The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.1584

- Prev. Close: 1.1551

- % chg. over the last day: -0.28 %

The euro fell to $1.15 after hitting a three-and-a-half-year high of $1.163 on June 12, as global markets were concerned about escalating tensions in the Middle East. Israel struck Iranian nuclear facilities and key personnel, raising fears of a larger conflict. Israel claims that Iran’s nuclear program poses an existential threat and vows to continue its operations. Iran responded by launching hundreds of drones and warned of further retaliatory measures. On the monetary policy front, recent comments from ECB officials have reinforced expectations of a pause in the easing cycle to assess the impact of new US tariffs.

Trading recommendations

- Support levels: 1.1505, 1.1445, 1.1373, 1.1356, 1.1312, 1.1296, 1.1269

- Resistance levels: 1.1572, 1.1616

The EUR/USD currency pair’s hourly trend is bullish. The price corrected on Friday to the support level of 1.1505, where buyers took the initiative. Currently, the price has reached the resistance level of 1.1572, and it is important to assess the price action here. If sellers react and the price consolidates below after the test, this will most likely trigger a sell-off to 1.1505. A breakout and consolidation of 1.1505 will open the way to 1.1616.

Alternative scenario:if the price breaks through the support level of 1.1373 and consolidates below it, the downward trend will likely resume.

No news for today

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.3614

- Prev. Close: 1.3574

- % chg. over the last day: -0.30 %

The British pound fell to $1.35 after hitting a three-year high of $1.363, as escalating tensions in the Middle East prompted investors to rush to safe assets amid fears of a larger conflict. Meanwhile, data showed that UK GDP fell 0.3% month-on-month in April, worse than the expected 0.1% decline, partly due to a sharp drop in exports to the US following the introduction of new tariffs. Signs of economic stress and declining labor demand, as evidenced by employment data released on Tuesday, reinforced market expectations that the Bank of England would cut interest rates more aggressively than expected.

Trading recommendations

- Support levels: 1.3533, 1.3465, 1.3435, 1.3390, 1.3333, 1.3291, 1.3121

- Resistance levels: 1.3603, 1.3632

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish, but on Friday, the price fell sharply to the support level of 1.3533, where buyers took the initiative. Currently, the price is heading towards testing liquidity above 1.3603. If sellers react here, we may see a sell-off to 1.3533. An impulsive breakout of 1.3603 will open the way for the price to 1.3633.

Alternative scenario:If the price breaks through the support level of 1.3554 and consolidates below it, the downward trend will likely resume.

No news for today

The USD/JPY currency pair

Technical indicators of the currency pair:

- Prev. Open: 143.47

- Prev. Close: 144.10

- % chg. over the last day: +0.44 %

On Monday, the Japanese yen fell to 144.2 per dollar, extending its losses for the second session in a row, as the US dollar strengthened amid increased demand for safe-haven currencies. These movements came amid intensified attacks between Israel and Iran over the weekend, with both countries striking each other’s energy infrastructure, leading to further oil price increases. This will reduce the likelihood of further interest rate cuts by the Federal Reserve in the near term, as policymakers grapple with tariff and inflation risks. Domestically, investor attention is focused on the Bank of Japan’s upcoming decision. The Central Bank is expected to leave interest rates unchanged this week as officials monitor global developments and assess the impact of rising oil prices on Japan’s inflation outlook.

Trading recommendations

- Support levels: 143.88, 143.47, 142.76, 142.19

- Resistance levels: 144.67, 145.35, 146.27, 146.85, 148.28

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The Japanese yen is forming a flat accumulation with boundaries of 143.88–144.67. Currently, the price is trying to test liquidity below 143.88. If buyers react here, it will open up opportunities for buy trades up to 144.67. A breakdown and consolidation below 144.67 will lead to a price drop to 143.47.

Alternative scenario:if the price breaks through the support level of 142.77 and consolidates below it, the downtrend will likely resume.

No news for today

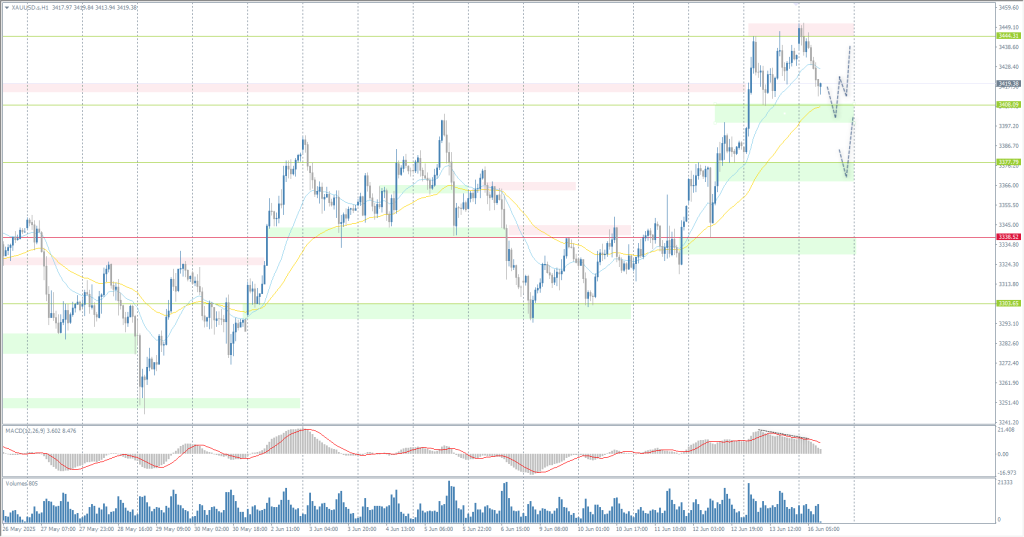

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 3386

- Prev. Close: 3434

- % chg. over the last day: +1.42 %

On Monday, the price of gold fell to around $3,420 per ounce but remained close to the historic highs reached in April as growing tensions in the Middle East prompted investors to rush to safe assets. The conflict between Israel and Iran is now in its fourth day, with both sides launching a barrage of drones and missiles at military and residential targets, heightening fears of a wider regional conflict. Meanwhile, investors are preparing for key Central Bank meetings this week, with a particular focus on the US Federal Reserve. The Fed is expected to leave rates unchanged, but the main focus will be on further guidance regarding the timing and extent of future rate cuts.

Trading recommendations

- Support levels: 3408, 3377, 3338, 3303, 3272, 3248

- Resistance levels: 3444, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold corrected on Monday to the support level of 3408. However, the bias and overall fundamental picture remain bullish. For buy deals, it is best to consider the support level of 3408 or 3377, in the event of a deeper correction. Selling is not recommended at this time.

Alternative scenario:if the price breaks and consolidates below the support level of 3338, the downtrend will likely resume.

No news for today

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.