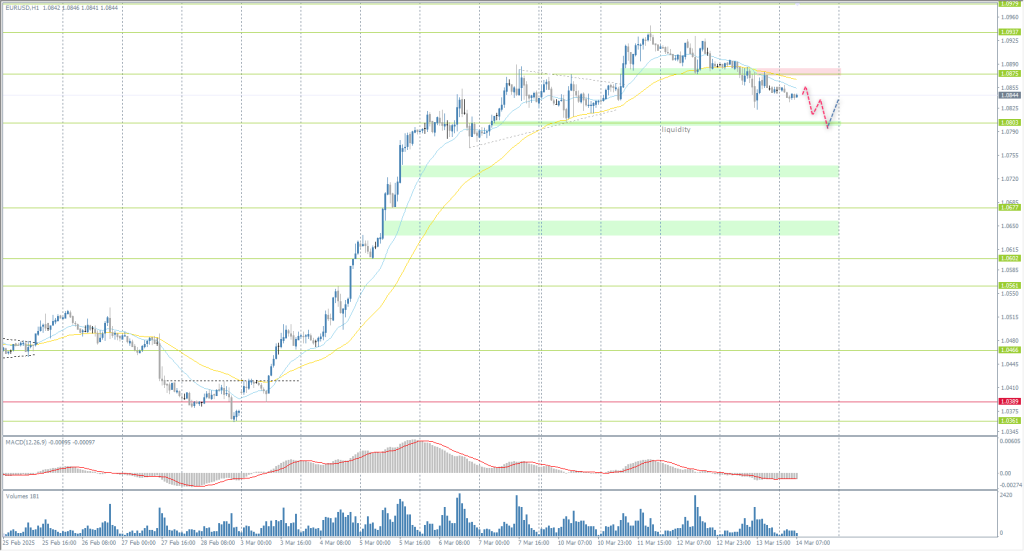

The EUR/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.0889

- Đóng trước đó: 1.0852

- % thay đổi 24 giờ qua: -0.34 %

The euro fell below $1.09, retreating from four-month highs reached earlier this month, as traders keep a close eye on escalating trade tensions. In the latest developments, President Trump threatened to impose 200% tariffs on all wines, champagne, and other alcoholic beverages from the EU in response to a retaliatory tax on US whiskey announced by the EU earlier in the week. Meanwhile, the Russian president has not backed a temporary truce previously brokered by Ukraine and the United States. In Germany, parliament is debating a new budget package, including a 500 billion euro infrastructure fund aimed at boosting infrastructure and defense.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.0803, 1.0677, 1.0602, 1.0561, 1.0466

- Mức kháng cự: 1.0875, 1.0937, 1.0979

The EUR/USD currency pair’s hourly trend is bullish. The price is correcting. The support level of 1.0875 was broken, and now it is the resistance level. Sellers will seek to bring the price down to 1.0803 to test liquidity. Intraday, you can look for sell trades from EMA lines or from 1.0875 resistance level, but with confirmation. Buying should be considered from 1.0803, also subject to a buying reaction.

Kịch bản thay thế:if the price breaks through the support level of 1.0803 and consolidates below it, the downtrend will likely resume.

Tin tức cập nhật cho: 2025.03.14

- US Michigan Consumer Sentiment (m/m) at 16:00 (GMT+2).

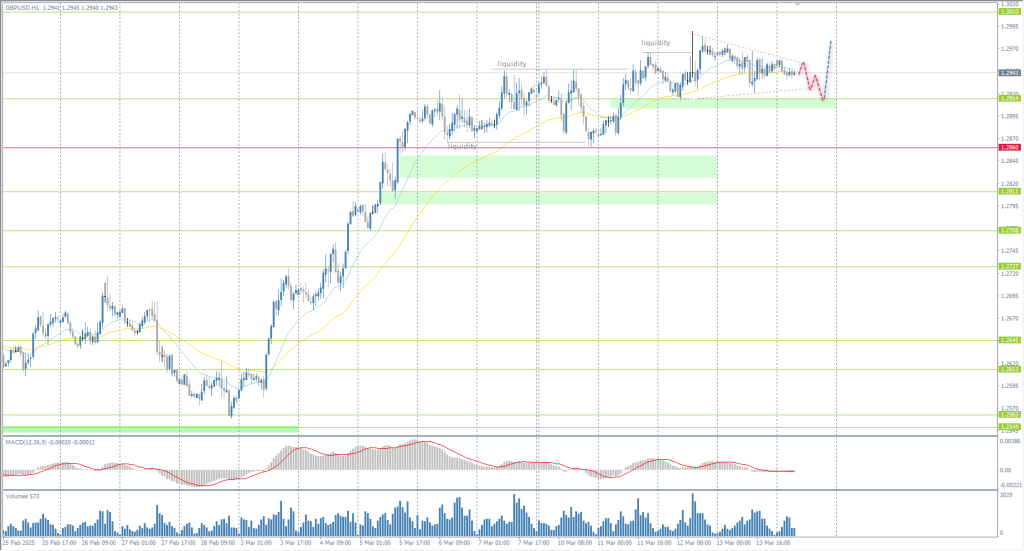

The GBP/USD currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 1.2965

- Đóng trước đó: 1.2948

- % thay đổi 24 giờ qua: +0.13 %

The latest US PPI and CPI data showed that price pressures eased in February, which gives the Fed more room to cut rates. In turn, traders cut bets on a Bank of England rate cut to 52bp for 2025, meaning UK interest rates will remain elevated for longer. This situation will create some parity between the dollar and the pound. Today, the UK will publish several economic data, including the GDP report. Even a slight rise in the economy could help sterling gain strength.

Khuyến nghị giao dịch

- Mức hỗ trợ: 1.2914, 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- Mức kháng cự: 1.3010

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish. The situation has not changed much. Buyers will seek to test the liquidity zone above 1.3010. Currently, the price is forming a narrowing wedge, a harbinger of an impulsive movement. It is best to consider the EMA lines or the support level at 1.2914. Selling should be looked for from 1.3010, subject to sellers’ reaction.

Kịch bản thay thế:if the price breaks the support level of 1.2860 and consolidates below it, the downtrend will likely resume.

Tin tức cập nhật cho: 2025.03.14

- UK GDP (q/q) at 09:00 (GMT+2);

- UK Industrial Production (m/m) at 09:00 (GMT+2);

- UK Manufacturing Production (m/m) at 09:00 (GMT+2);

- UK Trade Balance (m/m) at 09:00 (GMT+2).

The USD/JPY currency pair

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 148.23

- Đóng trước đó: 147.73

- % thay đổi 24 giờ qua: -0.33 %

The Japanese yen slid to 148 per dollar on Friday, reversing the gains of the previous session, as escalating global trade tensions boosted the dollar against major currencies. Earlier this week, Japanese companies agreed to significant wage hikes for the third straight year to help workers cope with inflation and address labor shortages. The wage hikes are expected to boost consumer spending, spur inflation, and give the Bank of Japan more room for future rate hikes. The Central Bank is expected to keep rates unchanged next week, but if inflationary pressures persist, policymakers will likely resort to further rate hikes this year.

Khuyến nghị giao dịch

- Mức hỗ trợ: 147.61, 146.65, 146.00

- Mức kháng cự: 148.45, 149.19, 150.16, 151.29, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. The Japanese yen is starting to form a broadly volatile flat. Yesterday, the price tested the liquidity below 147.61, where the buyers took the initiative. Now, the price has reached the supply zone near the resistance level at 148.45. Here we can consider selling, but only after the sellers’ reaction. Profit targets are 148.17 and 147.61.

Kịch bản thay thế:if the price breaks above the resistance at 151.29, the uptrend will likely resume.

Không có tin tức cho ngày hôm nay

The XAU/USD currency pair (gold)

Các chỉ báo kỹ thuật của cặp tiền tệ:

- Mở trước đó: 2933

- Đóng trước đó: 2988

- % thay đổi 24 giờ qua: +1.87 %

Gold prices rose more than 1% on Thursday to surpass $2,990 per ounce, hitting new record highs amid heightened risk aversion and bets on Federal Reserve monetary easing. Escalating trade tensions spurred a flight to safety, with US President Trump threatening to impose 200% tariffs on wine and other alcoholic beverages from the EU in response to the bloc’s recently announced tariffs on US whiskey. Geopolitical concerns also impacted sentiment, as Russia announced its rejection of a 30-day ceasefire accepted by Ukraine and backed by the US.

Khuyến nghị giao dịch

- Mức hỗ trợ: 2976, 2954, 2930, 2906, 2896, 2859, 2833

- Mức kháng cự: 3000

From the point of view of technical analysis, the trend on the XAU/USD has changed to an uptrend. The price is trading at historical highs and is aiming for the psychological mark of 3000. For buying, we can consider EMA lines or support level 2976, but with confirmation. For selling, there are no optimal entry points right now, as there is a lack of counter-selling initiatives.

Kịch bản thay thế:if the price breaks below the support level 2906, the downtrend will likely resume.

Tin tức cập nhật cho: 2025.03.14

- US Michigan Consumer Sentiment (m/m) at 16:00 (GMT+2).

Bài viết này phản ánh quan điểm cá nhân và không nên được hiểu là lời khuyên và/hoặc đề nghị đầu tư và/hoặc hối thúc thực hiện các giao dịch tài chính và/hoặc bảo đảm và/hoặc dự báo về các sự kiện trong tương lai.