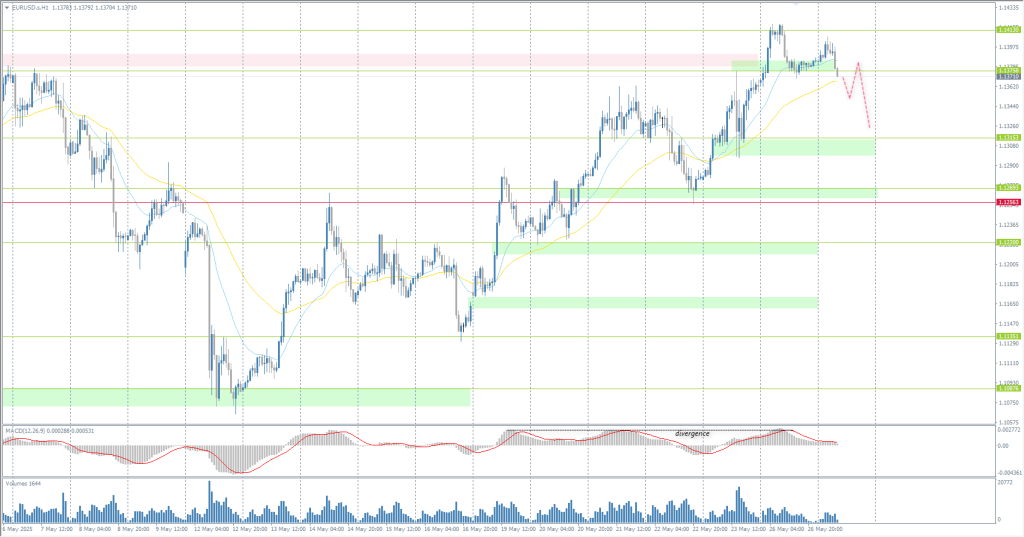

The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.1366

- Prev. Close: 1.1385

- % chg. over the last day: +0.16 %

The euro rose to 1.14 USD, the strongest level in about a month, after President Trump announced the postponement of the planned imposition of a 50% tariff on EU imports. Following a phone call with EU spokeswoman Ursula von der Leyen, Trump announced an extension of trade talks until July 9. Under the reciprocal tariff system unveiled in April, the EU faced a 20% levy, which has been temporarily reduced to 10% until the new deadline. Meanwhile, the Eurozone’s economic outlook remains fragile. The EC has lowered its growth expected for 2024 to 0.9%. On the monetary policy front, the ECB is widely expected to cut interest rates at its June meeting.

Trading recommendations

- Support levels: 1.1376, 1.1315, 1.1269, 1.1220, 1.1170, 1.1135

- Resistance levels: 1.1413, 1.1456

The EUR/USD currency pair’s hourly trend has changed to an upward trend. The euro reached the resistance level at 1.1413, where the sellers took the initiative. Moreover, intraday bias is now also behind the sellers. Given the MACD divergence, there is a high probability of a corrective move to 1.1315. Selling can be looked for after price consolidation below 1.1376. There are no optimal conditions for buying now.

Alternative scenario:if the price breaks the support level of 1.1256 and consolidates below it, the downtrend will likely resume.

News feed for: 2025.05.27

- German GfK Consumer Climate (m/m) at 09:00 (GMT+3);

- US Durable Goods Orders (m/m) at 15:30 (GMT+3);

- US CB Consumer Confidence (m/m) at 17:00 (GMT+3).

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.3522

- Prev. Close: 1.3563

- % chg. over the last day: +0.30 %

According to economists, the Bank of England (BoE) will make the next rate cut in August at the earliest, and they expect the rate to decrease once a quarter. At the same time, a faster rate cut is not ruled out. For the time being, the softer inflation outlook is likely to be reflected in a lower end point for the Bank Rate. Markets are pricing in an endpoint rate of 3.7%, although economists had previously expected it to eventually fall to 3.25%. This revision is a hawkish factor, which also supports the British pound.

Trading recommendations

- Support levels: 1.3542, 1.3474, 1.3434, 1.3382, 1.3333, 1.3291, 1.3121

- Resistance levels: 1.3593, 1.3713

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly is bullish. However, the first signs of fixation of previously opened purchases appeared. Currently, the price has corrected to the support level of 1.3542, but there is no reaction from buyers, which increases the probability of a deeper correction. Selling can be considered if the price fixes impulsively below 1.3542. It is worth returning to the idea of buying if buyers take the initiative from the support level of 1.3542.

Alternative scenario:if the price breaks the support level of 1.3390 and consolidates below it, the downtrend will likely resume.

No news for today

The USD/JPY currency pair

Technical indicators of the currency pair:

- Prev. Open: 142.46

- Prev. Close: 142.83

- % chg. over the last day: +0.26 %

The Japanese yen strengthened to 142 per dollar on Tuesday, reaching its highest level in four weeks, as the US dollar continued to retreat amid growing concerns over fiscal policy. Market sentiment was dampened by President Donald Trump’s sweeping tax and spending bill, which is expected to significantly increase the US budget deficit. The yen also benefited from safe-haven demand as investors reacted to increased market volatility caused by Trump’s unpredictable trade stance. On the domestic front, attention remains focused on the Bank of Japan’s monetary policy course. Expectations are growing that the Central Bank will continue to tighten policy due to persistent inflationary pressures.

Trading recommendations

- Support levels: 142.19, 141.52

- Resistance levels: 143.03, 144.10, 144.80, 145.46, 146.36, 148.28, 150.47

From a technical point of view, the medium-term trend of the USD/JPY is bearish. The yen strengthened to the support level of 142.19, where buyers showed a reaction. Currently, the price has reached the supply zone above the resistance level 143.07 and there is no reaction of sellers. There is a high probability that the 143.07 level will be broken, and the price will rush to the next level of 144.10. In this scenario, intraday buying can be considered if the price consolidates above 143.07.

Alternative scenario:if the price breaks the resistance level of 144.32 and consolidates above it, the uptrend will likely resume.

No news for today

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 3353

- Prev. Close: 3341

- % chg. over the last day: -0.36 %

Investors are keeping a close eye on global events, including the widening US budget deficit, ongoing trade negotiations and geopolitical tensions in the Middle East and Ukraine, all of which could affect the attractiveness of gold as a safe haven. Investors are currently awaiting the release of the latest FOMC meeting minutes on Wednesday and PCE inflation data on Friday for further clues on the Fed’s interest rate outlook.

Trading recommendations

- Support levels: 3314, 3285, 3250, 3204, 3151, 3103, 3049

- Resistance levels: 3363, 3414

From the point of view of technical analysis, the trend on the XAU/USD is bullish. The price has reached the resistance level of 3363, where partial fixation of previously opened purchases is observed. The MACD divergence indicates correction, but space for growth remains. Under such market conditions, buy trades are best considered from the support level of 3314 or EMA lines, but with confirmation. A price move below 3314 could open up selling space to 3285.

Alternative scenario:if the price breaks and consolidates below the support level of 3204, the downtrend will likely resume.

News feed for: 2025.05.27

- US Durable Goods Orders (m/m) at 15:30 (GMT+3);

- US CB Consumer Confidence (m/m) at 17:00 (GMT+3).

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.