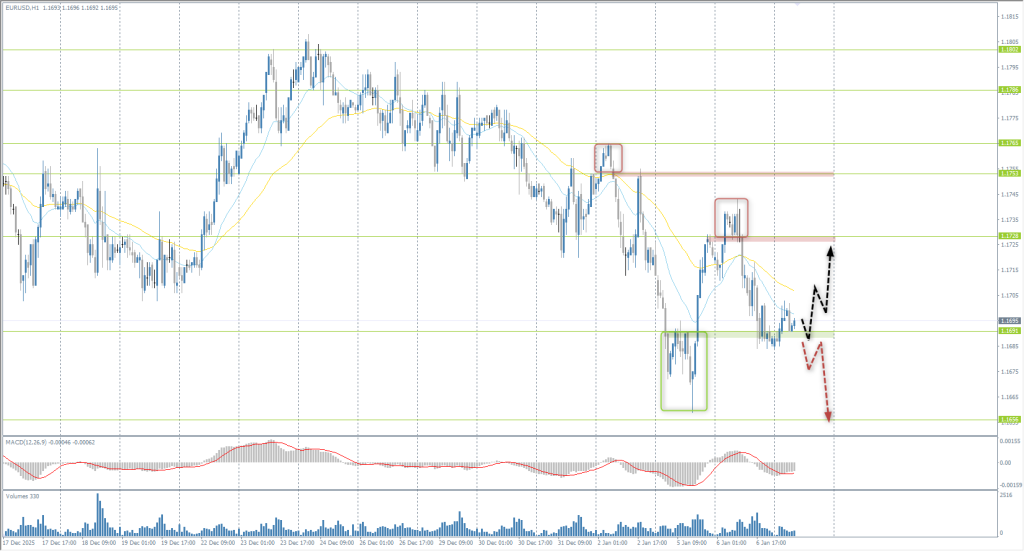

The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.1719

- Prev. Close: 1.1688

- % chg. over the last day: -0.26%

The euro lost its morning gains and traded near $1.17 as fresh European inflation data pointed to easing price pressures and reduced expectations of ECB policy tightening. In Germany, December inflation slowed to 1.8% y/y, falling below the 2.0% expectations and dropping below the ECB’s target for the first time since September 2024. This decline was driven by cheaper food and a sharper drop in energy prices. At the Eurozone level, the Harmonized Index of Consumer Prices rose by only 2.0%, the lowest since July and also below expectations (2.2%). Following this data, money markets have practically ruled out an ECB rate hike by December 2026, with the probability of tightening by March 2027 estimated at only about 24%.

Trading recommendations

- Support levels: 1.1691, 1.1656, 1.1590, 1.1555, 1.1503

- Resistance levels: 1.1728, 1.1753, 1.1765, 1.1786, 1.1802, 1.1833

The euro failed to consolidate above 1.1728. The price formed a locked balance above this level before dropping impulsively. The price has now reached the support level of 1.1691, where buy trades can be considered. A drop below this level is highly undesirable for buyers, as it would trigger a sell-off toward 1.1656.

Alternative scenario:- Trend: Neutral

- Sup: 1.1691

- Res: 1.1753

- Note: Consider buys from the 1.1691 level, but with confirmation. Consolidation below this price will trigger a sell-off to 1.1656.

News feed for: 2026.01.07

- German Retail Sales (m/m) at 09:00 (GMT+2); – EUR (MED)

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+2); – EUR (MED)

- US ADP Non-Farm Employment Change (m/m) at 15:15 (GMT+2); – USD (MED)

- US ISM Services PMI (m/m) at 17:00 (GMT+2); – USD (MED)

- US JOLTs Job Openings (m/m) at 17:00 (GMT+2); – USD (HIGH)

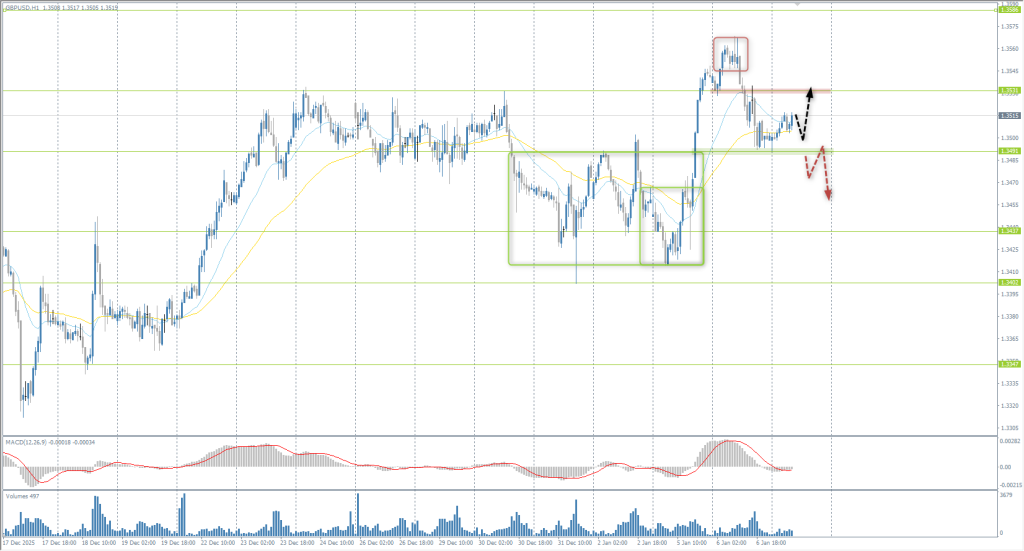

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.3537

- Prev. Close: 1.3501

- % chg. over the last day: -0.27 %

Last year, the British pound had significantly less influence on GBP/USD dynamics than the US dollar. Against a backdrop of faster-than-expected inflation cooling in the UK, the Bank of England’s view has strengthened that inflation could approach the 2% target by spring. This increases the likelihood of a weaker pound, if not against the dollar, then at least against other currencies, as markets begin to price in a more dovish monetary policy course in the coming months. Looking ahead, investors are already factoring in another 25 bps rate cut by the Bank of England to 3.5%, though the policy trajectory will depend on the speed of disinflation and economic growth dynamics.

Trading recommendations

- Support levels: 1.3526, 1.3491, 1.3437, 1.3402, 1.3347, 1.3354, 1.3292

- Resistance levels: 1.3586

The British pound has corrected to the support level of 1.3491. It is crucial for buyers to hold the price above this level. An impulsive drop below 1.3491 could trigger a sell-off to 1.3467 and lower. As long as this hasn’t happened, look for intraday buys from 1.3491 with a target of 1.3531.

Alternative scenario:- Trend: Up

- Sup: 1.3491

- Res: 1.3531

- Note: Consider buys from support at 1.3491, but with confirmation. There are currently no optimal entry points for sales.

News feed for: 2026.01.07

- UK Services PMI (m/m) at 11:30 (GMT+2). – GBP (MED)

The USD/JPY currency pair

Technical indicators of the currency pair:

- Prev. Open: 156.33

- Prev. Close: 156.63

- % chg. over the last day: +0.19 %

On Wednesday, the Japanese yen weakened to 156.5 per dollar, continuing its decline for a second session amid deteriorating sentiment due to rising tensions with China. Beijing introduced export restrictions on military-related supplies to Japan, including electronics, sensors, and aerospace technologies, in response to PM Sanae Takaichi’s statements regarding Taiwan last year. Domestically, the market still expects the Bank of Japan to continue raising rates in 2026. Governor Kazuo Ueda emphasized that further policy adjustments would depend on economic and price dynamics, expressing confidence in the persistence of a sustainable wage-inflation cycle.

Trading recommendations

- Support levels: 156.00, 155.69, 154.92, 154.41, 154.17

- Resistance levels: 156.96, 157.28, 157.78, 159.47

The Japanese yen has consolidated below 156.56. A locked balance formed above this level, which will now act as a resistance zone. The intraday bias favors sellers. Sell trades can be considered from 156.56, but with confirmation. No optimal entry points for buys currently.

Alternative scenario:- Trend: Neutral

- Sup: 156.00

- Res: 156.56

- Note: Look for sales from 156.56 or EMA lines, but with confirmation. Profit target is the support level of 156.00.

No news for today

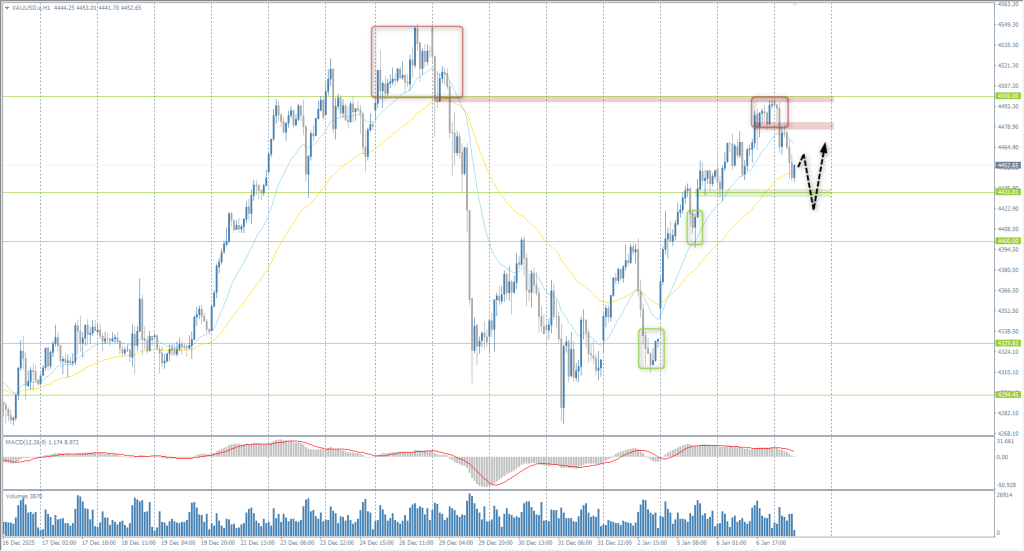

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 4450

- Prev. Close: 4494

- % chg. over the last day: +0.98 %

On Tuesday, gold prices rose to $4,500 per ounce, hitting a weekly high and continuing the rally following Monday’s 3% jump. Increased safe-haven demand was driven by escalating geopolitical tensions and expectations of US monetary policy easing. The market gained momentum from the US detention of Venezuelan President Nicolás Maduro over the weekend. President Donald Trump stated that Washington is temporarily “managing” Venezuela and threatened a second strike if US demands are not met. On Monday, Maduro pleaded not guilty in a New York court to charges related to narco-terrorism and weapons possession, further heightening market nervousness.

Trading recommendations

- Support levels: 4433, 4400, 4329, 4294

- Resistance levels: 4500, 4550

Gold reached a weekly high at the 4,500 resistance level, where profit-taking began. The price is currently correcting, and the 4433 support level is of interest to buyers. Initiative-driven reaction is key here. No optimal entry points for buys at this exact moment.

Alternative scenario:- Trend: Neutral

- Sup: 4433

- Res: 4500

- Note: Look for buy trades from the 4433 support level, but with confirmation. No optimal entry points for sales currently.

News feed for: 2026.01.07

- US ADP Non-Farm Employment Change (m/m) at 15:15 (GMT+2); – USD (MED)

- US ISM Services PMI (m/m) at 17:00 (GMT+2); – USD (MED)

- US JOLTs Job Openings (m/m) at 17:00 (GMT+2); – USD (HIGH)

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.