The EUR/USD currency pair

Indicadores técnicos do par de moedas:

- Anterior Abrir: 1.1393

- Anterior Fechar: 1.1365

- % de mudança no último dia: -0.24 %

The euro slid to $1.13, slightly off the January 2022 highs, after the ECB cut borrowing costs for the sixth consecutive time, as expected. The Central Bank cut its key deposit rate by 25 bps to 2.25%, the lowest level since early 2023, and dropped a reference to “restrictive” policy, while warning that growth prospects have worsened amid escalating trade tensions. Traders are now mostly betting on three more 25bp rate cuts before the end of the year. Nevertheless, the euro rose by about 5% against the dollar in April as investors reassessed the dollar’s role in the global financial system.

Recomendações de negociação

- Níveis de suporte: 1.1246, 1.1157, 1.1088, 1.0960

- Níveis de resistência: 1.1496

The EUR/USD currency pair’s hourly trend is bullish. The euro is trading in a sideways phase at the level of EMA lines. The situation has not changed: the bias remains for the bulls, as the price has not reached an important liquidity pool and has not formed a liquidity grab before the reversal. Therefore, intraday, it is possible to look for buy trades. The minimum profit target is to renew Monday’s high. The maximum profit target is to reach the resistance level of 1.1496. However, it is recommended to refrain from trading today due to the thin market.

Cenário alternativo:if the price breaks the support level of 1.0960 and consolidates below it, the downtrend will likely resume.

Sem novidades para hoje

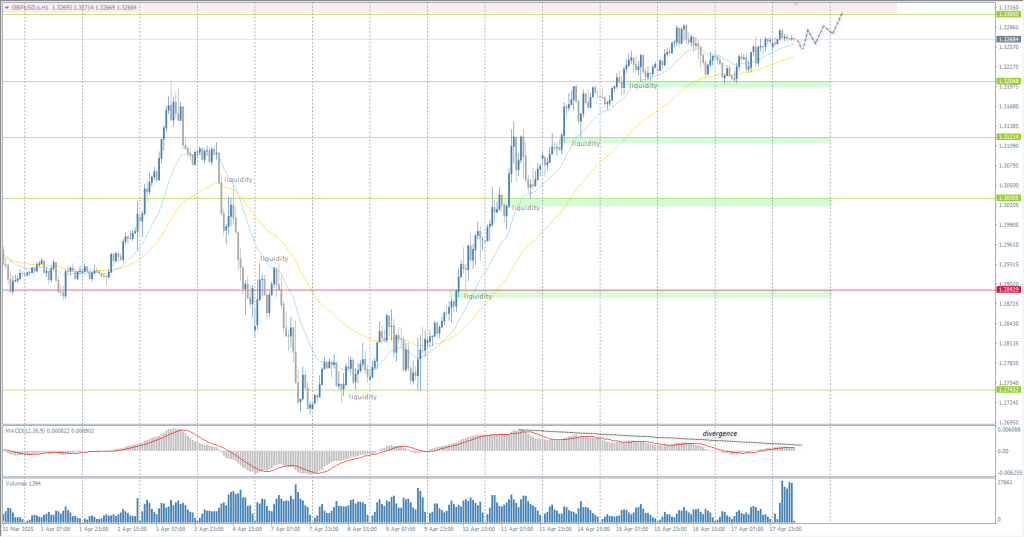

The GBP/USD currency pair

Indicadores técnicos do par de moedas:

- Anterior Abrir: 1.3243

- Anterior Fechar: 1.3266

- % de mudança no último dia: +0.17 %

Today is a holiday weekend in Great Britain — Good Friday. The London Stock Exchange will be closed. Weak volatility is expected on currency pairs with the British currency.

Recomendações de negociação

- Níveis de suporte: 1.3207, 1.3121, 1.3030, 1.2891, 1.2743

- Níveis de resistência: 1.3305, 1.3290

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly time frame is bullish. Given that the important liquidity level above 1.3305 has not been reached, intraday buying from EMA lines can be considered. However, since today is Good Friday, it is best to refrain from trading today due to the thin market and return to trading on Tuesday, April 22.

Cenário alternativo:if the price breaks the resistance level of 1.3114 and consolidates above it, the uptrend will likely resume.

Sem novidades para hoje

The USD/JPY currency pair

Indicadores técnicos do par de moedas:

- Anterior Abrir: 141.83

- Anterior Fechar: 141.42

- % de mudança no último dia: -0.29 %

Japan’s overall inflation fell to a four-month low of 3.6% in March, while core inflation rose in line with expectations to 3.2%. Market attention will now turn to next week’s Bank of Japan meeting, where the Central Bank is expected to leave interest rates unchanged at 0.5%. However, policymakers may revise down their growth expectations amid growing concerns over the impact of US tariffs on the Japanese economy,

Recomendações de negociação

- Níveis de suporte: 142.21, 141.61, 140.45

- Níveis de resistência: 144.08, 145.14, 147.14

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. The situation has not changed: on Wednesday, the yen reached the important support level of 141.61, where the buyers took the initiative. This indicates a liquidity grab, and now, the price will seek to distribute this liquidity higher. Ideally, to the resistance level of 144.08. Therefore, intraday, we can look for buying from the EMA lines. But since most financial markets are closed today, the price is likely to flatten on the EMA lines.

Cenário alternativo:if the price breaks through the resistance level at 147.14 and consolidates above it, the uptrend will likely resume.

Feed de notícias para: 2025.04.18

- Japan National Core Consumer Price Index at 02:30 (GMT+3).

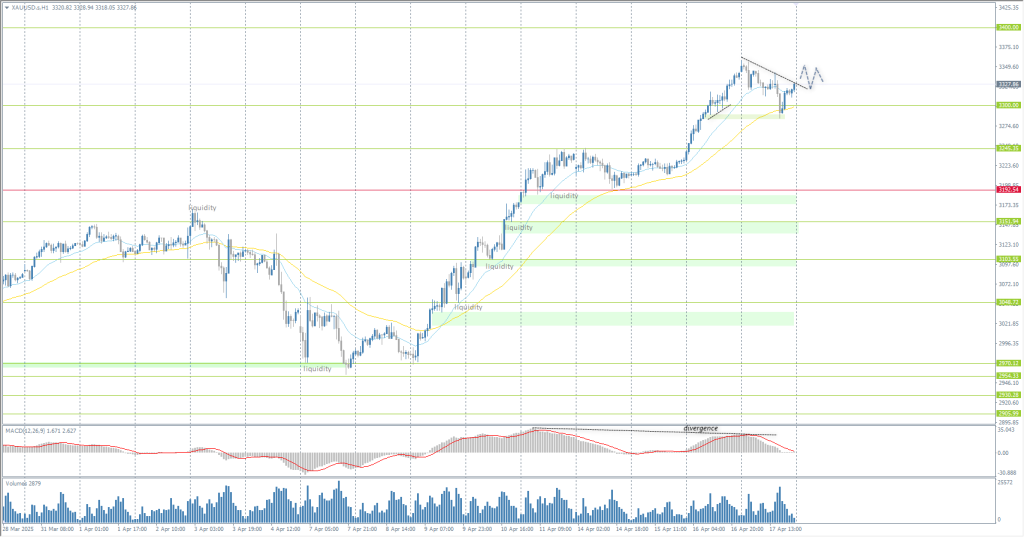

The XAU/USD currency pair (gold)

Indicadores técnicos do par de moedas:

- Anterior Abrir: 3343

- Anterior Fechar: 3327

- % de mudança no último dia: -0.48 %

Gold fell below $3330 an ounce on Thursday as investors booked profits ahead of the Easter holiday and after bullion hit a record high earlier in the session, driven by demand for safe-haven assets amid continued uncertainty over US trade policy. The ever-changing headlines on tariffs have taken center stage in the market. Investors are keeping a close eye on the prospects of trade talks between the US and China, after China expressed willingness to resume trade negotiations but under certain conditions. Gold is not trading today due to the Good Friday holiday.

Recomendações de negociação

- Níveis de suporte: 3300, 3192, 3152, 3103, 3048, 3035

- Níveis de resistência: 3400, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold is not trading today. There could be a price gap at the market open next week amid ongoing tariff uncertainty. The bias remains in favor of the bulls. Sell trades are not recommended.

Cenário alternativo:if the price breaks and consolidates below the support level of 3192, the downtrend will likely resume.

Sem novidades para hoje

Este artigo reflete uma opinião pessoal e não deve ser interpretado como uma recomendação de investimento e/ou oferta e/ou um pedido persistente para a realização de transações financeiras e/ou uma garantia e/ou uma previsão de eventos futuros.