The EUR/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.1690

- Đóng trước đó: 1.1753

- % thay đổi 24 giờ qua: +0.53 %

The euro stabilized at $1.1730 as investors await the European Central Bank’s policy decision. The ECB is expected to leave interest rates unchanged on Thursday after eight consecutive cuts, with policymakers taking a wait-and-see approach amid uncertainty over the impact of higher-than-expected US tariffs and the strengthening euro on growth and inflation in Europe. At the same time, EU officials are preparing to meet later this week to discuss measures in case no agreement is reached with US President Donald Trump, whose stance on tariffs appears to have hardened ahead of the August 1 deadline.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.1714, 1.1657, 1.1615

- Mức kháng cự: 1.1762, 1.1810, 1.1913

The EUR/USD currency pair’s hourly trend has changed to upward. The price has consolidated above the priority change level and is trading above the EMA lines. For buy deals, consider the support level of 1.1715, but with confirmation. Profit targets are 1.1726 and 1.1810. There are currently no optimal entry points for sales.

Kịch bản thay thế:if the price breaks through the support level of 1.1615 and consolidates below it, the downward trend will likely resume.

Tin tức cập nhật cho: 2025.07.23

- US Existing Home Sales (m/m) at 17:00 (GMT+3).

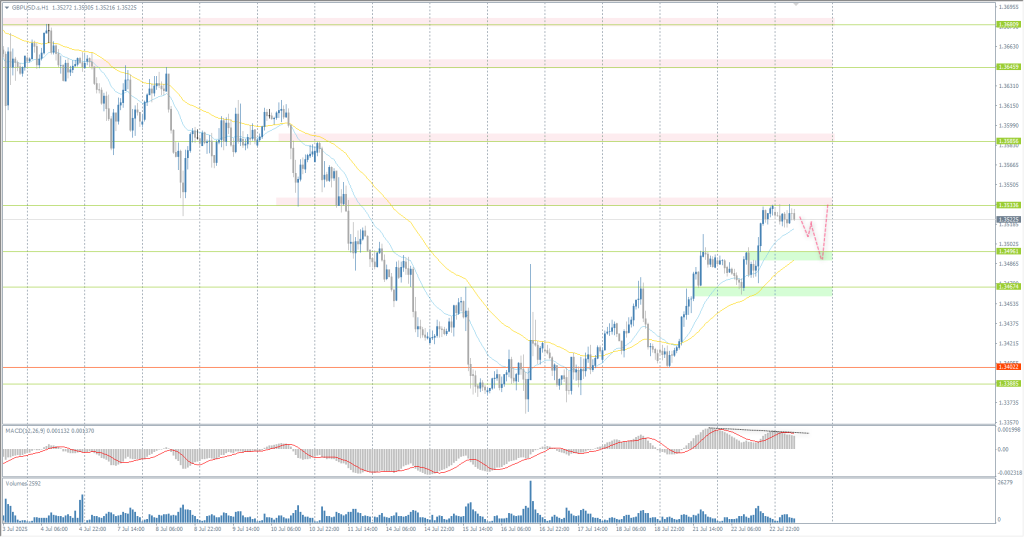

The GBP/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.3488

- Đóng trước đó: 1.3533

- % thay đổi 24 giờ qua: +0.33 %

The pound sterling continues to be supported by the trade agreement signed with the US amid tense trade negotiations between the US and its largest trading partners: the European Union (EU), Canada, and Mexico. These three countries received letters from the White House announcing the introduction of tariffs ranging from 30% to 35% starting August 1. Official UK data showed that net public sector borrowing last month was £20.7 billion, exceeding the Office for Budget Responsibility’s (OBR) June expectations of £17.1 billion. This data has fueled investor speculation that Chancellor Rachel Reeves may be forced to raise taxes in the autumn budget to meet her public finance targets.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.3493, 1.3467, 1.3402

- Mức kháng cự: 1.3533, 1.3586, 1.3645

In terms of technical analysis, the trend on the currency pair GBP/USD has changed to upward. The British pound has consolidated above the priority change level and is trading above the EMA lines. The price has now reached the resistance level of 1.3533, which, together with the MACD divergence, could lead to a corrective movement. Buy trades should be considered from the support level of 1.3496 or 1.3467. Sell trades can be sought from 1.3533, but only with short-term targets, as these will be counter-trend trades.

Kịch bản thay thế:if the price breaks through the support level of 1.3402 and consolidates below it, the downward trend will likely resume.

Không có tin tức cho ngày hôm nay

The USD/JPY currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 147.33

- Đóng trước đó: 146.61

- % thay đổi 24 giờ qua: -0.49 %

President Donald Trump announced the conclusion of a trade agreement with Japan. The agreement announced by President Donald Trump includes a 15% tariff on Japanese exports to the US. Trump also said that Japan will invest $550 billion in the US and open its markets to key American goods. Prime Minister Shigeru Ishiba confirmed that he had been informed of the negotiations but did not disclose any details, reaffirming his commitment to protecting “national interests.” In addition, according to some reports, Ishiba is considering resigning depending on the outcome of the tariff negotiations. Political uncertainty has intensified after the ruling coalition lost its majority in the upper house of parliament in last weekend’s elections, which came amid growing pressure on Japan from US trade policy.

Khuyến nghị giao dịch

- Mức hỗ trợ: 146.32, 145.88, 145.28, 144.18

- Mức kháng cự: 147.15, 147.93

From a technical point of view, the medium-term trend of the USD/JPY has changed to downward. The price has consolidated below the priority change level, but has reached the support level of 146.32, where buyers have taken the initiative. Sell trades can be considered from the resistance level of 147.15, provided there is a reaction from sellers. There are currently no optimal entry points for buying.

Kịch bản thay thế:if the price breaks through the resistance level of 147.93 and consolidates above it, the uptrend will likely resume.

Không có tin tức cho ngày hôm nay

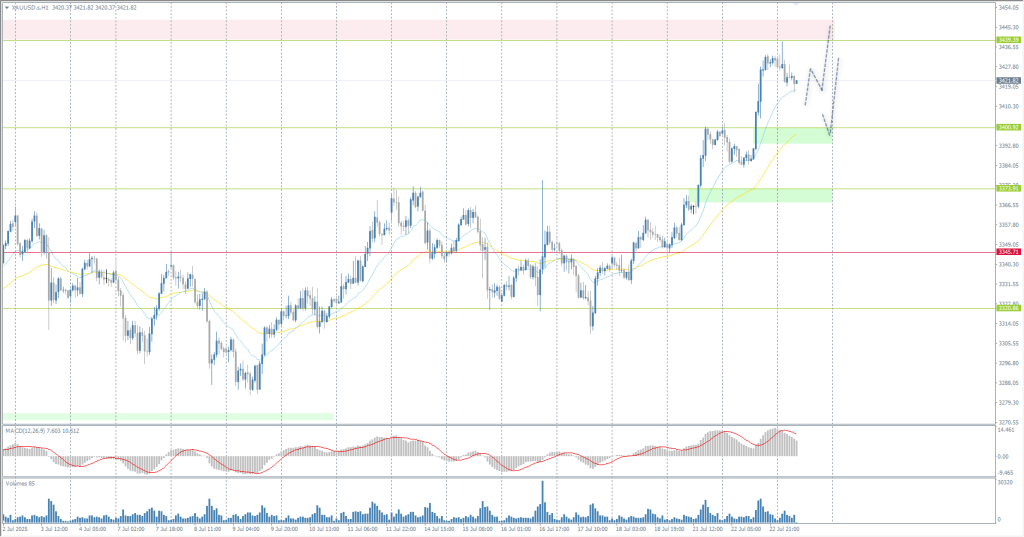

The XAU/USD currency pair (gold)

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 3398

- Đóng trước đó: 3431

- % thay đổi 24 giờ qua: +0.97 %

Gold recovered early losses and rose above $3,420 per ounce, reaching its highest level since June 16, as US Treasury yields and the dollar continued to weaken amid ongoing uncertainty over trade negotiations. With the August 1 deadline set by President Donald Trump for imposing tariffs approaching, fears intensified that the US and the EU might not reach an agreement. According to reports, EU diplomats have begun considering broader countermeasures in case Trump follows through on his threat to impose a 30% tariff on goods from the EU. Meanwhile, Treasury Secretary Scott Bessent announced plans to meet with his Chinese counterpart next week, hinting at a possible extension of the August deadline.

Khuyến nghị giao dịch

- Mức hỗ trợ: 3400, 3373, 3345, 3320, 3309

- Mức kháng cự: 3439, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold continues its rally. The price has now reached the resistance level of 3439, where there are initial signs of fixing, but this is not enough for a full reversal. For buy deals, it is worth considering the EMA levels or the support level of 3400. There are currently no optimal entry points for sales.

Kịch bản thay thế:if the price breaks through the support level of 3345 and consolidates below it, the downtrend will likely resume.

Tin tức cập nhật cho: 2025.07.23

- US Existing Home Sales (m/m) at 17:00 (GMT+3).

Bài viết này phản ánh quan điểm cá nhân và không nên được hiểu là lời khuyên và/hoặc đề nghị đầu tư và/hoặc hối thúc thực hiện các giao dịch tài chính và/hoặc bảo đảm và/hoặc dự báo về các sự kiện trong tương lai.