The EUR/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.1815

- Prev. Close: 1.1807

- % chg. over the last day: -0.07%

The euro traded near the $1.18 mark amid expectations of the ECB decision and the assessment of fresh inflation data. January statistics showed a further slowdown in Eurozone price pressure: the headline CPI dropped to 1.7% YoY, while core inflation fell to 2.2%, hitting multi-year lows. Given these figures, the market has little doubt that the European Central Bank (ECB) will keep rates unchanged today. The regulator continues to evaluate the impact of a strong euro and the influx of cheap imports from China on inflation prospects; meanwhile, signals are increasingly suggesting that further strengthening of the single currency could bring the discussion of monetary easing back to the table.

Trading recommendations

- Support levels: 1.1777, 1.1754, 1.1726

- Resistance levels: 1.1839, 1.1874, 1.1953, 1.1859, 1.2050, 1.3000

Yesterday, the euro reversed downward from resistance near 1.1839, shifting focus to the 1.1754-1.1777 support zone, where significant liquidity is concentrated. Price behavior in this range today will be the key benchmark for the market to assess buyers’ readiness to defend current levels. In the event of a sharp buyback after a support test and a return above the range, an intraday bullish scenario could form with a re-test target at 1.1839. However, a confident, impulsive breakout of the 1.1777 mark would indicate seller dominance and increase the likelihood of continued decline toward the next liquidity zone below 1.1726.

Alternative scenario:- Trend: Down

- Sup: 1.1777

- Res: 1.1839

- Note: For buy deals, a false breakout of 1.1777 is required. For sells, expect a confident impulsive breakout of 1.1777.

News feed for: 2026.02.05

- Eurozone ECB Interest Rate Decision at 15:15 (GMT+2); – EUR (HIGH)

- Eurozone ECB Deposit Facility Rate at 15:15 (GMT+2); – EUR (HIGH)

- US Initial Jobless Claims (w/w) at 15:30 (GMT+2); – USD (MED)

- Eurozone ECB Press Conference at 15:45 (GMT+2); – EUR (MED)

The GBP/USD currency pair

Technical indicators of the currency pair:

- Prev. Open: 1.3693

- Prev. Close: 1.3652

- % chg. over the last day: -0.30 %

The Bank of England will hold its meeting today, with the market expecting the key rate to be maintained at 3.75%. Despite slowing wage growth, December inflation data exceeded 3%, forcing the regulator to act cautiously. The base case suggests a split vote within the committee. The key event for investors will be the updated Monetary Policy Report, where the Bank may adjust its macroeconomic projections. The main risk for the pound remains a potential shift toward a more dovish rhetoric. If the minutes indicate an expansion of the “dovish” camp, pressure on GBP will intensify, as the market is currently pricing in almost no policy easing in the near term.

Trading recommendations

- Support levels: 1.3622, 1.3568

- Resistance levels: 1.3674, 1.3732, 1.3787, 1.3871, 1.4000

The British pound has weakened notably and is currently testing the liquidity pool below the 1.3622 support, making this zone critical for short-term dynamics. Price reaction here will determine the further direction and show whether buyers are ready to seize the initiative. A false breakout of the level could trigger a sharp reversal upward with a target near 1.3674, while a confident impulsive breakout of 1.3622 would open the path for an accelerated sell-off toward 1.3568. That said, the presence of MACD divergence and SMT divergence with EUR/USD shifts the balance of risks toward a bounce, making the growth scenario more likely.

Alternative scenario:- Trend: Neutral

- Sup: 1.3622

- Res: 1.3674

- Note: For buy deals, a false breakout of 1.3622 is required. For sells, expect a confident impulsive breakout of 1.3622.

News feed for: 2026.02.05

- UK BoE Interest Rate Decision at 14:00 (GMT+2); – GBP (HIGH)

- UK BoE Monetary Policy Report at 14:00 (GMT+2). – GBP (HIGH)

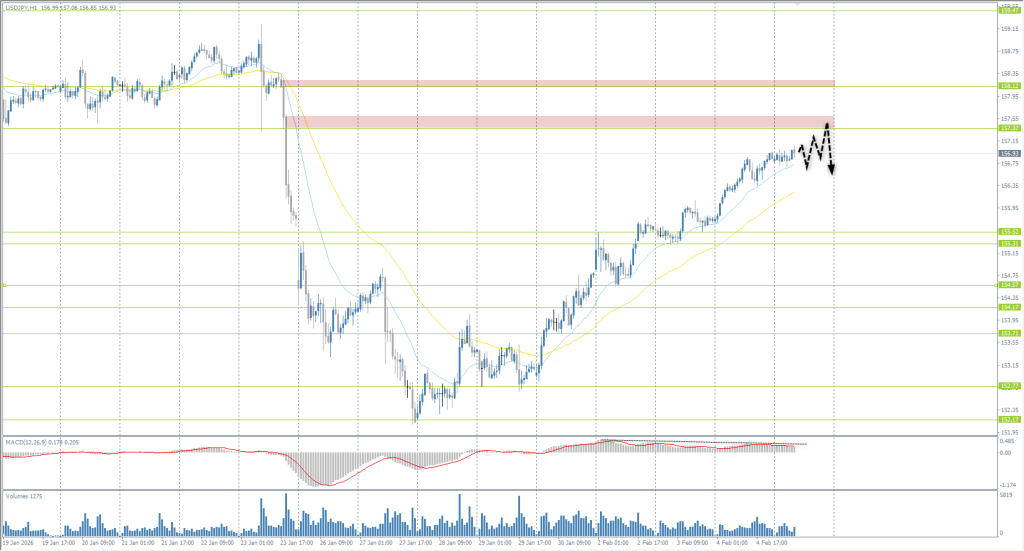

The USD/JPY currency pair

Technical indicators of the currency pair:

- Prev. Open: 155.72

- Prev. Close: 156.83

- % chg. over the last day: +0.71 %

On Thursday, the yen traded near 157 per dollar, remaining at nearly two-week lows and losing over 1% since the start of the week due to political uncertainty ahead of the Lower House elections. Expectations that the ruling party under Prime Minister Takaichi will strengthen its position have increased pressure on Japanese assets, as her course toward expanding fiscal spending raises concerns about debt sustainability and curbs demand for the yen.

Trading recommendations

- Support levels: 155.52, 155.31, 154.57, 154.17, 153.71, 152.77, 152.17

- Resistance levels: 157.37, 158.12

The Japanese yen is slowly but surely moving toward the 157.37 resistance level. EMA lines continue to serve effectively as dynamic support. Meanwhile, divergence continues to form on the MACD, signaling a weakening of the growth momentum. However, without the appearance of a clear counter-initiative from sellers, it is premature to speak of a reversal. In current market conditions, it is logical to consider intraday buys targeting 157.37 or even 158.12. Sells require initiative from sellers.

Alternative scenario:- Trend: Up

- Sup: 155.52

- Res: 157.37

- Note: Look for buy trades from the EMA lines targeting 157.37 or 158.12. There are no optimal entry points for sells.

No news for today

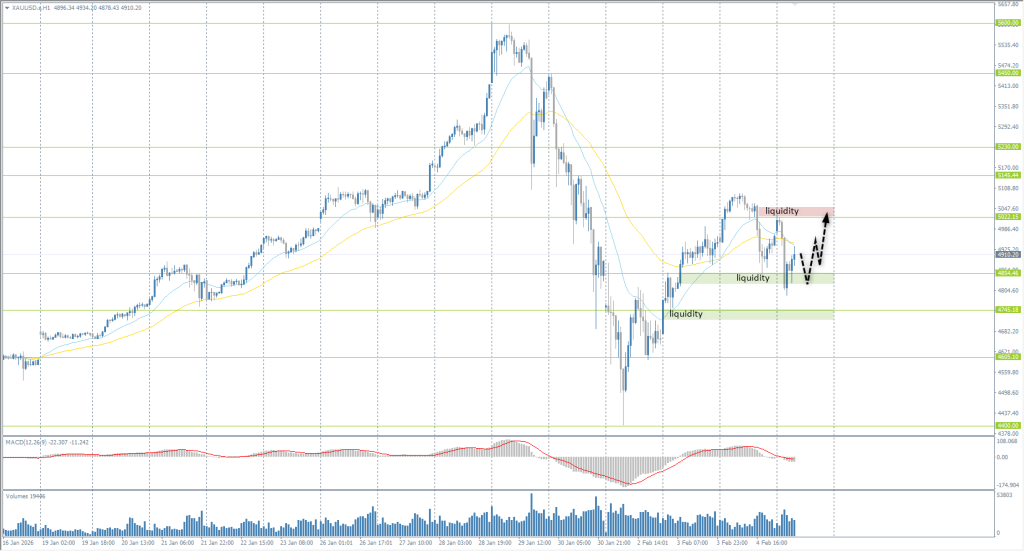

The XAU/USD currency pair (gold)

Technical indicators of the currency pair:

- Prev. Open: 4960

- Prev. Close: 4965

- % chg. over the last day: +0.10 %

On Wednesday, gold pulled back from recent highs and traded just below the $5,000 level as the market reassessed fresh US macro data. Amid the delay of key labor market statistics, investors focused on the ADP report, which indicated weaker-than-expected private payroll growth, while strong ISM services data confirmed resilient economic activity. Previously, gold experienced a sharp surge, rising over 6%, its largest daily gain since the 2008 financial crisis, fueled by the return of buyers after a sharp correction early in the week.

Trading recommendations

- Support levels: 4854, 4745, 4605, 4400

- Resistance levels: 5022, 4948, 5145, 5230

Gold declined sharply, forming a false breakout of the support near 4854, after which the market likely moved to redistribute the captured liquidity. This shifts the focus upward toward the zone above 5022, which now acts as the key target for recovery. Within the day, the current structure allows for the consideration of buys, whereas for short positions, it is advisable to wait for price reaction near and above 5022. Market behavior in this area will allow us to assess whether growth potential remains or if the move is exhausting itself.

Alternative scenario:- Trend: Neutral

- Sup: 4854

- Res: 5022

- Note: Look for intraday buys targeting 5022. Sells should only be considered after evaluating the price reaction to liquidity above 5022.

News feed for: 2026.02.05

- US Initial Jobless Claims (w/w) at 15:30 (GMT+2). – USD (MED)

This article reflects a personal opinion and should not be interpreted as an investment advice, and/or offer, and/or a persistent request for carrying out financial transactions, and/or a guarantee, and/or a forecast of future events.