The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.1954

- Prev. Close: 1.1971

- % chg. over the last day: +0.14%

On Thursday, the euro demonstrated moderate strengthening against the backdrop of overall US dollar weakness. Additional support for the single currency came from Eurozone macroeconomic data. A key factor was the improvement in regional economic sentiment: the Eurozone Economic Sentiment Indicator rose by 2.2 points in January to reach 99.4 – its highest level in three years. At the same time, money supply data came in slightly weaker than projections. The M3 aggregate volume increased by 2.8% year-on-year in December, falling short of the expected 3.0%. This factor partially limited the euro’s growth potential, indicating still-subdued rates of credit activity and liquidity. Overall, the dollar continues to show fundamental weakness, as the FOMC is expected to cut interest rates by approximately 50 basis points in 2026, while the ECB is expected to keep rates unchanged throughout the year.

Trading recommendations

- Support levels: 1.1908, 1.1859, 1.1835, 1.1805, 1.1754

- Resistance levels: 1.2050, 1.3000

Compared to yesterday, the picture remains virtually unchanged. The market has entered a sideways consolidation phase with estimated boundaries of 1.1908-1.2050. The current dynamics are worrying buyers: the price is testing the 1.1908 support for the fourth time in the last three days, which statistically increases the risk of a breakout and indicates weakening demand in this zone. Sales only make sense after a confident breakout of 1.1908, with a near-term target around 1.1859 (the first liquidity zone below). Buys remain relevant, but only upon the appearance of bullish initiative: either from 1.1908 (clear reaction, volume, momentum) or from the stronger support at 1.1859. While the price is boxed in the range and trading at the lower boundary, the priority is to wait for confirmation rather than acting prematurely.

Alternative scenario:- Trend: Up

- Sup: 1.1908

- Res: 1.2049

- Note: For buy deals, сonsider sells only after a breakout of 1.1908 with a target of 1.1859. For buy trades, wait for initiative from buyers.

News feed for: 2026.01.30

- Eurozone GDP (m/m) at 12:00 (GMT+2); – EUR (MED)

- German Inflation Rate (m/m) at 15:00 (GMT+2); – EUR (MED)

- US Producer Price Index (m/m) at 15:30 (GMT+2); – USD (HIGH)

- US Chicago PMI (m/m) at 16:45 (GMT+2). – USD (LOW)

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.3799

- Prev. Close: 1.3807

- % chg. over the last day: +0.06 %

In the UK, fresh BRC data pointed to accelerating price pressures, heightening concerns regarding inflation persistence, which may limit the Bank of England’s room for rate cuts in the short term. At the same time, the recent strengthening of the British pound, driven by general US dollar weakness, could partially mitigate imported inflation and support inflation expectations, offsetting some of the pressure from domestic prices. Sterling is holding above the $1.38 mark, hovering near its highest level since September 2021.

Trading recommendations

- Support levels: 1.3752, 1.3725, 1.3670, 1.3646, 1.3568

- Resistance levels: 1.3871, 1.4000

The technical picture for the pound largely mirrors the euro’s dynamics. The price is correcting, and the 1.3752 support level is noticeably weakening due to a series of retests, increasing the probability of a breakout. The intraday bias is currently tilted toward sellers. However, the overall trend remains bullish, so the downward move currently looks like a correction rather than a reversal. In current conditions, sell trades only make sense within the framework of a correction, targeting the nearest support levels without attempting to hold the position against the primary trend. For buys, the 1.3725 level remains the key zone – it is crucial to see buyer initiative and confirmation of interest here. If 1.3725 breaks, pressure could intensify, leading to a deeper sell-off toward the 1.3670 area.

Alternative scenario:- Trend: Up

- Sup: 1.3752

- Res: 1.3871

- Note: Look for buy trades from the 1.3725 support level, but with confirmation. A breakout of 1.3725 will trigger a sell-off to 1.3670.

No news for today

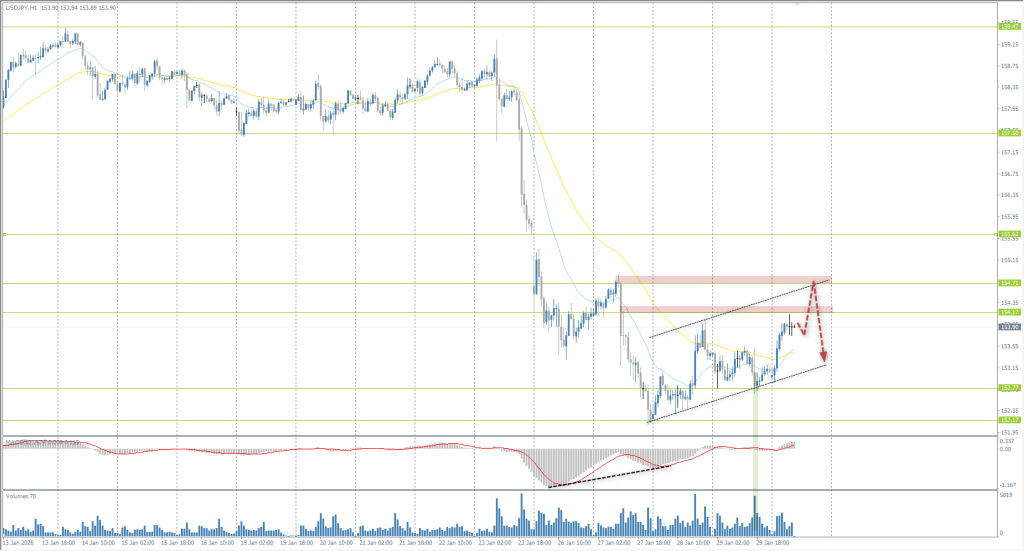

The USD/JPY currency pair

Technical indicators of the currency pair:

- Prev. Open: 153.39

- Prev. Close: 153.08

- % chg. over the last day: -0.20 %

On Friday, the Japanese yen weakened toward the 154 mark against the dollar but retained potential for its first monthly gain since August. Since the start of the month, the yen has gained about 2%, supported by persistent talk of possible currency intervention, which previously pushed the rate to a four-month high. Recent macroeconomic data from Japan was mixed: retail sales unexpectedly declined in December, pointing to weak domestic demand, while industrial production fell less than expected, partially cushioning the negative impact on the yen.

Trading recommendations

- Support levels: 152.77, 152.17, 151.54

- Resistance levels: 154.17, 154.71, 155.62

The yen has started a corrective move from the 152.17 level without reaching the expected liquidity pool below 151.54, indicating premature profit-taking and rising counter-demand. The price is currently trading near resistance zones, so the key moment will be the sellers’ reaction and the nature of price behavior at these levels. Sell trades only make sense if a confirmed bearish initiative appears around 154.17 or 154.71. Entering without a reaction is risky, as the correction could evolve into a deeper recovery. A breakout above 154.71 would be an extremely negative signal for sellers and would cast doubt on the continuation of the current downtrend.

Alternative scenario:- Trend: Down

- Sup: 152.77

- Res: 154.17

- Note: Consider sell trades from resistance levels 154.17 or 154.71, but only with confirmation. A breakout of 154.71 is highly undesirable for the maintenance of the downtrend.

News feed for: 2026.01.30

- Japan Tokyo Core CPI (m/m) at 01:30 (GMT+2); – JPY (MED)

- Japan Unemployment Rate (m/m) at 01:30 (GMT+2); – JPY (MED)

- Japan Retail Sales (m/m) at 01:50 (GMT+2). – JPY (LOW)

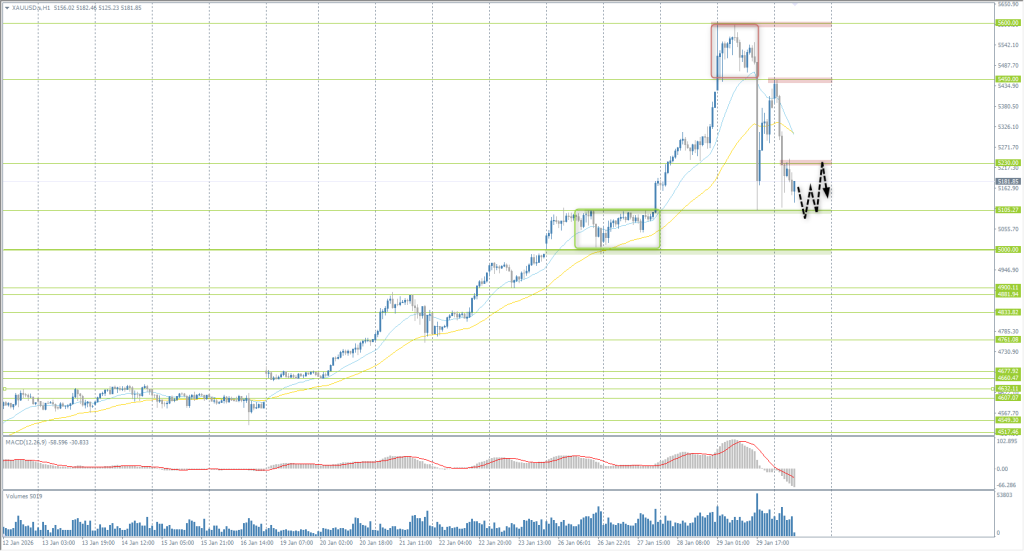

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 5422

- Prev. Close: 5377

- % chg. over the last day: -0.83 %

Gold prices dropped sharply yesterday, falling toward the $5200 per ounce level as investors took profits following a massive rally that saw prices hit an all-time high near $5600. However, geopolitical tensions continue to influence market sentiment. Iran stated its readiness to “defend and respond like never before” to new threats from the US. The situation escalated further after the European Union designated the Islamic Revolutionary Guard Corps as a terrorist organization, the US increased its military presence near Iran, and Tehran conducted live-fire exercises in the Strait of Hormuz.

Trading recommendations

- Support levels: 5105, 5000, 4900

- Resistance levels: 5230, 5450, 5600

Strong profit-taking occurred in the gold market yesterday, largely driven by the futures contract rollover. Within the current contract, liquidity remains limited, resulting in sustained high volatility. There is a high probability that gold is entering an accumulation phase to build liquidity after the impulsive growth. It is advisable to evaluate buying activity at the 5105 and 5000 support levels, where bullish initiative may emerge. For sell scenarios, focus on price reactions in the 5230 and 5450 zones, from which local movements within the consolidation are possible.

Alternative scenario:- Trend: Neutral

- Sup: 5105

- Res: 5230

- Note: For buy deals, evaluate the reaction at support levels 5105 and 5000. For sells, look for confirmation at 5230 and 5450.

News feed for: 2026.01.30

- US Producer Price Index (m/m) at 15:30 (GMT+2); – USD (HIGH)

- US Chicago PMI (m/m) at 16:45 (GMT+2). – USD (LOW)

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.