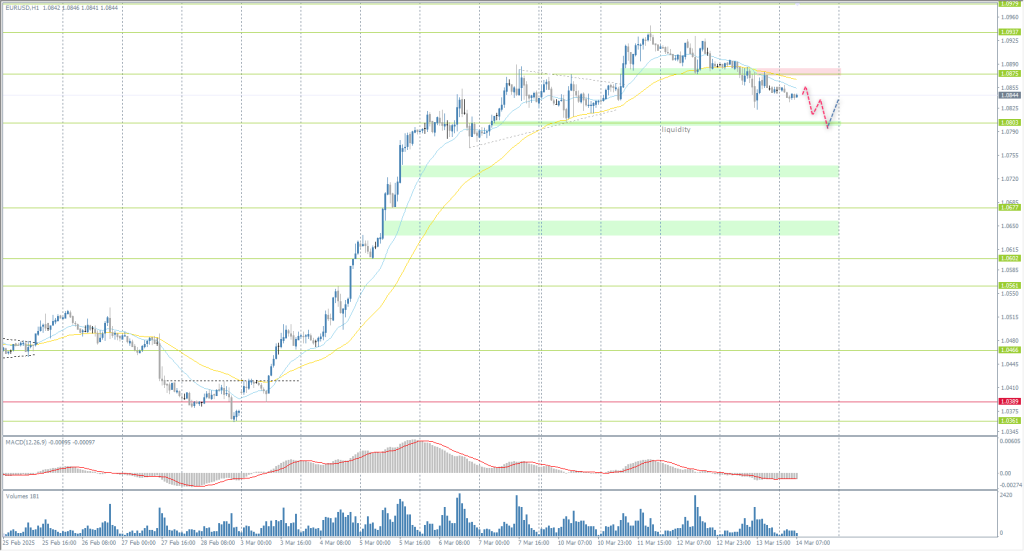

The EUR/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.0889

- 前一收盤價: 1.0852

- 過去一天的變化%: -0.34 %

The euro fell below $1.09, retreating from four-month highs reached earlier this month, as traders keep a close eye on escalating trade tensions. In the latest developments, President Trump threatened to impose 200% tariffs on all wines, champagne, and other alcoholic beverages from the EU in response to a retaliatory tax on US whiskey announced by the EU earlier in the week. Meanwhile, the Russian president has not backed a temporary truce previously brokered by Ukraine and the United States. In Germany, parliament is debating a new budget package, including a 500 billion euro infrastructure fund aimed at boosting infrastructure and defense.

交易建議

- 支撐價位: 1.0803, 1.0677, 1.0602, 1.0561, 1.0466

- 阻力價位: 1.0875, 1.0937, 1.0979

The EUR/USD currency pair’s hourly trend is bullish. The price is correcting. The support level of 1.0875 was broken, and now it is the resistance level. Sellers will seek to bring the price down to 1.0803 to test liquidity. Intraday, you can look for sell trades from EMA lines or from 1.0875 resistance level, but with confirmation. Buying should be considered from 1.0803, also subject to a buying reaction.

選擇場景:if the price breaks through the support level of 1.0803 and consolidates below it, the downtrend will likely resume.

新聞動態: 2025.03.14

- US Michigan Consumer Sentiment (m/m) at 16:00 (GMT+2).

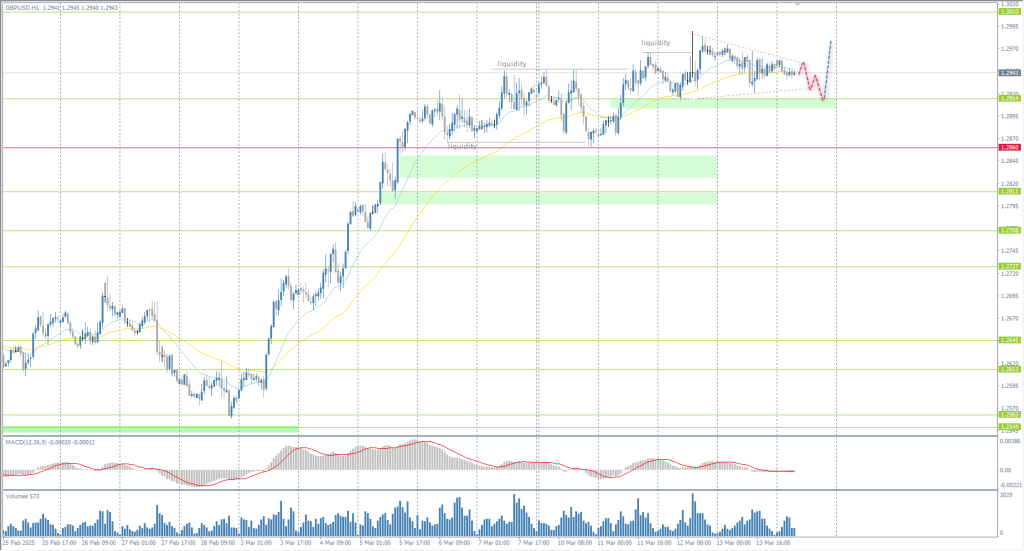

The GBP/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.2965

- 前一收盤價: 1.2948

- 過去一天的變化%: +0.13 %

The latest US PPI and CPI data showed that price pressures eased in February, which gives the Fed more room to cut rates. In turn, traders cut bets on a Bank of England rate cut to 52bp for 2025, meaning UK interest rates will remain elevated for longer. This situation will create some parity between the dollar and the pound. Today, the UK will publish several economic data, including the GDP report. Even a slight rise in the economy could help sterling gain strength.

交易建議

- 支撐價位: 1.2914, 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- 阻力價位: 1.3010

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish. The situation has not changed much. Buyers will seek to test the liquidity zone above 1.3010. Currently, the price is forming a narrowing wedge, a harbinger of an impulsive movement. It is best to consider the EMA lines or the support level at 1.2914. Selling should be looked for from 1.3010, subject to sellers’ reaction.

選擇場景:if the price breaks the support level of 1.2860 and consolidates below it, the downtrend will likely resume.

新聞動態: 2025.03.14

- UK GDP (q/q) at 09:00 (GMT+2);

- UK Industrial Production (m/m) at 09:00 (GMT+2);

- UK Manufacturing Production (m/m) at 09:00 (GMT+2);

- UK Trade Balance (m/m) at 09:00 (GMT+2).

The USD/JPY currency pair

貨幣對的技術指標:

- 前一開盤價: 148.23

- 前一收盤價: 147.73

- 過去一天的變化%: -0.33 %

The Japanese yen slid to 148 per dollar on Friday, reversing the gains of the previous session, as escalating global trade tensions boosted the dollar against major currencies. Earlier this week, Japanese companies agreed to significant wage hikes for the third straight year to help workers cope with inflation and address labor shortages. The wage hikes are expected to boost consumer spending, spur inflation, and give the Bank of Japan more room for future rate hikes. The Central Bank is expected to keep rates unchanged next week, but if inflationary pressures persist, policymakers will likely resort to further rate hikes this year.

交易建議

- 支撐價位: 147.61, 146.65, 146.00

- 阻力價位: 148.45, 149.19, 150.16, 151.29, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. The Japanese yen is starting to form a broadly volatile flat. Yesterday, the price tested the liquidity below 147.61, where the buyers took the initiative. Now, the price has reached the supply zone near the resistance level at 148.45. Here we can consider selling, but only after the sellers’ reaction. Profit targets are 148.17 and 147.61.

選擇場景:if the price breaks above the resistance at 151.29, the uptrend will likely resume.

今天沒有新聞

The XAU/USD currency pair (gold)

貨幣對的技術指標:

- 前一開盤價: 2933

- 前一收盤價: 2988

- 過去一天的變化%: +1.87 %

Gold prices rose more than 1% on Thursday to surpass $2,990 per ounce, hitting new record highs amid heightened risk aversion and bets on Federal Reserve monetary easing. Escalating trade tensions spurred a flight to safety, with US President Trump threatening to impose 200% tariffs on wine and other alcoholic beverages from the EU in response to the bloc’s recently announced tariffs on US whiskey. Geopolitical concerns also impacted sentiment, as Russia announced its rejection of a 30-day ceasefire accepted by Ukraine and backed by the US.

交易建議

- 支撐價位: 2976, 2954, 2930, 2906, 2896, 2859, 2833

- 阻力價位: 3000

From the point of view of technical analysis, the trend on the XAU/USD has changed to an uptrend. The price is trading at historical highs and is aiming for the psychological mark of 3000. For buying, we can consider EMA lines or support level 2976, but with confirmation. For selling, there are no optimal entry points right now, as there is a lack of counter-selling initiatives.

選擇場景:if the price breaks below the support level 2906, the downtrend will likely resume.

新聞動態: 2025.03.14

- US Michigan Consumer Sentiment (m/m) at 16:00 (GMT+2).

本文僅反映個人觀點,不應被視為投資建議和/或要約和/或進行金融交易的持續要求和/或擔保和/或對未來事件的預測。