The EUR/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.1751

- Đóng trước đó: 1.1746

- % thay đổi 24 giờ qua: -0.04%

The euro strengthened to $1.178 against a backdrop of general US dollar weakness. The single currency was supported by mixed data from the US economy, which intensified expectations for continued Fed rate cuts: Non-Farm Payrolls rose by 64K in November, but the October revision showed a contraction of 105K, while unemployment climbed to 4.6% – the highest since 2021. Simultaneously, markets reduced expectations for further ECB easing following signals from the regulator that additional rate cuts in 2026 might not be necessary. ECB President Christine Lagarde also noted that the bank plans to raise Eurozone economic growth expectations next week, pointing to its relative resilience despite trade tensions.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.1725, 1.1680, 1.1656, 1.1590, 1.1555, 1.1503

- Mức kháng cự: 1.1763, 1.1786

The euro has settled below 1.1763. This scenario suggests the formation of a locked balance above this level, with the support level of 1.1725 being the target for new liquidity. The MACD divergence confirms a corrective scenario over the next 1-2 trading days. For buy deals, we are waiting for a correction to 1.1725, but with confirmation. There are currently no optimal entry points for selling.

Kịch bản thay thế:- Trend: Up

- Sup: 1.1725

- Res: 1.1763

- Note: Considering buys from the 1.1725 support, but with confirmation. The price holding above 1.1763 will open the path to 1.1786.

Tin tức cập nhật cho: 2025.12.17

- Germany Ifo Business Climate (m/m) at 11:00 (GMT+2); – EUR, DE40 (MED)

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+2); – EUR, DE40 (MED)

The GBP/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.3364

- Đóng trước đó: 1.3422

- % thay đổi 24 giờ qua: +0.43 %

The UK labor market continued to weaken: the unemployment rate rose to 5.1%, matching market expectations and reaching its highest level since March 2021. The number of unemployed persons increased by 158K to 1.83 million, with growth seen across all job-search duration categories, while employment contracted by 16K for the second consecutive quarter, primarily due to a decline in full-time positions. Despite the weak data, the British pound strengthened following the news release.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.3383, 1.3400, 1.3354, 1.3292, 1.3268, 1.3156, 1.3111

- Mức kháng cự: 1.3454

Yesterday, the British pound confidently broke above the 1.3400 level. It was important for buyers to hold the price above this level, but during the Asian session, the price settled below it. In this scenario, buy trades can be sought from 1.3383, but with confirmation. A move below this price will invalidate the growth scenario. There are currently no optimal entry points for selling.

Kịch bản thay thế:- Trend: Up

- Sup: 1.3383

- Res: 1.3454

- Note: Buy trades can be sought from 1.3383, but with confirmation.

Tin tức cập nhật cho: 2025.12.17

- UK Consumer Price Index (m/m) at 09:00 (GMT+2). – GBP, UK100 (HIGH)

The USD/JPY currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 155.20

- Đóng trước đó: 154.70

- % thay đổi 24 giờ qua: -0.32 %

The Japanese yen is holding near a monthly high on the back of strong economic data, which has bolstered expectations of a Bank of Japan interest rate hike as early as this week. Exports rose by 6.1% in November, significantly exceeding prognoses of 4.8% and marking the strongest growth in nine months. Meanwhile, core machinery orders, a key leading indicator of capital spending, unexpectedly increased by 7%, contrary to expectations of a 2.3% decline. Markets are almost certain that the BoJ will raise the key rate by 25 basis points to 0.75% on Friday. Investors will be paying close attention to Governor Kazuo Ueda’s comments, which could clarify the policy trajectory for next year amid speculation of a rate hike to 1% by July.

Khuyến nghị giao dịch

- Mức hỗ trợ: 154.92, 154.41, 154.17

- Mức kháng cự: 155.50, 156.10, 156.57, 157.11

Yesterday, the Japanese currency did indeed decline to the support level of 154.41. However, since the decline was not impulsive and a divergence has formed on the MACD indicator, there is a high probability of a corrective movement. Buy trades are best considered when the price holds above 154.92. For sell deals, look for trades around 155.50.

Kịch bản thay thế:- Trend: Neutral

- Sup: 154.92

- Res: 155.50

- Note: Considering buy trades after the price holds above 154.92. For sells, we are looking for trades around 155.50.

Tin tức cập nhật cho: 2025.12.17

- Japan Trade Balance (m/m) at 01:50 (GMT+2). – JPY (MED)

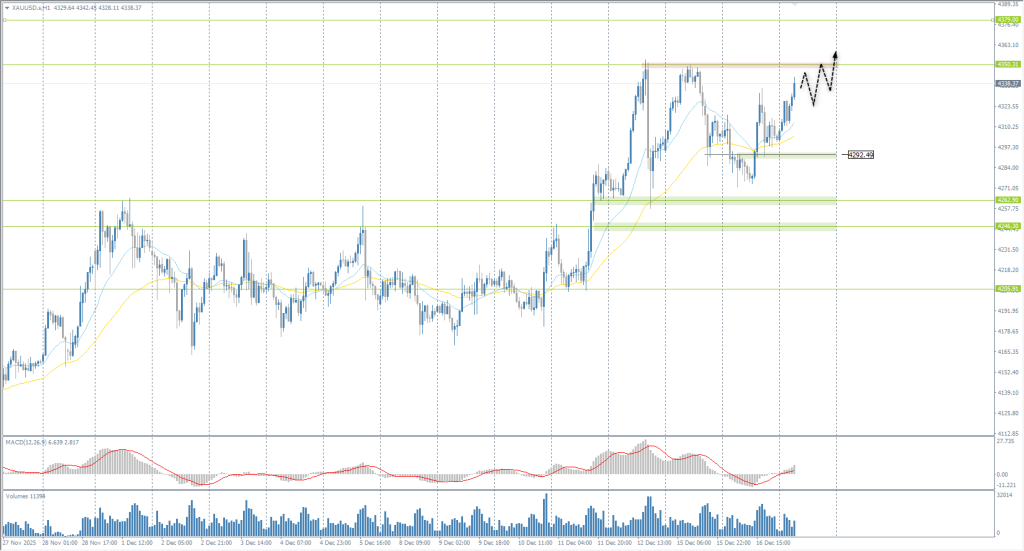

The XAU/USD currency pair (gold)

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 4307

- Đóng trước đó: 4302

- % thay đổi 24 giờ qua: -0.11%

On Tuesday, gold rose above $4320 per ounce, reaching its highest level since October and nearing record highs, driven by renewed safe-haven demand and softer US macroeconomic signals. The delayed labor market report confirmed an economic cooling: unemployment rose to 4.6%, and wage growth slowed to its lowest level in over two years, fueling expectations of Fed policy easing. The metal was further supported by weak and mixed data on retail sales and regional activity indicators, which intensified concerns about growth prospects.

Khuyến nghị giao dịch

- Mức hỗ trợ: 4293, 4263, 4246, 4205

- Mức kháng cự: 4350, 4379

Gold continues to form a high-volatility consolidation within the 4263-4350 range. The price is currently trading in the middle of this range, which makes finding high-quality entry points difficult. The intraday bias remains with the buyers, so traders can look for intraday buy opportunities. There are currently no optimal entry points for selling. The medium-term target for gold remains the resistance level of 4379.

Kịch bản thay thế:- Trend: Up

- Sup: 4293

- Res: 4350

- Note: Looking for buy trades within the day. There are currently no optimal entry points for selling.

Không có tin tức cho ngày hôm nay

Bài viết này phản ánh quan điểm cá nhân và không nên được hiểu là lời khuyên và/hoặc đề nghị đầu tư và/hoặc hối thúc thực hiện các giao dịch tài chính và/hoặc bảo đảm và/hoặc dự báo về các sự kiện trong tương lai.