. Intraday, you can look for buy trades with a target of 1.1637 and above. There are currently no optimal entry points for selling.

Senario alternatif:if the price breaks below the 1.1543 support and consolidates, a bearish trend will likely resume.

Suapan baharu untuk: 2025.10.23

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3), (Tentative);

- US Existing Home Sales (m/m) at 17:00 (GMT+3), (Tentative).

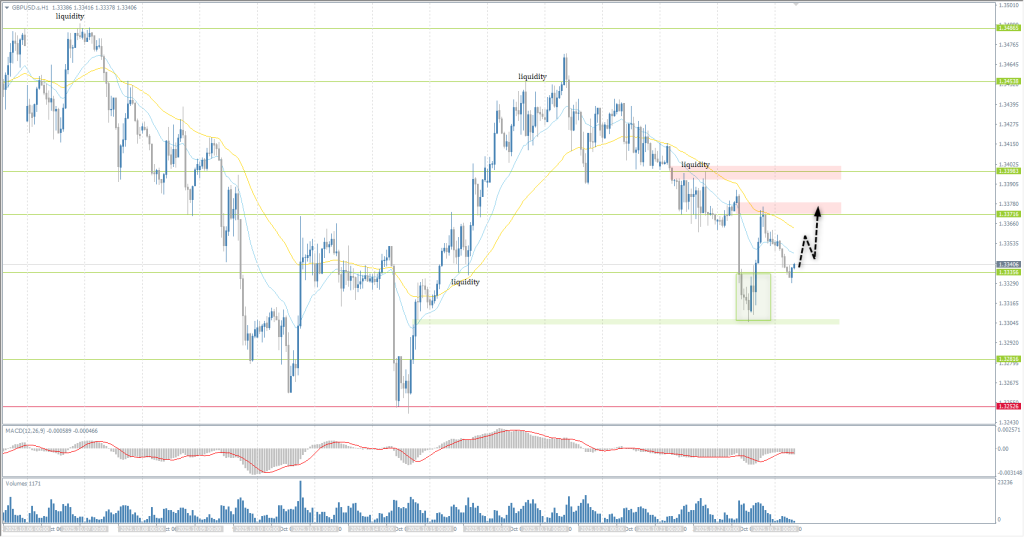

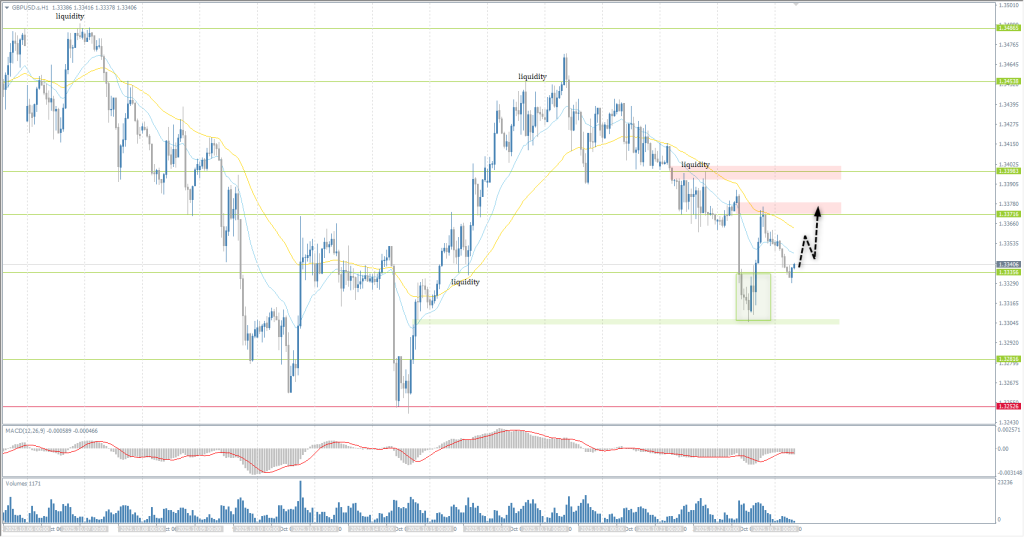

The GBP/USD currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 1.3367

- Ditutup Sebelum: 1.3353

- % perubahan sepanjang hari terakhir: -0.10 %

The pound sterling continued to decline to $1.33, reaching a weekly low after UK inflation data came in weaker than expected. Headline inflation in September remained at 3.8%, falling short of expectations of a rise to 4% as food price growth continued to slow. At the same time, core inflation fell to 3.5%. Soft UK inflation data reinforced expectations that the Bank of England may begin cutting rates in the coming months.

Cadangan perdagangan

- Tahap sokongan: 1.3335, 1.3281

- Tahap rintangan: 1.3371, 1.3398, 1.3453, 1.3486

Technically, the trend remains bullish. The pound reached the support level of 1.3335, where buyers became active after testing liquidity. On intraday time frames, you can look for buy trades from the formed locked balance. For sell deals, traders can consider the resistance level of 1.3371, but only with confirmation.

Senario alternatif:if the price breaks through the support level of 1.3253 and consolidates below it, the downtrend will likely resume.

Tiada berita untuk hari ini

The USD/JPY currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 151.86

- Ditutup Sebelum: 151.95

- % perubahan sepanjang hari terakhir: +0.06 %

The yen weakened to above 152 per dollar on Thursday, approaching an eight-month low, as expectations grew for large-scale stimulus measures from new Prime Minister Sanae Takaichi. Analysts believe that Takahashi will pursue an expansionary fiscal policy, combining it with a dovish approach by the Bank of Japan, which is expected to keep rates unchanged at its meeting next week. At the same time, markets are now expecting the next rate hike in January 2026.

Cadangan perdagangan

- Tahap sokongan: 151.45, 150.15, 149.75

- Tahap rintangan: 152.15, 153.28, 154.80

The medium-term trend is bullish. The price broke through the resistance level of 152.15 and is trading above it. It is important for buyers not to let the price settle below the 152 level again. A return on impulsive candles will form a locked balance above the level, which is likely to lead to a sell-off below 151.45. If buyers react to the 152.00-152.15 zone, the price will have a path open to 153.28.

Senario alternatif:if the price breaks below 149.75 and consolidates lower, a bearish trend will likely resume.

Tiada berita untuk hari ini

The XAU/USD currency pair (gold)

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 4109

- Ditutup Sebelum: 4102

- % perubahan sepanjang hari terakhir: -0.17%

Gold prices continued to decline on Wednesday due to improved global risk sentiment. Market optimism was boosted by expectations of easing trade tensions between the US and China: Donald Trump and Xi Jinping are set to meet next week to discuss a possible settlement of tariff disputes and prevent further escalation. Despite the recent correction, gold remains the growth leader in 2025.

Cadangan perdagangan

- Tahap sokongan: 4050, 4000, 3946

- Tahap rintangan: 4102, 4162, 4184, 4270, 4379, 4400

Technically, the medium-term trend is bullish. Gold is forming a wide-range flat pattern. This is to be expected after Tuesday’s sharp decline. The intraday bias remains with the sellers, so intraday trades should be considered from 4102 or 4162, aiming to update the weekly low. To resume the uptrend, the price needs to break above 4184.

Senario alternatif:if the price breaks below support at 3946 and consolidates, a bearish trend will likely resume.

Suapan baharu untuk: 2025.10.23

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3), (Tentative);

- US Existing Home Sales (m/m) at 17:00 (GMT+3), (Tentative).

Artikel ini menyatakan pendapat peribadi dan tidak seharusnya ditafsirkan sebagai nasihat pelaburan, dan/atau tawaran, dan/atau permohonan berterusan untuk menjalankan transaksi kewangan, dan/atau jaminan, dan/atau ramalan peristiwa akan datang.