The EUR/USD currency pair

Döviz çiftinin teknik göstergeleri:

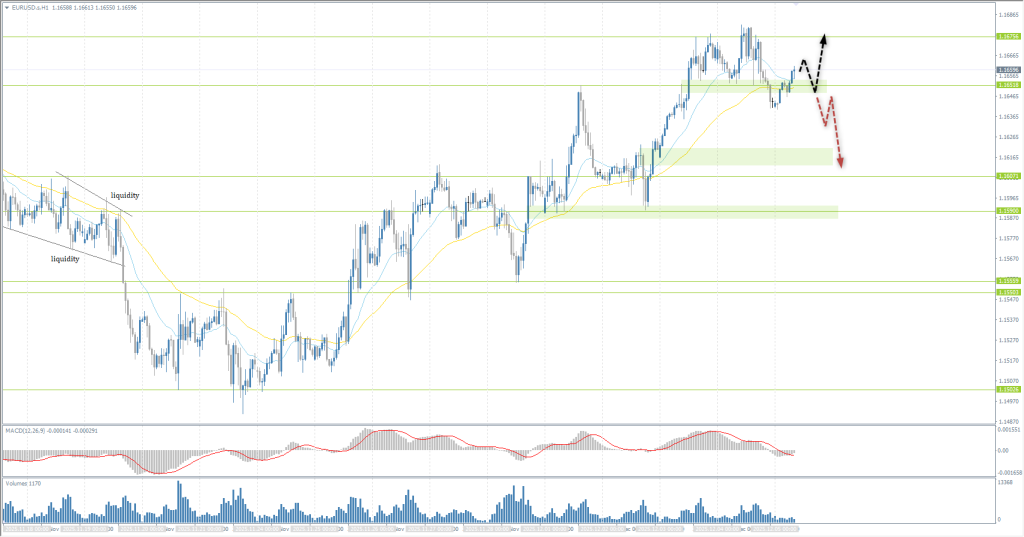

- Öncekini Aç: 1.1665

- Öncekini Kapat: 1.1644

- Son güne göre % değişim: -0.18%

The euro slightly declined yesterday. The main pressure came from a strengthening dollar following stronger-than-expected US jobless claims data – the market interpreted this as a signal of a more “hawkish” stance from the Fed. Further negative sentiment for the euro was generated by news that US-Russia talks yielded no progress on ending the war in Ukraine. In terms of macro statistics, Eurozone retail sales in October matched expectations and remained flat month-over-month. The derivatives market currently prices the probability of an ECB rate cut at the December meeting at only about 1%.

İşlem önerileri

- Destek seviyeleri: 1.1652, 1.1607, 1.1590, 1.1555, 1.1503

- Direnç seviyeleri: 1.1675, 1.1728

A ranging consolidation pattern is forming on the euro with boundaries between 1.1652-1.1752. Yesterday, towards the close of the US session, the price attempted to consolidate below 1.1652, but Asian buyers pushed the price back up. Intraday, we should consider buying from 1.1652 with a target of 1.1675. There are currently no optimal entry points for sales.

Alternatif senaryo:- Trend: Up

- Sup: 1.1652

- Res: 1.1675

- Note: Сonsidering buying from 1.1653, but with confirmation. For sales, price consolidation below this level is necessary.

Haber akışı: 2025.12.05

- Eurozone GDP (q/q) at 12:00 (GMT+2); – EUR (MED)

- US Core PCE Price Index (m/m) at 15:30 (GMT+2); – USD (HIGH)

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+2). – USD (MED)

The GBP/USD currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 1.3348

- Öncekini Kapat: 1.3323

- Son güne göre % değişim: -0.18 %

The pound strengthened confidently against the dollar after Rachel Reeves presented the Autumn Budget, which included tax measures totaling £26.1 billion by 2029-2030. These steps temporarily reduced uncertainty and, along with improved growth expectations from the OBR for 2025, supported the currency. The US dollar is also under pressure from expectations of a December Fed rate cut.

İşlem önerileri

- Destek seviyeleri: 1.3327, 1.3268, 1.3156, 1.3111, 1.3080

- Direnç seviyeleri: 1.3372

The British pound is trading in a wider range with boundaries between 1.3327-1.3365. For buying, it is ideal to wait for a correction to 1.3327. For sales, 1.3372 can be considered, but with confirmation in the form of seller initiative. Price consolidation below 1.3327 will trigger a sell-off to 1.3268.

Alternatif senaryo:- Trend: Up

- Sup: 1.3327

- Res: 1.3372

- Note: Considering buy deals from the 1.3327, but with confirmation. Profit target is 1.3372.

Bugün için haber yok

The USD/JPY currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 155.24

- Öncekini Kapat: 155.06

- Son güne göre % değişim: -0.11 %

The Japanese yen strengthened to the 155 level against the dollar on Friday and was heading for a second consecutive week of gains amid speculation of a potential Bank of Japan rate hike as early as the end of the month. Key government officials will not obstruct such a move, though some officials remain cautious about the timing. Optimism was boosted by Bank of Japan Governor Kazuo Ueda’s statements about solid economic prospects and a readiness to act if necessary, as well as comments from the Finance Minister on the importance of achieving the 2% inflation target.

İşlem önerileri

- Destek seviyeleri: 154.41, 154.17

- Direnç seviyeleri: 155.12, 155.50, 156.09, 156.40, 157.11, 157.87

Sellers held the price below 155.50, leading to further yen strengthening. The price is currently heading towards the support level of 154.82, where a bullish reaction may occur, especially given the MACD divergence. Intraday, buy deals can be considered from 154.41 or 154.17, but with confirmation. For sales, it is best to wait for a correction to 155.12.

Alternatif senaryo:- Trend: Neutral

- Sup: 154.41

- Res: 155.12

- Note: Considering buy trades from 154.41 or 154.17, but with confirmation. For sales, it is best to wait for a correction to 155.12.

Bugün için haber yok

The XAU/USD currency pair (gold)

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 4206

- Öncekini Kapat: 4210

- Son güne göre % değişim: +0.10%

Gold climbed back above $4,210 per ounce, recouping earlier losses due to growing confidence in imminent Fed policy easing. Weak US employment data, including ADP job cuts and a rise in announced layoffs, reinforced expectations of a 25 basis point rate cut in December. The weakening dollar further increased gold’s appeal. Investors are awaiting PCE data on Friday, which will help shape expectations for the trajectory of future easing.

İşlem önerileri

- Destek seviyeleri: 4183, 4145, 4108, 4031, 4007, 3966

- Direnç seviyeleri: 4229, 4379

Gold is also trading in a wide range. Sellers have established the resistance level at 4229, and buyers at 4183. Intraday, sales should be considered from the resistance level of 4229, but with confirmation. A break of 4229 will open the price path to 4255. The intraday bias is currently with the buyers.

Alternatif senaryo:- Trend: Up

- Sup: 4183

- Res: 4229

- Note: Looking for sales from 4229, but with confirmation. Price consolidation above 4229 will open the path for growth to 4255.

Haber akışı: 2025.12.05

- US Core PCE Price Index (m/m) at 15:30 (GMT+2); – USD (HIGH)

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+2). – USD (MED)

Bu makale kişisel bir görüşü yansıtmaktadır ve yatırım tavsiyesi ve/veya teklifi ve/veya finansal işlemlerin gerçekleştirilmesi için ısrarlı bir talep ve/veya bir garanti ve/veya gelecekteki olaylara ilişkin bir tahmin olarak yorumlanmamalıdır.