The EUR/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.1653

- Đóng trước đó: 1.1627

- % thay đổi 24 giờ qua: -0.42 %

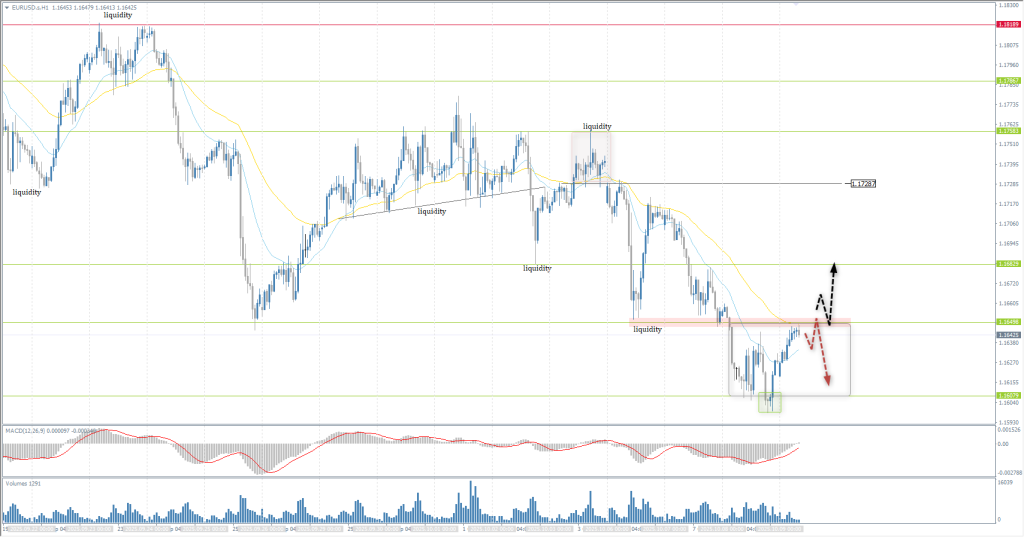

The EUR/USD pair extended its losses on Wednesday, reaching a six-week low. Weaker-than-expected economic news from the Eurozone had a negative impact on the euro after German industrial production fell by the most in nearly 3.5 years. In addition, political turmoil in France weighed on the euro after French Prime Minister Lecornu resigned following President Macron’s formation of a new cabinet, which increased uncertainty about the Eurozone’s second-largest economy. ECB Governing Council member Müller said that the Eurozone economy is gradually gaining momentum and inflation is in line with the ECB’s 2% target. Swaps estimate the probability of an ECB rate cut of 25 bps at the October 30 meeting at 1%.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.1608

- Mức kháng cự: 1.1650, 1.1683, 1.1728, 1.1754, 1.1786, 1.1819

The EUR/USD currency pair’s hourly trend is downward. The euro reached the support level of 1.1608, after which buyers took the initiative. Today, the focus is on the resistance level of 1.1650. A breakout could cause a sharp rise in price to 1.1683. If sellers react to 1.1650, we can expect a flat to form during the day, followed by a decline in price to 1.1608.

Kịch bản thay thế:if the price breaks through the resistance level of 1.1758 and consolidates above it, the uptrend will likely resume.

Tin tức cập nhật cho: 2025.10.09

- German Trade Balance (m/m) at 09:00 (GMT+3);

- Eurozone ECB Monetary Meeting Accounts at 14:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3) (Tentative);

- US Fed Chair Powell Speaks at 15:30 (GMT+3).

The GBP/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.3434

- Đóng trước đó: 1.3402

- % thay đổi 24 giờ qua: -0.16 %

The pound sterling (GBP) is falling against the US dollar amid growing expectations that the Bank of England (BoE) will cut interest rates again for the rest of the year. The Bank of England’s dovish expectations are intensifying due to growing concerns about the UK labor market, which is undermining the pound against the US dollar. Reuters reported that in the three months to September, UK businesses expected to keep employment levels unchanged over the next 12 months, the first time since January that they had shown a reluctance to increase staffing levels.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.3400, 1.3388, 1.3332, 1.3315

- Mức kháng cự: 1.3463, 1.3522, 1.3585

In terms of technical analysis, the trend on the currency pair GBP/USD is a downtrend. The British pound fell to 1.3388, and after testing the liquidity pool, the price impulsively consolidated above the level. The price is now trading at the EMA level near the downtrend line. Here, sellers will try to prevent the price from rising higher. A breakout and consolidation above the downward trend line will change the structure and open up opportunities for buy deals.

Kịch bản thay thế:if the price breaks through the resistance level of 1.3532 and consolidates above it, the uptrend will likely resume.

Không có tin tức cho ngày hôm nay

The USD/JPY currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 151.89

- Đóng trước đó: 152.67

- % thay đổi 24 giờ qua: +0.51 %

On Thursday, the Japanese yen traded around 152.5 per dollar, remaining close to its lowest level since February, as political changes and weak economic data weakened the prospects of a rate hike by the Bank of Japan. Conservative leader Sanae Takaichi, a staunch supporter of Abenomics-style stimulus, secured victory in the party leadership election, putting her in line to become Japan’s next prime minister and fueling expectations of increased budget spending and continued loose monetary policy. Meanwhile, real wages in Japan fell 1.4% year-on-year in August, extending an eight-month streak of declines as inflation continued to outpace wage growth.

Khuyến nghị giao dịch

- Mức hỗ trợ: 151.31, 149.95, 148.83, 147.81

- Mức kháng cự: 152.60, 154.80

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The Japanese yen is hovering at the resistance level of 152.60. A flat accumulation is forming. It is important to be patient and assess the price action. A true downward price breakdown will trigger a sell-off to 151.31. A false downward breakout followed by an upward price breakout will open the way for further growth to 154.80. Given the MACD divergence, the probability of a decline is greater than the probability of growth.

Kịch bản thay thế:if the price breaks through the support level of 147.05 and consolidates below it, the downtrend will likely resume.

Không có tin tức cho ngày hôm nay

The XAU/USD currency pair (gold)

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 3980

- Đóng trước đó: 4045

- % thay đổi 24 giờ qua: +1.63%

On Wednesday, gold exceeded $4050 per ounce, extending its record high, as economic uncertainty and the dovish stance of the US Federal Reserve continue to encourage markets to shift from the dollar to precious metals. The stalemate in the US Congress has led to the government shutdown entering its second week, threatening large-scale layoffs for civil servants. In addition, the shutdown has prevented the publication of economic data, amplifying the impact of pessimistic data from private sources, including job cuts in ADP and declines in employment indices in ISM PMI surveys. As a result, the minutes of the latest FOMC meeting showed that policymakers are likely to continue cutting rates due to labour market instability. Increased interest in gold has prompted China to offer custodial services to foreign investors, taking advantage of pessimism about dollar-denominated assets.

Khuyến nghị giao dịch

- Mức hỗ trợ: 4000, 3944, 3896, 3867, 3820, 3800

- Mức kháng cự: 4050, 4100

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold is showing the first signs of profit-taking. Against this backdrop, the price corrected to 4000, but buyers quickly began to buy back gold. Today, attention is focused on the area near the resistance level of 4050. If the price reacts to the level bearishly, it is highly likely that a flat will begin to form, followed by a decline in price to 4000. A breakout and consolidation above 4050 will open the way for the price to 4100.

Kịch bản thay thế:if the price breaks the support level of 3819 and consolidates below it, the downtrend will likely resume.

Tin tức cập nhật cho: 2025.10.09

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3) (Tentative);

- US Fed Chair Powell Speaks at 15:30 (GMT+3).

Bài viết này phản ánh quan điểm cá nhân và không nên được hiểu là lời khuyên và/hoặc đề nghị đầu tư và/hoặc hối thúc thực hiện các giao dịch tài chính và/hoặc bảo đảm và/hoặc dự báo về các sự kiện trong tương lai.