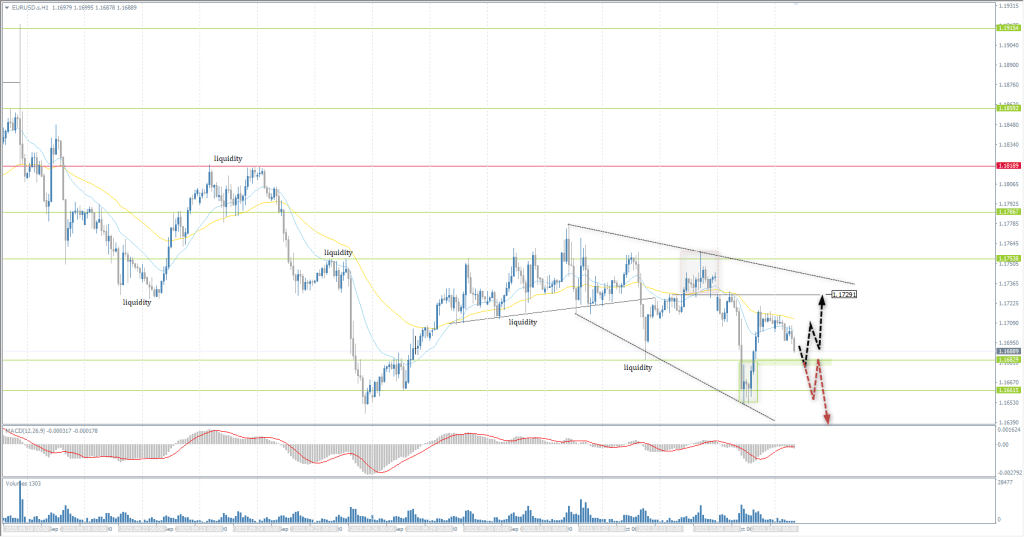

The EUR/USD currency pair

ตัวชี้วัดทางเทคนิคของคู่สกุลเงิน:

- ก่อนหน้า เปิด: 1.1718

- ก่อนหน้า ปิด: 1.1708

- % เปลี่ยนในช่วงวันสุดท้าย: -0.09 %

On Monday, the euro fell after the resignation of France’s newly appointed Prime Minister Sébastien Lecornu. This move followed President Emmanuel Macron’s decision to keep the cabinet virtually unchanged, which drew sharp criticism from opposition parties. Lecornu, who took office less than a month ago, faced the difficult task of pushing the budget through a deeply divided parliament. The upcoming financial plan is expected to include unpopular spending cuts and tax increases aimed at reducing France’s deficit, the largest in the Eurozone, which will further exacerbate political tensions and investor concerns.

คำแนะนำการซื้อขาย

- ระดับแนวรับ: 1.1683, 1.1634

- ระดับแนวต้าน: 1.1728, 1.1754, 1.1786, 1.1819

The EUR/USD currency pair’s hourly trend is downward. Yesterday, after testing the resistance level of 1.1729, the euro fell and updated the low of the previous week. Moreover, after capturing liquidity below 1.1683, the price closed sharply higher, indicating the formation of a locked balance below the level. In this scenario, intraday buy deals from 1.1683 can be considered, provided that buyers react. If the price does not react and consolidates below 1.1683, a further decline to 1.1634 should be expected.

สถานการณ์ของทางเลือก:if the price breaks through the resistance level of 1.1819 and consolidates above it, the uptrend will likely resume.

ฟีดข่าวสารสำหรับ: 2025.10.07

- US Trade Balance (m/m) at 15:30 (GMT+3) (Tentative);

- Eurozone ECB President Lagarde Speaks at 19:10 (GMT+3).

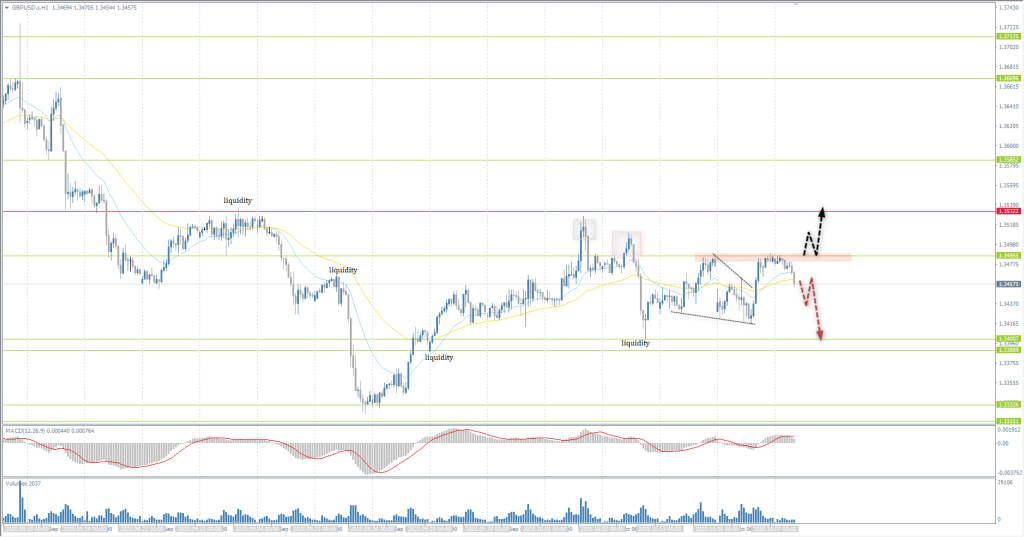

The GBP/USD currency pair

ตัวชี้วัดทางเทคนิคของคู่สกุลเงิน:

- ก่อนหน้า เปิด: 1.3429

- ก่อนหน้า ปิด: 1.3484

- % เปลี่ยนในช่วงวันสุดท้าย: +0.41 %

On Monday, the British pound fell to $1.344, giving back some of last week’s 0.6% gains as the dollar regained strength and renewed political turmoil in France caused instability in European markets. On the monetary policy front, the Bank of England kept rates unchanged, and investors do not expect them to fall until 2026 as inflation remains stubbornly high due to continued rises in food, energy, and housing costs.

คำแนะนำการซื้อขาย

- ระดับแนวรับ: 1.3400, 1.3388, 1.3332, 1.3315

- ระดับแนวต้าน: 1.3463, 1.3522, 1.3585

In terms of technical analysis, the trend on the currency pair GBP/USD is a downtrend. The British pound has formed another locked balance above 1.3464, and now the zone above this level is a large resistance zone. The price has already tried twice to break through this level, but so far without success, which indicates the strength of the sellers. In this scenario, intraday sales can be considered from the EMA lines or from the resistance level of 1.3464. Profit targets are 1.3400 and 1.3389. For buy deals, it is necessary to see an impulse breakout of the 1.3464 level.

สถานการณ์ของทางเลือก:if the price breaks through the resistance level of 1.3532 and consolidates above it, the uptrend will likely resume.

ไม่มีข่าวสารสำหรับวันนี้

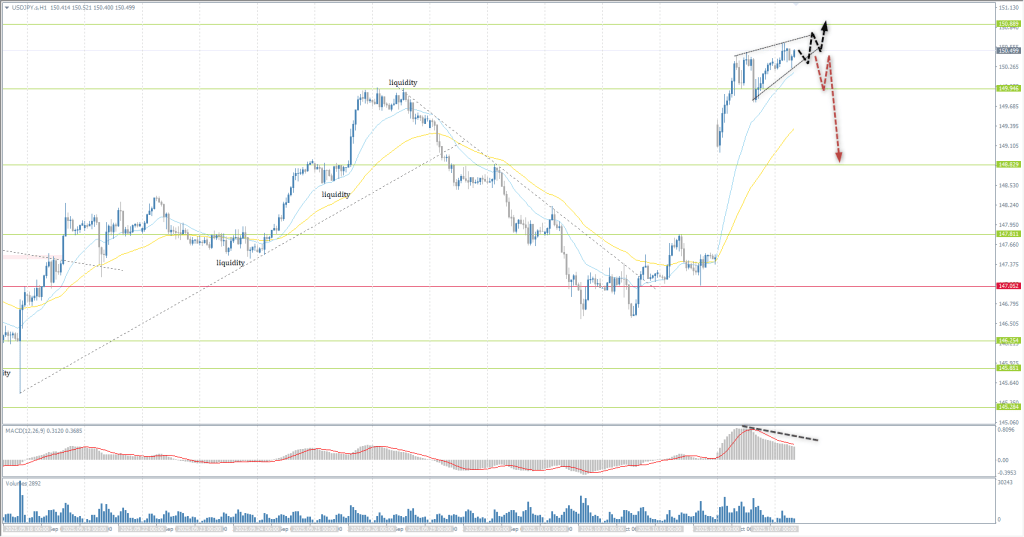

The USD/JPY currency pair

ตัวชี้วัดทางเทคนิคของคู่สกุลเงิน:

- ก่อนหน้า เปิด: 149.42

- ก่อนหน้า ปิด: 150.34

- % เปลี่ยนในช่วงวันสุดท้าย: +0.62 %

On Tuesday, the Japanese yen weakened to around 150.5 per dollar, falling to its lowest level in more than two months after Sanae Takaichi, a supporter of soft fiscal policy and economic stimulus, won the race for leadership of the ruling Liberal Democratic Party over the weekend, paving the way for her to become prime minister. Her victory reinforced expectations of large-scale fiscal spending and continued loose monetary policy. On the data front, Japanese household spending rose by 2.3% in August, exceeding projections and posting its fastest growth in three months, helped by government measures to ease cost pressures and offset the impact of US tariffs.

คำแนะนำการซื้อขาย

- ระดับแนวรับ: 147.47, 146.25, 148.85

- ระดับแนวต้าน: 150.89

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The price gap that formed on Monday remains unclosed. The price is now heading towards the resistance level of 150.89, with liquidity compression observed. As a rule, such formations precede impulsive, rapid movements. Given the divergence on the MACD indicator, the probability of an impulsive decline is higher than that of an impulsive rise.

สถานการณ์ของทางเลือก:if the price breaks through the support level of 147.05 and consolidates below it, the downtrend will likely resume.

ไม่มีข่าวสารสำหรับวันนี้

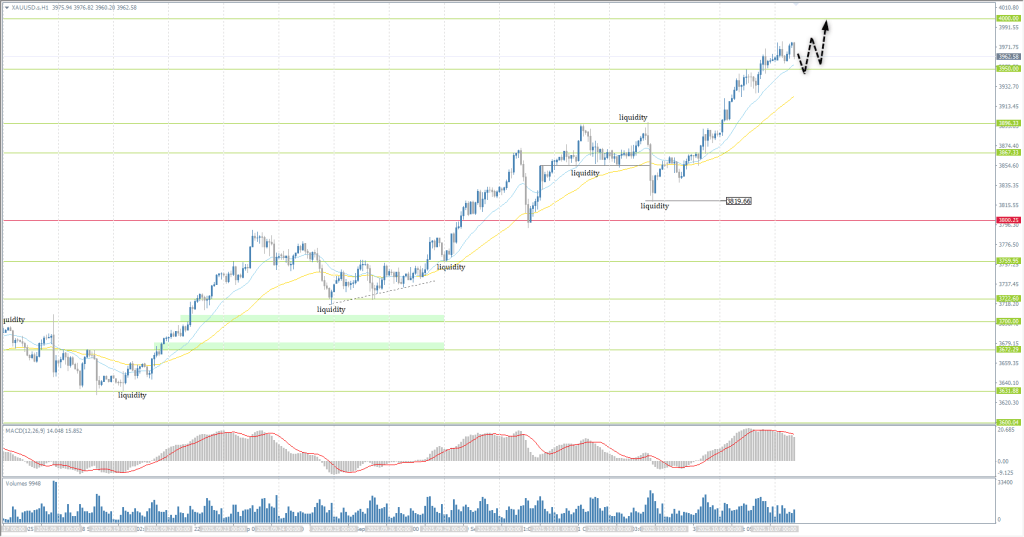

The XAU/USD currency pair (gold)

ตัวชี้วัดทางเทคนิคของคู่สกุลเงิน:

- ก่อนหน้า เปิด: 3885

- ก่อนหน้า ปิด: 3959

- % เปลี่ยนในช่วงวันสุดท้าย: +1.90%

On Tuesday, gold prices rose to $3970 per ounce, close to the record high reached earlier in the session, driven by economic uncertainty and expectations of further rate cuts in the US. The US government remains shut down this week, with the White House threatening mass layoffs of federal employees. This has also deprived investors of key data needed to assess the state of the US economy, complicating the Fed’s decision-making process. Nevertheless, traders are pricing in an additional 25 basis point rate cut in both October and December with a probability of 95% and 83%, respectively. This year, precious metal prices have risen by more than 50% thanks to sustained demand for safe assets, expectations of Fed policy easing, active purchases by central banks, geopolitical tensions, tariffs, and increased inflows into ETFs.

คำแนะนำการซื้อขาย

- ระดับแนวรับ: 3950, 3896, 3867, 3820, 3800

- ระดับแนวต้าน: 4000

From the point of view of technical analysis, the trend on the XAU/USD is bullish. No changes compared to yesterday. Gold continues its rally. The current target for gold is the psychological mark of 4000. There are no prerequisites for selling at this time, as there is no reaction from sellers. For buying, it is worth considering trades from the EMA lines or from the nearest support level of 3950.

สถานการณ์ของทางเลือก:if the price breaks the support level of 3800 and consolidates below it, the downtrend will likely resume.

ฟีดข่าวสารสำหรับ: 2025.10.07

- US Trade Balance (m/m) at 15:30 (GMT+3) (Tentative);

บทความนี้สะท้อนถึงความคิดเห็นส่วนตัว และไม่ควรตีความว่าเป็นคำแนะนำในการลงทุน และ/หรือข้อเสนอ และ/หรือการร้องขออย่างต่อเนื่องในการทำธุรกรรมทางการเงิน และ/หรือการรับประกัน และ/หรือการคาดการณ์เหตุการณ์ในอนาคต