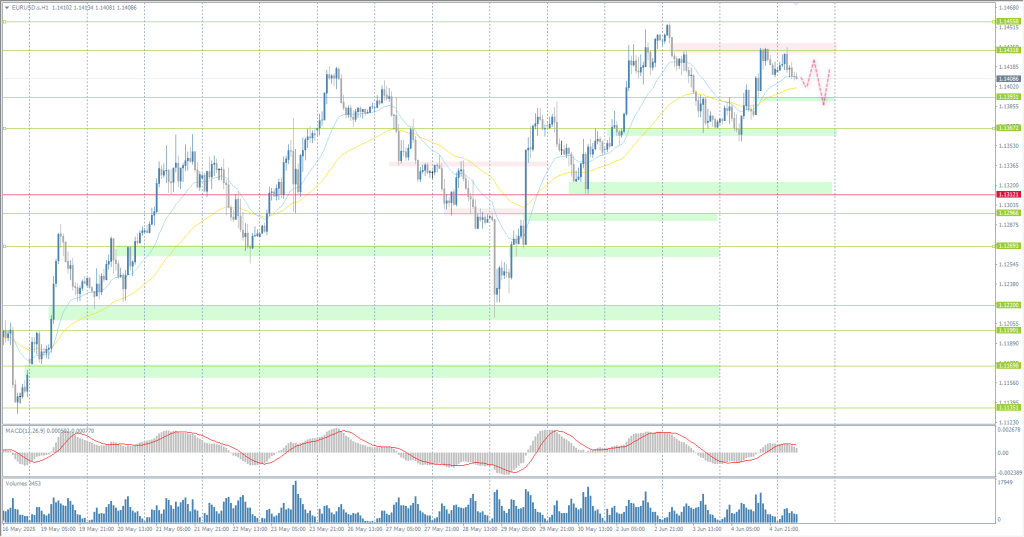

The EUR/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.1372

- 前一收盘价: 1.1417

- 过去一天的变化%: +0.39 %

The European Central Bank (ECB) will hold a monetary policy meeting today. Markets widely expect a 25 basis point rate cut, which would bring the key rate down from 2.40% to 2.15%. However, as the easing cycle is potentially nearing its end, the ECB may pause at its July meeting. ECB economists are expected to revise their GDP expectations upward, reflecting stronger-than-expected first-quarter data. Given that the June rate cut is already largely a foregone conclusion, market attention is likely to focus on the ECB’s updated economic expectations. An upward revision of growth and inflation projections could support the euro. Conversely, any signs of economic weakness could put downward pressure on the European currency.

交易建议

- 支撑价位: 1.1393, 1.1367, 1.1312, 1.1296, 1.1269, 1.1220, 1.1200

- 阻力价位: 1.1431, 1.1456, 1.1483

The EUR/USD currency pair’s hourly trend is bearish. Yesterday, the euro reached the resistance level of 1.1414, where sellers showed weak initiative. The price is now correcting to the support level of 1.1393, where it is important to assess the price action. If buyers react here, we can consider buying again up to 1.1414 and 1.1431. If the price manages to consolidate below 1.1393, this will trigger a sell-off to 1.1367.

选择场景:if the price breaks through the support level of 1.1323 and consolidates below it, the downward trend will likely resume.

新闻动态: 2025.06.05

- Eurozone ECB Interest Rate Decision at 15:15 (GMT+3);

- Eurozone ECB Rate Statement at 15:15 (GMT+3);

- US Trade Balance (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- Eurozone ECB Press Conference at 15:45 (GMT+3).

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.3512

- 前一收盘价: 1.3554

- 过去一天的变化%: +0.31 %

The S&P Global UK Services PMI for May 2025 was revised slightly upward to 50.9 from a preliminary reading of 50.2, exceeding April’s reading of 49. However, the situation with prevailing demand remained challenging, as the total number of new jobs declined for the fourth time in five months, despite export sales remaining virtually unchanged. Employment declined for the eighth consecutive month.

交易建议

- 支撑价位: 1.3548, 1.3505, 1.3454, 1.3435, 1.3390, 1.3333, 1.3291, 1.3121

- 阻力价位: 1.3585

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly is bullish. The British pound closed impulsively above the flat accumulation that had been forming over the last three days. For buy deals, consider the support level of 1.3548 with a target of 1.3585. A sharp drop below 1.3548 will trigger a sell-off to 1.3505.

选择场景:if the price breaks the support level of 1.3390 and consolidates below it, the downtrend will likely resume.

今天没有新闻

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 143.94

- 前一收盘价: 142.76

- 过去一天的变化%: -0.82 %

The Bank of Japan (BoJ) is considering slowing down the pace of its bond-buying program in the next fiscal year to prevent market disruptions. This move follows recent volatility in the Japanese government bond (JGB) market, where yields on ultra-long bonds rose amid concerns about the deterioration of Japan’s public finances. While some Bank of Japan officials favor maintaining the current pace of reduction to reduce the bank’s presence in the market, others believe it is appropriate to slow down the pace. A decision is expected at the Central Bank’s meeting on June 16–17.

交易建议

- 支撑价位: 142.62, 142.19

- 阻力价位: 143.27, 143.64, 144.44, 145.45, 146.27, 146.85, 148.28

From a technical point of view, the medium-term trend of the USD/JPY is bullish. Yesterday, the price rebounded sharply from the priority change level and is again trading below the EMA lines. For sell deals, you can consider resistance levels of 143.27 and 143.64, but with confirmation in the form of a reaction. There are currently no optimal entry points for buying.

选择场景:if the price breaks through the resistance level of 144.44 and consolidates above it, the uptrend will likely resume.

今天没有新闻

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 3355

- 前一收盘价: 3373

- 过去一天的变化%: +0.53 %

Gold rose on Wednesday, climbing to $3370 per ounce and approaching a monthly high, as a series of weak US economic reports heightened concerns about the outlook. The ISM Services PMI showed that the sector contracted in May for the first time in nearly a year, driven by a sharp decline in new business and a sharp rise in production costs, likely related to the Trump administration’s new tariffs. In addition, ADP data showed that private employers added only 37,000 jobs in May, well below expectations and the slowest pace since March 2023. Investors are now awaiting Friday’s Nonfarm Payrolls data for further clues on the direction of Fed policy.

交易建议

- 支撑价位: 3365, 3343, 3325, 3303, 3276, 3248

- 阻力价位: 3414

From the point of view of technical analysis, the trend on the XAU/USD is bullish. There are no signs of a reversal. Any pullback should be used to find optimal entry points for buying. Support levels 3365 and 3343 are best suited for longs. It is highly likely that the price will not show any strong movements until the US labor market report on Friday.

选择场景:if the price breaks and consolidates below the support level of 3272, the downtrend will likely resume.

新闻动态: 2025.06.05

- US Trade Balance (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3).

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。