The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.1455

- Prev. Close: 1.1576

- % chg. over the last day: +1.05 %

The euro traded around $1.15, close to the 2021 highs reached earlier this month, as investors weighed the escalation of geopolitical tensions in the Middle East, inflation risks, and prospects for monetary policy. On the economic front, flash PMI indices painted a mixed picture: private sector activity in the Eurozone showed signs of stabilizing as Germany returned to growth, while France saw a further contraction. Meanwhile, analysts continue to expect the European Central Bank to cut its key deposit rate by 25 basis points in September, bringing it down to 1.75%.

Trading recommendations

- Support levels: 1.1544, 1.1572, 1.1471, 1.1445, 1.1373, 1.1356

- Resistance levels: 1.1616

The EUR/USD currency pair’s hourly trend is bullish. Yesterday, the euro rebounded sharply amid rumors of a ceasefire in the Middle East. Currently, the price is trying to test liquidity above 1.1616. If sellers react here, it will open up opportunities for selling. For buying, it is better to wait for a correction to the EMA lines or to the support level of 1.1544, but also with confirmation.

Alternative scenario:if the price breaks through the support level of 1.1446 and consolidates below it, the downward trend will likely resume.

News feed for: 2025.06.24

- German Ifo Business Climate (m/m) at 11:00 (GMT+3);

- Eurozone ECB President Lagarde Speaks at 16:00 (GMT+3);

- US Fed Chair Powell Testifies at 17:00 (GMT+3);

- US CB Consumer Confidence (m/m) at 17:00 (GMT+3).

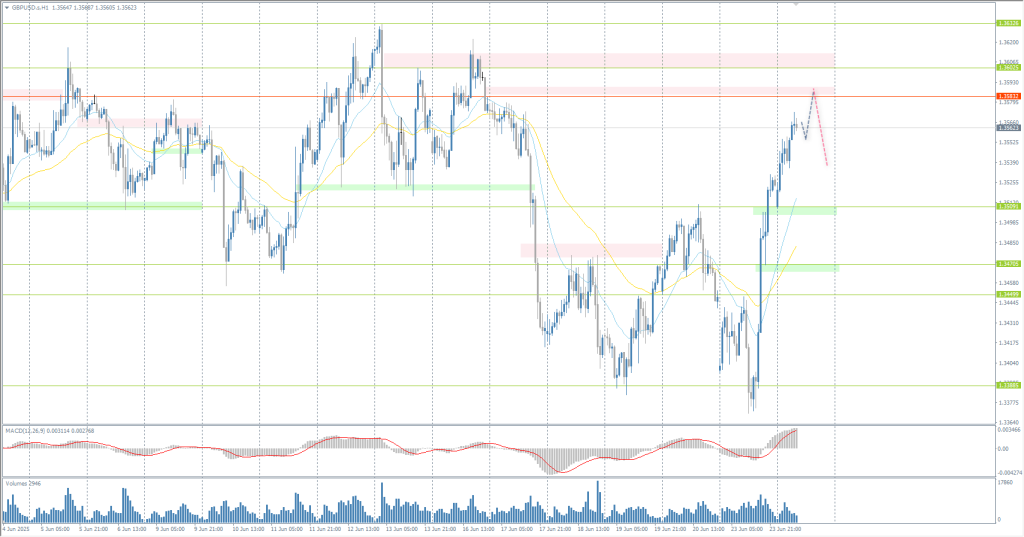

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.3399

- Prev. Close: 1.3524

- % chg. over the last day: +0.93 %

Economic data from the UK provided some support for the pound: S&P Global’s flash PMI rose to 50.7 in June, slightly exceeding expectations. The manufacturing sector continued to contract, but less than projected, while the services sector was in line with estimates. However, the pound remained under pressure after the Bank of England’s decision last week to keep rates unchanged. The vote was softer than expected: three of the nine MPC members supported a rate cut, while a 7–2 vote had been expected. The Bank of England cited ongoing inflationary and geopolitical risks, warning of “two-sided risks” and expecting inflation to remain high until 2025.

Trading recommendations

- Support levels: 1.3509, 1.3471, 1.3450, 1.3388

- Resistance levels: 1.3583, 1.3603

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The British pound strengthened sharply yesterday amid rumors of a ceasefire in the Middle East. The price is now trying to test the priority change level of 1.3583. If sellers react here, traders can look for sell deals on intraday time frames. Buy deals should be considered from the level of 1.3509 or from the EMA lines, but also with confirmation.

Alternative scenario:if the price breaks through the resistance level of 1.3583 and consolidates above it, the uptrend will likely resume.

No news for today

The USD/JPY currency pair

Technical indicators of the currency pair:

- Prev. Open: 146.70

- Prev. Close: 146.14

- % chg. over the last day: -0.38 %

On Tuesday, the Japanese yen rose to 145.5 per dollar, rebounding from multi-week lows amid a weakening dollar after US President Donald Trump announced a ceasefire agreement between Israel and Iran, which he called a “12-day war.” Markets also shrugged off Iran’s retaliatory strike on a US base in Qatar, which did not result in casualties, while Tehran’s decision not to attack the crucial Strait of Hormuz helped ease fears of more widespread supply disruptions.

Trading recommendations

- Support levels: 145.02, 144.73, 144.36

- Resistance levels: 146.62, 148.28

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The price is now seeking to test the liquidity zone below the priority change level of 145.02. If buyers react here, it will open up opportunities for buy deals to the EMA lines or the resistance level of 146.62. There are currently no optimal entry points for sales.

Alternative scenario:if the price breaks through the support level of 145.02 and consolidates below it, the downtrend will likely resume.

No news for today

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 3392

- Prev. Close: 3368

- % chg. over the last day: -0.71 %

On Tuesday, gold traded below $3,350 per ounce, close to two-week lows, as the ceasefire agreement between Israel and Iran reduced demand for safe-haven assets. President Donald Trump announced on Monday that the two countries had agreed to a complete ceasefire, adding that Iran would begin the truce immediately and Israel would follow suit in 12 hours. Meanwhile, Federal Reserve Governor Michelle Bowman said she would support a rate cut in July if inflationary pressures remained subdued, echoing recent dovish comments by Fed Governor Christopher Waller. Investors are now awaiting Fed Chairman Jerome Powell’s testimony before the US Congress on Tuesday and Wednesday, seeking more clarity on the direction of Central Bank policy.

Trading recommendations

- Support levels: 3338, 3315, 3303, 3272, 3248

- Resistance levels: 3357, 3379, 3405, 3444, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish, but close to a reversal. Gold is trying to consolidate below the priority change level. If buyers do not react here, it will trigger a sell-off to the support level of 3315, where a short-term rebound is likely amid profit-taking. For sales, it is better to consider the EMA lines or the resistance level of 3357, but also with confirmation.

Alternative scenario:if the price breaks and consolidates below the support level of 3338, the downtrend will likely resume.

News feed for: 2025.06.24

- US Fed Chair Powell Testifies at 17:00 (GMT+3);

- US CB Consumer Confidence (m/m) at 17:00 (GMT+3).

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.