The EUR/USD currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 1.1590

- Öncekini Kapat: 1.1609

- Son güne göre % değişim: +0.16%

The euro is strengthening to a 2-week high amid a weakening dollar and the ECB’s stable policy. The positive momentum was further supported by “hawkish” comments from ECB Governing Council member and Bundesbank President Nagel that interest rates in the Eurozone are at a good level. The euro is also benefiting from central bank policy divergences: the ECB has concluded its rate-cutting cycle, while the Fed is expected to continue easing.

İşlem önerileri

- Destek seviyeleri: 1.1607, 1.1590, 1.1555, 1.1503

- Direnç seviyeleri: 1.1653

The euro sharply rose yesterday and reached the resistance level of 1.1653, where profit-taking began. This led to a sharp price correction to 1.1607. Today, the focus is on the price’s reaction to the support level of 1.1607 or 1.1590. For the continuation of the bullish trend, it is crucial for buyers to hold the price above 1.1590. A break of this level would trigger a sell-off to 1.1555.

Alternatif senaryo:- Trend: Up

- Sup: 1.1607

- Res: 1.1656

- Note: Considering buying from 1.1607 or 1.1590, but with confirmation.

Haber akışı: 2025.12.02

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+2); – EUR (MED)

- Eurozone Unemployment Rate (m/m) at 12:00 (GMT+2). – EUR (LOW)

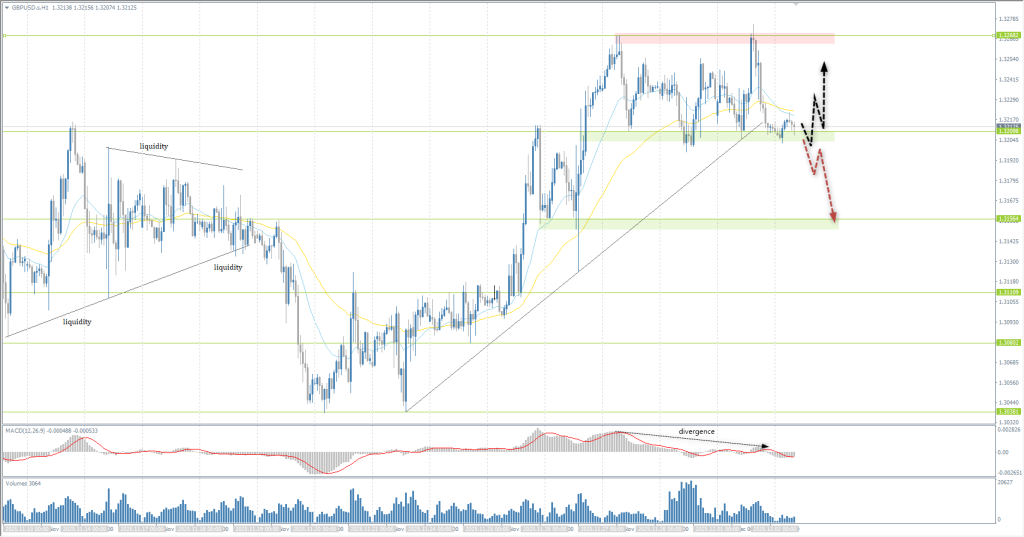

The GBP/USD currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 1.3220

- Öncekini Kapat: 1.3212

- Son güne göre % değişim: -0.06 %

The British pound strengthened yesterday, reaching its highest level since October 28th. Markets continue to assess the consequences of the UK’s November budget, including £26 billion in tax increases, with the Prime Minister and Chancellor defending the measures as necessary to reduce borrowing. In terms of monetary policy, the Bank of England is expected to cut the rate by 25 bps in December, followed by a pause due to inflation acceleration risks. In comparison, US markets are already fully pricing in the Fed’s third rate cut in December and at least two additional cuts next year.

İşlem önerileri

- Destek seviyeleri: 1.3210, 1.3156, 1.3111, 1.3080

- Direnç seviyeleri: 1.3268

The British pound continues to trade sideways in the range between 1.3210-1.3268. Yesterday, the price reached the upper boundary of the range, after which profit-taking on previously opened long positions began, leading to a correction. Today, traders need to evaluate the price action at the 1.3210 level. A strong impulsive break and consolidation below 1.3210 would cause a decline to 1.3156. If buyers show initiative from 1.3210, intraday buy trades can be considered again.

Alternatif senaryo:- Trend: Up

- Sup: 1.3210

- Res: 1.3268

- Note: Considering new buy deals from 1.3210, but with confirmation. An impulsive consolidation below may trigger a sell-off.

Haber akışı: 2025.12.02

- UK FPC Meeting Minutes at 09:00 (GMT+2). – GBP (LOW)

The USD/JPY currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 156.03

- Öncekini Kapat: 155.46

- Son güne göre % değişim: -0.36 %

On Tuesday, the Japanese yen weakened to 155.7 per dollar, pulling back after three sessions of gains as traders took profits. The yen’s previous rally was linked to increased expectations of a potential Bank of Japan rate hike, signaling a possible shift in monetary policy. Finance Minister Satsuki Katayama emphasized the coordinated actions of the government and the central bank, as well as the importance of achieving 2% inflation with sustained wage growth.

İşlem önerileri

- Destek seviyeleri: 154.82, 154.41

- Direnç seviyeleri: 155.73, 156.40, 157.11, 157.87

Yesterday, the price impulsively consolidated below a contracting triangle, after which it reached the nearest support level of 155.00. Here, traders began to close previously opened short positions, leading to a correction to 155.73. Today, it is important to assess the price’s reaction to the area near this level. If sellers are active, repeat sell trades can be sought intraday from 155.73. If the price impulsively consolidates above 155.73, the path to 156.40 opens up.

Alternatif senaryo:- Trend: Neutral

- Sup: 154.82

- Res: 155.73

- Note: Look for repeat sell trades from 155.73, but with confirmation. A price move above 155.73 may trigger a rise to 156.40.

Bugün için haber yok

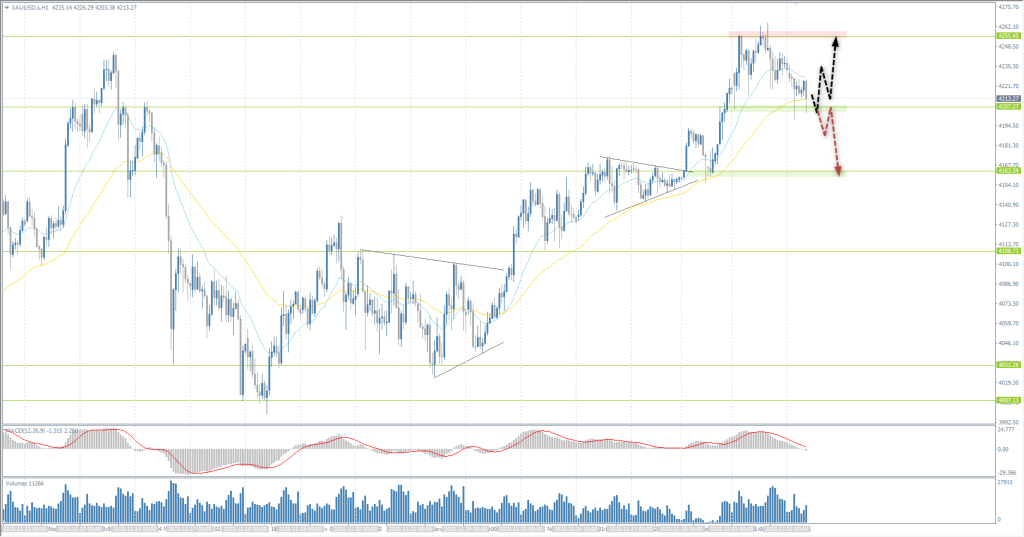

The XAU/USD currency pair (gold)

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 4220

- Öncekini Kapat: 4237

- Son güne göre % değişim: +0.40%

On Tuesday, gold prices fell to $4,210 per ounce as investors took profits following a rally to a six-week high the previous day. The main driver of the preceding rally was intensified expectations that the Fed will cut the rate by 25 bps as early as next week – markets price the probability of such a move at approximately 88%. Investors are now awaiting the speech by Jerome Powell, which is scheduled for today and may provide additional signals on monetary policy.

İşlem önerileri

- Destek seviyeleri: 4207, 4167, 4145, 4108, 4031, 4007, 3966

- Direnç seviyeleri: 4255, 4379

Yesterday, gold reached the resistance level of 4255, after which profit-taking began, and the price corrected to the 4207 level. Here, it is important to assess how ready buyers are to support the rally. An impulsive consolidation of the price below 4207 may trigger a sell-off to 4163. For buy deals, we are evaluating the reaction from 4207, but with confirmation. Sales can be considered after an impulsive break of 4207.

Alternatif senaryo:- Trend: Up

- Sup: 4207

- Res: 4255

- Note: For buy deals, consider the 4207 level, but with confirmation. Consolidation below may trigger a drop to 4163.

Bugün için haber yok

Bu makale kişisel bir görüşü yansıtmaktadır ve yatırım tavsiyesi ve/veya teklifi ve/veya finansal işlemlerin gerçekleştirilmesi için ısrarlı bir talep ve/veya bir garanti ve/veya gelecekteki olaylara ilişkin bir tahmin olarak yorumlanmamalıdır.