The EUR/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.1424

- 前一收盘价: 1.1487

- 过去一天的变化%: +0.55 %

The euro consolidated above the $1.14 mark, approaching three-year highs last seen in April, as investors weighed increasingly divergent policy expectations from the European Central Bank and the US Federal Reserve. Recent comments by ECB officials have reinforced expectations that the Central Bank may soon pause its easing cycle, adopting a wait-and-see stance to assess the economic impact of new US tariffs. In May, inflation in the Eurozone fell to 1.9%, and the ECB conducted its eighth consecutive rate cut, lowering the deposit rate to 2%. Meanwhile, the bloc’s economy showed resilience, growing 0.6% in the first quarter, the strongest pace since the third quarter of 2022.

交易建议

- 支撑价位: 1.1500, 1.1455, 1.1405, 1.1375, 1.1356, 1.1312, 1.1296, 1.1269

- 阻力价位: 1.1572

The EUR/USD currency pair’s hourly trend is bearish. The euro broke through all the nearest resistance levels and closed higher. Currently, the price has a clear path to 1.1572. Buy trades can be considered from 1.1500 or from the dynamic EMA lines. There are no optimal entry points for sales at the moment.

选择场景:if the price breaks through the support level of 1.1373 and consolidates below it, the downward trend will likely resume.

新闻动态: 2025.06.12

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Producer Price Index (m/m) at 15:30 (GMT+3).

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.3495

- 前一收盘价: 1.3546

- 过去一天的变化%: +0.38 %

The British pound rose to $1.353, reaching a three-year high, amid a weakening US dollar after softer-than-expected US inflation data for May. The data eased concerns that recent tariffs had significantly affected prices, reducing pressure on the Fed to raise rates. In the UK, Chancellor Rachel Reeves presented a multi-year spending review that calls for £2 trillion in government spending, with an annual increase in departmental budgets of 2.3% in real terms. The pound also benefited from expectations that the Bank of England will keep interest rates unchanged next week.

交易建议

- 支撑价位: 1.3540, 1.3465, 1.3435, 1.3390, 1.3333, 1.3291, 1.3121

- 阻力价位: 1.3616

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly chart has changed to an uptrend. In just two days, the pound has changed its priority again and returned to growth. Currently, the price has a clear path to 1.3616. For buy deals, you can consider moving averages or the support level of 1.3540. There are currently no optimal entry points for sales.

选择场景:If the price breaks through the support level of 1.3465 and consolidates below it, the downward trend will likely resume.

新闻动态: 2025.06.12

- UK GDP (q/q) at 09:00 (GMT+3);

- UK Industrial Production (m/m) at 09:00 (GMT+3);

- UK Trade Balance (m/m) at 09:00 (GMT+3).

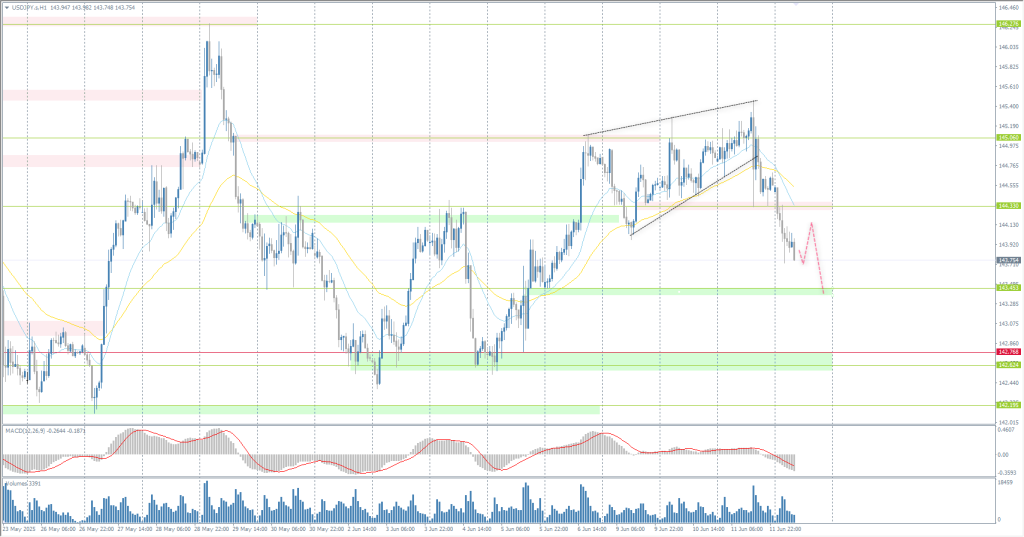

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 144.81

- 前一收盘价: 144.63

- 过去一天的变化%: -0.12 %

The Japanese yen rose to 144 per dollar on Thursday, continuing its growth compared to the previous session, as new tariff threats from US President Donald Trump contributed to increased demand for safe assets. Trump announced plans to send letters to key trading partners within the next week or two detailing unilateral tariffs aimed at forcing countries to conclude trade agreements. In Japan, fresh data showed a further deterioration in business sentiment in the second quarter, as uncertainty over US trade policy weighs on the export-oriented economy.

交易建议

- 支撑价位: 143.45, 142.62, 142.19

- 阻力价位: 144.33, 145.06, 146.27, 146.85, 148.28

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The Japanese yen failed to consolidate above the resistance level of 145.06. The price began to correct and closed below the upward trend line. Currently, the price is trying to test the support level of 143.45. Sell trades can be considered from the EMA lines or from the resistance level of 144.33. For buy deals, 143.45 can be considered, but only if buyers take the initiative.

选择场景:if the price breaks through the support level of 142.77 and consolidates below it, the downtrend will likely resume.

今天没有新闻

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 3321

- 前一收盘价: 3355

- 过去一天的变化%: +1.02 %

Gold rose above $3,370 per ounce on Thursday after gaining 1% earlier in the session, as lower-than-expected US inflation data reinforced expectations that the Federal Reserve could begin cutting interest rates by September. Consumer prices rose by 2.4% year-on-year in May, slightly higher than April’s 2.3% but below the market expectations of 2.5%. Core inflation remained at 2.8%, slightly below the expected 2.9%. In addition to monetary policy signals, investors closely monitored developments in trade relations between the US and China. Officials from both countries announced the conclusion of a framework agreement aimed at restoring a trade truce.

交易建议

- 支撑价位: 3345, 3303, 3272, 3248

- 阻力价位: 3375, 3392, 3403

From the point of view of technical analysis, the trend on the XAU/USD is bullish. The price has consolidated above the resistance level of 3345. The accumulated liquidity within the wide-range flat will now be distributed above the price maximum. The goal is to update last week’s high of 3403. For buy deals, you can consider the EMA lines or the intermediate support level of 3357. There are currently no optimal entry points for sales.

选择场景:if the price breaks and consolidates below the support level of 3272, the downtrend will likely resume.

新闻动态: 2025.06.12

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Producer Price Index (m/m) at 15:30 (GMT+3).

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。