The EUR/USD currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 1.1850

- Ditutup Sebelum: 1.1855

- % perubahan sepanjang hari terakhir: +0.04%

The Dollar Index rose to a weekly high, gaining 0.25% on the back of hawkish signals from the US Federal Reserve. FOMC representatives, including Austan Goolsbee and Michael Barr, pointed to persistent inflationary pressures in the services sector and the appropriateness of maintaining rates at current levels for some time. EUR/USD dropped to a weekly low and ended the session slightly down following weak data from Germany: the ZEW Expectations Index for February unexpectedly fell to 58.3, against a projected increase. Additional pressure came from the strengthening dollar, while the market is pricing in almost no chance of an ECB rate cut at the March 19 meeting, assessing the probability as minimal.

Cadangan perdagangan

- Tahap sokongan: 1.1805, 1.1777, 1.1754, 1.1726

- Tahap rintangan: 1.1850, 1.1894, 1.1955, 1.2050, 1.3000

The euro found support near 1.1805, where an uptick in demand reversed short-term dynamics and altered the movement structure. Consolidating above the starting point of the previous downward impulse signals a weakening of the bearish scenario and a shift toward a more neutral or moderately positive sentiment. The intraday focus shifts toward buying on pullbacks to the EMA lines, with the immediate target being the liquidity zone above the 1.1894 resistance, where profit-taking is likely.

Senario alternatif:- Trend: Neutral

- Sup: 1.1805

- Res: 1.1894

- Note: Сonsidering buys from the EMA lines, but with confirmation. There are currently no optimal entry points for sells.

Suapan baharu untuk: 2026.02.18

- US Durable Goods Orders (m/m) at 15:30 (GMT+2); – USD (MED)

- US Building Permits (m/m) at 15:30 (GMT+2); – USD (LOW)

- US Industrial Production (m/m) at 16:15 (GMT+2); – USD (LOW)

- US FOMC Meeting Minutes at 21:00 (GMT+2). – USD (HIGH)

The GBP/USD currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 1.3631

- Ditutup Sebelum: 1.3566

- % perubahan sepanjang hari terakhir: -0.47 %

The British pound fell below 1.36 dollars, hitting its lowest level since February 5 amid signs of a cooling labor market and growing expectations of Bank of England policy easing. According to the Office for National Statistics, average weekly earnings including bonuses rose to 4.2% in the three months to December, the slowest pace since August 2024 and below expectations, while unemployment rose to 5.2%, reaching its highest level since early 2021. Weak employment dynamics have boosted market bets on interest rate cuts: investors have fully priced in a 25 bp move in April and see a high probability of easing as early as March. By November, the market expects at least two cuts, placing further pressure on the British currency.

Cadangan perdagangan

- Tahap sokongan: 1.3549, 1.3514

- Tahap rintangan: 1.3606, 1.3670, 1.3697, 1.3732, 1.3787

The pound weakened sharply on the back of poor labor market statistics, reaching a liquidity zone below 1.3514, which triggered a technical bounce. However, the intraday structure still indicates seller dominance, limiting the potential for a sustained recovery. Support near 1.3549 can be viewed as a pivot point for short-term buys with moderate targets. Consolidating below this level will increase pressure and raise the likelihood of a retest of the 1.3514 area, keeping the downward scenario as the priority.

Senario alternatif:- Trend: Neutral

- Sup: 1.3549

- Res: 1.3606

- Note: It is appropriate to look for intraday buys from the 1.3549 support level, but with confirmation. A break of 1.3549 will lead to a renewed sell-off down to 1.3514.

Suapan baharu untuk: 2026.02.18

- UK Inflation Rate (m/m) at 09:00 (GMT+2). – GBP (HIGH)

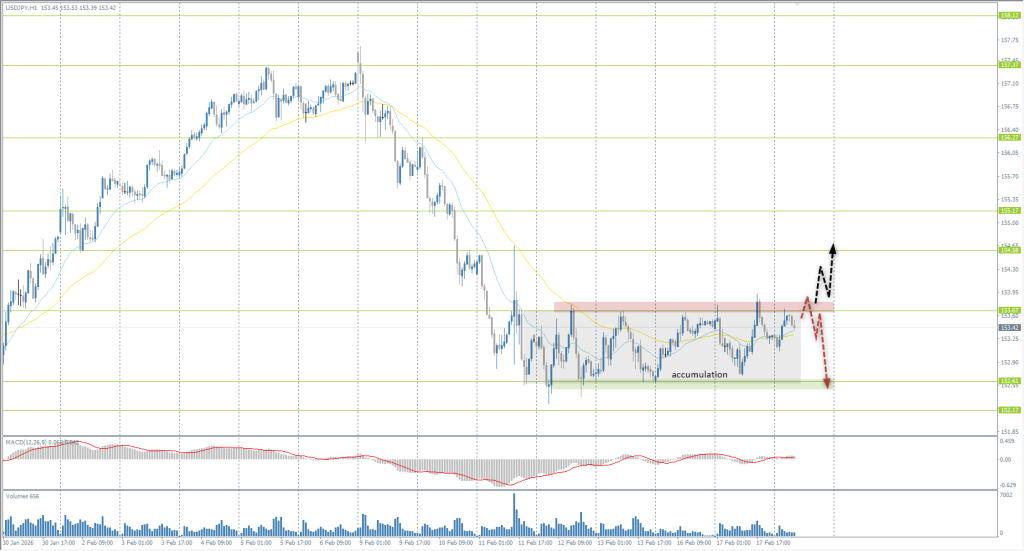

The USD/JPY currency pair

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 153.40

- Ditutup Sebelum: 153.30

- % perubahan sepanjang hari terakhir: -0.06 %

The Japanese yen weakened toward 153.5 per dollar, erasing some recent gains despite strong foreign trade statistics: in January, exports showed their fastest growth rate in three years due to robust demand for AI chips. This data strengthened expectations for further Bank of Japan policy normalization; however, disappointing Q4 GDP, which brought the economy closer to a technical recession, limited investor optimism. The market is pricing in the probability of a rate hike as early as April, anticipating that Prime Minister Sanae Takaichi’s economic program will support growth and indirectly bolster the tightening path.

Cadangan perdagangan

- Tahap sokongan: 152.61, 152.17, 151.54

- Tahap rintangan: 153.67, 154.58, 155.19

The yen is consolidating for a fifth consecutive session within the 152.61-153.67 range, forming an accumulation zone. This prolonged flat increases the likelihood of a more pronounced move once the price breaks out, but while it remains within the corridor, the priority is trading from its boundaries. The 153.67 resistance serves as a key point for short positions targeting the lower boundary. Meanwhile, a confident impulsive breakout of this level would signal the formation of a bullish structure with an immediate target near 154.58.

Senario alternatif:- Trend: Neutral

- Sup: 152.61

- Res: 153.67

- Note: Looking for intraday sells from the 153.67 resistance level, but with confirmation. Buys are permissible after an impulsive breakout of 153.67.

Suapan baharu untuk: 2026.02.18

- Japan Trade Balance (m/m) at 01:50 (GMT+2). – JPY (LOW)

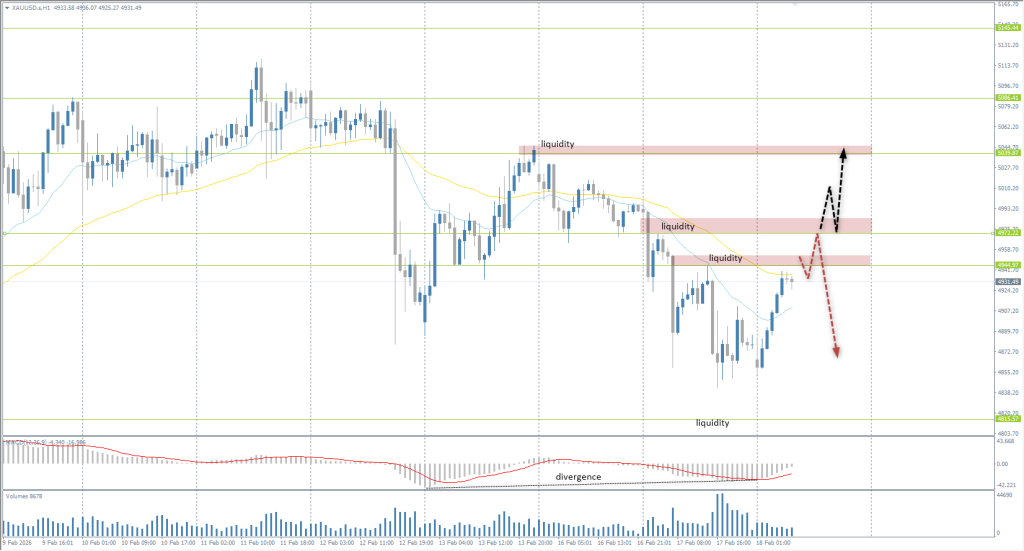

The XAU/USD currency pair (gold)

Indikator teknikal pasangan mata wang:

- Dibuka Sebelum: 4991

- Ditutup Sebelum: 4878

- % perubahan sepanjang hari terakhir: -2.31 %

Gold fell by more than 2%, dropping toward $4,870 per ounce amid a strengthening dollar and a revision of US Fed rate expectations. Despite softer US inflation data boosting expectations for at least one rate cut this year, steady employment growth and positive GDP signals have reduced the likelihood of rapid and aggressive policy easing. The persistence of the interest rate differential supported the dollar and increased pressure on gold denominated in the US currency.

Cadangan perdagangan

- Tahap sokongan: 4897, 4815, 4745, 4605, 4400

- Tahap rintangan: 4945, 4972, 5039, 5086, 5145, 5230

A bearish bias remains on intraday time frames for gold, increasing the probability of a continued decline toward 4815. The resistance zones at 4945 and 4972 can be considered as areas to look for sells. There are currently no optimal entry points for buys, but in the event of an impulsive breakout of 4972, the intraday bias would shift toward buyers.

Senario alternatif:- Trend: Neutral

- Sup: 4815

- Res: 4945

- Note: For intraday, consider sells from the 4945 or 4972 resistance levels. There are currently no optimal entry points for buys.

Suapan baharu untuk: 2026.02.18

- US Durable Goods Orders (m/m) at 15:30 (GMT+2); – USD (MED)

- US Building Permits (m/m) at 15:30 (GMT+2); – USD (LOW)

- US Industrial Production (m/m) at 16:15 (GMT+2); – USD (LOW)

- US FOMC Meeting Minutes at 21:00 (GMT+2). – USD (HIGH)

Artikel ini menyatakan pendapat peribadi dan tidak seharusnya ditafsirkan sebagai nasihat pelaburan, dan/atau tawaran, dan/atau permohonan berterusan untuk menjalankan transaksi kewangan, dan/atau jaminan, dan/atau ramalan peristiwa akan datang.