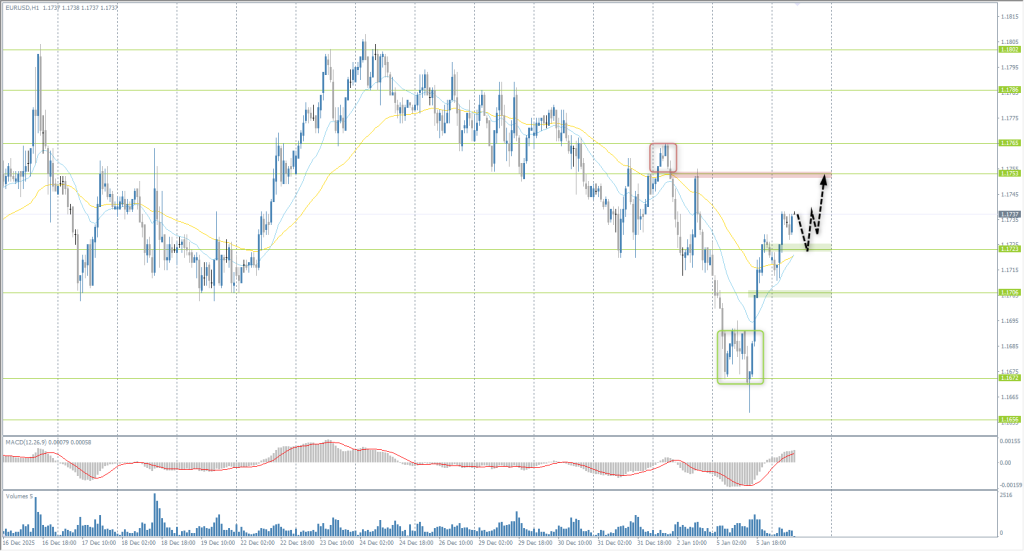

The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.1721

- Prev. Close: 1.1721

- % chg. over the last day: 0.0%

The Dollar Index lost most of its early gains and traded just above 98.5 as geopolitical fears surrounding Venezuela eased and weak macro data dampened sentiment. Additional pressure came from ISM data: the December Index showed the sharpest contraction in the manufacturing sector since 2024, intensifying doubts about the resilience of the US economy. Markets are focused on a series of key releases this week, including the employment report, JOLTS, ADP, and the University of Michigan Consumer Sentiment Index. Despite a more cautious Fed outlook, investors still price in two rate cuts this year, limiting the dollar’s potential for strength.

Trading recommendations

- Support levels: 1.1723, 1.1706, 1.1680, 1.1656, 1.1590, 1.1555, 1.1503

- Resistance levels: 1.1753, 1.1765, 1.1786, 1.1802, 1.1833

The euro recovered sharply following the decline in the Dollar Index. The price consolidated above the 1.1723 level, opening potential opportunities up to 1.1753 and higher. For buys, the 1.1723 level or EMA lines can be considered, but with confirmation. For sell deals, assess the price reaction at 1.1753.

Alternative scenario:- Trend: Neutral

- Sup: 1.1723

- Res: 1.1753

- Note: Consider buy deals from the 1.1723 level or EMA lines, but with confirmation. For sales, evaluate price reaction at 1.1753.

News feed for: 2026.01.06

- Eurozone Services PMI (m/m) at 11:00 (GMT+2); – EUR (MED)

- German Consumer Price Index (m/m) at 15:00 (GMT+2); – EUR (MED)

- US Services PMI (m/m) at 16:45 (GMT+2). – USD (MED)

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.3447

- Prev. Close: 1.3541

- % chg. over the last day: +0.70 %

The British pound held near $1.346, remaining close to a three-month high, as markets focus on the monetary policy divergence between the Bank of England and the Fed. Expectations of at least two US rate cuts this year continue to pressure the dollar, while markets price in only one additional cut for the Bank of England in 2026, supporting the pound’s relative yield.

Trading recommendations

- Support levels: 1.3526, 1.3491, 1.3437, 1.3402, 1.3347, 1.3354, 1.3292

- Resistance levels: 1.3586

The British pound appears stronger than the euro. The price has consolidated above the 1.3526 level, with an intraday bias favoring buyers. There is a high probability of a test of the 1.3586 resistance level. For buys, it is best to use the EMA lines or the 1.3526 support level, but with confirmation. No optimal entry points for sales currently.

Alternative scenario:- Trend: Up

- Sup: 1.3526

- Res: 1.3586

- Note: Consider buy deals from the EMA lines or from the 1.3526 support, but with confirmation. No optimal entry points for sales at this time.

News feed for: 2026.01.06

- UK Services PMI (m/m) at 11:30 (GMT+2). – GBP (MED)

The USD/JPY currency pair

Technical indicators of the currency pair:

- Prev. Open: 156.70

- Prev. Close: 156.36

- % chg. over the last day: -0.22 %

On Tuesday, the Japanese yen strengthened to 156 per dollar, recovering from a decline to a two-week low amid rising expectations for further BoJ policy tightening. The currency was supported by statements from Governor Kazuo Ueda, who confirmed readiness to adjust interest rates as the economy and price dynamics evolve in line with the regulator’s baseline expectations. Ueda’s comments reinforced market confidence that Japan is finally exiting its multi-year deflationary regime and transitioning to a more sustainable growth model.

Trading recommendations

- Support levels: 156.00, 155.69, 154.92, 154.41, 154.17

- Resistance levels: 156.56, 156.96, 157.28, 157.78, 159.47

The Japanese yen has strengthened against the dollar. The price consolidated impulsively below 156.56 and failed to break back above after a test. The price is now heading toward a test of the 156.00 support level. For sales, consider the EMA lines or the 156.56 resistance level. For buys, evaluate the price reaction at the 156.00 level.

Alternative scenario:- Trend: Neutral

- Sup: 156.00

- Res: 156.56

- Note: Looking for sell deals from 156.56 or EMA lines, but with confirmation. For buys, evaluate price reaction at the 156.00 level.

No news for today

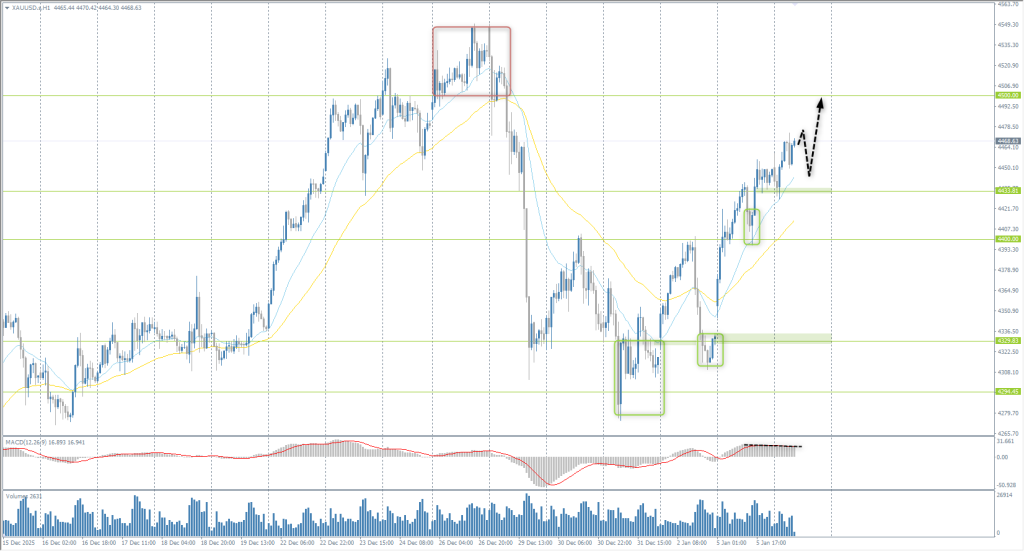

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 4354

- Prev. Close: 4449

- % chg. over the last day: +2.19 %

On Tuesday, gold rose above $4,460 per ounce, continuing its growth for a third consecutive session amid increased safe-haven demand. Market momentum was driven by events in Venezuela. Donald Trump’s statements regarding a temporary governance of Venezuela and possible further strikes intensified geopolitical uncertainty and supported interest in gold. Additional investor focus is on US macro data, primarily Friday’s December employment report, which could impact Fed policy expectations. Meanwhile, comments from Minneapolis Fed President Neel Kashkari, pointing to persistent inflationary pressures and risks of rising unemployment, added to the uncertainty surrounding the rate trajectory, which also benefits gold.

Trading recommendations

- Support levels: 4433, 4400, 4329, 4294

- Resistance levels: 4500, 4550

Gold has consolidated above 4433 and is now aiming for a test of the 4500 resistance. The intraday bias favors buyers, though small false moves down to the EMA lines are possible. Buy trades should be sought from the 4433 support level or the EMA lines. No optimal entry points for sales currently.

Alternative scenario:- Trend: Neutral

- Sup: 4433

- Res: 450

- Note: Consider buy trades from the 4433 support level or the EMA lines. No optimal entry points for sell deals at this time.

News feed for: 2026.01.06

- US Services PMI (m/m) at 16:45 (GMT+2). – USD (MED)

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.