The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.1648

- Prev. Close: 1.1615

- % chg. over the last day: -0.28 %

Yesterday, the euro hovered around $1.16, slightly below the 2021 high reached last month, as traders weighed economic, political, and monetary prospects. Attention is shifting to Friday’s meeting between US President Trump and Russian President Putin, aimed at finding ways to resolve the conflict in Ukraine. In the US, expectations of an imminent Fed rate cut have risen, especially after weak payroll data and a lower ISM services PMI Index. Meanwhile, the ECB ended its current easing cycle in July after eight cuts over the past year, bringing borrowing costs to their lowest level since November 2022. However, some market participants believe another ECB rate cut is possible before the end of the year.

Trading recommendations

- Support levels: 1.1589, 1.1528, 1.1485, 1.1375, 1.1313

- Resistance levels: 1.1636, 1.1678, 1.1710, 1.1770

The EUR/USD currency pair’s hourly trend is bullish. Yesterday, the euro price corrected to 1.1589, where buyers showed a moderate reaction. Sellers formed an additional resistance level at 1.1636, which may now become a stumbling block for further growth. Decisions should be made based on the price reaction at 1.1636. If buyers break through the level, the road to 1.1678 and above will open. If sellers react to 1.1636, we expect a decline below 1.1588.

Alternative scenario:if the price breaks the support level of 1.1528 and consolidates below it, the downtrend will likely resume.

News feed for: 2025.08.12

- German ZEW Economic Sentiment (m/m) at 12:00 (GMT+3);

- Eurozone ZEW Economic Sentiment (m/m) at 12:00 (GMT+3);

- US Consumer Price Index (m/m) at 15:30 (GMT+3).

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.3446

- Prev. Close: 1.3432

- % chg. over the last day: -0.10 %

The British pound fell to $1.341 as traders await UK employment and GDP data, which could determine the Bank of England’s policy expectations following last Thursday’s vote to cut rates. The Bank of England cut its bank rate by 25 basis points to 4% with four MPC members voting against, and signaled a possible slowdown in the pace of quarterly easing due to stagnant inflation. Markets are divided on the likelihood of a rate cut in December, with the odds at around 76%. Expectations point to stable unemployment at 4.7%, while preliminary GDP slowed sharply to 0.1% in Q2 from 0.7% in Q1. Softer data could increase the odds of another rate cut this year.

Trading recommendations

- Support levels: 1.3390, 1.3313, 1.3214, 1.3137

- Resistance levels: 1.3462, 1.3586

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. Yesterday, sellers reacted to the 1.3463 level as part of profit-taking. There is a high probability of a corrective decline to 1.3390, where one can look for buying opportunities, provided there is an appropriate reaction. Intraday, the bias is in favor of sellers.

Alternative scenario:if the price breaks through the support level of 1.3280 and consolidates below it, the downtrend will likely resume.

News feed for: 2025.08.12

- UK Average Earnings Index (m/m) at 09:00 (GMT+3);

- UK Claimant Count Change (m/m) at 09:00 (GMT+3);

- UK Unemployment Rate (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

Technical indicators of the currency pair:

- Prev. Open: 147.52

- Prev. Close: 148.14

- % chg. over the last day: +0.42 %

On Tuesday, the yen fell to 148 per dollar, its third consecutive decline, as improved global trade prospects reduced demand for safe-haven currencies. The trade truce between the US and China was extended for another 90 days, easing tensions and giving negotiators more time to reach an agreement. Domestically, investors assessed the Bank of Japan’s policy outlook, with board members divided on the timing and pace of future rate hikes. Some officials argued for maintaining an accommodative policy for the time being, citing uncertainty that the bank’s economic expectations would come true.

Trading recommendations

- Support levels: 147.91, 147.45, 146.62, 146.34

- Resistance levels: 148.56, 149.18, 150.34

From a technical point of view, the medium-term trend of the USD/JPY is bearish. Yesterday, the Japanese yen consolidated above 147.92, but the breakout occurred without impulsive candles, indicating a lack of reaction to higher liquidity. The price will likely return below this level, and today’s inflation news could be the trigger. For sell deals, consider the resistance level of 148.56, but with confirmation. There are currently no optimal entry points for buying.

Alternative scenario:if the price breaks through the support level of 150.91 and consolidates below it, the downtrend will resume.

No news for today

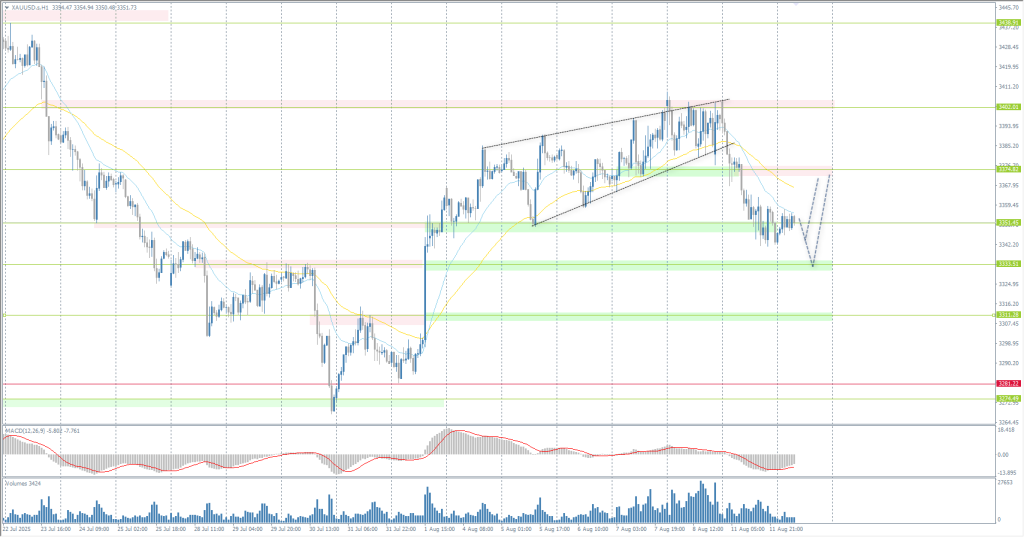

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 3404

- Prev. Close: 3343

- % chg. over the last day: -1.82 %

On Tuesday, gold prices rose to around $3,350 per ounce after a sharp drop in the previous session, as investors shifted their attention to the US consumer inflation report, which could provide new clues about the Federal Reserve’s interest rate policy. On Monday, the precious metal fell after President Donald Trump said that gold would not be subject to tariffs, following earlier reports that imports of bullion could be subject to duties. At the same time, Trump extended the truce with China for another 90 days, a few hours before the new tariffs were imposed, easing tensions between the world’s two largest economies.

Trading recommendations

- Support levels: 3351, 3333, 3311, 3281

- Resistance levels: 3374, 3402, 3433

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold has corrected to the support level of 3351, where buyers are trying to seize the initiative within the day. Another wave of decline to 3333 cannot be ruled out in order to gain more liquidity for further growth. It is precisely the levels of 3333 and 3351 that should be considered for buy deals to continue the upward trend. There are currently no optimal entry points for sales.

Alternative scenario:if the price breaks the support level of 3281 and consolidates below it, the downtrend will likely resume.

News feed for: 2025.08.12

- US Consumer Price Index (m/m) at 15:30 (GMT+3).

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.