The EUR/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.1714

- 前一收盘价: 1.1700

- 过去一天的变化%: -0.12 %

The US and EU appear to be nearing a trade agreement. The head of the EU trade department said that significant progress has been made on a framework agreement and that an agreement could be reached within a few days. Any potential agreement is expected to include a base tariff of at least 10% with possible exemptions for key products such as Airbus aircraft. This year, the euro has strengthened against the dollar by almost 13% thanks to the general weakening of the dollar amid concerns about President Trump’s tariffs and rising US debt levels. Investor sentiment has also been buoyed by renewed hopes for an economic recovery, especially after Germany’s shift to a more active fiscal policy. On the monetary policy front, the ECB is widely expected to keep interest rates unchanged this month, but markets still anticipate at least one more cut before the end of the year.

交易建议

- 支撑价位: 1.1686, 1.1651, 1.1642, 1.1581, 1.1518

- 阻力价位: 1.1762, 1.1810, 1.1913

The EUR/USD currency pair’s hourly trend is bullish, but it is close to a potential change. The price is testing the priority change level. At the same time, selling pressure prevails throughout the day. On the other hand, the MACD indicator points to divergence, increasing the likelihood of corrective growth. For buy deals, consider the support level of 1.1686, pending confirmation. Consolidation of the price below this level could trigger a sell-off to 1.1650 and below.

选择场景:if the price breaks through the support level of 1.1668 and consolidates below it, the downward trend is likely to resume.

新闻动态: 2025.07.11

There is no news feed for today.

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.3583

- 前一收盘价: 1.3577

- 过去一天的变化%: -0.04 %

Today, the UK will release a large package of economic data, with the main reports being GDP data for the last month (previous: -0.3%, forecast: +0.1% m/m) and industrial production data (previous: -0.6%, forecast: +0.4% m/m). A moderate rise is expected after a sharp monthly decline. Stronger-than-expected figures will ease concerns about stagnation and bolster the Bank of England’s (BoE) hawkish stance, potentially providing support for the British pound.

交易建议

- 支撑价位: 1.3509, 1.3471, 1.3450, 1.3388

- 阻力价位: 1.3646, 1.3680, 1.3712, 1.3752, 1.3770, 1.4000

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The price is currently testing liquidity below 1.3509, so intraday sales can be considered. Buy deals can be considered from the 1.3471-1.3509 zone, but only with confirmation and short-term targets.

选择场景:if the price breaks through the resistance level of 1.3680 and consolidates above it, the uptrend will likely resume.

新闻动态: 2025.07.11

- UK GDP (m/m) at 09:00 (GMT+3);

- UK Industrial Production (m/m) at 09:00 (GMT+3);

- UK Manufacturing Production (m/m) at 09:00 (GMT+3);

- UK Trade Balance (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 146.34

- 前一收盘价: 146.26

- 过去一天的变化%: -0.05 %

The Bank of Japan said on Thursday that the impact of US tariffs on Japanese exports and factory production has been limited so far. However, many companies are increasingly concerned about weakening global demand. According to a summary of its quarterly meeting with regional branch managers, some companies have postponed or revised capital expenditures. In contrast, others continue to invest in efficiency improvements and addressing labor shortages. In a separate report, the Bank of Japan confirmed its view that all nine regions are “recovering at a moderate pace,” which is unchanged from three months ago.

交易建议

- 支撑价位: 146.13, 145.88, 145.28, 144.18

- 阻力价位: 147.15, 148.28

From a technical perspective, the medium-term trend of the USD/JPY is bullish. The Japanese yen has resumed its upward rally. The price is now testing the resistance level of 147.15. If sellers react here, it will open up opportunities to sell down to 146.13. If the price consolidates above 147.15, it will open the way to 148.28.

选择场景:if the price breaks through the support level of 144.18 and consolidates below it, the downward trend is likely to resume.

新闻动态: 2025.07.11

There is no news feed for today.

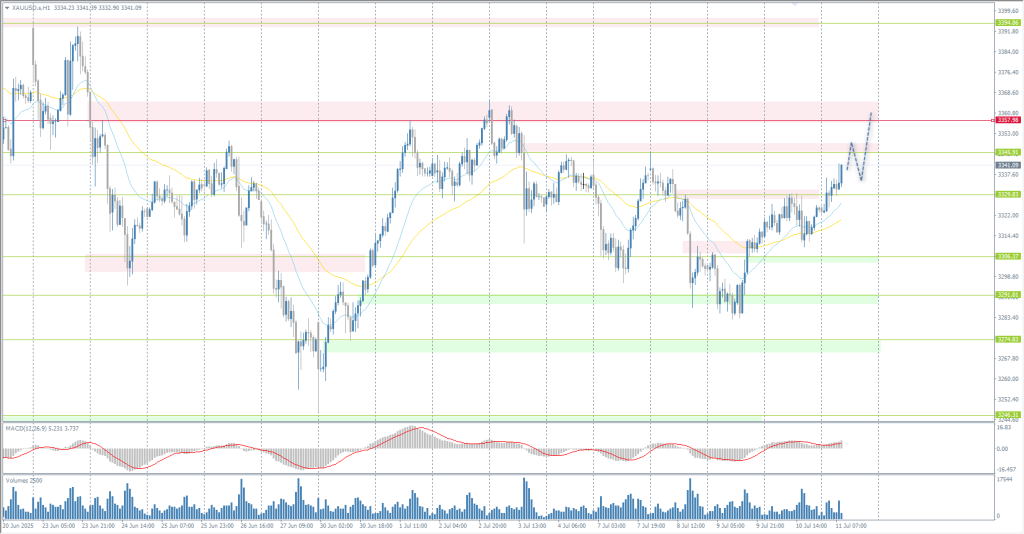

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 3321

- 前一收盘价: 3323

- 过去一天的变化%: +0.09 %

On Friday, gold rose to around $3,330 per ounce and has been rising for the third consecutive session, supported by demand for safe-haven currencies amid escalating trade tensions. President Donald Trump announced the introduction of 35% tariffs on Canadian imports, effective August 1, and plans to introduce tariffs of 15-20% on most other trading partners. This followed previous threats against Brazil and a proposal to impose duties on copper, semiconductors, and pharmaceutical products. Meanwhile, Trump’s call for the Fed to cut rates by 300 basis points fueled speculation about a “dovish” Fed candidate next year and heightened concerns about long-term inflation expectations. Markets continued to forecast two rate cuts this year, although interest rate futures indicate that rates will remain unchanged at the upcoming meeting.

交易建议

- 支撑价位: 3306, 3291, 3274

- 阻力价位: 3329, 3345, 3357, 3393, 3405, 3444, 3500

From the technical analysis perspective, the trend on the XAU/USD is downward, but is close to changing. The intraday bias is currently in favor of buyers. The price has consolidated above 3329 and is now seeking to test liquidity above the resistance level of 3349, where it is important to assess price action. If sellers take the initiative here, it will open up opportunities for sell trades to the support level of 3329. If the price consolidates above 3345, it will open the way to the priority change level of 3345.

选择场景:if the price breaks through and consolidates above the resistance level of 3357, the upward trend will likely resume.

新闻动态: 2025.07.11

There is no news feed for today.

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。