The EUR/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.1708

- Đóng trước đó: 1.1725

- % thay đổi 24 giờ qua: +0.15 %

The euro traded at around $1.17, remaining close to its highest level since August 2021. The EU is seeking to finalize a preliminary agreement with the US this week to lock in a 10% rate after August 1, while negotiations on a permanent agreement continue. Meanwhile, the EU has announced that it is preparing retaliatory tariffs on a range of US goods in response to the US imposing duties on metal. Officials have warned that if no agreement is reached, further measures, such as export controls and restrictions on US access to government contracts, could be taken. On the monetary policy front, markets are expecting another ECB rate cut this year.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.1686, 1.1651, 1.1642, 1.1581, 1.1518

- Mức kháng cự: 1.1762, 1.1810, 1.1913

The EUR/USD currency pair’s hourly trend is bullish, but conditions are developing for a trend reversal. Selling pressure is increasing throughout the day. The price has already tested the priority reversal level twice, with each rebound weaker than the previous one. In such market conditions, sell trades can be sought from the EMA lines or the resistance level of 1.1762. There are currently no optimal entry points for buy trades.

Kịch bản thay thế:if the price breaks through the support level of 1.1686 and consolidates below it, the downward trend is likely to resume.

Tin tức cập nhật cho: 2025.07.09

- US FOMC Meeting Minutes at 21:00 (GMT+3).

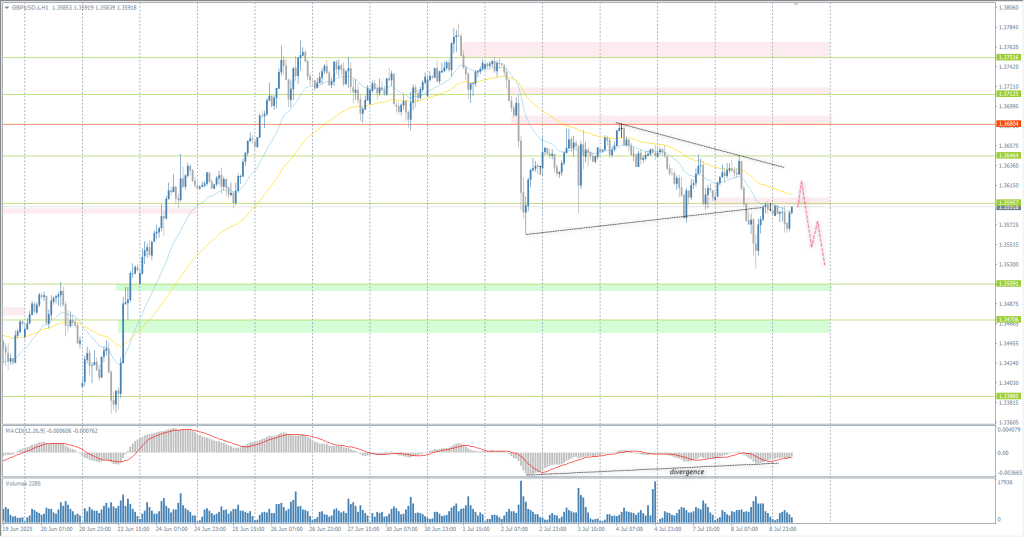

The GBP/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.3599

- Đóng trước đó: 1.3589

- % thay đổi 24 giờ qua: -0.07 %

The British pound fell below $1.36, reaching a two-week low under pressure from a strengthening US dollar and concerns about the country’s financial prospects. US President Donald Trump warned 14 countries, including Japan and South Korea, that he would impose 25% tariffs from August 1. So far, only the UK and Vietnam have reached agreements to avoid the new tariffs, which are unrelated to existing tariffs on cars, steel, and aluminum. The UK is rushing to strike a deal with the US to lift tariffs on British steel, fearing they could jump to 50%, which would threaten the already fragile steel industry. Growing global tensions and calls for increased defense spending are also adding to long-term financial uncertainty.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.3509, 1.3471, 1.3450, 1.3388

- Mức kháng cự: 1.3596, 1.3646, 1.3680, 1.3712, 1.3752, 1.3770, 1.4000

In terms of technical analysis, the trend on the GBP/USD currency pair has shifted downward. The price has consolidated below the priority change level and is trading confidently below the moving averages. For sell deals, you can consider resistance levels of 1.3596 or 1.3646. There are currently no optimal entry points for buying.

Kịch bản thay thế:if the price breaks through the resistance level of 1.3680 and consolidates above it, the uptrend will likely resume.

Tin tức cập nhật cho: 2025.07.09

- UK FPC Meeting Minutes at 12:30 (GMT+3).

The USD/JPY currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 146.02

- Đóng trước đó: 146.57

- % thay đổi 24 giờ qua: +0.37 %

On Wednesday, the Japanese yen fell below 147 per dollar, marking its third consecutive session of decline amid escalating trade negotiations between the US and Japan, particularly on the issue of protecting the Japanese rice market. The decline followed US President Donald Trump’s announcement of a 25% tariff on Japanese goods, which will take effect on August 1. Trump stressed that the newly imposed tariffs, which will affect a total of 14 countries, will not be revised or postponed. Japanese Prime Minister Shigeru Ishiba called the latest measures “regrettable” but confirmed Japan’s intention to continue negotiations with Washington in search of a mutually beneficial solution.

Khuyến nghị giao dịch

- Mức hỗ trợ: 146.51, 145.88, 145.28, 144.18

- Mức kháng cự: 147.15, 148.28

From a technical perspective, the medium-term trend of the USD/JPY is bullish. The price is growing steadily with short pullbacks. Currently, a divergence has formed on the MACD indicator, which, in conjunction with the resistance level at 147.15, may lead to a correction. To join the trend, it is best to use the EMA lines or the support level of 146.51.

Kịch bản thay thế:if the price breaks through the support level of 144.18 and consolidates below it, the downward trend is likely to resume.

Không có tin tức cho ngày hôm nay

The XAU/USD currency pair (gold)

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 3339

- Đóng trước đó: 3301

- % thay đổi 24 giờ qua: -1.15 %

On Wednesday, the price of gold fell below $3,300 per ounce, extending its decline by more than 1% compared to the previous session, as the Federal Reserve’s moderate forecast offset concerns about renewed trade tensions. President Donald Trump ruled out further extensions of the tariffs imposed on August 1. He announced new broad measures, including a 50% tariff on copper imports, potential 200% duties on pharmaceuticals, and a 10% levy on goods from BRICS countries. Investors are now awaiting the release of the minutes of the June FOMC meeting for more information on the Fed’s stance on monetary policy.

Khuyến nghị giao dịch

- Mức hỗ trợ: 3301, 3274, 3246

- Mức kháng cự: 3342, 3357, 3393, 3405, 3444, 3500

From a technical analysis perspective, the trend on the XAU/USD is downward. Yesterday, sellers took the initiative from 3329, after which the price reached the support level of 3291. Currently, the reaction of buyers is weak, which could potentially lead to a further decline in the price to 3274. For sell deals, you can consider the resistance level of 3310 or the EMA line. There are no optimal entry points for purchases yet.

Kịch bản thay thế:if the price breaks through and consolidates above the resistance level of 3357, the upward trend will likely resume.

Tin tức cập nhật cho: 2025.07.09

- US FOMC Meeting Minutes at 21:00 (GMT+3).

Bài viết này phản ánh quan điểm cá nhân và không nên được hiểu là lời khuyên và/hoặc đề nghị đầu tư và/hoặc hối thúc thực hiện các giao dịch tài chính và/hoặc bảo đảm và/hoặc dự báo về các sự kiện trong tương lai.