The EUR/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.0913

- Đóng trước đó: 1.0887

- % thay đổi 24 giờ qua: -0.23 %

Trade tensions escalated after US tariffs of 25 percent on steel and aluminum imports from Canada, Australia, the EU, and other countries went into effect on Wednesday, prompting retaliatory measures from the European Union. The EU announced retaliatory tariffs on 26 billion euros worth of US goods, which will begin in April and apply to steel, aluminum, textiles, leather goods, poultry, beef, eggs, and other products. The euro’s rally was also fueled by expectations that increased defense spending will strengthen the bloc’s economy, while the ECB’s easing cycle may soon come to an end. ECB President Lagarde said yesterday that sharp changes in global trade and higher Eurozone defense spending would make it difficult to maintain stable inflation.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.0884, 1.0820, 1.0677, 1.0602, 1.0561, 1.0466

- Mức kháng cự: 1.0937, 1.0979

The EUR/USD currency pair’s hourly trend is bullish. After the price tested the resistance level of 1.0937, the price started to form a flat accumulation with downward pressure inside. Now, it is important to evaluate the price reaction to the support level of 1.0875. If sellers break down the level, the price may rush to 1.0820. If the buyers react and the price forms a false breakdown, a new rise to 1.0937 is very likely.

Kịch bản thay thế:if the price breaks through the support level of 1.0803 and consolidates below it, the downtrend will likely resume.

Tin tức cập nhật cho: 2025.03.13

- Eurozone Industrial Production (m/m) at 12:00 (GMT+2);

- US Producer Price Index (m/m) at 14:30 (GMT+2);

- US Initial Jobless Claims (w/w) at 14:30 (GMT+2).

The GBP/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.2945

- Đóng trước đó: 1.2963

- % thay đổi 24 giờ qua: +0.13 %

The UK government is desperate to boost economic growth as it faces spending cuts and tax hikes this year. A reset of economic ties between the UK and the EU would help this, and sweeping changes are becoming increasingly likely. British Prime Minister Keir Starmer said he hoped Britain could avoid US tariffs on steel and aluminum, saying the government would take a “pragmatic approach” by keeping all options open.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.2914, 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- Mức kháng cự: 1.3010

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish. The British pound aims to test the liquidity zone above 1.3010. The MACD indicates a divergence, but the price can make another upside move. For buy deals, it is best to consider the EMA lines or the support level of 12914. Selling should be looked for from 1.3010, provided sellers react.

Kịch bản thay thế:if the price breaks the support level of 1.2860 and consolidates below it, the downtrend will likely resume.

Không có tin tức cho ngày hôm nay

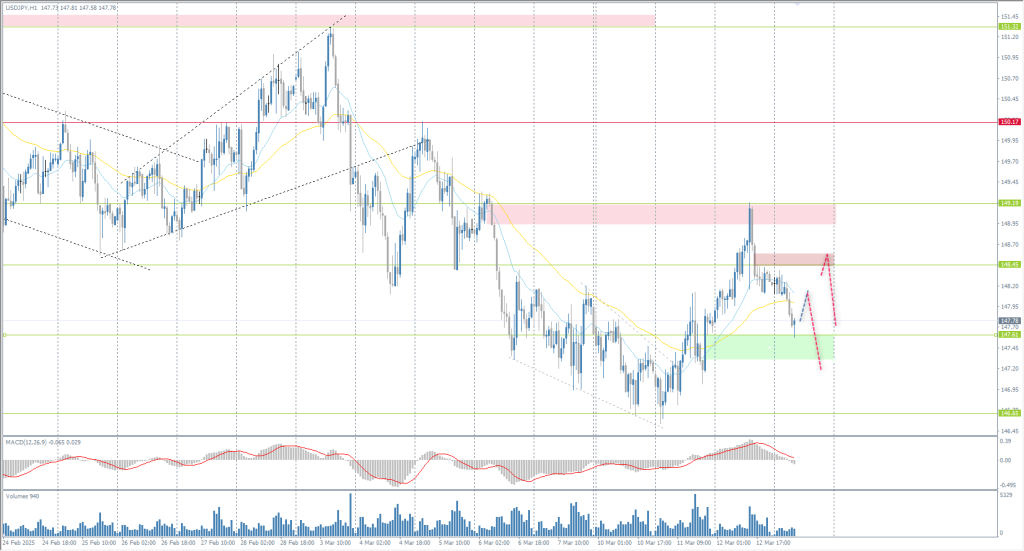

The USD/JPY currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 147.76

- Đóng trước đó: 148.21

- % thay đổi 24 giờ qua: +0.30 %

The Japanese yen slipped below 148.8 per dollar on Wednesday after weaker-than-expected US inflation data eased fears of stagflation and strengthened the dollar. However, the currency remains near five-month highs as traders expect further interest rate hikes in Japan as inflation remains elevated. Japanese companies agreed to significant wage increases for the third consecutive year, which will boost consumer spending, spurring inflation and potentially giving the Bank of Japan more room for additional interest rate hikes.

Khuyến nghị giao dịch

- Mức hỗ trợ: 147.61, 146.65, 146.00

- Mức kháng cự: 148.45, 149.19, 150.16, 151.29, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. The Japanese yen corrected to 149.19, where sellers became more active. Currently, the price has reached the demand zone near the support level at 147.61. There is a reaction of buyers, which means that the price may rise to the EMA lines or to the resistance level at 148.45, which can be used for selling with the aim to renew the lows of the week.

Kịch bản thay thế:if the price breaks above the resistance at 151.29, the uptrend will likely resume.

Không có tin tức cho ngày hôm nay

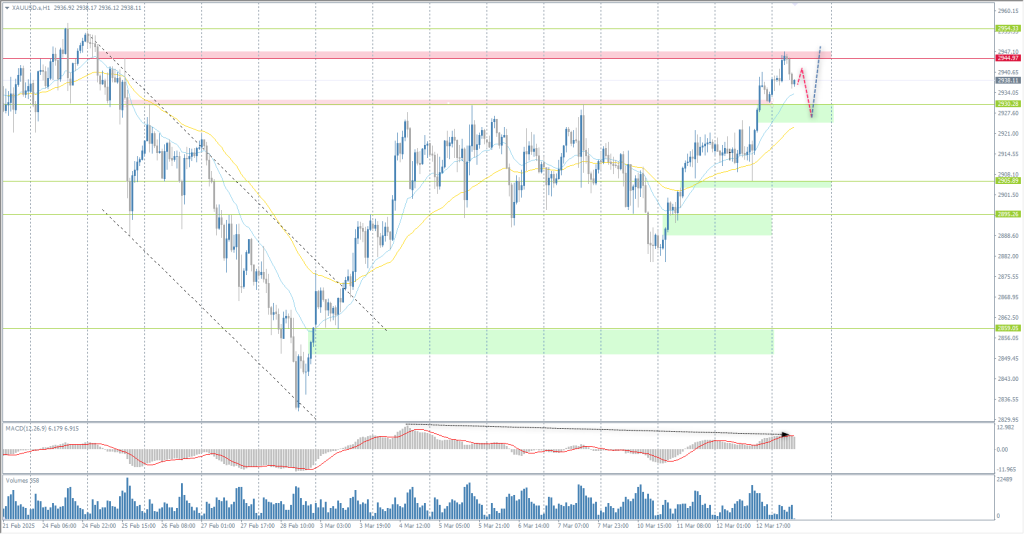

The XAU/USD currency pair (gold)

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 2916

- Đóng trước đó: 2934

- % thay đổi 24 giờ qua: +0.62 %

Gold rose to $2,940 an ounce on Thursday, nearing record highs, as escalating global trade tensions continue to fuel demand for safe-haven gold. On Wednesday, President Donald Trump warned of additional tariffs on EU goods after the EU and Canada retaliated against existing US trade barriers. Commerce Secretary Howard Lutnick also said Trump would impose trade protections on copper as well. The impact of the tariffs has yet to materialize, but it could lead to higher inflation in the coming months.

Khuyến nghị giao dịch

- Mức hỗ trợ: 2930, 2905, 2896, 2859, 2833

- Mức kháng cự: 2944

From the point of view of technical analysis, the trend on the XAU/USD is bearish, but it is close to a shift. The price has reached the priority change level, where sellers are actively defending the level. Now, against the background of MACD divergence, gold is correcting, but fundamental reasons for further growth remain. For buying, we can consider the support level of 2930 or EMA lines, but with confirmation. For selling, there are no optimal entry points right now.

Kịch bản thay thế:if the price breaks and consolidates above the resistance at 2945, the uptrend will likely resume.

Tin tức cập nhật cho: 2025.03.13

- US Producer Price Index (m/m) at 14:30 (GMT+2);

- US Initial Jobless Claims (w/w) at 14:30 (GMT+2).

Bài viết này phản ánh quan điểm cá nhân và không nên được hiểu là lời khuyên và/hoặc đề nghị đầu tư và/hoặc hối thúc thực hiện các giao dịch tài chính và/hoặc bảo đảm và/hoặc dự báo về các sự kiện trong tương lai.