The EUR/USD currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 1.1811

- Öncekini Kapat: 1.1915

- Son güne göre % değişim: +0.88%

The euro rose above 1.19 dollars, holding near highs last seen in late January after the ECB signaled that it does not see a problem with the currency’s recent strengthening. The regulator kept rates unchanged and confirmed expectations for inflation to stabilize at 2%, while Christine Lagarde described the inflation outlook as “good,” noting potential volatility in incoming data. An additional supporting factor for the euro was the weakening of the US dollar in anticipation of key employment and inflation reports. News of the early resignation of Bank of France Governor Villeroy de Galhau did not exert significant pressure on the euro.

İşlem önerileri

- Destek seviyeleri: 1.1870, 1.1833, 1.1777, 1.1754, 1.1726

- Direnç seviyeleri: 1.1955, 1.2050, 1.3000

The euro broke impulsively above 1.1839, triggering an upward movement toward 1.1870 and higher. Within the current structure, the price is aimed at collecting liquidity above 1.1955. Therefore, buying remains the priority. The optimal zones for long entries are pullbacks to the EMA or to the 1.1870 support level when confirmation appears. The market structure remains bullish, and there are currently no high-quality points for selling.

Alternatif senaryo:- Trend: Up

- Sup: 1.1870

- Res: 1.1955

- Note: Сonsidering buys from the EMA lines or the 1.1870 support level. There are no optimal entry points for selling right now.

Haber akışı: 2026.02.10

- US Retail Sales (m/m) at 15:30 (GMT+2). – USD (MED)

The GBP/USD currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 1.3593

- Öncekini Kapat: 1.3694

- Son güne göre % değişim: +0.74 %

The British pound is holding near 1.36 dollars, remaining below the January four-year high of 1.387, amid increased political uncertainty and softening expectations for Bank of England policy. Pressure on the currency intensified following the resignation of Prime Minister Keir Starmer’s chief of staff, reviving speculation about the stability of his leadership, as well as amid disputes surrounding Peter Mandelson’s appointment as Ambassador to the US. An additional negative factor was expectations of further rate cuts by the Bank of England. Despite keeping the rate at 3.75%, the regulator adopted a more dovish tone, indicating that inflation would return to the 2% target as early as April, which increased pressure on the pound.

İşlem önerileri

- Destek seviyeleri: 1.3674, 1.3621, 1.3556, 1.3514

- Direnç seviyeleri: 1.3732, 1.3787, 1.3871, 1.4000

The British pound strengthened to 1.3674, where moderate profit-taking on previously opened long positions was observed. However, no reversal signs have formed – the market structure remains bullish, and the initiative is still with the buyers. During the day, the priority remains looking for buys on corrections. The most interesting entry zones are the 1.3474 support level and the EMA area when confirming signals appear. The target for the move is liquidity collection above 1.3732. No optimal conditions for selling are observed at the moment.

Alternatif senaryo:- Trend: Up

- Sup: 1.3674

- Res: 1.3732

- Note: Intraday, it is appropriate to look for buys from the 1.3674 support level or EMA lines. There are no optimal entry points for selling.

Bugün için haber yok

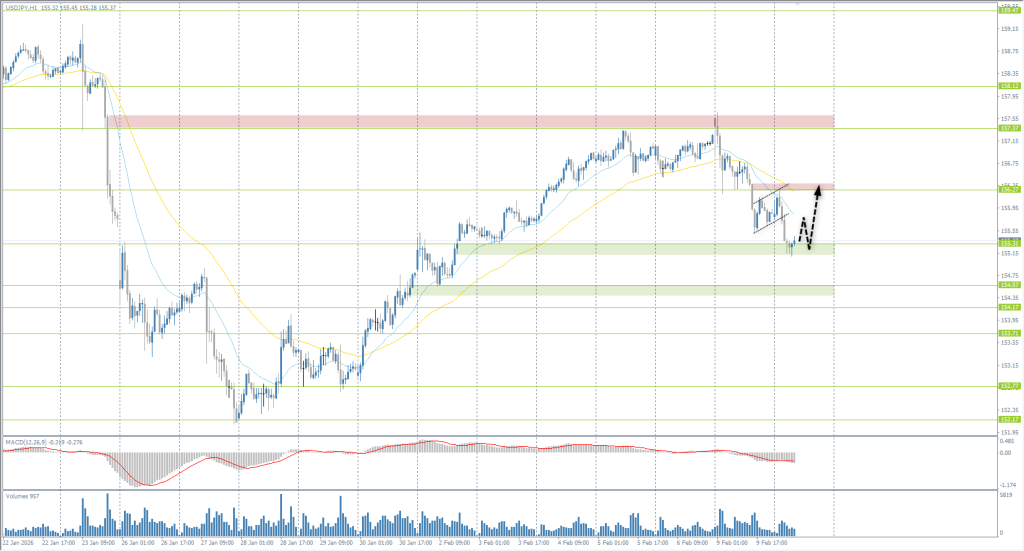

The USD/JPY currency pair

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 157.56

- Öncekini Kapat: 155.85

- Son güne göre % değişim: -1.10 %

On Tuesday, the Japanese yen strengthened to 155 per dollar, continuing its growth for a second consecutive session amid renewed verbal intervention by authorities and Prime Minister Sanae Takaichi’s convincing victory in the general election. Markets reacted positively to statements that fiscal stimulus plans would not lead to further deterioration of public finances. The ruling coalition secured a solid majority in the lower house of parliament, giving Takaichi a mandate to increase spending and cut taxes, including the promised two-year suspension of the 8% food tax. Additional support for the yen came from capital inflows into the Japanese stock market, where stocks hit all-time highs despite pressure on the bond market.

İşlem önerileri

- Destek seviyeleri: 155.31, 154.57, 154.17, 153.71

- Direnç seviyeleri: 156.27, 155.52, 157.37, 158.12

The Japanese yen continues to strengthen primarily due to the weakness of the US dollar. However, there are still few fundamental reasons for a sustained yen strengthening; therefore, current corrections should be viewed as an opportunity to look for buy trades. Currently, the price is near the 155.31 support, but the buyer reaction here is weak and MACD divergence is absent, which increases the likelihood of another local low. Priority zones for seeking buys are 155.31 and 154.57, but only after confirming initiative from buyers appears. There are no optimal conditions for selling at the moment.

Alternatif senaryo:- Trend: Neutral

- Sup: 155.31

- Res: 156.27

- Note: For buys, we are waiting for initiative from 155.31 or 154.57, but with confirmation in the form of an upward push. There are no optimal entry points for selling right now.

Bugün için haber yok

The XAU/USD currency pair (gold)

Döviz çiftinin teknik göstergeleri:

- Öncekini Aç: 4977

- Öncekini Kapat: 5060

- Son güne göre % değişim: +1.67 %

On Tuesday, gold dropped below 5030 dollars per ounce amid profit-taking after rising to weekly highs. The market focus is shifting to key US data – the Non-Farm Payrolls report and inflation figures – which may influence expectations for the Fed’s interest rate trajectory. Despite the short-term decline, medium-term factors remain favorable for gold: markets are still pricing in at least two rate cuts this year, the central bank of China extended gold purchases for the fifteenth consecutive month in January, and ongoing geopolitical tensions surrounding the US and Iran support demand for safe-haven assets.

İşlem önerileri

- Destek seviyeleri: 4968, 4745, 4605, 4400

- Direnç seviyeleri: 5086, 5145, 5230

Volatility in gold is gradually decreasing, which indicates growing liquidity and, as a result, an increase in open interest. Typically, during such periods, the market forms flat-like structures to accumulate liquidity before the next directional move. Currently, gold is trading in the range of 4968-5086. The priority for buying is working from the lower boundary of the range near 4968, but only if there are confirming signals. An impulsive breakout of this level could trigger a wave of sell-offs and a change in the short-term market structure.

Alternatif senaryo:- Trend: Neutral

- Sup: 4968

- Res: 5086

- Note: Considering buys from the 4968 support level, but with confirmation. An impulsive breakout of this level could trigger a sell-off.

Haber akışı: 2026.02.10

- US Retail Sales (m/m) at 15:30 (GMT+2). – USD (MED)

Bu makale kişisel bir görüşü yansıtmaktadır ve yatırım tavsiyesi ve/veya teklifi ve/veya finansal işlemlerin gerçekleştirilmesi için ısrarlı bir talep ve/veya bir garanti ve/veya gelecekteki olaylara ilişkin bir tahmin olarak yorumlanmamalıdır.