The EUR/USD currency pair

ตัวชี้วัดทางเทคนิคของคู่สกุลเงิน:

- ก่อนหน้า เปิด: 1.1694

- ก่อนหน้า ปิด: 1.1733

- % เปลี่ยนในช่วงวันสุดท้าย: +0.33 %

On Thursday, the euro rose above $1.17 again, helped by the European Central Bank’s hawkish tone and the weakening of the dollar after fresh data on inflation and jobless claims in the US reinforced expectations of a Federal Reserve rate cut this year. The ECB left rates unchanged for the second meeting in a row, with President Christine Lagarde noting that growth risks are now more balanced and announcing the “end” of the disinflationary process, signaling the likely end of the rate-cutting cycle. According to updated expectations, Eurozone GDP growth will be 1.2% in 2025 (compared to 0.9% in June), slow to 1.0% in 2026, and remain unchanged at 1.3% in 2027. Inflation expectations have been raised slightly to 2.1% in 2025 (from 2.0%), 1.7% in 2026 (from 1.6%), and 1.9% in 2027 (from 2.0%).

คำแนะนำการซื้อขาย

- ระดับแนวรับ: 1.1706, 1.1680, 1.1642, 1.1629, 1.1584, 1.1528

- ระดับแนวต้าน: 1.1756, 1.1786

The EUR/USD currency pair’s hourly trend is bullish. The European currency formed a locked balance below 1.1706, after which the euro rose to 1.1730, where it encountered selling pressure. The price is now trading at EMA levels again. Intraday, you can consider buying from the EMA lines or from the support level of 1.1706 with a target of 1.1756. There are currently no optimal entry points for selling.

สถานการณ์ของทางเลือก:if the price breaks the support level of 1.1629 and consolidates below it, the downtrend will likely resume.

ฟีดข่าวสารสำหรับ: 2025.09.12

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+3).

The GBP/USD currency pair

ตัวชี้วัดทางเทคนิคของคู่สกุลเงิน:

- ก่อนหน้า เปิด: 1.3528

- ก่อนหน้า ปิด: 1.3571

- % เปลี่ยนในช่วงวันสุดท้าย: +0.32 %

A block of macroeconomic statistics is expected to be published in the UK today. The key event will be the monthly GDP report. According to prognoses, the indicator will show a plateau after growing by 0.4% last month. If the data is lower than expected and a decline is recorded, pressure on the British pound may increase. Additionally, it should be noted that projections for industrial production also point to weaker results compared to the previous month.

คำแนะนำการซื้อขาย

- ระดับแนวรับ: 1.3519, 1.3545, 1.3485, 1.3449, 1.3398, 1.3312, 1.3281

- ระดับแนวต้าน: 1.3563, 1.3585

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. The British currency formed a locked balance below 1.3519, after which the price rose impulsively. Currently, the price has reached the resistance level of 1.3585, after which it closed impulsively below 1.3563. This could trigger a correction, as the liquidity of locked traders above 1.3563 could be distributed to the support level of 1.3519. Intraday, we can consider selling with a stop at 1.3585. For buying, we are waiting for the buyers’ reaction to the support level of 1.3519.

สถานการณ์ของทางเลือก:if the price breaks through the support level of 1.3417 and settles below it, the downtrend will likely resume.

ฟีดข่าวสารสำหรับ: 2025.09.12

- UK GDP (m/m) at 09:00 (GMT+3);

- UK Industrial Production (m/m) at 09:00 (GMT+3);

- UK Manufacturing Production (m/m) at 09:00 (GMT+3);

- UK Trade Balance (m/m) at 09:00 (GMT+3).

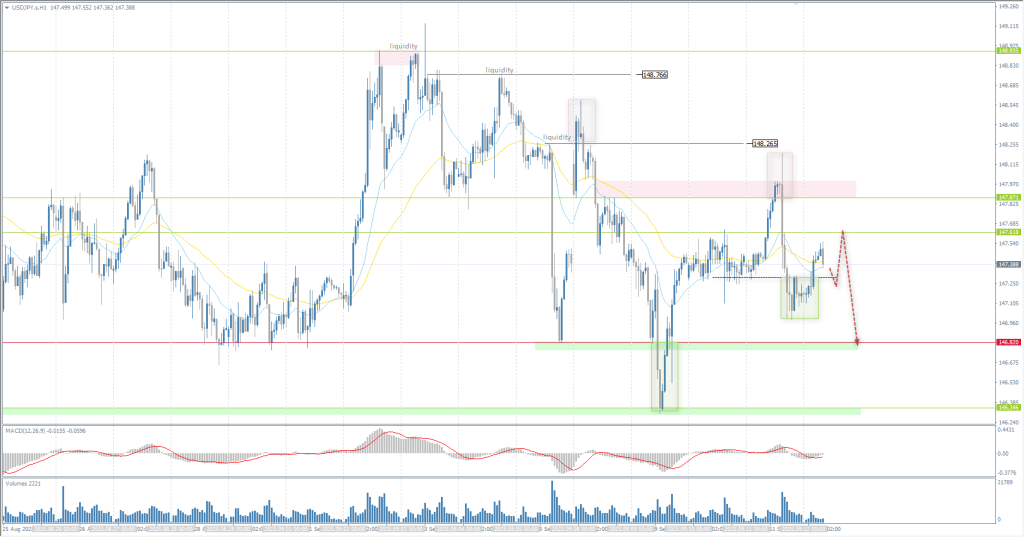

The USD/JPY currency pair

ตัวชี้วัดทางเทคนิคของคู่สกุลเงิน:

- ก่อนหน้า เปิด: 147.38

- ก่อนหน้า ปิด: 147.17

- % เปลี่ยนในช่วงวันสุดท้าย: -0.14 %

On Friday, the yen weakened to around 147.4 per dollar after the US and Japan issued a joint statement reiterating that exchange rates should remain market-driven and that excessive volatility is undesirable. Japan’s finance minister said the statement was significant in light of the new US customs order, although he noted that specific currency levels had not been discussed with the US Treasury Secretary. Domestically, investors continued to assess the Bank of Japan’s policy outlook amid mixed economic signals and political uncertainty. Prime Minister Shigeru Ishiba recently announced his resignation, facing mounting pressure after last year’s election defeat and deepening divisions within the ruling party.

คำแนะนำการซื้อขาย

- ระดับแนวรับ: 147.25, 146.82, 146.74

- ระดับแนวต้าน: 147.62, 147.87, 148.26

From a technical point of view, the medium-term trend of the USD/JPY is still bullish. Yesterday, the price formed a balance with trapped traders above 147.87, and now this zone will act as resistance. Levels of 147.62 and 147.87 can be considered for selling, provided that buyers react. Intraday, buy deals can be considered from 147.25 to these specified resistance levels.

สถานการณ์ของทางเลือก:if the price breaks through the support level of 147.09 and consolidates below it, the downtrend will likely resume.

ไม่มีข่าวสารสำหรับวันนี้

The XAU/USD currency pair (gold)

ตัวชี้วัดทางเทคนิคของคู่สกุลเงิน:

- ก่อนหน้า เปิด: 3642

- ก่อนหน้า ปิด: 3637

- % เปลี่ยนในช่วงวันสุดท้าย: -0.13 %

On Thursday, gold prices remained at $3630 per ounce, recovering from morning losses and staying close to record highs, as investors weighed a wave of economic data from the US that continues to support expectations of interest rate cuts. Weekly jobless claims rose by 27,000 to 263,000, the highest since October 2021. Meanwhile, US consumer prices rose 0.4% in August, double July’s 0.2% increase and slightly above expectations of 0.3%, bringing annual inflation to a seven-month high of 2.9%, in line with projections. This came after Wednesday’s Producer Price Index report, which showed an unexpected decline in prices. Geopolitical events further reinforce gold’s appeal as a safe haven.

คำแนะนำการซื้อขาย

- ระดับแนวรับ: 3638, 3600, 3575, 3560, 3500, 3469, 3438, 3402, 3383, 3374

- ระดับแนวต้าน: 3660, 3700

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold has formed a locked balance below 3638, and this area will now serve as support for the price. Intraday, buy deals from this level can be considered with the aim of updating the historical maximum. However, further growth should not be expected due to the large cumulative MACD divergence. It is important for buyers not to let the price settle below 3612. Otherwise, a sell-off to 3600 or even 3578 is possible.

สถานการณ์ของทางเลือก:if the price breaks the support level of 3511 and consolidates below it, the downtrend will likely resume.

ฟีดข่าวสารสำหรับ: 2025.09.12

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+3).

บทความนี้สะท้อนถึงความคิดเห็นส่วนตัว และไม่ควรตีความว่าเป็นคำแนะนำในการลงทุน และ/หรือข้อเสนอ และ/หรือการร้องขออย่างต่อเนื่องในการทำธุรกรรมทางการเงิน และ/หรือการรับประกัน และ/หรือการคาดการณ์เหตุการณ์ในอนาคต