The EUR/USD currency pair

Döviz çiftinin teknik göstergeleri:

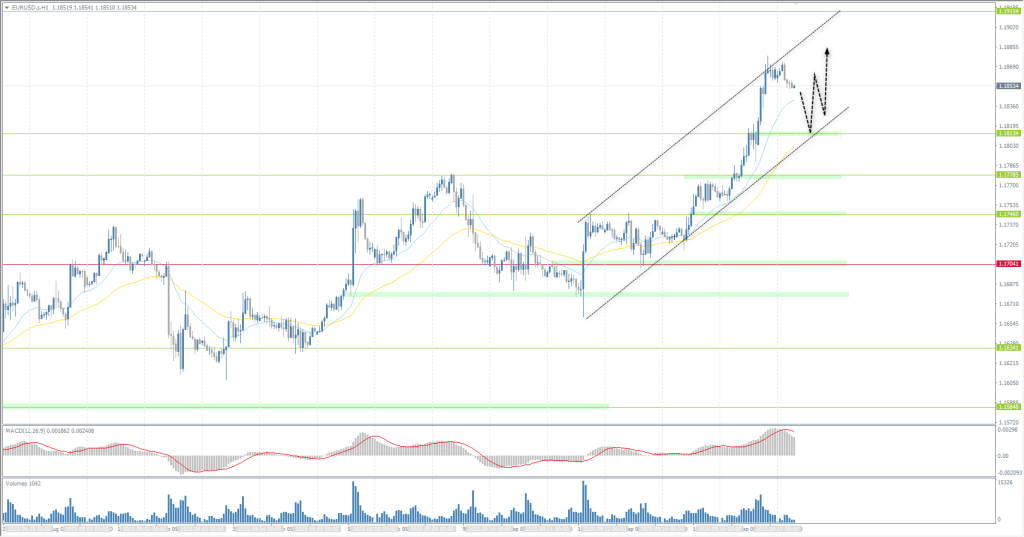

- Öncekini Aç: 1.1760

- Öncekini Kapat: 1.1867

- Son güne göre % değişim: +0.91 %

The euro rose above $1.18 for the first time since July, reaching its highest level since September 2021, helped by stronger-than-expected investor sentiment in the Eurozone and Germany, as well as a weaker dollar amid preparations by the US Federal Reserve to resume interest rate cuts this week. Markets generally expect the Fed to cut rates by at least 25 basis points as policymakers weigh a cooling labor market and persistent inflationary pressure from tariffs. European officials, on the other hand, continue to emphasize caution regarding inflation. ECB Executive Board member Isabel Schnabel urged policymakers to “keep a firm hand,” warning that risks ranging from tariffs and service inflation to food prices and fiscal policy remain significant.

İşlem önerileri

- Destek seviyeleri: 1.1813, 1.1778, 1.1746, 1.1704

- Direnç seviyeleri: 1.1915

The EUR/USD currency pair’s hourly trend is bullish. The euro strengthened sharply yesterday. The price is now heading towards a liquidity test above 1.1915. There are no prerequisites for a reversal at the moment, as a correction or reversal requires the formation of a locked balance above the resistance level. For buy deals, it is better to use the EMA lines or the support level of 1.1813. There are no optimal entry points for sales.

Alternatif senaryo:if the price breaks the support level of 1.1704 and consolidates below it, the downtrend will likely resume.

Haber akışı: 2025.09.17

- Eurozone ECB President Lagarde Speaks (m/m) at 10:30 (GMT+3);

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+3);

- US Building Permits (m/m) at 15:30 (GMT+3);

- US Fed Interest Rate Decision at 21:00 (GMT+3);

- US FOMC Statement at 21:00 (GMT+3);

- US FOMC Economic Projections at 21:00 (GMT+3);

- US FOMC Press Conference at 21:30 (GMT+3).

The GBP/USD currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 1.3597

- Öncekini Kapat: 1.3645

- Son güne göre % değişim: +0.35 %

The British pound rose to $1.363, its highest level since early July, as markets anticipate a busy week of Central Bank decisions and UK data. The Bank of England is expected to keep rates at 4% on Thursday, while slowing its annual £100 billion bond-buying program. UK inflation for August, due to be released today, is expected at 3.8% year-on-year, matching July’s 18-month high. The latest employment data showed wage growth excluding bonuses of 4.8% and 4.7% including bonuses, unemployment remained at 4.7%, and the number of jobs fell by 8,000, in line with expectations. The data points to a gradual slowdown in the labor market, as a result of which bets on a Bank of England rate cut have remained virtually unchanged, with the probability of a rate cut by December at only one in three.

İşlem önerileri

- Destek seviyeleri: 1.3618, 1.3585, 1.3523, 1.3501

- Direnç seviyeleri: 1.3681

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. The British currency is growing steadily, breaking through impulsively upward after each accumulation. There are no prerequisites for a reversal at this time. For buy deals, traders can consider the EMA lines or the support level of 1.3618. The profit target is 1.3680. There are currently no optimal entry points for sales.

Alternatif senaryo:if the price breaks through the support level of 1.3501 and settles below it, the downtrend will likely resume.

Haber akışı: 2025.09.17

- UK Consumer Price Index (m/m) at 09:00 (GMT+3);

- UK Producer Price Index (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 147.34

- Öncekini Kapat: 146.45

- Son güne göre % değişim: -0.61 %

On Wednesday, the Japanese yen fell to 146.6 per dollar after weak trade data reignited concerns about Japan’s export-dependent economy. Exports fell by 0.1% in August, less than expected but still the fourth consecutive monthly decline, driven by a 13.8% drop in shipments to the US. Imports fell by 5.2%, less than July’s 7.4% drop, but exceeding analysts’ expectations of 4.1%. On the monetary policy front, the Bank of Japan is expected to keep rates at 0.5% as policymakers assess domestic and external risks, including tariffs.

İşlem önerileri

- Destek seviyeleri: 146.35, 145.85

- Direnç seviyeleri: 146.82, 147.25, 147.48

From a technical point of view, the medium-term trend of the USD/JPY has changed to bearish one. The price has settled below the priority change level and is trading below the EMA lines. The price has now found support at 146.35, but the reaction from buyers is weak, which increases the likelihood of a further decline to 145.85. The EMA lines or the resistance level of 147.82 can be used for selling. There are currently no optimal entry points for buying.

Alternatif senaryo:if the price breaks through the resistance level of 147.48 and consolidates above it, the uptrend will likely resume.

Haber akışı: 2025.09.17

- Japan Trade Balance (m/m) at 02:50 (GMT+3).

The XAU/USD currency pair (gold)

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 3681

- Öncekini Kapat: 3689

- Son güne göre % değişim: +0.22 %

Gold prices rose to a record high of around $3,700 per ounce as investors assessed stronger-than-expected US economic data and awaited the Federal Reserve’s decision on Wednesday. Retail sales rose more than expected in August, and import prices showed their biggest increase in seven months, defying expectations of a slight decline. Despite the solid data, signs of a cooling labor market have reinforced expectations that the Fed will cut rates by 25 basis points for the first time since December, and possibly signal the start of an easing cycle that will last until 2026. Markets will be closely watching the Fed’s quarterly economic projections summary, including the dot plot, as well as Chairman Jerome Powell’s press conference for clues on the policy outlook.

İşlem önerileri

- Destek seviyeleri: 3674, 3657, 3615, 3600

- Direnç seviyeleri: 3700

From the point of view of technical analysis, the trend on the XAU/USD is bullish. The price reached the psychological mark of 3700, where profit-taking began. There is a small locked balance forming above the resistance level, as well as MACD divergence. These factors increase the likelihood of a corrective movement below 3674. For a further rally, the price needs to create a locked balance below the support level. For buy deals, we expect the formation of a locked balance below 3674. Intraday, sales can be considered, but with the nearest targets.

Alternatif senaryo:if the price breaks the support level of 3615 and consolidates below it, the downtrend will likely resume.

Haber akışı: 2025.09.17

- US Building Permits (m/m) at 15:30 (GMT+3);

- US Fed Interest Rate Decision at 21:00 (GMT+3);

- US FOMC Statement at 21:00 (GMT+3);

- US FOMC Economic Projections at 21:00 (GMT+3);

- US FOMC Press Conference at 21:30 (GMT+3).

Bu makale kişisel bir görüşü yansıtmaktadır ve yatırım tavsiyesi ve/veya teklifi ve/veya finansal işlemlerin gerçekleştirilmesi için ısrarlı bir talep ve/veya bir garanti ve/veya gelecekteki olaylara ilişkin bir tahmin olarak yorumlanmamalıdır.