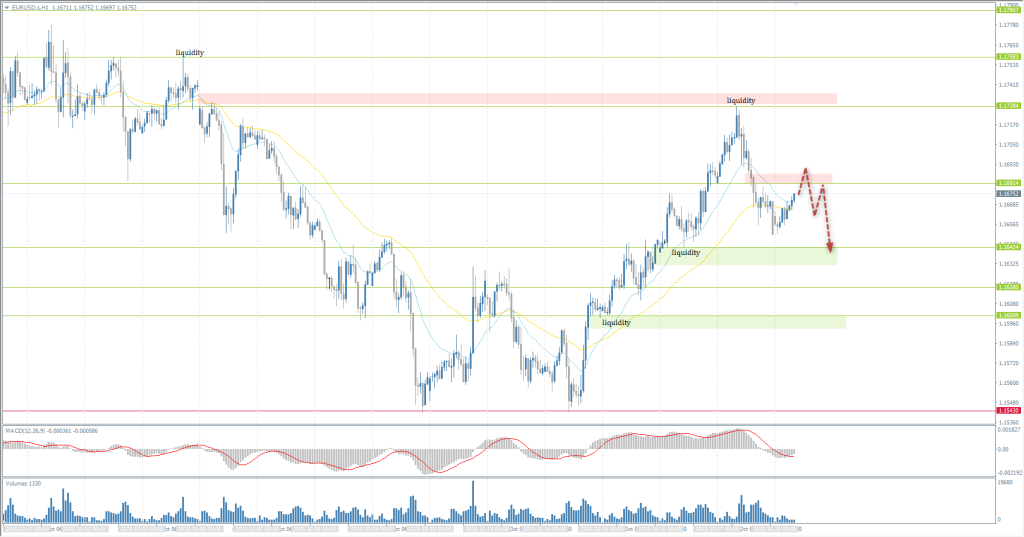

The EUR/USD currency pair

Indicadores técnicos do par de moedas:

- Anterior Abrir: 1.1682

- Anterior Fechar: 1.1651

- % de mudança no último dia: -0.27 %

On Friday, the euro strengthened to a three-week high amid dollar weakness and political easing in France. Prime Minister Sébastien Lecornu narrowly survived two consecutive no-confidence votes and pledged to suspend the controversial pension reform. This move helped avoid government dissolution and gave President Emmanuel Macron a temporary reprieve ahead of national budget debates. Meanwhile, the US dollar declined for the fourth straight session after Fed officials Christopher Waller and Stephen Miran advocated for further rate cuts to support the labor market.

Recomendações de negociação

- Níveis de suporte: 1.1642, 1.1618, 1.1600, 1.1543

- Níveis de resistência: 1.1681, 1.1728, 1.1754, 1.1786, 1.1819

The hourly trend for EUR/USD is bullish. After testing resistance at 1.1728, the euro retreated and settled below 1.1681, suggesting a potential test of 1.1642. Short positions may be considered from 1.1681 with intraday confirmation. Long positions require a bullish reaction at one of the support levels.

Cenário alternativo:If the price breaks below the 1.1543 support and consolidates, a bearish trend will likely resume.

Sem novidades para hoje

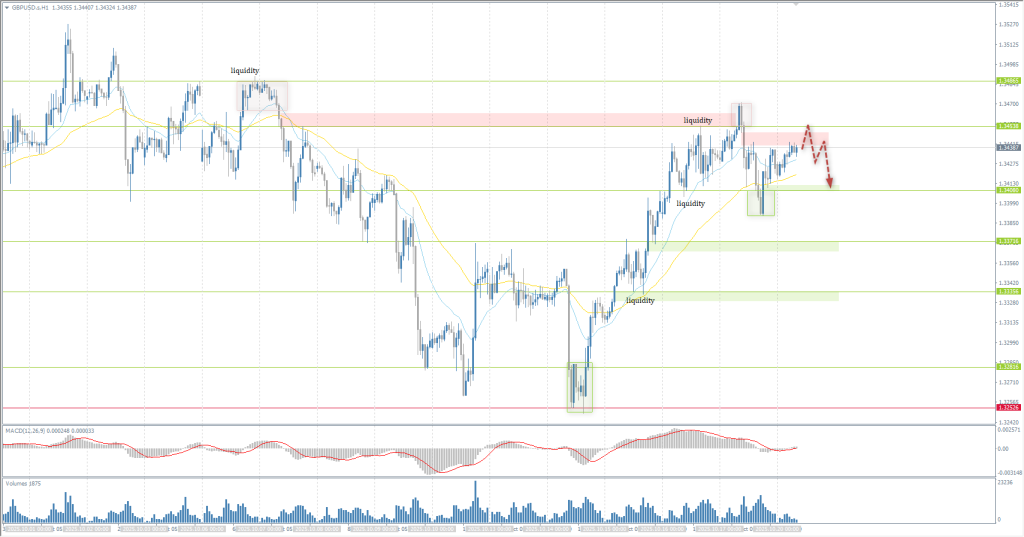

The GBP/USD currency pair

Indicadores técnicos do par de moedas:

- Anterior Abrir: 1.3434

- Anterior Fechar: 1.3424

- % de mudança no último dia: -0.08 %

UK bond yields fell following an unexpected rise in unemployment and dovish remarks from Bank of England Governor Andrew Bailey. He noted that the economy is operating “below potential” and the labor market is weakening, with unemployment reaching 4.8% – the highest since 2021. Markets now fully price in a rate cut by February, with some expecting easing as early as December.

Recomendações de negociação

- Níveis de suporte: 1.3408, 1.3371, 1.3335, 1.3281

- Níveis de resistência: 1.3453, 1.3486

Technically, the trend remains bullish. Similar to EUR/USD, after testing liquidity above 1.3454, the price corrected to 1.3408, where buyers became active. The price is now aiming to retest 1.3454. Short positions may be considered from this level with intraday confirmation. Long positions require a reaction at 1.3408 or 1.3371.

Cenário alternativo:If the price breaks through the support level of 1.3253 and consolidates below it, the downtrend will likely resume.

Sem novidades para hoje

The USD/JPY currency pair

Indicadores técnicos do par de moedas:

- Anterior Abrir: 150.38

- Anterior Fechar: 150.62

- % de mudança no último dia: +0.60 %

On Monday, the yen fell to 151 per dollar, continuing its decline ahead of Tuesday’s leadership election in Japan. Markets reacted to news of a coalition agreement between the ruling Liberal Democratic Party and the Japan Innovation Party, paving the way for Sanae Takaichi to become Japan’s first female prime minister. The so-called “Takaichi trade,” based on continued loose monetary policy, boosted Japanese equities and may exert downward pressure on the yen in the medium to long term.

Recomendações de negociação

- Níveis de suporte: 150.15, 149.75, 148.83, 147.81

- Níveis de resistência: 151.18, 151.68, 152.50, 153.28, 154.80

The medium-term trend is bullish. On Friday, buyers defended a key pivot level, and the price broke above the descending channel and EMA lines. Consider long positions from 150.15 with confirmation. No optimal short entry points are currently available.

Cenário alternativo:If the price breaks below 149.75 and consolidates lower, a bearish trend will likely resume.

Sem novidades para hoje

The XAU/USD currency pair (gold)

Indicadores técnicos do par de moedas:

- Anterior Abrir: 4333

- Anterior Fechar: 4226

- % de mudança no último dia: -2.53%

Gold prices fell over 2% on Friday due to easing concerns over a US-China trade escalation. President Donald Trump stated that his proposed 100% tariffs on Chinese goods would be “temporary,” which markets interpreted as a sign of potential diplomatic softening ahead of his meeting with President Xi Jinping. Despite the correction, gold ended the week up nearly 6%, marking a historic ninth consecutive positive week.

Recomendações de negociação

- Níveis de suporte: 4167, 4090, 4050, 4000

- Níveis de resistência: 4278, 4380, 4400, 4500

Technically, the medium-term trend is bullish. To continue the rally, gold needs liquidity, typically found below visual support levels. The nearest is 4167, suggesting the correction may not be over. Intraday short positions may be considered from 4278 with confirmation. A strong breakout above 4278 could reignite the rally.

Cenário alternativo:If the price breaks below support at 3946 and consolidates, a bearish trend will likely resume.

Sem novidades para hoje

Este artigo reflete uma opinião pessoal e não deve ser interpretado como uma recomendação de investimento e/ou oferta e/ou um pedido persistente para a realização de transações financeiras e/ou uma garantia e/ou uma previsão de eventos futuros.