The EUR/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.0856

- Đóng trước đó: 1.0817

- % thay đổi 24 giờ qua: -0.36 %

The euro retreated on Friday due to the strengthening dollar and dovish comments from ECB Governing Council Representative Stournaras, who pointed in the direction of an ECB rate cut in April. In addition, concerns over US trade tariffs and their possible negative impact on the Eurozone economy are dragging down the euro. The euro’s losses accelerated on Friday after an unexpected decline in the Eurozone’s Consumer Confidence Index for March. Swaps discount the chances of a 25bp ECB rate cut at the April 17 meeting at 59%.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.0822, 1.0677, 1.0602, 1.0561, 1.0466

- Mức kháng cự: 1.0864, 1.0918, 1.0947, 1.0979

The EUR/USD currency pair’s hourly trend is bullish, but close to change. On Friday, the price tried to consolidate below the level of priority change at 1.0822. Buyers managed to defend positions not without problems, but sellers built a resistance level at 1.0864. Traders should return to buying only after the price consolidates above this level. Selling can be considered from 1.0864, but also with confirmation.

Kịch bản thay thế:if the price breaks through the support level of 1.0822 and consolidates below it, the downtrend will likely resume.

Tin tức cập nhật cho: 2025.03.24

- Germany Manufacturing PMI (m/m) at 10:30 (GMT+2);

- Germany Services PMI (m/m) at 10:30 (GMT+2);

- Eurozone Manufacturing PMI (m/m) at 11:00 (GMT+2);

- Eurozone Services PMI (m/m) at 11:00 (GMT+2);

- US Manufacturing PMI (m/m) at 15:45 (GMT+2);

- US Services PMI (m/m) at 15:45 (GMT+2).

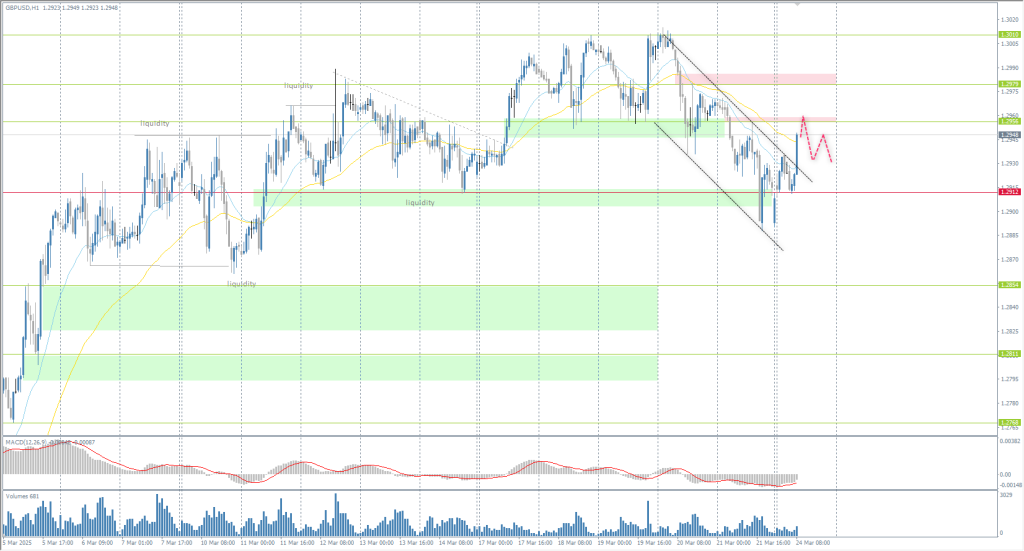

The GBP/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.2968

- Đóng trước đó: 1.2915

- % thay đổi 24 giờ qua: -0.41 %

This week will be full of economic data in the UK. The main ones are the February Consumer Price Index on Wednesday and Chancellor Reeves’ Spring Budget statement on Thursday. The base effect predicts that year-on-year consumer prices are likely to fall in February and March. The Office for Budget Responsibility is expected to revise its economic expectations downwards ahead of Reeves’ speech. The overall narrative for the British currency this week is negative.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.2956, 1.2912, 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- Mức kháng cự: 1.3010

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish. On Friday, sterling fell sharply and reached the priority change level of 1.2912. However, buyers quickly bought sterling back, which led to a sharp rise at Monday’s opening. Price is now looking to test liquidity above the 1.2956 resistance level. Here we can look for selling, provided the selling side reacts. There are no optimal entry points for buying right now.

Kịch bản thay thế:if the price breaks the support level of 1.2912 and consolidates below it, the downtrend will likely resume.

Tin tức cập nhật cho: 2025.03.24

- UK Manufacturing PMI (m/m) at 11:30 (GMT+2);

- UK Services PMI (m/m) at 11:30 (GMT+2);

- UK BoE Gov Bailey Speech at 20:00 (GMT+2).

The USD/JPY currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 148.78

- Đóng trước đó: 149.31

- % thay đổi 24 giờ qua: +0.35 %

The Japanese yen slipped to 149.90 per dollar on Monday, extending losses from the previous session, as disappointing business activity data countered the Bank of Japan’s hawkish outlook. Japan’s private sector activity contracted in March for the first time in five months, with the decline in manufacturing extending into a ninth month, while service sector activity also turned negative.

Khuyến nghị giao dịch

- Mức hỗ trợ: 148.95, 148.58, 148.25

- Mức kháng cự: 149.65, 150.17, 151.29, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish. The yen has reached the supply zone above 149.65, but there is no seller’s reaction. In this scenario, the yen will seek to test liquidity above 150.17. Intraday, you can look for buying with a target up to this level. Traders should return to selling if the price consolidates below 149.65.

Kịch bản thay thế:if the price breaks through the support level at 148.25 and consolidates below it, the downtrend will likely resume.

Tin tức cập nhật cho: 2025.03.24

- Japan Manufacturing PMI (m/m) at 02:30 (GMT+2);

- Japan Services PMI (m/m) at 02:30 (GMT+2).

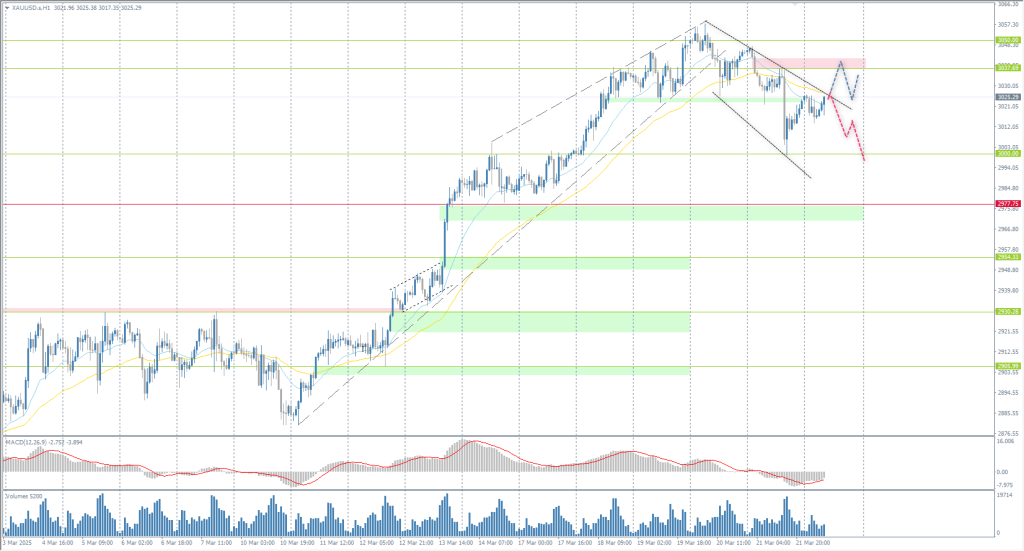

The XAU/USD currency pair (gold)

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 3023

- Đóng trước đó: 3045

- % thay đổi 24 giờ qua: -0.73 %

“Hawkish” comments from New York Fed President Williams and Chicago Fed President Goolsbee on Friday hurt precious metals when they expressed their support for a stable Fed policy. Despite this, gold’s appeal as a safe-haven currency remains high amid uncertainty over tariffs and expectations of a rate cut by the US Federal Reserve. President Donald Trump remains committed to imposing new reciprocal tariffs on April 2, although he has hinted that there may be some flexibility in this plan.

Khuyến nghị giao dịch

- Mức hỗ trợ: 3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- Mức kháng cự: 3037, 3050, 3100

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold corrected to the support level of 3000, where the price bounced impulsively. Currently, the price is trading at the level of moving averages in the supply zone. We can look for selling here, but subject to an appropriate reaction. At the moment, it is absent. Selling can also be considered from the resistance level of 3037. There are no optimal entry points for buy deals right now.

Kịch bản thay thế:if the price breaks below the support level 2906, the downtrend will likely resume.

Tin tức cập nhật cho: 2025.03.24

- US Manufacturing PMI (m/m) at 15:45 (GMT+2);

- US Services PMI (m/m) at 15:45 (GMT+2).

Bài viết này phản ánh quan điểm cá nhân và không nên được hiểu là lời khuyên và/hoặc đề nghị đầu tư và/hoặc hối thúc thực hiện các giao dịch tài chính và/hoặc bảo đảm và/hoặc dự báo về các sự kiện trong tương lai.