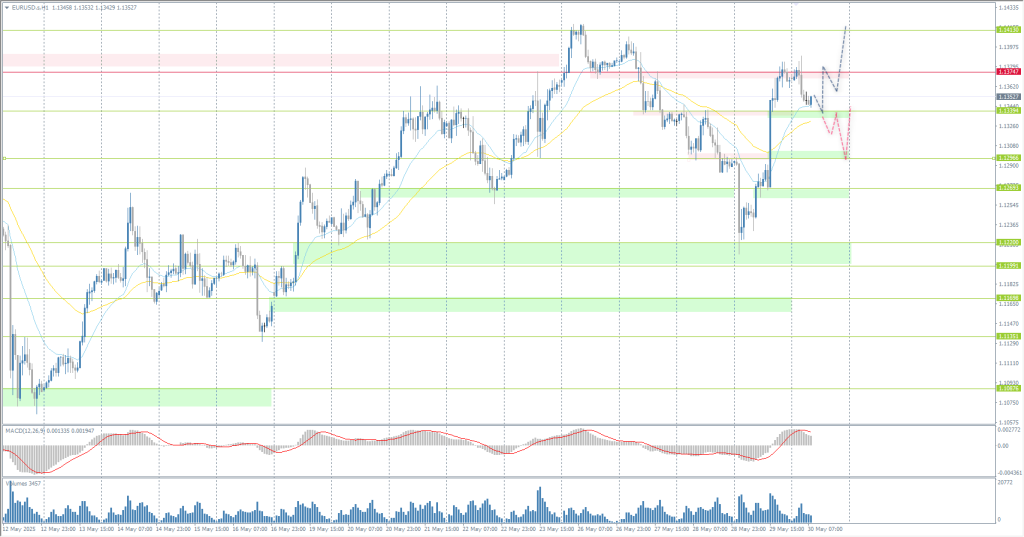

The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.1293

- Prev. Close: 1.1367

- % chg. over the last day: +0.65 %

The euro recovered its earlier losses and rose above $1.135 again as the dollar weakened after the release of new economic data that reinforced expectations of multiple Fed rate cuts this year. The US GDP contracted by 0.2% year-on-year in the first quarter, which was slightly better than the initial expectations of a 0.3% decline, but still marked the first quarterly contraction in GDP in three years. As for monetary policy, the ECB will announce its decision next week. Although many analysts expect another rate cut, some ECB officials have recently taken a more hawkish tone, advocating a pause in further easing.

Trading recommendations

- Support levels: 1.1339, 1.1296, 1.1269, 1.1220, 1.1200, 1.1169, 1.1135

- Resistance levels: 1.1374, 1.1413

The EUR/USD currency pair’s hourly trend has changed to downward, but close to changing. The US tariff hikes continue to cause chaotic volatility spikes. Yesterday, the price rose sharply and reached the priority change level of 1.1374. The probability of a change in the medium-term trend is high. For buy deals, it is worth considering the support levels of 1.1339 and 1.1296. There are currently no optimal entry points for sales.

Alternative scenario:if the price breaks through the resistance level of 1.1374 and consolidates above it, the uptrend will likely resume.

News feed for: 2025.05.30

- German Retail Sales (m/m) at 09:00 (GMT+3);

- German Inflation Rate (m/m) at 15:00 (GMT+3);

- US Core PCE Index (m/m) at 15:30 (GMT+3);

- US Chicago PMI (m/m) at 16:45 (GMT+3);

- US Revised UoM Inflation Expectations (m/m) at 17:00 (GMT+3).

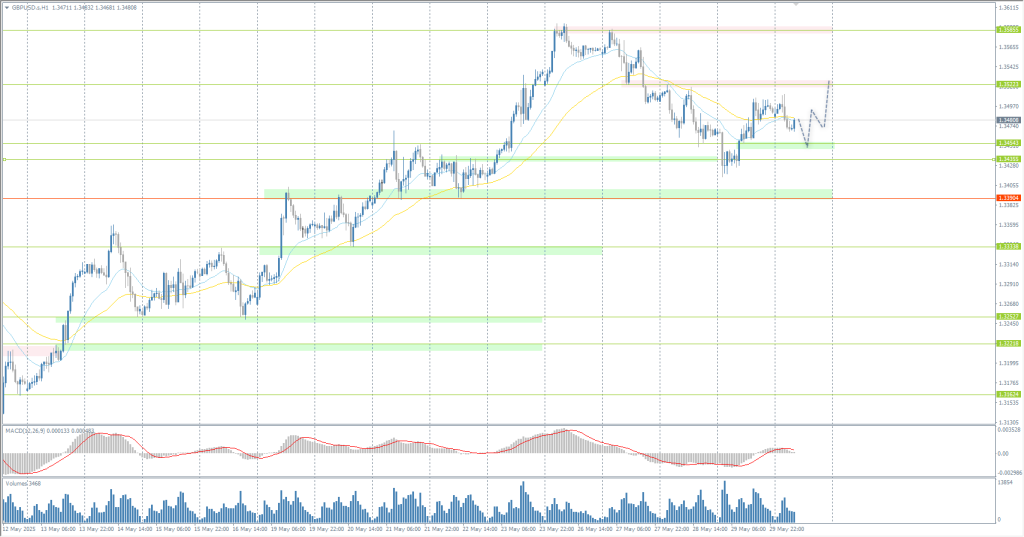

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.3465

- Prev. Close: 1.3490

- % chg. over the last day: +0.18 %

Weak US economic data, including a contraction in the economy in the first quarter and an increase in the number of applications for unemployment benefits, have reinforced expectations of two Fed rate cuts by early 2026. In the UK, Business Secretary Jonathan Reynolds is seeking to accelerate a trade deal with the US, with tariff reductions on British goods still awaiting Trump’s signature. The court ruling may influence this context, although its impact on the deal remains unclear.

Trading recommendations

- Support levels: 1.3454, 1.3435, 1.3390, 1.3333, 1.3291, 1.3121

- Resistance levels: 1.3522, 1.3585

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly is bullish. The British pound is more resilient to global tariff uncertainty. The price has been corrected to the EMA lines. Intraday, buy trades can be considered here. The support level of 1.3454 may also become a support for further price growth. There are currently no optimal entry points for sales.

Alternative scenario:if the price breaks the support level of 1.3390 and consolidates below it, the downtrend will likely resume.

No news for today

The USD/JPY currency pair

Technical indicators of the currency pair:

- Prev. Open: 144.80

- Prev. Close: 144.18

- % chg. over the last day: -0.43 %

On Friday, the Japanese yen rose above 144 per dollar, continuing its growth compared to the previous session after Tokyo’s core inflation data came in stronger than expected. The positive data reinforced expectations that the Bank of Japan may raise interest rates further, with markets anticipating a 25 basis point hike in July. In the external market, the yen also received support from renewed demand for safe-haven currencies after a US appeals court reinstated President Donald Trump’s retaliatory tariffs, overturning an earlier federal court ruling.

Trading recommendations

- Support levels: 143.84, 143.03

- Resistance levels: 144.75, 145.45, 146.27, 146.85, 148.28

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The Japanese yen is once again striving to reach the priority change level amid the weakness of the US dollar. The intraday bias is currently in favor of sellers. In this scenario, sell trades can be considered from the EMA lines or from the 143.84 level after the price consolidates below it. Buy trades can be considered if the price shows a bullish reaction at 143.84. In this case, the growth space up to 144.75 can be used.

Alternative scenario:if the price breaks through the support level of 143.03 and consolidates below it, the downward trend will likely resume.

News feed for: 2025.05.30

- Japan Tokyo Core CPI (m/m) at 02:30 (GMT+3);

- Japan Unemployment Rate (m/m) at 02:30 (GMT+3);

- Japan Retail Sales (m/m) at 02:50 (GMT+3);

- Japan Industrial Production (m/m) at 02:50 (GMT+3).

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 3287

- Prev. Close: 3318

- % chg. over the last day: +0.94 %

On Friday, gold prices fell to $3,290 per ounce, losing more than 1% over the week, as investors became more cautious ahead of the release of the US PCE inflation report, which could provide new insight into the Federal Reserve’s interest rate trajectory. On Thursday, bullion rose nearly 1% after a federal appeals court allowed President Donald Trump to temporarily keep in place sweeping tariffs, a day after the US Court of International Trade blocked their implementation, ruling that the method used to impose them was “illegal”. Meanwhile, San Francisco Fed President Mary Daly said on Thursday that policymakers could still implement two rate cuts this year.

Trading recommendations

- Support levels: 3289, 3248

- Resistance levels: 3323, 3363

From the point of view of technical analysis, the trend on the XAU/USD is bullish. After testing the priority change level, the price returned to growth. However, sellers are confidently defending the 3323 level. It is important for buyers to hold the 3289 support level. A break below this level could trigger a sell-off to 3248. Consolidation of the price above the EMA lines will resume the bullish bias within the day.

Alternative scenario:if the price breaks and consolidates below the support level of 3248, the downtrend will likely resume.

News feed for: 2025.05.30

- US Core PCE Index (m/m) at 15:30 (GMT+3);

- US Chicago PMI (m/m) at 16:45 (GMT+3);

- US Revised UoM Inflation Expectations (m/m) at 17:00 (GMT+3).

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.