The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.1481

- Prev. Close: 1.1480

- % chg. over the last day: -0.01 %

The US Federal Reserve left the federal funds rate unchanged at 4.25–4.50% at its fourth consecutive meeting in June 2025, in line with expectations, as policymakers take a cautious stance to fully assess the economic impact of President Trump’s policies. Officials also noted that uncertainty about the economic outlook has diminished but remains high. Despite this, the Fed continues to expect two rate cuts at the end of this year, although it expects only one quarter-point cut in 2026 and 2027. In its updated prognoses, the Fed lowered its GDP growth expectations for 2025 to 1.4% (from 1.7% in March) and for 2026 to 1.6% (from 1.8%).

Trading recommendations

- Support levels: 1.1445, 1.1373, 1.1356, 1.1312, 1.1296, 1.1269

- Resistance levels: 1.1488, 1.1539, 1.1572, 1.1616

The EUR/USD currency pair’s hourly trend is bullish. The euro corrected to the support level of 1.1445. Buyers reacted here, but the reaction was weak, which increases the likelihood of a deeper decline. Sell trades can be considered from the EMA lines or from the resistance level of 1.1488. There are no optimal entry points for purchases at this time.

Alternative scenario:if the price breaks through the support level of 1.1405 and consolidates below it, the downward trend will likely resume.

No news for today

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.3424

- Prev. Close: 1.3421

- % chg. over the last day: -0.02 %

Today, the Bank of England will hold its regular meeting on monetary policy. It is widely expected that the Bank of England will keep the bank rate at 4.25%. Further guidance is expected to be confirmed as “gradual and cautious.” The reaction of currency markets is likely to be moderate but volatile. The British pound may come under short-term pressure if the Bank of England highlights inflation risks or uncertainty regarding wages.

Trading recommendations

- Support levels: 1.3435, 1.3390, 1.3333, 1.3291, 1.3121

- Resistance levels: 1.3463, 1.3522, 1.3583

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The British pound reached the support level of 1.3388, but buyer reaction here is weak, despite the MACD divergence. This increases the likelihood of a further decline. Sell trades can be considered from the EMA lines or from the resistance level of 1.3475. Buy deals are possible intraday after a breakout of 1.3423, but only with short-term targets.

Alternative scenario:if the price breaks through the resistance level of 1.3583 and consolidates above it, the uptrend will likely resume.

News feed for: 2025.06.19

- UK BoE Interest Rate Decision at 14:00 (GMT+3);

- UK BoE MPC Meeting Minutes at 14:00 (GMT+3).

The USD/JPY currency pair

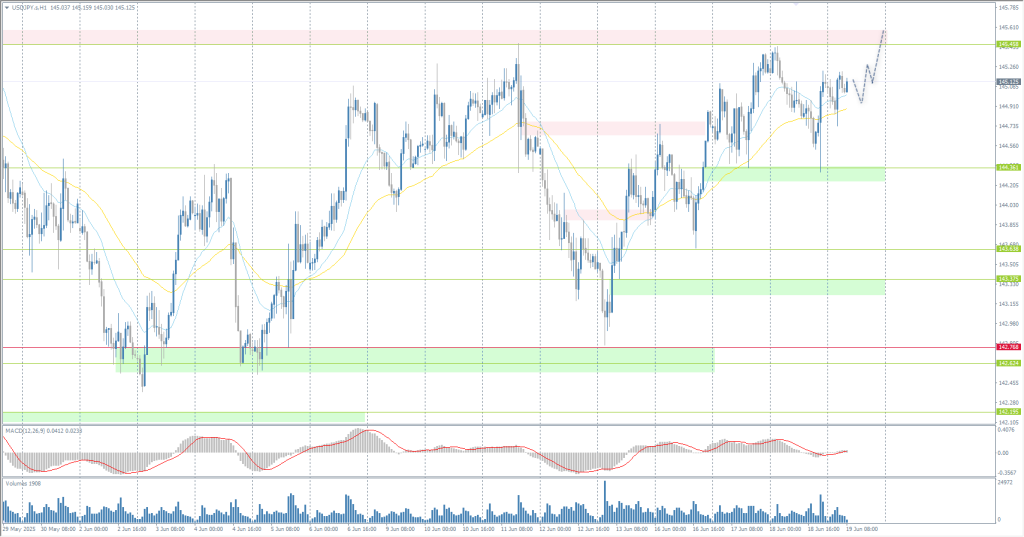

Technical indicators of the currency pair:

- Prev. Open: 145.24

- Prev. Close: 145.11

- % chg. over the last day: -0.09 %

On Thursday, the Japanese yen fell to 145 per dollar, approaching three-week lows, as it came under pressure from a strengthening US dollar. The dollar rose after the US Federal Reserve left interest rates unchanged and signaled a cautious approach to policy adjustments, warning that President Trump’s tariffs could lead to a resurgence in inflation. The dollar also outperformed the yen as a safe-haven currency amid rising geopolitical tensions, with the Israeli-Iranian conflict heightening concerns about more active US involvement in the Middle East.

Trading recommendations

- Support levels: 144.36, 143.88, 143.47, 142.76, 142.19

- Resistance levels: 145.45, 146.27, 146.85, 148.28

From a technical point of view, the medium-term trend of the USD/JPY is bullish. Yesterday, the price fell to the support level of 144.36, grabbing additional liquidity. Currently, the Japanese yen is seeking to test liquidity above 145.46. Buying opportunities can be sought from the EMA lines. Selling opportunities can be considered from 145.46, provided there is a reaction from sellers.

Alternative scenario:if the price breaks through the support level of 142.77 and consolidates below it, the downtrend will likely resume.

No news for today

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 3392

- Prev. Close: 3369

- % chg. over the last day: -0.68 %

Gold is trading close to $3380 per ounce, supported by its appeal as a “safe haven” amid ongoing geopolitical tensions. The Israeli-Iranian conflict is now in its seventh day. According to reports, the Israeli military has carried out more than 20 strikes on targets in Tehran and its surroundings, including facilities linked to Iran’s nuclear weapons development and missile production. The US is also considering joining Israel in bombing Iranian nuclear facilities, which could lead to the conflict escalating into a larger regional war.

Trading recommendations

- Support levels: 3338, 3303, 3272, 3248

- Resistance levels: 3379, 3405, 3444, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. However, yesterday, gold consolidated below 3380, which could potentially lead to a deeper correction. Consolidation above 3380 will restore the bullish bias: in this scenario, traders can look for buy trades with a target of 3405 and above.

Alternative scenario:if the price breaks and consolidates below the support level of 3338, the downtrend will likely resume.

No news for today

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.