The EUR/USD currency pair

货币对的技术指标:

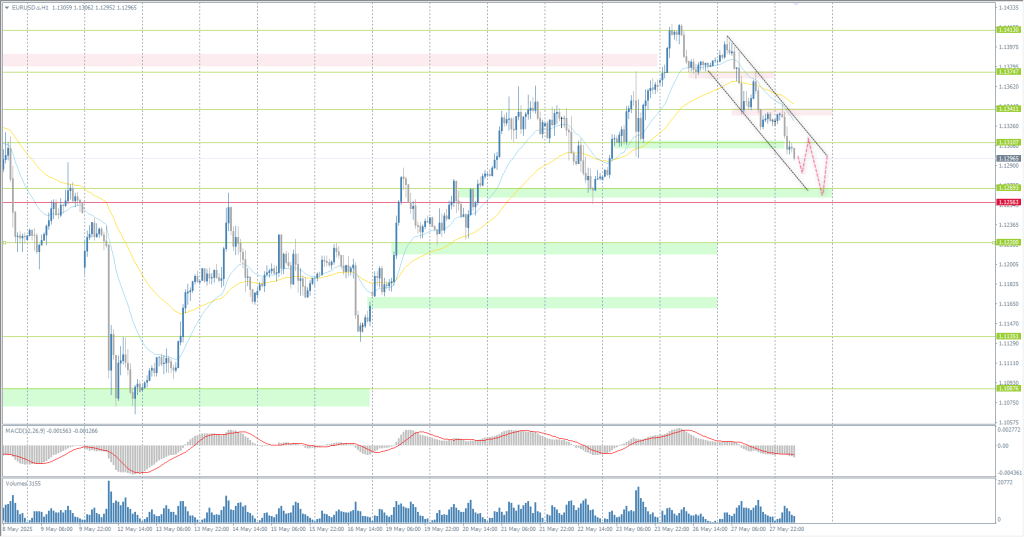

- 前一开盘价: 1.1385

- 前一收盘价: 1.1331

- 过去一天的变化%: -0.47 %

The Eurozone Economic Sentiment Indicator (ESI) rose for the first time in three months to 94.8 in May 2025 from an upwardly revised 93.8 in April and exceeded expectations of 94. However, the indicator remains below the long-term average of 100. On the price side, expectations for consumer inflation fell to 23.6 from 29.4, the highest level since November 2022, while expectations for producer selling prices fell to 7.9 from 10.6.

交易建议

- 支撑价位: 1.1269, 1.1220, 1.1170, 1.1135

- 阻力价位: 1.1311, 1.1374, 1.1413, 1.1456

The EUR/USD currency pair’s hourly trend has changed to an upward trend. The euro expectedly went into correction. However, the surprise was that buyers did not react to the support level of 1.1311, which opened the space for further decline to 1.1269. Intraday selling from 1.1311 or 1.1341 could be considered. There are currently no optimal entry points for buying.

选择场景:if the price breaks the support level of 1.1256 and consolidates below it, the downtrend will likely resume.

新闻动态: 2025.05.28

- German Unemployment Rate at 10:55 (m/m) (GMT+3);

- US Richmond Manufacturing Index (m/m) at 17:00 (GMT+3);

- US FOMC Meeting Minutes at 21:00 (GMT+3).

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.3558

- 前一收盘价: 1.3507

- 过去一天的变化%: -0.38 %

The Confederation of British Industry’s measure of UK retail sales fell sharply to 27 in May 2025 from 8 in April, well below expectations of 18. Meanwhile, a measure of pending sales fell to 37% in June, the lowest since February 2024. In addition, the quarterly measure of business sentiment fell to 29% in May, the lowest level in five years.

交易建议

- 支撑价位: 1.3474, 1.3434, 1.3382, 1.3333, 1.3291, 1.3121

- 阻力价位: 1.3522, 1.3585, 1.3713

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly is bullish. However, there are the first signs of fixation of previously opened purchases. Currently, the price has corrected to the support level of 1.3473, but there is no reaction from buyers, which increases the probability of a deeper correction to 1.3435. Selling can be considered from 1.3522, but with confirmation. The buying idea should be revisited if buyers take the initiative from the support level of 1.3435.

选择场景:if the price breaks the support level of 1.3390 and consolidates below it, the downtrend will likely resume.

今天没有新闻

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 142.81

- 前一收盘价: 144.32

- 过去一天的变化%: +1.06 %

On Tuesday, the yen and Japanese government bond yields fell sharply after reports that the Ministry of Finance is considering reducing the issuance of ultra-long-term bonds. The move is seen as an attempt to contain rising yields after last week’s disappointing 20-year bond auction, which saw the lowest demand in more than a decade, and investors are now turning their attention to the upcoming sale of 40-year bonds.

交易建议

- 支撑价位: 143.87, 143.03, 142.19, 141.52

- 阻力价位: 144.77, 145.46, 146.36, 148.28, 150.47

From a technical point of view, the medium-term trend of the USD/JPY is bearish, but close to change. The Japanese yen fell sharply in price yesterday and reached the level of priority shift, where sellers showed a moderate reaction. Intraday buying from 143.87 could be considered, provided buyers react. Traders should return to selling if the price consolidates below 143.87.

选择场景:if the price breaks the resistance level of 144.77 and consolidates above it, the uptrend will likely resume.

今天没有新闻

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 3343

- 前一收盘价: 3300

- 过去一天的变化%: -1.30 %

Gold traded around $3300 per ounce on Wednesday after a sharp drop in the previous session as a stronger US dollar and improved risk sentiment weighed on the precious metal. The dollar rose after data showed that US consumer confidence rose sharply in May from a five-year low, suggesting a more optimistic outlook for the economy and labor market. In addition, President Donald Trump’s recent decision to delay the imposition of tariffs on imports from the EU, allowing more time for negotiations, eased fears of escalating trade tensions.

交易建议

- 支撑价位: 3285, 3250, 3204, 3151, 3103, 3049

- 阻力价位: 3323, 3363, 3414

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold is forming a broadly volatile flat, which may become the basis for a trend change. It is essential to evaluate the price reaction to the resistance level of 3323. A breakout and consolidation above this level will open opportunities for buying to continue the uptrend. But if sellers react to 3323, it may lead to a sharp sell-off.

选择场景:if the price breaks and consolidates below the support level of 3204, the downtrend will likely resume.

新闻动态: 2025.05.28

- US Richmond Manufacturing Index (m/m) at 17:00 (GMT+3);

- US FOMC Meeting Minutes at 21:00 (GMT+3).

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。