The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.1478

- Prev. Close: 1.1494

- % chg. over the last day: +0.14 %

In the US, a conflict is brewing between Trump and Fed Chairman Powell. Yesterday, Trump criticized Powell, saying, “Jerome Powell is costing our country hundreds of billions of dollars. He is truly one of the dumbest and most destructive people in government, and the Fed Board is complicit. Europe has made 10 cuts, we have made none. It’s too late — it’s a disgrace to America.” Potentially, this could lead to the US Federal Reserve either making a forced cut next month or Powell being fired from his position at the US Federal Reserve. In either case, the US dollar could receive medium-term support, which is negative for the euro.

Trading recommendations

- Support levels: 1.1488, 1.1445, 1.1373, 1.1356, 1.1312, 1.1296, 1.1269

- Resistance levels: 1.1539, 1.1572, 1.1616

The EUR/USD currency pair’s hourly trend is bullish. Yesterday, the euro reached the support level of 1.1445, where buyers responded with initiative. Currently, the price is trying to test the resistance level of 1.1539, where profit-taking is likely to occur, given the recent volatility. For buy deals, traders may consider the support level of 1.1488.

Alternative scenario:if the price breaks through the support level of 1.1405 and consolidates below it, the downward trend will likely resume.

News feed for: 2025.06.20

- German Producer Price Index (m/m) at 09:00 (GMT+3);

- US Philadelphia Fed Manufacturing Index (m/m) at 15:30 (GMT+3).

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.3422

- Prev. Close: 1.3467

- % chg. over the last day: +0.33 %

The British pound is holding steady at around $1.34 after the Bank of England left interest rates unchanged amid a challenging environment of persistent inflation, rising geopolitical tensions, and potential trade disruptions due to proposed US tariffs. However, the decision was not unanimous: six of the nine members of the Monetary Policy Committee voted to keep rates unchanged, while three voted for a 25 basis point cut, contrary to market expectations of a 7-2 split.

Trading recommendations

- Support levels: 1.3475, 1.3450, 1.3388, 1.3333, 1.3291, 1.3121

- Resistance levels: 1.3522, 1.3583

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The British pound reached the support level of 1.3388, where buyers took the initiative. The price has now corrected above the EMA lines, where buyers are likely to take profits. In this scenario, the price may fall to 1.3450. There are no optimal entry points for buying at the moment.

Alternative scenario:if the price breaks through the resistance level of 1.3583 and consolidates above it, the uptrend will likely resume.

News feed for: 2025.06.20

- UK Retail Sales (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

Technical indicators of the currency pair:

- Prev. Open: 145.08

- Prev. Close: 145.45

- % chg. over the last day: +0.25 %

The Japanese yen is trading close to 145 per dollar on Friday, recovering some of its recent losses after core inflation in Japan accelerated for the third consecutive month to 3.7%, the highest since January 2023. This reinforces expectations that the Bank of Japan may continue to tighten monetary policy to combat persistent inflationary pressures. Earlier this week, the Bank of Japan kept its base interest rate at 0.5%, but noted that companies continue to pass on wage increases to prices, keeping core inflation high.

Trading recommendations

- Support levels: 144.36, 143.88, 143.47, 142.76, 142.19

- Resistance levels: 145.46, 146.27, 146.85, 148.28

From a technical point of view, the medium-term trend of the USD/JPY is bullish. Yesterday, the Japanese yen reached the liquidity zone above 145.46, after which it closed below the level. Given the MACD divergence, profit-taking may occur here, leading to a price decline to 144.73. This support level can be considered for buy deals, but with confirmation.

Alternative scenario:if the price breaks through the support level of 142.77 and consolidates below it, the downtrend will likely resume.

News feed for: 2025.06.20

- Japan National Core Consumer Price Index at 02:30 (GMT+3);

- Japan Monetary Policy Meeting Minutes at 02:50 (GMT+3);

- Japan BOJ Gov Ueda Speaks at 09:40 (GMT+3).

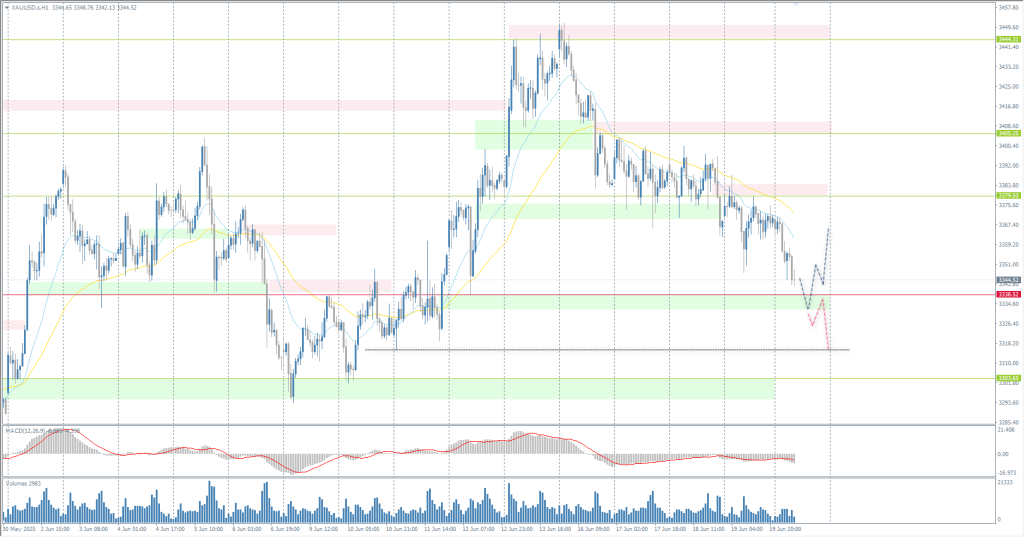

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 3371

- Prev. Close: 3370

- % chg. over the last day: -0.03 %

Gold fell below $3,350 an ounce on Friday, trading near a weekly low and heading for its first weekly decline in three weeks, as investors sold bullion to cover losses in other markets amid escalating tensions in the Middle East. Israel and Iran continued to exchange blows, with Israel stepping up strikes on strategic and government targets in Tehran after reports of an Iranian missile hitting a major Israeli hospital.

Trading recommendations

- Support levels: 3338, 3315, 3303, 3272, 3248

- Resistance levels: 3379, 3405, 3444, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish, but close to a reversal. Gold is heading towards the priority change level of 3338. Below this level, there is a concentration of liquidity, and it is important to assess the price action on this liquidity. If, after testing, the price impulsively returns above the level, this will be a strong signal to buy. If, during testing, the price impulsively closes below, this will trigger a sell-off to 3315.

Alternative scenario:if the price breaks and consolidates below the support level of 3338, the downtrend will likely resume.

News feed for: 2025.06.20

- US Philadelphia Fed Manufacturing Index (m/m) at 15:30 (GMT+3).

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.