The EUR/USD currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 1.1863

- Ditutup Sebelum: 1.1869

- % perubahan sepanjang hari terakhir: +0.05%

The euro continues to trade near 1.19, remaining close to its four-year high above 1.20. Support for the single currency came from signals from the ECB indicating the regulator is not concerned by its recent appreciation. ECB President Christine Lagarde noted that the inflation outlook is in “good shape,” while cautioning against overreacting to short-term data fluctuations. Regarding macro data, US inflation slowed to 2.4% in January, while employment rose by 130,000, exceeding expectations. The combination of softer price pressure and a resilient labor market has reinforced the view that the US Fed still has room for potential rate cuts this year.

Cadangan perdagangan

- Tahap sokongan: 1.1833, 1.1777, 1.1754, 1.1726

- Tahap rintangan: 1.1894, 1.1955, 1.2050, 1.3000

The situation remains virtually unchanged compared to Friday. Following the Euro’s drop to 1.1833 post-NFP report, the currency entered a flat phase within the 1.1833-1.1894 range and has been trading sideways for four days. It is crucial for buyers to hold 1.1830: an impulsive consolidation below this level could open the path for a decline toward 1.1777. Selling is advisable near 1.1894, but only upon confirmation of seller initiative. Given the bank holiday in the US today, the price is likely to continue trading near the EMA lines.

Senario alternatif:- Trend: Up

- Sup: 1.1833

- Res: 1.1894

- Note: Consider buy deals from the 1.1833 support level. For sales, evaluate the price reaction at 1.1894.

Suapan baharu untuk: 2026.02.16

- Eurozone Industrial Production (m/m) at 12:00 (GMT+2). – EUR (LOW)

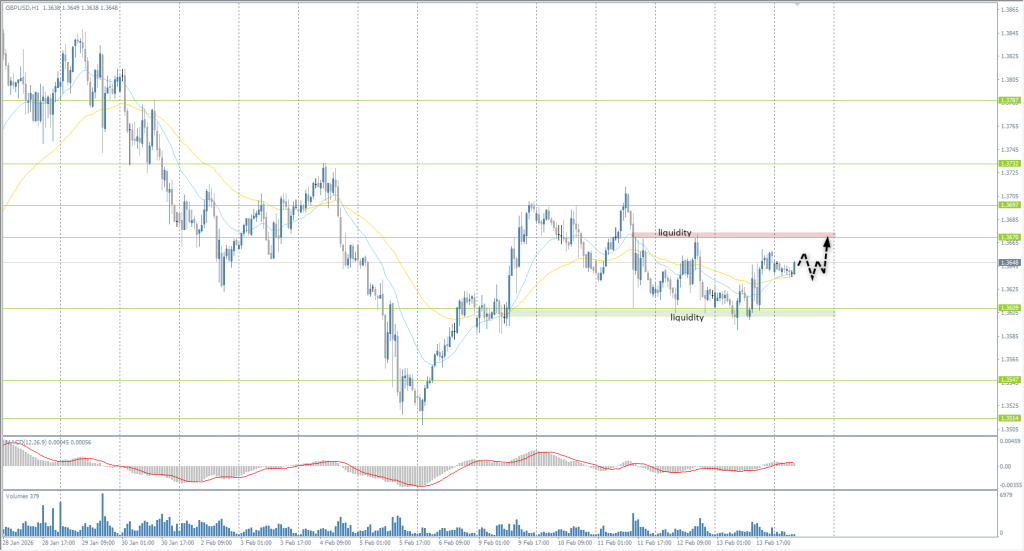

The GBP/USD currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 1.3610

- Ditutup Sebelum: 1.3654

- % perubahan sepanjang hari terakhir: +0.32 %

The immediate threat of Prime Minister Keir Starmer’s resignation has receded, reducing the political risk premium and easing domestic pressure on the Pound. However, investor attention is shifting to a dense macroeconomic agenda: employment, inflation, and retail sales data will be released this week, along with the January public finance report and the preliminary February manufacturing PMI. Following the Bank of England meeting on February 5, the market sharply revised rate expectations, raising the probability of a March hike from 20% to over 70%. Thus, any signs of slowing price pressure or activity could impact these assessments.

Cadangan perdagangan

- Tahap sokongan: 1.3609, 1.3547, 1.3514

- Tahap rintangan: 1.3670, 1.3697, 1.3732, 1.3787, 1.3871, 1.4000

After clearing liquidity below 1.3609 on Friday, the British Pound formed a bullish reaction and is now attempting to redistribute momentum above immediate resistance levels. Intraday priority shifts toward buying, and the optimal tactic appears to be joining the movement on pullbacks supported by the EMA lines. The immediate upside target is the 1.3670 area. However, low volatility should be expected: Monday and the US bank holiday may limit the amplitude of movements and slow the achievement of targets.

Senario alternatif:- Trend: Up

- Sup: 1.3609

- Res: 1.3670

- Note: Intraday, it is appropriate to look for buys from the EMA lines, but with confirmation. There are no optimal entry points for sales.

Tiada berita untuk hari ini

The USD/JPY currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 152.73

- Ditutup Sebelum: 152.69

- % perubahan sepanjang hari terakhir: -0.03 %

On Monday, the Japanese yen traded near 153 against the dollar, erasing some of last week’s gains after weak GDP data. Japan’s economy grew by only 0.1% QoQ in Q4, below the expected 0.4%, and consumer spending rose by only 0.1%, indicating sluggish domestic demand amid high inflation. Despite this, the yen strengthened by nearly 3% last week, its highest level since November 2024, driven by expectations of active fiscal support from Prime Minister Sanae Takaichi, bets on further BoJ tightening, and the risk of potential currency intervention.

Cadangan perdagangan

- Tahap sokongan: 152.61, 152.17, 151.54

- Tahap rintangan: 153.67, 153.83, 154.58, 155.19

The yen is forming a flat accumulation in the 152.61-153.67 range. There is a high probability the price will test liquidity at 152.17. Therefore, the intraday priority remains to sell. The optimal zone for shorting is the 153.67 resistance, subject to confirmation. Buys can be considered upon a false breakout at 152.17 and the emergence of a bullish initiative following the test.

Senario alternatif:- Trend: Down

- Sup: 152.61

- Res: 153.67

- Note: Looking for sell deals from the 153.67 level, but with confirmation. For buys, expect bullish initiative from 152.17.

Suapan baharu untuk: 2026.02.16

- Japan GDP (q/q) at 01:50 (GMT+2); – JPY (MED)

- Japan Industrial Production (m/m) at 06:30 (GMT+2). – JPY (LOW)

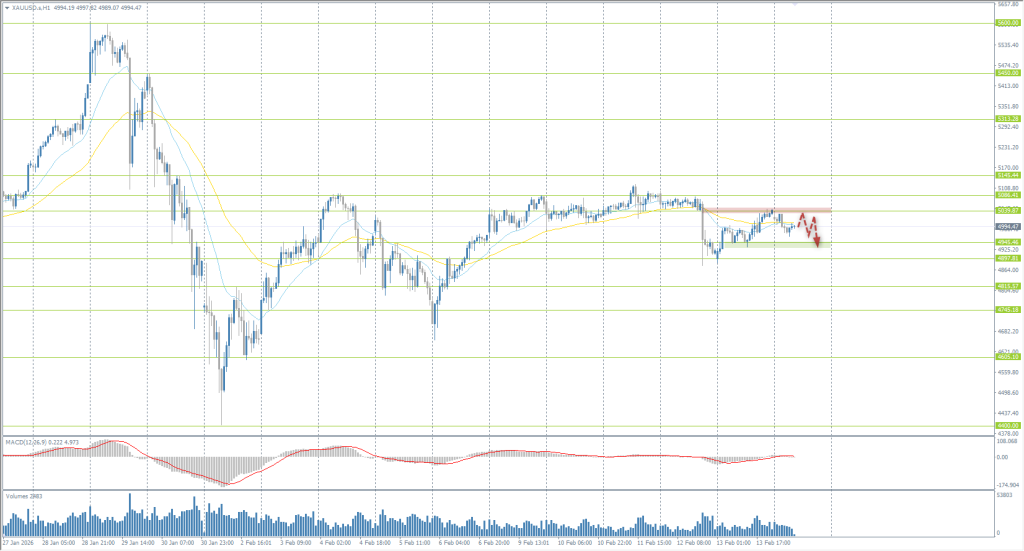

The XAU/USD currency pair (gold)

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 4897

- Ditutup Sebelum: 5042

- % perubahan sepanjang hari terakhir: +2.96 %

On Friday, Gold rose to $5,030 per ounce, narrowing its weekly losses. Support came from weaker-than-expected US inflation data: the slowdown to 2.4% headline and 2.5% core reduced pressure on bond yields and the dollar, strengthening the metal’s position. The statistics bolstered expectations for a dovish shift from the US Fed despite the strong labor market. While recent volatility was driven by large-scale asset liquidation, long-term demand is sustained by central bank purchases, geopolitical risks, and concerns over rising debt burdens.

Cadangan perdagangan

- Tahap sokongan: 4945, 4897, 4815, 4745, 4605, 4400

- Tahap rintangan: 5039, 5086, 5145, 5230

At the close of trading on Friday, Gold tested the 5039 resistance level, where sellers were expected to show initiative. The price will likely aim to test liquidity below 4945. Intraday sales can be considered, but with a tight stop loss. Buying trades can be sought after a test of 4945, but only with confirmation.

Senario alternatif:- Trend: Neutral

- Sup: 4945

- Res: 5039

- Note: Intraday, consider selling from the EMA lines. For buys, evaluate the reaction after the test of the 4945 support level.

Tiada berita untuk hari ini

Artikel ini menyatakan pendapat peribadi dan tidak seharusnya ditafsirkan sebagai nasihat pelaburan, dan/atau tawaran, dan/atau permohonan berterusan untuk menjalankan transaksi kewangan, dan/atau jaminan, dan/atau ramalan peristiwa akan datang.