The EUR/USD currency pair

Indicadores técnicos do par de moedas:

- Anterior Abrir: 1.1895

- Anterior Fechar: 1.1812

- % de mudança no último dia: -0.70 %

Consumer price inflation in the Eurozone in August 2025 was 2.0%, slightly below the preliminary estimate of 2.1%, as energy prices fell more than previously expected. Core inflation has been in line with the European Central Bank’s 2% target for the third month in a row, reinforcing expectations that monetary policy will remain stable for some time. At the same time, the US Federal Reserve cut the federal funds rate by 25 basis points in September 2025, bringing it to a range of 4.00% to 4.25%, in line with expectations. The interest rate differential now favors the strengthening of the European currency against the dollar.

Recomendações de negociação

- Níveis de suporte: 1.1780, 1.1746, 1.1704

- Níveis de resistência: 1.1809, 1.1858, 1.1915

The EUR/USD currency pair’s hourly trend is bullish, but the intraday bias is now in favor of sellers. Yesterday, the euro price reached the resistance level of 1.1915, after which there was a sharp rejection of the price. As a result, a locked balance formed above 1.1858, and the captured liquidity began to be distributed lower. To continue growing, the price needs to form a locked balance below the support level. Closing the price above 1.1809 will open up new buying opportunities. It is important for buyers to keep the price above 1.1780; otherwise, the price may fall to 1.1746.

Cenário alternativo:if the price breaks the support level of 1.1704 and consolidates below it, the downtrend will likely resume.

Feed de notícias para: 2025.09.18

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Philadelphia Fed Manufacturing Index (m/m) at 15:30 (GMT+3).

The GBP/USD currency pair

Indicadores técnicos do par de moedas:

- Anterior Abrir: 1.3645

- Anterior Fechar: 1.3623

- % de mudança no último dia: -0.16 %

The annual inflation rate in the UK in August 2025 was 3.8%, unchanged from July. Annual core inflation fell to 3.6% from 3.8%, in line with expectations. With inflation remaining stable, the Bank of England is widely expected to keep its base rate at 4.00% today. The Bank of England is likely to slow down its quantitative tightening policy in light of recent volatility in UK bond markets, and the minutes may reveal the extent of concern about inflation versus growth. A neutral or slightly dovish tone (keeping rates on hold but emphasizing risks to growth) could lead to a decline in the pound against the US dollar or the euro.

Recomendações de negociação

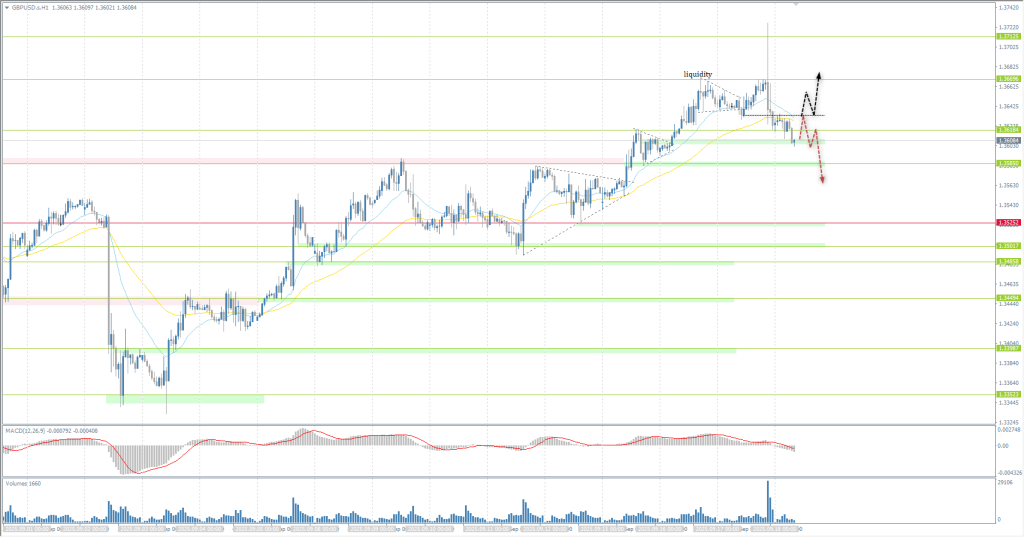

- Níveis de suporte: 1.3585, 1.3525, 1.3501

- Níveis de resistência: 1.3618, 1.3634, 1.3669, 1.3713

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. The situation is very similar to that of the euro. The price tested the resistance level of 1.3713, after which a locked balance was formed. Now, liquidity above 1.3669 is distributed lower. For buy deals, it is worth waiting for an impulsive return of the price above 1.3634. Without consolidation above this level, the probability of a further decline remains high.

Cenário alternativo:if the price breaks through the support level of 1.3501 and settles below it, the downtrend will likely resume.

Feed de notícias para: 2025.09.18

- UK BoE Interest Rate Decision at 14:00 (GMT+3);

- UK BoE MPC Meeting Minutes at 14:00 (GMT+3).

The USD/JPY currency pair

Indicadores técnicos do par de moedas:

- Anterior Abrir: 146.43

- Anterior Fechar: 146.96

- % de mudança no último dia: +0.36 %

On Thursday, the yen retreated from the two-month high reached in the previous session as the dollar strengthened after the latest Federal Reserve monetary policy decision. On Wednesday, the Fed announced a widely expected quarter-point rate cut, while signaling that there would be two more cuts this year but only one in 2026, refuting expectations of two or three cuts next year. On the domestic front, the Bank of Japan began a two-day policy meeting, at which rates are expected to remain unchanged as officials assess the impact of US tariffs on Japan’s export-oriented economy. However, analysts note that the Bank of Japan may raise rates by 25 basis points in October amid signs of resilience. Politically, the ruling Liberal Democratic Party will elect a new leader on October 4 to replace outgoing Prime Minister Shigeru Ishiba.

Recomendações de negociação

- Níveis de suporte: 146.82, 146.25, 145.85

- Níveis de resistência: 147.25, 147.48, 148.03

From a technical point of view, the medium-term trend of the USD/JPY is bearish, but the intraday bias is bullish. The price is now trying to test liquidity above 147.25 and may reach the priority change level of 147.48. It is very important for sellers not to let the price consolidate above 147.48; otherwise, there will be a trend reversal. Sell trades can be considered after the formation of a locked balance above 147.25, followed by the price consolidating below this level.

Cenário alternativo:if the price breaks through the resistance level of 147.48 and consolidates above it, the uptrend will likely resume.

Sem novidades para hoje

The XAU/USD currency pair (gold)

Indicadores técnicos do par de moedas:

- Anterior Abrir: 3689

- Anterior Fechar: 3662

- % de mudança no último dia: -0.74 %

On Wednesday, gold fell back to $3665 per ounce after briefly reaching a new record high amid the long-awaited rate cut by the Federal Reserve. The Fed cut its benchmark rate by a quarter point to a range of 4% to 4.25% in an 11-1 vote, with Fed member Stephen Miran arguing for a more significant half-point cut and other potential supporters siding with the majority. Policymakers noted slowing employment growth and elevated inflation, highlighting the continuing risks to both sides of the Fed’s dual mandate. Meanwhile, gold has risen about 41% over the past year thanks to aggressive Central Bank purchases, safe-haven currency flows, and a retreat from a weakening US dollar.

Recomendações de negociação

- Níveis de suporte: 3655, 3615, 3600

- Níveis de resistência: 3700

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold has corrected to the support level of 3655. Here, you can consider buying trades, but with confirmation on intraday time frames. It is very important for buyers not to let the price settle below 3655. A breakdown and consolidation below will open up opportunities to sell to the 3615 priority change level.

Cenário alternativo:if the price breaks the support level of 3615 and consolidates below it, the downtrend will likely resume.

Feed de notícias para: 2025.09.18

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Philadelphia Fed Manufacturing Index (m/m) at 15:30 (GMT+3).

Este artigo reflete uma opinião pessoal e não deve ser interpretado como uma recomendação de investimento e/ou oferta e/ou um pedido persistente para a realização de transações financeiras e/ou uma garantia e/ou uma previsão de eventos futuros.