The EUR/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.1638

- 前一收盘价: 1.1593

- 过去一天的变化%: -0.36 %

The euro fell to $1.16, its lowest level in about a month, under pressure from a modest rise in the US dollar. The dollar was boosted by weaker expectations of Fed rate cuts this year after the latest inflation data, as well as President Trump’s indication that he has no plans to fire Fed Chairman Jerome Powell. Meanwhile, markets remain focused on trade developments, and optimism remains that a deal between the US and the EU can be reached before August 1. President Trump announced the introduction of 30% tariffs on imports from the European Union starting next month, but later expressed his willingness to negotiate. As for monetary policy, investors generally expect the ECB to keep interest rates unchanged at its meeting next week.

交易建议

- 支撑价位: 1.1561, 1.1518

- 阻力价位: 1.1660, 1.1714, 1.1762, 1.1810, 1.1913

The EUR/USD currency pair’s hourly trend is bearish. Yesterday, the euro formed a false breakdown of the 1.1561 support level. The captured liquidity is now distributed higher, and the nearest resistance level is 1.1660. Intraday, you can look for buy trades up to this level. For sell deals, it is important to see the reaction of sellers at 1.1660 or 1.1714.

选择场景:if the price breaks through the resistance level of 1.1714 and consolidates above it, the uptrend will likely resume.

新闻动态: 2025.07.18

- German Producer Price Index (m/m) at 09:00 (GMT+3);

- US Building Permits (m/m) at 15:30 (GMT+3);

- US Michigan Inflation Expectations (m/m) at 17:00 (GMT+3).

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.3417

- 前一收盘价: 1.3415

- 过去一天的变化%: -0.02 %

The British pound traded around $1.3400, close to an eight-week low. In the UK, investors are assessing the latest employment and inflation data for clues on monetary policy. The labor market continues to weaken: employment fell again, although revised tax data indicate that the decline is not as severe as previously thought. The unemployment rate rose to 4.7%, and wage growth, while remaining historically strong, is showing signs of slowing. At the same time, inflation in June came as a surprise: it was 3.6% against expectations of 3.4%. Mixed signals create uncertainty for the Bank of England. Slowing wage growth supports a potential rate cut, but stagnant inflation may delay it. Traders have lowered their expectations somewhat, but still believe that rates will be cut twice in 2025.

交易建议

- 支撑价位: 1.3374

- 阻力价位: 1.3485, 1.3532, 1.3619, 1.3680, 1.3712

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The British pound is trading in a wide range between 1.3374 and 1.3485. Intraday, the bias is currently in favor of buyers, but the price is likely to remain within this range until the end of the day. There are no optimal entry points for selling here.

选择场景:if the price breaks through the resistance level of 1.3485 and consolidates above it, the uptrend will likely resume.

今天没有新闻

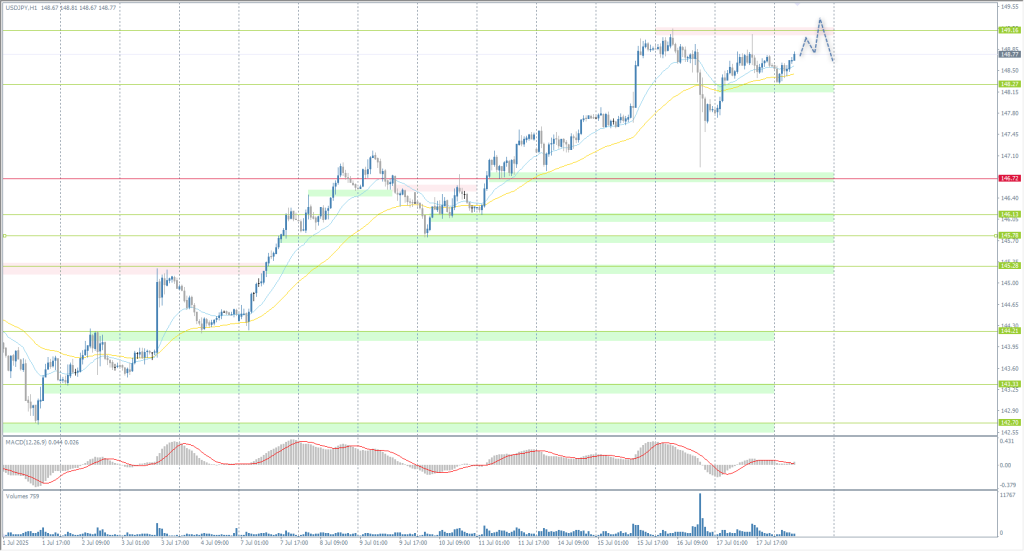

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 147.85

- 前一收盘价: 148.57

- 过去一天的变化%: +0.48 %

The Japanese yen rose to 148 per dollar on Friday, recovering from a significant drop in the previous session as investors digested the latest inflation data. Core inflation fell to 3.3% in June 2025 from 3.5% in May, but inflation has remained above the Bank of Japan’s 2% target for the 39th consecutive month. This has reinforced expectations that the Bank of Japan may consider tightening monetary policy, given the prolonged period of inflation above target. Meanwhile, data released on Wednesday showed that Japan’s trade surplus narrowed in June, falling short of expectations as exports fell for the second month and imports rose slightly.

交易建议

- 支撑价位: 148.27, 146.72, 146.13, 145.88, 145.28, 144.18

- 阻力价位: 149.16

From a technical point of view, the medium-term trend of the USD/JPY is bullish. Currently, the price is forming a flat accumulation in the range of 148.27–149.16. Intraday, the bias is towards buyers, so the price will tend to test liquidity above 149.16. Buy trades can be considered from the EMA lines or from the support level of 148.27. Sell trades can be considered if sellers take the initiative at the resistance level of 149.16.

选择场景:if the price breaks through the support level of 146.72 and consolidates below it, the downward trend will likely resume.

新闻动态: 2025.07.18

- Japan National Core Consumer Price Index at 02:30 (GMT+3).

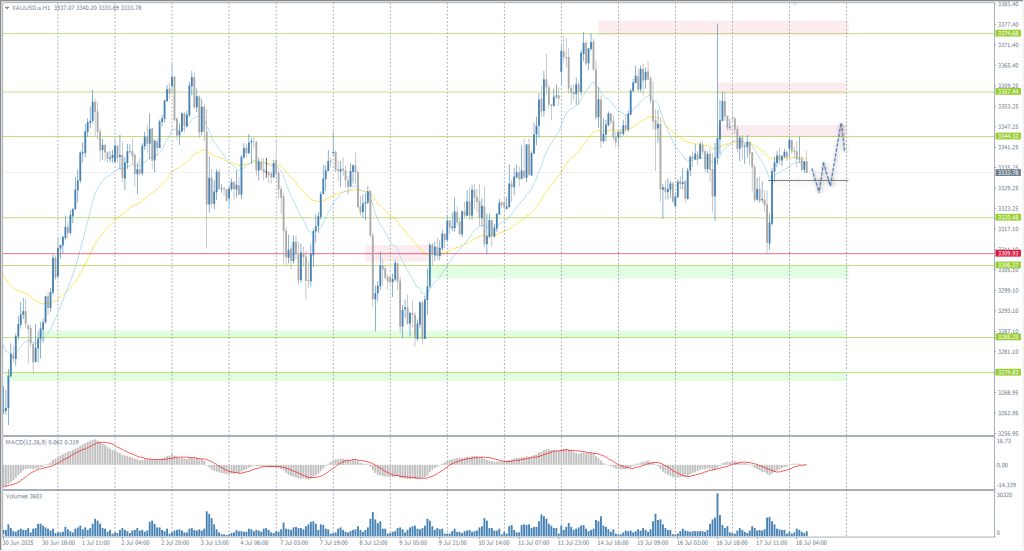

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 3350

- 前一收盘价: 3340

- 过去一天的变化%: -0.30 %

Gold prices fell to $3320 per ounce on Thursday, wiping out the small gains made during the previous session, as evidence of a strong US economy limited the urgent need for the Fed to cut interest rates. Core and headline retail sales rose more than expected in June, while initial jobless claims fell for a fifth week to a three-month low. The strong data reinforced bets that the Fed would hold rates steady this month. However, growing reports that the White House plans to fire Fed Chair Powell boosted demand for safe-haven assets.

交易建议

- 支撑价位: 3320, 3309

- 阻力价位: 3344, 3357, 3374, 3405, 3444, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Yesterday, the price fell to the priority change level of 3309, where buyers showed impulsive initiative. This movement also captured liquidity below 3320, and now this liquidity needs to be distributed higher. The most suitable resistance levels are 3344 or 3357. Intraday, you can look for buy deals from the EMA lines. There are no optimal entry points for sales at the moment.

选择场景:if the price breaks through the support level of 3309 and consolidates below it, the downtrend will likely resume.

新闻动态: 2025.07.18

- US Building Permits (m/m) at 15:30 (GMT+3);

- US Michigan Inflation Expectations (m/m) at 17:00 (GMT+3).

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。