The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.1561

- Prev. Close: 1.1480

- % chg. over the last day: -0.70 %

The euro retreated on Tuesday due to the strengthening of the dollar. In addition, dovish comments by ECB Governing Council member Stournaras on Tuesday weighed on the euro when he said that the ECB could proceed with further interest rate cuts if economic growth and inflation slow more than expected. The euro came under pressure despite the fact that economic growth expectations in Germany rose more than expected, according to the June ZEW survey.

Trading recommendations

- Support levels: 1.1489, 1.1445, 1.1373, 1.1356, 1.1312, 1.1296, 1.1269

- Resistance levels: 1.1539, 1.1572, 1.1616

The EUR/USD currency pair’s hourly trend is bullish. The euro corrected to the support level of 1.1489. Buyers reacted here, but the reaction is weak, which increases the likelihood of a deeper decline. Sell trades can be considered from the EMA lines or from the resistance level of 1.1539. There are currently no optimal entry points for buying.

Alternative scenario:if the price breaks through the support level of 1.1373 and consolidates below it, the downward trend will likely resume.

News feed for: 2025.06.18

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Building Permits (m/m) at 15:30 (GMT+3);

- US Federal Funds Rate at 21:00 (GMT+3);

- US FOMC Economic Projections at 21:00 (GMT+3);

- US FOMC Statement at 21:00 (GMT+3);

- US FOMC Press Conference at 21:30 (GMT+3).

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.3574

- Prev. Close: 1.3427

- % chg. over the last day: -1.09 %

The annual inflation rate in the UK fell to 3.4% in May 2025 from 3.5% in April, in line with expectations. Inflation in the services sector also slowed to 4.7% from 5.4%. The annual core inflation rate in the UK fell to 3.5% in May 2025 from a year-to-date high of 3.8% in the previous month, slightly below market expectations of 3.6%. The slowdown was mainly due to a slowdown in the growth rate of the CPI for services. This was the lowest monthly growth in the last four months, indicating some easing of core inflationary pressures. The data increases the likelihood of a rate cut by the Bank of England.

Trading recommendations

- Support levels: 1.3435, 1.3390, 1.3333, 1.3291, 1.3121

- Resistance levels: 1.3463, 1.3522, 1.3583

In terms of technical analysis, the trend on the currency pair GBP/USD has changed to downward. The British pound was sold off yesterday. The price has consolidated below the priority change level. Sell trades should be considered from the EMA lines near the 1.3463 level or from the 1.3522 resistance level. It is important to enter only after confirmation in the form of seller initiative. There are no optimal entry points for buy deals at this time.

Alternative scenario:if the price breaks through the resistance level of 1.3583 and consolidates above it, the uptrend will likely resume.

News feed for: 2025.06.18

- UK Consumer Price Index (m/m) at 09:00 (GMT+3);

- UK Producer Price Index (m/m) at 09:00 (GMT+3).

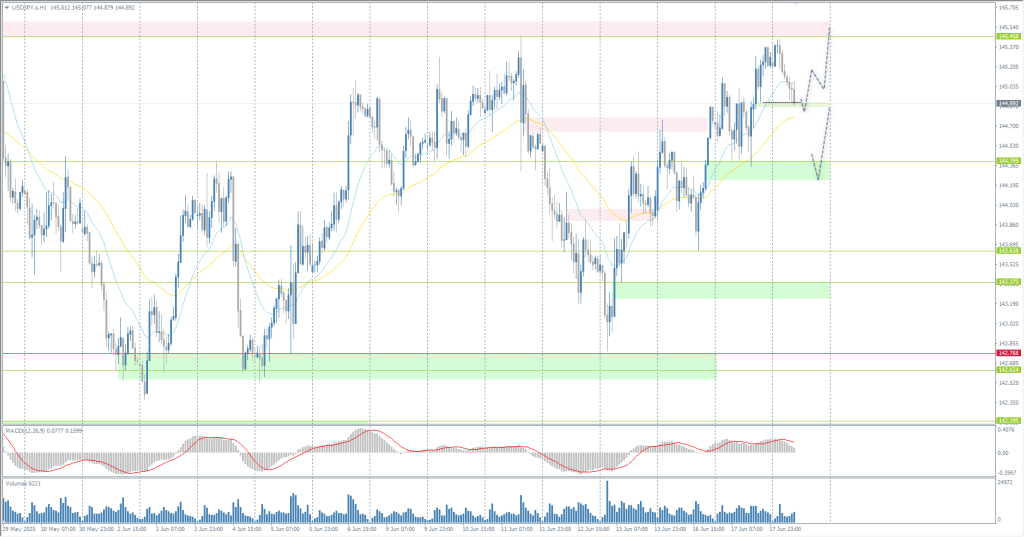

The USD/JPY currency pair

Technical indicators of the currency pair:

- Prev. Open: 144.72

- Prev. Close: 145.28

- % chg. over the last day: +0.38 %

The Japanese yen is holding steady at around 145.2 per dollar on Wednesday after falling for three consecutive sessions, as a series of disappointing economic indicators has affected sentiment. Exports in May declined for the first time in eight months, affected by US tariffs, while imports fell more than expected. Orders for core equipment fell in April, and sentiment in the manufacturing sector deteriorated in June, highlighting growing concerns about domestic demand. On the political front, the Bank of Japan left interest rates unchanged on Tuesday and signaled a gradual approach to balance sheet reduction, confirming its cautious stance on unwinding stimulus.

Trading recommendations

- Support levels: 144.40, 143.88, 143.47, 142.76, 142.19

- Resistance levels: 145.45, 146.27, 146.85, 148.28

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The Japanese yen is seeking to test liquidity above 145.46. Buy trades can be sought from the EMA lines or from the support level of 144.40. Selling can only be considered in the event of a sharp breakout of 144.40 with further consolidation of the price below.

Alternative scenario:if the price breaks through the support level of 142.77 and consolidates below it, the downtrend will likely resume.

News feed for: 2025.06.18

- Japan Trade Balance (m/m) at 02:50 (GMT+3).

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 3386

- Prev. Close: 3389

- % chg. over the last day: +0.08 %

On Tuesday, gold traded near the $3390 per ounce mark. Escalating tensions in the Middle East increased demand for safe-haven assets. US President Donald Trump called for the immediate evacuation of Tehran after Israel stepped up air strikes on Iran, targeting elite military units and state media.

Trading recommendations

- Support levels: 3375, 3338, 3303, 3272, 3248

- Resistance levels: 3405, 3444, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold continues to accumulate liquidity near the 3375 support level. A consolidation below 3377 will open the way for a sell-off to 3338, so it is very important for buyers not to let the price fall below this level. A consolidation above 3405 will restore the bullish bias: in this scenario, you can look for buy trades with a target of 3444.

Alternative scenario:if the price breaks and consolidates below the support level of 3338, the downtrend will likely resume.

News feed for: 2025.06.18

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Building Permits (m/m) at 15:30 (GMT+3);

- US Federal Funds Rate at 21:00 (GMT+3);

- US FOMC Economic Projections at 21:00 (GMT+3);

- US FOMC Statement at 21:00 (GMT+3);

- US FOMC Press Conference at 21:30 (GMT+3).

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.