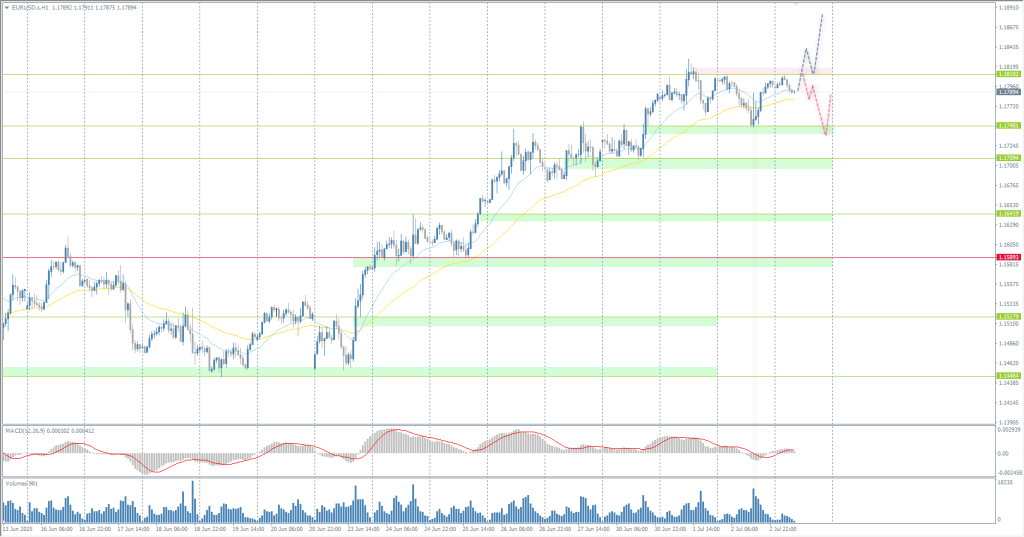

The EUR/USD currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 1.1803

- Öncekini Kapat: 1.1798

- Son güne göre % değişim: -0.04 %

The euro remained at $1.18, hovering near its highest level since August 2021, as investors assessed comments from European Central Bank officials after inflation in the Eurozone reached the ECB’s 2% target. The latest comments from ECB officials suggest that interest rates are likely to be kept at current levels at this month’s meeting amid ongoing concerns about global trade tensions and instability in the Middle East.

İşlem önerileri

- Destek seviyeleri: 1.1748, 1.1709, 1.1666, 1.1642, 1.1581, 1.1518

- Direnç seviyeleri: 1.1810, 1.1913

The EUR/USD currency pair’s hourly trend is bullish. The price still has the potential to reach 1.1913, but sellers have formed a resistance level at 1.1810. For buy deals, it is worth considering the support level of 1.1748, but with confirmation. Buy deals can also be considered after breaking through the resistance level of 1.1810. There are currently no optimal entry points for sales.

Alternatif senaryo:if the price breaks through the support level of 1.1589 and consolidates below it, the downward trend will likely resume.

Haber akışı: 2025.07.03

- German Services PMI (m/m) at 10:55 (GMT+3);

- Eurozone Services PMI (m/m) at 11:00 (GMT+3);

- Eurozone ECB Monetary Policy Meeting Accounts at 14:30 (GMT+3);

- US Nonfarm Payrolls (m/m) at 15:30 (GMT+3);

- US Unemployment Rate (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (m/m) at 15:30 (GMT+3);

- US Trade Balance (m/m) at 15:30 (GMT+3);

- US ISM Services PMI (m/m) at 17:00 (GMT+3).

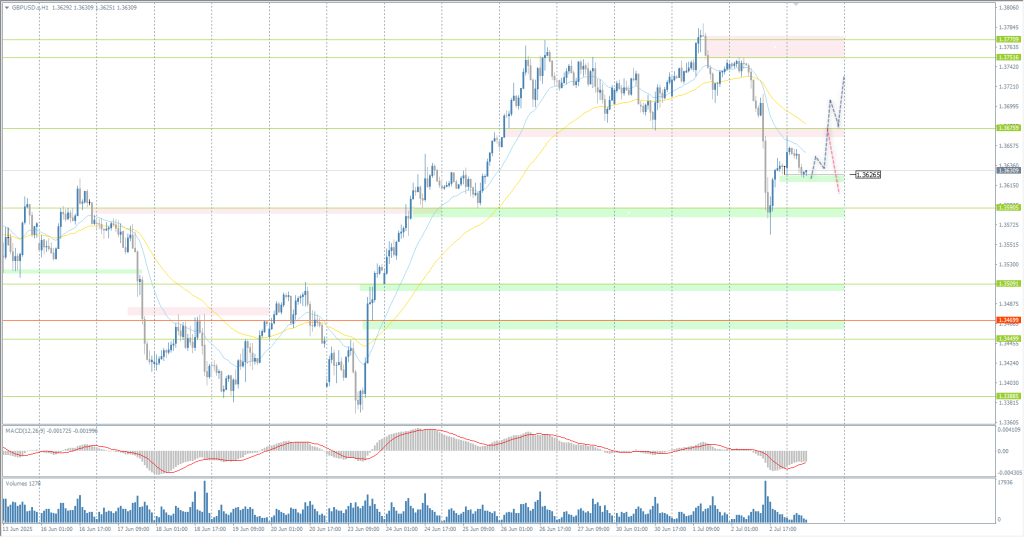

The GBP/USD currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 1.3740

- Öncekini Kapat: 1.3635

- Son güne göre % değişim: -0.77 %

The British pound fell below $1.36 amid political turmoil and growing uncertainty over the UK’s fiscal leadership. Speculation intensified after Chancellor Rachel Reeves showed visible emotion during Prime Minister’s Questions, and Prime Minister Keir Starmer failed to back her after the government’s U-turn on a controversial welfare bill. The situation exacerbates concerns about confidence in the fiscal system, especially given recent budget cuts and limited room for maneuver. Investors fear that the instability surrounding Reeves’ position could derail the UK’s economic plans, triggering a sell-off in the markets. Meanwhile, Bank of England Governor Alan Taylor has called for an accelerated rate cut, warning of the growing risk of a hard landing.

İşlem önerileri

- Destek seviyeleri: 1.3626, 1.3591, 1.3509, 1.3471, 1.3450, 1.3388

- Direnç seviyeleri: 1.3675, 1.3752, 1.3770, 1.4000

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. The British pound corrected sharply yesterday and reached the support level of 1.3591. Buyers formed an additional support level of 1.2636, which can be used as a basis for intraday buying, but only with confirmation in the form of buyer initiative on lower time frames. For sell deals, the resistance level of 1.3675 can be considered, but also with confirmation.

Alternatif senaryo:if the price breaks through the support level of 1.3470 and consolidates below it, the downward trend will likely resume.

Haber akışı: 2025.07.03

- UK Services PMI (m/m) at 11:30 (GMT+3).

The USD/JPY currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 143.38

- Öncekini Kapat: 143.64

- Son güne göre % değişim: +0.18 %

The Japanese yen stabilized at 143.7 per dollar on Thursday after some pressure in the previous session, as optimism about trade developments and a weaker US dollar supported sentiment. Japanese officials reaffirmed their commitment to reaching a trade agreement with Washington, although they did not provide any details on potential concessions. The yen also benefited from the overall weakening of the dollar, as investors await the June US employment report, which could strengthen the case for a Federal Reserve rate cut as early as July.

İşlem önerileri

- Destek seviyeleri: 143.33, 142.64

- Direnç seviyeleri: 144.10, 144.48, 144.96, 145.95, 146.62, 148.28

From a technical point of view, the medium-term trend of the USD/JPY is bearish. The price is forming a flat accumulation near the EMA lines. Most likely, the price will remain at approximately the same level until the US labor market report is released. For sell deals, we are considering resistance levels of 144.10 and 144.48, but with confirmation. For buy deals, the support level of 143.33 is suitable, but also with confirmation.

Alternatif senaryo:if the price breaks through the resistance level of 145.95 and consolidates above it, the uptrend will likely resume.

Haber akışı: 2025.07.03

- Japan Services PMI (m/m) at 03:30 (GMT+3).

The XAU/USD currency pair (gold)

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 3337

- Öncekini Kapat: 3357

- Son güne göre % değişim: +0.60 %

On Thursday, gold fell to $3340 per ounce, giving back some of its gains from the previous session, as optimism about trade developments reduced the metal’s appeal as a safe haven. President Trump announced that the US had reached a trade agreement with Vietnam, under which some tough tariffs on Vietnamese products would be lifted in exchange for greater access for American goods to the Vietnamese market. The deal also raised hopes for additional bilateral trade agreements.

İşlem önerileri

- Destek seviyeleri: 3327, 3301, 3274, 3246

- Direnç seviyeleri: 3357, 3357, 3393, 3405, 3444, 3500

From the point of view of technical analysis, the trend on the XAU/USD is downward, but close to a reversal. The price has been testing the priority change level for the second time in the last two days. Sellers are reacting, but each subsequent reaction is weaker than the previous one, which potentially increases the likelihood of further price growth. For buy deals, it is best to consider the support level of 3327, or wait for a breakout and consolidation of the price above 3357. For sales, 3357 can be considered, but with short targets and a short stop loss.

Alternatif senaryo:if the price breaks through and consolidates above the resistance level of 3357, the upward trend will likely resume.

Haber akışı: 2025.07.03

- US Nonfarm Payrolls (m/m) at 15:30 (GMT+3);

- US Unemployment Rate (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (m/m) at 15:30 (GMT+3);

- US Trade Balance (m/m) at 15:30 (GMT+3);

- US ISM Services PMI (m/m) at 17:00 (GMT+3).

Bu makale kişisel bir görüşü yansıtmaktadır ve yatırım tavsiyesi ve/veya teklifi ve/veya finansal işlemlerin gerçekleştirilmesi için ısrarlı bir talep ve/veya bir garanti ve/veya gelecekteki olaylara ilişkin bir tahmin olarak yorumlanmamalıdır.