The EUR/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.1705

- 前一收盘价: 1.1647

- 过去一天的变化%: -0.50 %

In mid-August, the euro hovered around $1.16, slightly below its 2021 high reached last month, as traders weighed economic, political, and monetary prospects. Attention is shifting to Friday’s meeting between US President Trump and Russian President Putin, aimed at finding ways to resolve the conflict in Ukraine. On the economic front, Eurozone GDP grew by 0.1% in the second quarter, the weakest reading since the fourth quarter of 2023, slowing from 0.6% in the first quarter. The slowdown followed growth in the first quarter due to higher tariffs, while ongoing uncertainty over US trade measures caused businesses and households to be more cautious.

交易建议

- 支撑价位: 1.1629, 1.1589, 1.1528, 1.1485, 1.1375, 1.1313

- 阻力价位: 1.1692, 1.1719, 1.1770

The EUR/USD currency pair’s hourly trend is bullish. The euro consolidated below 1.1692 yesterday, triggering a corrective wave to 1.1637. Buyers reacted here, and now the price is heading toward testing the resistance level of 1.1692. Intraday, traders can look for buy trades, but with confirmation. There are no optimal entry points for sales at the moment.

选择场景:if the price breaks the support level of 1.1590 and consolidates below it, the downtrend will likely resume.

新闻动态: 2025.08.15

- Eurozone Employment Change (m/m) at 12:00 (GMT+3);

- Eurozone Industrial Production (m/m) at 12:00 (GMT+3);

- Eurozone GDP (q/q) at 12:00 (GMT+3);

- US Producer Price Index (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3).

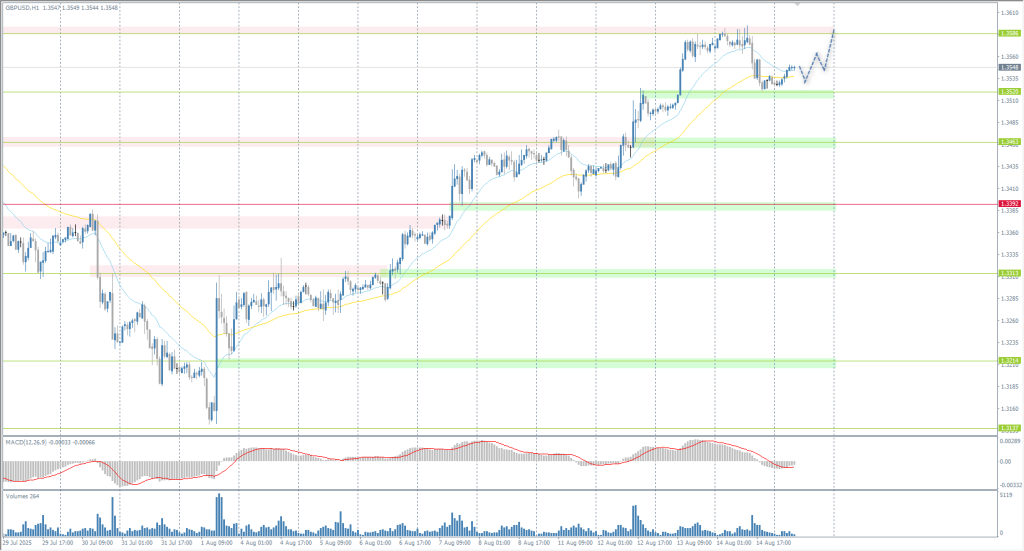

The GBP/USD currency pair

货币对的技术指标:

- 前一开盘价: 1.3570

- 前一收盘价: 1.3529

- 过去一天的变化%: -0.30 %

The British pound traded at $1.36, its highest level in five weeks, after UK GDP exceeded expectations. The economy grew by 0.3% in the second quarter compared to the expected 0.1%, with annual growth of 1.2%. GDP for June also exceeded expectations, growing by 0.4%. Stronger-than-expected data reduces the likelihood of further rate cuts by the Bank of England in the near future after last week’s decision to cut rates by 25 basis points. At the same time, the dollar weakened after US inflation data reinforced bets on a Fed rate cut in September.

交易建议

- 支撑价位: 1.3520, 1.3462, 1.3390, 1.3313, 1.3214, 1.3137

- 阻力价位: 1.3586

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. The British pound corrected to 1.3550, where buyers entered the market. Currently, the price will strive to reach 1.3586 again, which opens up opportunities for intraday purchases. There are no optimal entry points for sell deals at the moment, as the sellers’ initiative is insufficient.

选择场景:if the price breaks through the support level of 1.3392 and consolidates below it, the downward trend will likely resume.

新闻动态: 2025.08.15

- UK GDP (q/q) at 09:00 (GMT+3);

- UK Industrial Production (m/m) at 09:00 (GMT+3);

- UK Manufacturing Production (m/m) at 09:00 (GMT+3);

- UK Trade Balance (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

货币对的技术指标:

- 前一开盘价: 147.35

- 前一收盘价: 147.76

- 过去一天的变化%: +0.28 %

On Friday, the Japanese yen strengthened to 147 per dollar, offsetting losses from the previous session amid stronger-than-expected GDP data and growing expectations of a rate hike by the Bank of Japan. Japan’s economy grew 0.3% in the second quarter, accelerating from 0.1% in the first quarter, which was also in line with consensus expectations. The yen also got a boost from comments by US Treasury Secretary Scott Bessent, who said the Bank of Japan is lagging behind in the fight against inflation. Plus, the Central Bank is under pressure to ditch the Inflation Index tied to domestic demand and wage growth, which is holding back policy tightening. Bank of Japan Governor Kazuo Ueda remains cautious, emphasizing that “core inflation” remains below the 2% target.

交易建议

- 支撑价位: 146.74, 146.35

- 阻力价位: 147.86, 148.52, 149.18, 150.34

From a technical point of view, the medium-term trend of the USD/JPY is bearish. Yesterday, buyers took the initiative from 146.35, and now the zone below 146.74 is a zone of “locked” sellers. The price will tend to test this zone, so the support level of 146.74 can be used to look for buy trades. Sales can be considered on intraday timeframes up to this level, but with a short stop.

选择场景:if the price breaks through the resistance level of 148.53 and consolidates above it, the uptrend will likely resume.

今天没有新闻

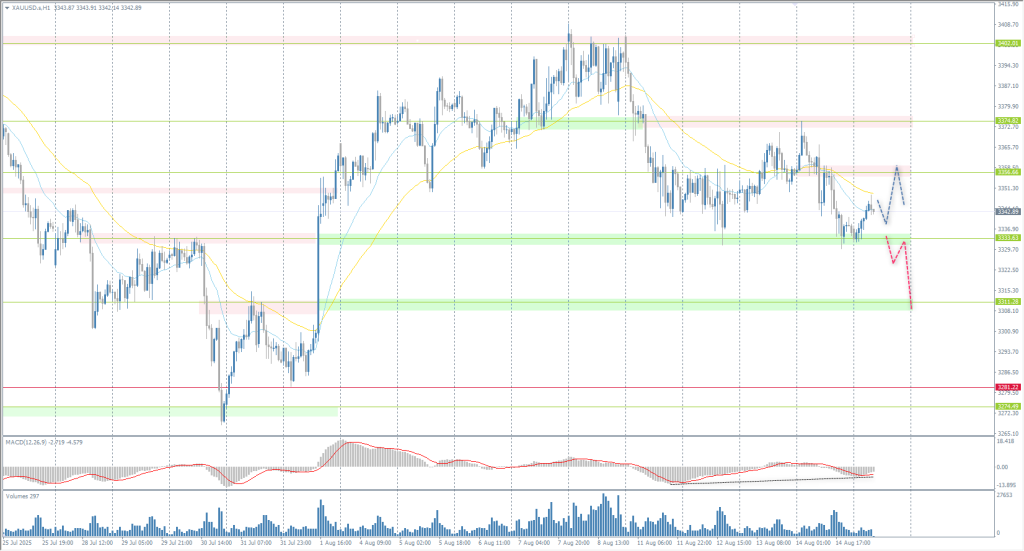

The XAU/USD currency pair (gold)

货币对的技术指标:

- 前一开盘价: 3357

- 前一收盘价: 3335

- 过去一天的变化%: -0.65 %

On Friday, gold prices fluctuated below the $3,340 per ounce mark, maintaining the losses of the previous session and showing the worst performance since the end of June, as higher-than-expected US data dampened hopes for a significant Fed rate cut. The US producer prices rose at their fastest pace in three years in July, significantly exceeding expectations, indicating that companies are passing on higher import costs associated with tariffs to consumers. Traders are now leaning toward a 25 basis point rate cut next month, followed by another 25 basis points in October, reflecting comments from Fed’s Mary Daly, who opposed a 50 basis point rate cut in September. Investors’ attention is shifting to whether Fed Chairman Jerome Powell will provide new guidance on monetary policy at the Central Bank’s annual economic symposium in Jackson Hole, Wyoming, next week.

交易建议

- 支撑价位: 3333, 3311, 3281

- 阻力价位: 3356, 3374, 3402, 3433

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold reached the support level of 3333, where buyers reacted. It is very important for buyers not to let the price fall below this level, otherwise a sell-off to 3311 may occur. Intraday, you can consider buying up to 3356, but with a stop below 3311.

选择场景:if the price breaks the support level of 3281 and consolidates below it, the downtrend will likely resume.

新闻动态: 2025.08.15

- US Producer Price Index (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3).

本文仅反映个人观点,不应被视为投资建议和/或要约和/或进行金融交易的持续要求和/或担保和/或对未来事件的预测。