The EUR/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.0905

- Đóng trước đó: 1.0958

- % thay đổi 24 giờ qua: +0.48 %

The EUR exchange rate fluctuated around USD 1.0950 as investors paused while waiting for clearer signals on how the EU plans to respond to the US tariffs. That came after two consecutive sessions of declines, helped by a broader retreat in risky currencies amid escalating trade tensions and deepening concerns about global growth. On Monday, the European Commission said it had offered the Trump administration a deal on zero tariffs in a bid to avert a trade war, with EU ministers agreeing to make the talks a priority. However, the offer was rejected by Washington.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.0991, .0879, 1.0805, 1.0785

- Mức kháng cự: 1.1088, 1.1136, 1.1201

The EUR/USD currency pair’s hourly trend is bullish. The euro broke through the descending trend line and rushed to test the liquidity above 1.1088. It is too late to buy here, as the price has deviated strongly from the midlines. For selling, 1.1088 can be considered, subject to the sellers’ reaction. Statistically, after the breakout, the price returns to test the breakout spot, so a corrective downside wave is very likely.

Kịch bản thay thế:if the price breaks the support level of 1.0805 and consolidates below it, the downtrend will likely resume.

Tin tức cập nhật cho: 2025.04.09

- US FOMC Meeting Minutes at 21:00 (GMT+3).

The GBP/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.2716

- Đóng trước đó: 1.2765

- % thay đổi 24 giờ qua: +0.38 %

The Dollar Index fell to 102.5 on Wednesday, declining for the second consecutive session as the implementation of President Donald Trump’s sweeping tariffs put pressure on the currency. This allowed risk assets to strengthen slightly against the dollar. China is facing 104% duties in a full-blown trade war with the US, and Beijing has vowed to “fight to the end” to protect its interests. Markets fear that an escalating global trade war could push the US economy into recession and force the Federal Reserve to cut interest rates further. On the other hand, the US tariff policy will contribute to a slowdown in the global economy, which will also encourage other economies to cut rates until inflation creeps up again.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.2678, 1.2645

- Mức kháng cự: 1.2853, 1.2953, 1.3050, 1.3176

From the point of view of technical analysis, the trend on the GBP/USD currency is bearish. The price has corrected to the resistance level of 1.2853. Here, we can consider selling if there is a reaction from sellers. The price has not reached the global support level, which increases the probability of further decline. Therefore, only selling should be considered in the British pound.

Kịch bản thay thế:if the price breaks the resistance level of 1.3114 and consolidates above it, the uptrend will likely resume.

Không có tin tức cho ngày hôm nay

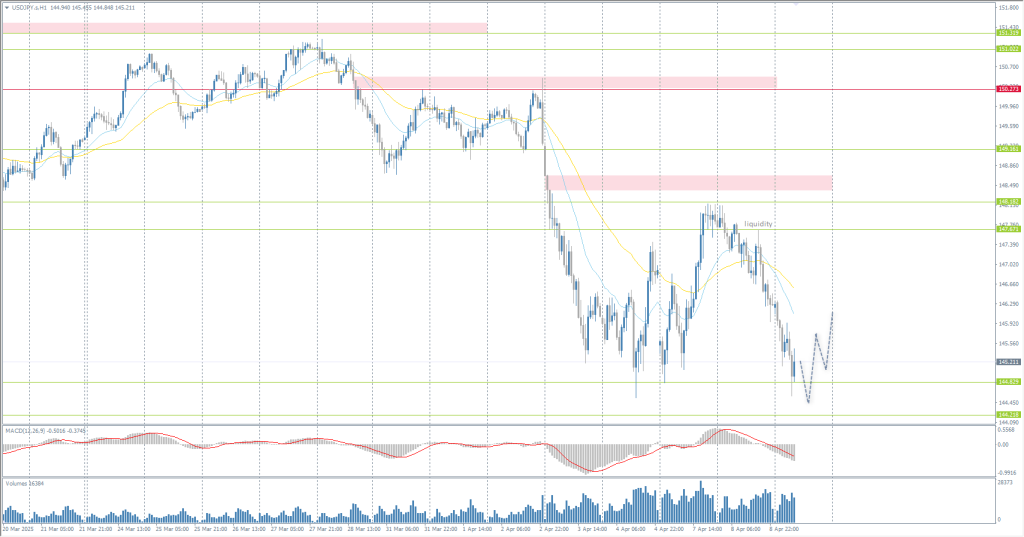

The USD/JPY currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 147.84

- Đóng trước đó: 146.26

- % thay đổi 24 giờ qua: -1.08 %

The Japanese yen exceeded 145 per dollar on Wednesday, rising for the second consecutive session, as the implementation of US President Donald Trump’s sweeping tariffs boosted demand for safer assets. The currency also benefited from overall dollar weakness as Trump’s escalation of the global trade war fueled fears of a possible US recession, which could lead to further interest rate cuts by the Federal Reserve. On the domestic front, Japan’s current account surplus rose to a record high in February thanks to strong export growth and lower imports, providing further support for the yen.

Khuyến nghị giao dịch

- Mức hỗ trợ: 144.83, 144.22

- Mức kháng cự: 147.67, 148.41, 149.16, 150.27

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. The yen strengthened again to the support level of 144.83. It is noteworthy that at the top, the price did not grab new liquidity. Without new liquidity, it will be difficult to continue the downward movement. Therefore, given the MACD divergence, there is a high probability of a new rise in price from 144.83 or 144.21. The yen, probably, will form a broadly volatile flat.

Kịch bản thay thế:if the price breaks through the resistance level at 150.27 and consolidates above it, the uptrend will likely resume.

Không có tin tức cho ngày hôm nay

The XAU/USD currency pair (gold)

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 2982

- Đóng trước đó: 2982

- % thay đổi 24 giờ qua: 0.00 %

Gold rose above $3,010 an ounce on Wednesday, supported by safe-haven demand as the prospect of a full-blown trade war heightened fears of a global recession and rising inflation. Tariffs imposed by President Donald Trump against dozens of countries have already taken effect, including massive 104% duties on Chinese goods. On Tuesday, Trump also said he would soon announce “major” tariffs on pharmaceutical imports. In support of the precious metal, the World Gold Council reported that inflows into gold-backed ETFs totaled 226.5 metric tons worth $21.1 billion in the first quarter, the largest in three years.

Khuyến nghị giao dịch

- Mức hỗ trợ: 2970, 2954, 2930, 2906, 2896, 2859, 2833

- Mức kháng cự: 3054, 3087, 3136, 3167, 3200

From the point of view of technical analysis, the trend on the XAU/USD is bearish. Currently, the gold is forming a broadly volatile flat with the boundaries of 2970-3054. A narrowing triangle has formed inside the flat, which was broken by the price moving upwards. This increases the probability of growth to the upper boundary of the flat to test new liquidity. Intraday, you can look for buy trades from the EMA lines. However, it is worth noting that if the price returns sharply inside the narrowing triangle, it will change the situation. In such a scenario, gold will go to update the low of the week.

Kịch bản thay thế:if the price breaks and consolidates above the resistance level of 3135, the uptrend will likely resume.

Tin tức cập nhật cho: 2025.04.09

- US FOMC Meeting Minutes at 21:00 (GMT+3).

Bài viết này phản ánh quan điểm cá nhân và không nên được hiểu là lời khuyên và/hoặc đề nghị đầu tư và/hoặc hối thúc thực hiện các giao dịch tài chính và/hoặc bảo đảm và/hoặc dự báo về các sự kiện trong tương lai.