The EUR/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.1588

- Đóng trước đó: 1.1546

- % thay đổi 24 giờ qua: -0.36 %

The euro fell below $1.16, continuing its 1.3% decline on Monday, the sharpest one-day drop in more than two months, and reaching its lowest level since June 20. The move reflects growing investor concerns that the recently announced trade agreement between the US and the European Union is disproportionately beneficial to the US and does little to improve the economic outlook for the Eurozone. The agreement has drawn sharp criticism from France, while others, including German Chancellor Merkel, have highlighted its potential negative impact on European exporters and, as a result, on economic growth. Expectations for rate cuts have also changed in Europe: markets have pushed back the likelihood of a 25 basis point cut to March 2026, now pricing it at 90%. The likelihood of a cut in December has fallen below 70%.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.1518

- Mức kháng cự: 1.1557, 1.1612, 1.1710, 1.1770

The EUR/USD currency pair’s hourly trend is bearish. The price is trading below the EMA lines. Currently, the price has formed a locked balance above 1.1557, and now the liquidity of this balance will be distributed below. Intraday, you can look for sell trades from 1.1557 with a target of 1.1518. Consolidation of the price above 1.1557 with a breakout of the trend line could trigger a sharp rise in the price to 1.1612.

Kịch bản thay thế:if the price breaks through the resistance level of 1.1770 and consolidates above it, the uptrend will likely resume.

Tin tức cập nhật cho: 2025.07.30

- German Retail Sales (m/m) at 09:00 (GMT+3);

- German GDP (m/m) at 11:00 (GMT+3);

- Eurozone GDP (m/m) at 12:00 (GMT+3);

- US ADP Non-Farm Employment Change (m/m) at 15:30 (GMT+3);

- US GDP (m/m) at 15:30 (GMT+3);

- US Pending Home Sales (m/m) at 17:00 (GMT+3);

- US FOMC Statement (m/m) at 21:00 (GMT+3);

- US Fed Interest Rate Decision (m/m) at 21:00 (GMT+3);

- US Fed Press Conference (m/m) at 21:30 (GMT+3).

Các chỉ báo kỹ thuật của cặp tiền tệ:

Khuyến nghị giao dịch

Không có tin tức cho ngày hôm nay

The GBP/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.3352

- Đóng trước đó: 1.3350

- % thay đổi 24 giờ qua: -0.02 %

The British pound fell to $1.336, its lowest level since May 20, as weak UK data shifted the market’s focus from inflation to slowing growth, while optimism about trade supported the US currency. Although warm weather boosted food sales, overall economic momentum remains fragile, and the latest PMI data was disappointing. This reinforced expectations that the Bank of England may cut interest rates by 25 basis points in August, with another cut likely by the end of the year as it shifts its focus to supporting growth.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.3333, 1.3252

- Mức kháng cự: 1.3371, 1.3402, 1.3452, 1.3470

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The British pound has corrected to the resistance level of 1.3371, where traders can look for sell deals to continue the decline. It is important for sellers to keep the price below 1.3371, as a breakout of this level will trigger buyers to “lock” below the level, leading to a sharp rise in price to 1.3402 and above for liquidity distribution.

Kịch bản thay thế:if the price breaks through the resistance level of 1.3470 and consolidates above it, the uptrend will likely resume.

Không có tin tức cho ngày hôm nay

The USD/JPY currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

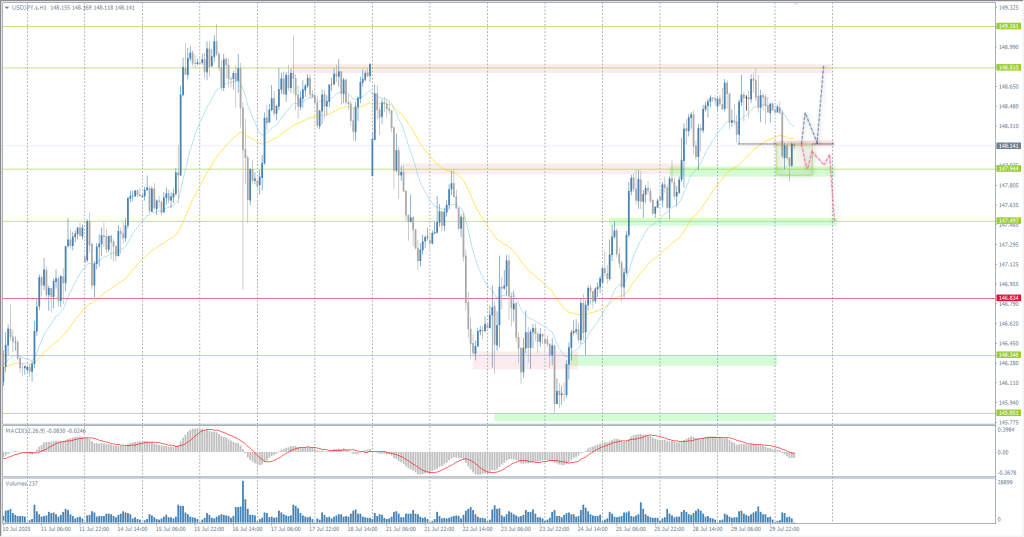

- Mở trước đó: 148.48

- Đóng trước đó: 148.45

- % thay đổi 24 giờ qua: -0.02 %

On Wednesday, the Japanese yen strengthened to 148 per dollar, recouping some losses incurred earlier in the week as the US dollar retreated ahead of the Federal Reserve’s policy announcement. The Fed is expected to keep interest rates unchanged, although markets are focused on potential signals pointing to a rate cut in September. Investors also assessed the outcome of trade talks between the US and China in Stockholm, which ended on Tuesday without an extension of the current truce. On the domestic front, market participants eagerly awaited the Bank of Japan’s monetary policy decision, expecting rates to remain unchanged as officials assess the economic impact of US tariffs. The Bank of Japan is also expected to raise its inflation expectations in its quarterly review.

Khuyến nghị giao dịch

- Mức hỗ trợ: 147.94, 147.50, 146.83

- Mức kháng cự: 148.14, 148.81, 149.16

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The price corrected as expected to the support level of 147.94, where buyers reacted. Currently, buyers face an obstacle in the form of an intermediate resistance level of 148.14. A breakout of this level will trigger a price increase to 148.81. However, if sellers manage to hold 148.14 and the price continues to fluctuate below this level, the corrective downward wave may continue to 147.50.

Kịch bản thay thế:if the price breaks through the support level of 146.83 and consolidates below it, the downtrend will likely resume.

Không có tin tức cho ngày hôm nay

The XAU/USD currency pair (gold)

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 3315

- Đóng trước đó: 3326

- % thay đổi 24 giờ qua: +0.33 %

On Wednesday, the price of gold fluctuated around $3,320 per ounce, remaining close to a three-week low, as easing trade tensions reduced the metal’s appeal as a safe haven. Investors are also closely watching the FOMC decision, which is due to be announced today. Although the Fed is widely expected to leave rates unchanged, markets will focus on Chairman Powell’s press conference for clues about a possible rate cut in September. Attention is also turning to a number of key US economic reports. This week, job openings came in slightly below expectations, while consumer confidence rose.

Khuyến nghị giao dịch

- Mức hỗ trợ: 3323, 3296

- Mức kháng cự: 3351, 3374, 3401, 3438

From the point of view of technical analysis, the trend on the XAU/USD is bearish. Buyers managed to stop the decline — the price returned above the 3323 level, but the nature of the movement indicates weakness. If the price consolidates below 3323 again, a sell-off to 3296 may occur. If buyers manage to keep the price above 3323 throughout the day, growth to 3351 is likely.

Kịch bản thay thế:if the price breaks through the resistance level of 1.3374 and consolidates above it, the uptrend will likely resume.

Tin tức cập nhật cho: 2025.07.30

- German Retail Sales (m/m) at 09:00 (GMT+3);

- German GDP (m/m) at 11:00 (GMT+3);

- Eurozone GDP (m/m) at 12:00 (GMT+3);

- US ADP Non-Farm Employment Change (m/m) at 15:30 (GMT+3);

- US GDP (m/m) at 15:30 (GMT+3);

- US Pending Home Sales (m/m) at 17:00 (GMT+3);

- US FOMC Statement (m/m) at 21:00 (GMT+3);

- US Fed Interest Rate Decision (m/m) at 21:00 (GMT+3);

- US Fed Press Conference (m/m) at 21:30 (GMT+3).

Bài viết này phản ánh quan điểm cá nhân và không nên được hiểu là lời khuyên và/hoặc đề nghị đầu tư và/hoặc hối thúc thực hiện các giao dịch tài chính và/hoặc bảo đảm và/hoặc dự báo về các sự kiện trong tương lai.