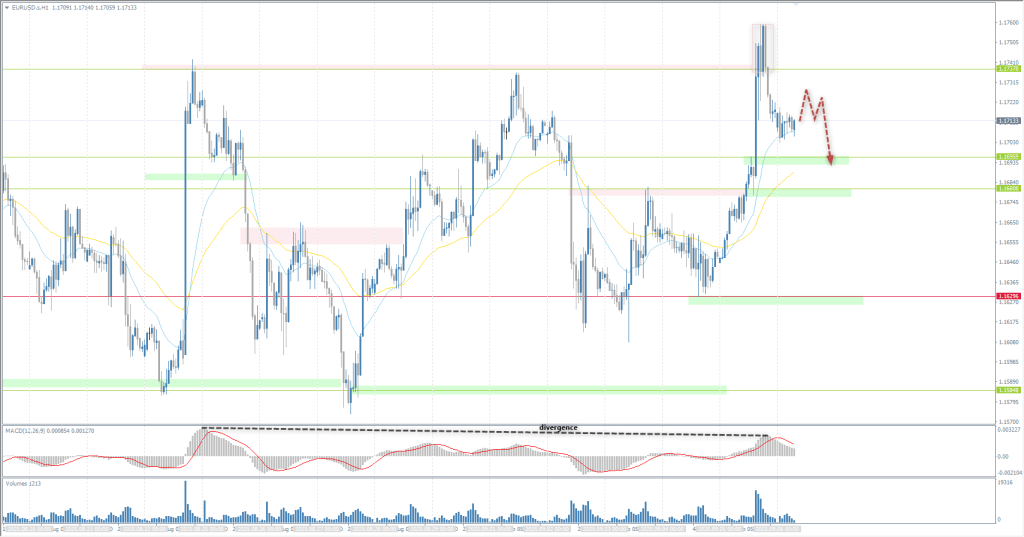

The EUR/USD currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 1.1645

- Öncekini Kapat: 1.1718

- Son güne göre % değişim: +0.63 %

The euro rose above $1.17, its strongest level since late July, as broad dollar weakness followed US employment data that signaled further cooling in the labor market. The report reinforced expectations of a Fed rate cut this month, and markets are now pricing in a rate cut of around 66 basis points in 2025. In August, the US economy added only 22,000 jobs, well below the projections of 75,000, and the unemployment rate rose to 4.3%, the highest since 2021 and in line with expectations. Attention will now shift to this week’s ECB meeting, where policymakers are expected to leave rates unchanged for the second time amid stable growth prospects and inflation close to target. Political attention is also focused on today’s vote of confidence in French Prime Minister François Bayrou.

İşlem önerileri

- Destek seviyeleri: 1.1696, 1.1680, 1.1642, 1.1629, 1.1584, 1.1528

- Direnç seviyeleri: 1.1737

The EUR/USD currency pair’s hourly trend is bullish. On Friday, the euro reached the resistance level of 1.1737, where, after accumulating liquidity, the price sharply consolidated below, forming a “locked” balance above. Currently, this liquidity is distributed lower, which is also confirmed by the MACD divergence. Today, it is worth considering selling to 1.1696 or 1.1680 intraday. It is important for sellers not to let the price re-consolidate above 1.1737.

Alternatif senaryo:if the price breaks the support level of 1.1629 and consolidates below it, the downtrend will likely resume.

Haber akışı: 2025.09.08

- Germany Trade Balance (m/m) at 09:00 (GMT+3);

- Germany Industrial Production (m/m) at 09:00 (GMT+3).

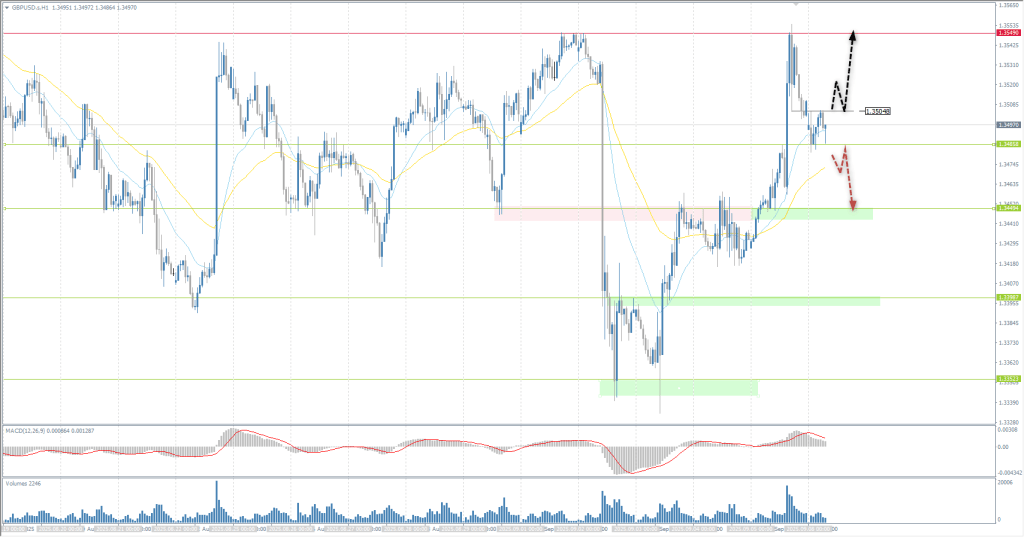

The GBP/USD currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 1.3427

- Öncekini Kapat: 1.3510

- Son güne göre % değişim: +0.62 %

The British pound rose above $1.35 amid a general weakening of the dollar after US employment data pointed to a further cooling of the labor market. However, financial uncertainty and concerns ahead of the autumn budget in November could put pressure on British assets. Meanwhile, Bank of England Governor Andrew Bailey told lawmakers that there is “significantly more uncertainty” about the timing of interest rate cuts in the UK.

İşlem önerileri

- Destek seviyeleri: 1.3485, 1.3449, 1.3398, 1.3312, 1.3281

- Direnç seviyeleri: 1.3549

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The British currency reached a priority change level on Friday, where sellers took the initiative. The price has now fallen to the support level of 1.3468, and sellers have formed an intermediate level of 1.3505. If buyers can push through 1.3505, a “locked” balance will be formed below this level, and the price will tend towards breaking through the priority change level again. Consolidation of the price below 1.3468 will trigger a sell-off to 1.3449.

Alternatif senaryo:if the price breaks through the resistance level of 1.3549 and consolidates above it, the uptrend will likely resume.

Bugün için haber yok

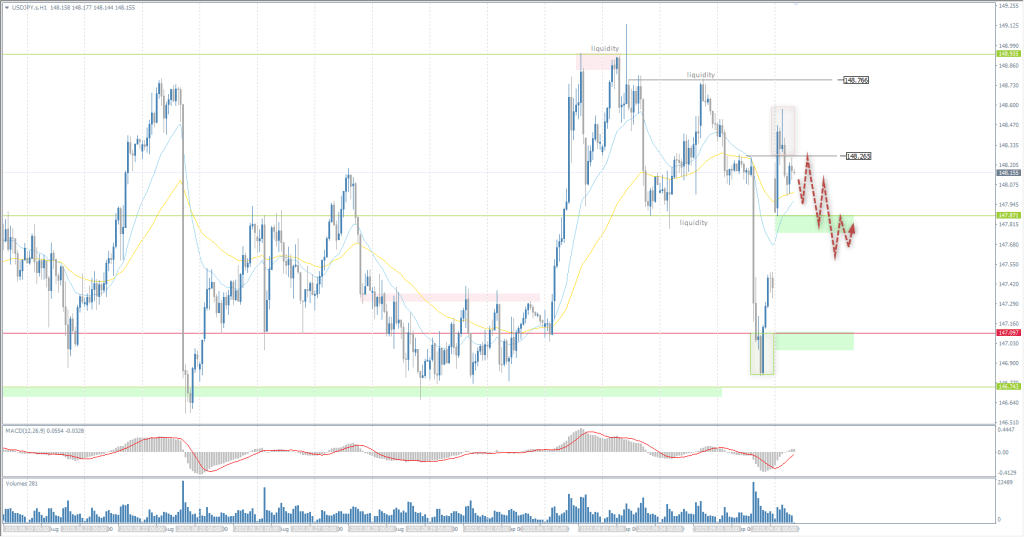

The USD/JPY currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 148.47

- Öncekini Kapat: 147.39

- Son güne göre % değişim: -0.73 %

On Monday, the yen traded around 148 per dollar, reversing the previous session’s gains after Prime Minister Shigeru Ishiba announced his resignation over the weekend. His departure followed a deepening rift within the ruling party and weeks of pressure stemming from his defeat in national elections late last year. The move also came as Japan struggled to reach a trade agreement with the US while trying to protect its key auto industry from high tariffs. Meanwhile, second-quarter GDP growth was revised upward on both an annual and quarterly basis, driven by steady exports and stable growth in private consumption. The stronger figures reinforce the Bank of Japan’s hawkish stance, with Governor Kazuo Ueda reiterating last week that a rate hike remains possible if the economic outlook remains unchanged.

İşlem önerileri

- Destek seviyeleri: 147.87, 147.09

- Direnç seviyeleri: 148.26, 148.76, 148.93, 149.55, 150.34

From a technical point of view, the medium-term trend of the USD/JPY is bullish. On Friday, the yen fell below 147.09, but after a slight accumulation, it sharply returned above that level. On Monday, a price gap formed after news from Japan, and now the price will seek to close this gap. Intraday, you can consider selling from 148.26 with a target of 147.87. There are currently no optimal entry points for buying.

Alternatif senaryo:if the price breaks through the support level of 147.09 and consolidates below it, the downward trend will likely resume.

Haber akışı: 2025.09.08

- Japan GDP (q/q) at 02:50 (GMT+3).

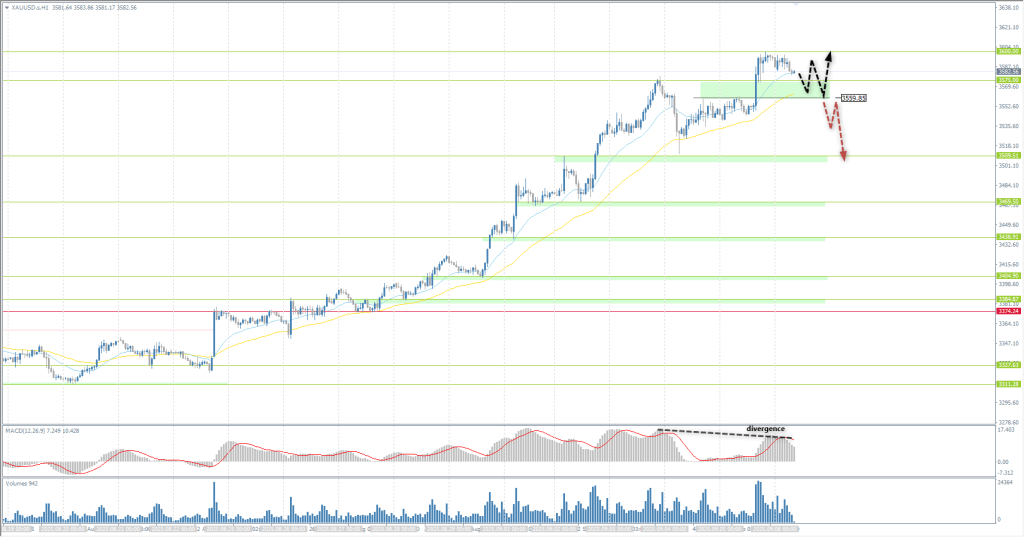

The XAU/USD currency pair (gold)

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 3550

- Öncekini Kapat: 3595

- Son güne göre % değişim: +1.26 %

Gold prices jumped more than 1% on Friday to a record high of $3,600 per ounce after a weaker-than-expected US employment report raised bets on a Federal Reserve rate cut. The data highlighted a cooling labor market and reinforced expectations that the Fed will cut rates later this month, with markets now pricing in about 66 basis points of easing by 2025. The price of bullion will rise by almost 3% over the week, the best weekly performance in three months, driven not only by bets on rate cuts, but also by concerns about the Fed’s independence, heightened political risks, and the steepness of the yield curve amid inflation fears.

İşlem önerileri

- Destek seviyeleri: 3575, 3560, 3500, 3469, 3438, 3402, 3383, 3374

- Direnç seviyeleri: 3600

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold has found a ceiling around 3600, where a flat accumulation is beginning to form. Given the MACD divergence, buyers should be extremely cautious here, as conditions for a correction are forming. It is important for buyers to keep the price above 3560 to maintain the bullish rally. A sharp drop below this level could trigger a correction.

Alternatif senaryo:if the price breaks the support level of 3374 and consolidates below it, the downtrend will likely resume.

Bugün için haber yok

Bu makale kişisel bir görüşü yansıtmaktadır ve yatırım tavsiyesi ve/veya teklifi ve/veya finansal işlemlerin gerçekleştirilmesi için ısrarlı bir talep ve/veya bir garanti ve/veya gelecekteki olaylara ilişkin bir tahmin olarak yorumlanmamalıdır.