The EUR/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.1184

- 前一收盘价: 1.1175

- 过去一天的变化%: -0.08 %

The euro moved back above $1.12, helped by a weaker dollar after an unexpected drop in US inflation and growing investor caution over US-China trade talks, despite both countries agreeing to a 90-day tariff truce to reach a broader deal. At the same time, markets have all but factored in a 95% chance of a rate cut in June as policymakers seek to support growth in the face of higher tariffs in the US. ECB policymaker Francois Villeroy de Gallhau said there was scope for another rate cut by the summer. At the same time, his counterpart Joachim Nagel expressed optimism, noting a “good probability” that inflation would move closer to the central bank’s 2% target.

交易建议

- 支撑价位: 1.1164, 1.1088, 1.1017, 1.0902

- 阻力价位: 1.1293, 1.1379

The EUR/USD currency pair’s hourly trend is bearish. But intraday bias is now for the buyers. The support level of 1.1164 can be considered for buy deals but with confirmation in the form of initiative. The profit target could be the level of 1.1293. There are no optimal entry points for selling now.

选择场景:if the price breaks the resistance level of 1.1293 and consolidates above it, the uptrend will likely resume.

新闻动态: 2025.05.15

- Eurozone GDP (q/q) at 12:00 (GMT+3)

- Eurozone Industrial Production (m/m) at 12:00 (GMT+3);

- US Retail Sales (m/m) at 15:30 (GMT+3);

- US Producer Price Index (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Fed Chair Powell Speaks at 15:40 (GMT+3);

- US Industrial Production (m/m) at 16:15 (GMT+3).

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.3304

- 前一收盘价: 1.3262

- 过去一天的变化%: -0.32 %

In the domestic market, attention was focused on comments from Bank of England officials. Deputy Governor Sarah Breeden emphasized the importance of reforming the long-term bond market. At the same time, Catherine Mann noted the need for clearer signs of price easing before supporting further rate cuts. Meanwhile, UK economic data showed that the unemployment rate rose to 4.5%, the highest since 2021, and wage growth slowed.

交易建议

- 支撑价位: 1.3253, 1.3121

- 阻力价位: 1.3322, 1.3356, 1.3382

Regarding technical analysis, the currency pair GBP/USD trend on the hourly timeframe is bearish. The British pound reached the priority change level of 1.3356, but sellers took the initiative. Currently, the price has corrected to the EMA lines and will likely create a flat accumulation here. We can consider the support level 1.3253 for buying but with confirmation. For selling, there are no optimal entry points right now.

选择场景:if the price breaks the resistance level of 1.3356 and consolidates above it, the uptrend will likely resume.

新闻动态: 2025.05.15

- UK GDP (m/m) at 09:00 (GMT+3);

- UK Industrial Production (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 147.44

- 前一收盘价: 146.74

- 过去一天的变化%: -0.48 %

The Japanese yen rose to 146 per dollar on Thursday, marking the third straight session of gains as continued global trade uncertainty pressured the dollar, boosting other currencies. The yen was also helped by a broader rally in Asian currencies, fueled by speculation that Washington favors a weaker dollar as part of ongoing trade talks. The Trump administration argues that the relative weakness of Asian currencies gives regional exporters an unfair trade advantage over their US counterparts.

交易建议

- 支撑价位: 147.61, 146.27, 145.71, 144.80

- 阻力价位: 148.28, 150.47

From a technical point of view, the medium-term trend of the USD/JPY is bullish. After testing the resistance level of 148.28, with a large accumulation of liquidity, the Japanese yen sharply corrected to the support level of 145.71. Here, the buyers took the initiative. The price is likely to flatten now to form new liquidity. Buying can be looked for from 145.71 but with confirmation. Selling can be considered from the EMA lines.

选择场景:if the price breaks the support level of 144.80 and consolidates below it, the downtrend will likely resume.

今天没有新闻

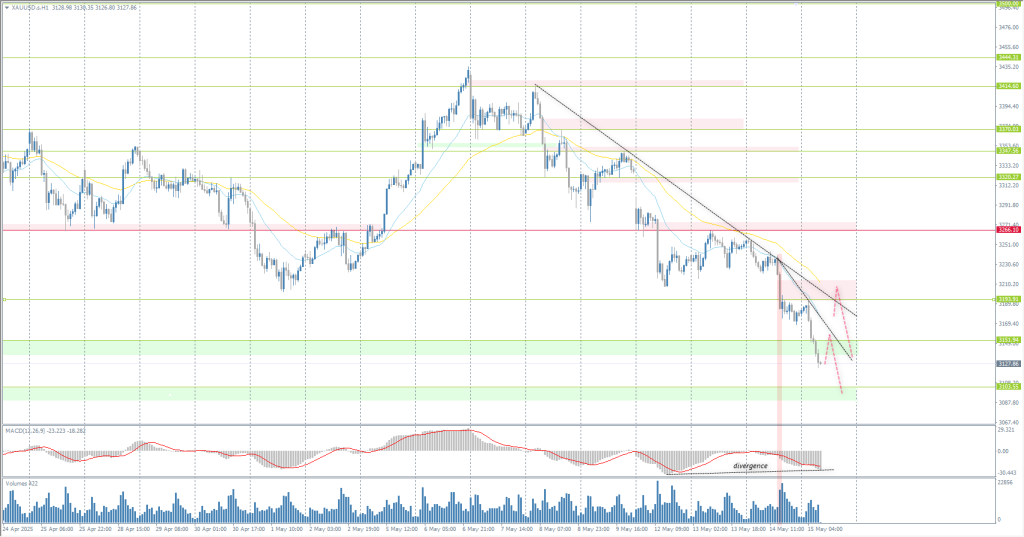

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 3252

- 前一收盘价: 3177

- 过去一天的变化%: -2.36 %

Gold fell to $3,170 per ounce on Thursday, extending its 2% decline from the previous session to a five-week low, as easing global trade tensions continue to dampen demand for safe-haven assets. The US and China agreed on significant tariff cuts and announced a 90-day pause to finalize a broader deal. At the same time, President Trump pointed to ongoing talks with India, Japan, and South Korea. Meanwhile, weaker-than-expected US inflation data reinforced expectations of a possible rate cut by the Federal Reserve, which tends to support non-income-producing assets.

交易建议

- 支撑价位: 3151, 3103, 3049

- 阻力价位: 3193, 3266, 3347, 3370

From the point of view of technical analysis, the trend on the XAU/USD has changed to a downtrend. A divergence is forming on the MACD indicator, but for a reversal, it is necessary to see the capture of new liquidity (new accumulation or false breakout. For sell deals, we can consider the 3193 zone, but with confirmation. For buying, there are no optimal entry points right now.

选择场景:if the price breaks and consolidates above the resistance level 3226, the uptrend is likely to resume.

新闻动态: 2025.05.15

- US Retail Sales (m/m) at 15:30 (GMT+3);

- US Producer Price Index (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Fed Chair Powell Speaks at 15:40 (GMT+3);

- US Industrial Production (m/m) at 16:15 (GMT+3).

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。